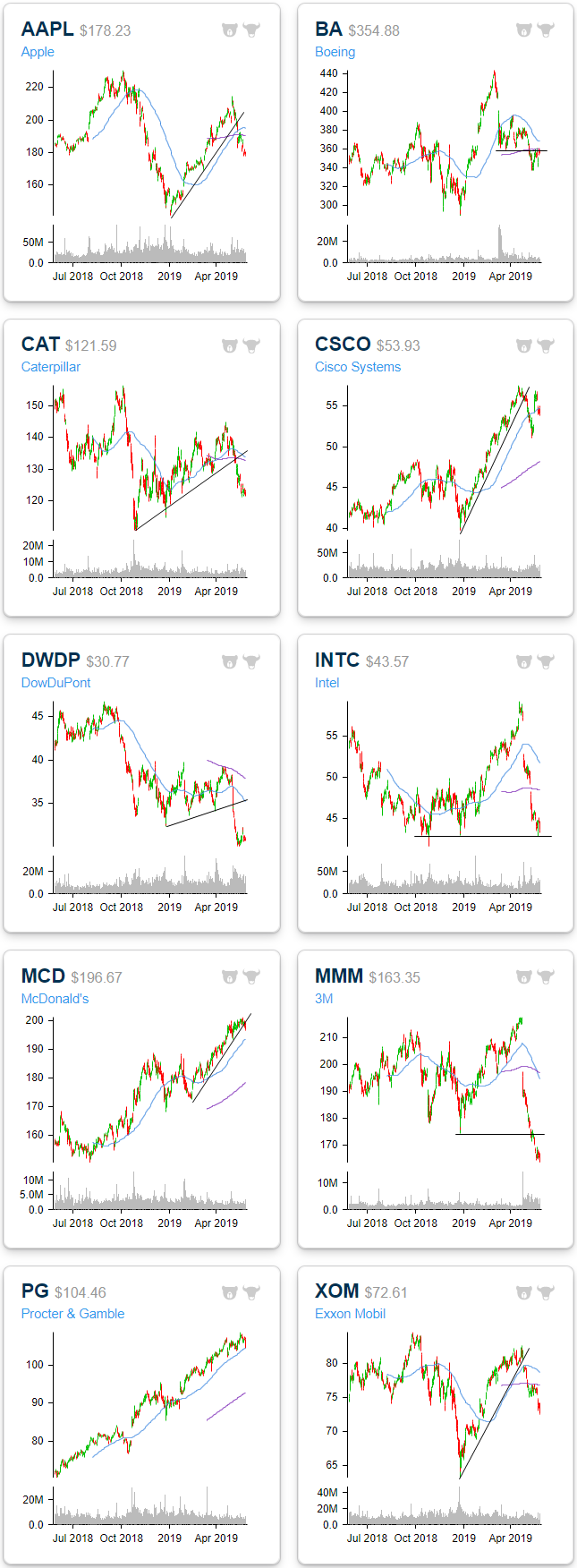

Dow Stocks Breaking Uptrends

May has not been the kindest of months for equities as the Dow now sits -4.68% lower MTD. Several of the big blue chips had been in strong uptrends all year headed into May, but have since rolled over. For some, the breakdowns are more individual stories such as Boeing’s (BA) 737 Max headaches or DowDuPont’s (DWDP) recent weak quarter following multiple spinoffs, but they are also a factor of broader trends of concerns around global trade and growth. For example, Caterpillar (CAT) which has acted as a bellwether for global trade given its high exposure to China has been hit particularly hard as tensions have ramped back up. May declines have broken CAT’s uptrend in addition to having sent it below its moving averages. Its peers are seeing the same patterns with broken uptrends from the likes of Apple (AAPL), Cisco (CSCO), Intel (INTC), 3M (MMM), and Exxon Mobil (XOM). In the case of DWDP and MMM, this month’s sharp declines have brought them around 52-week lows. Other Dow stocks like McDonalds (MCD) and Procter and Gamble (PG) have held up far better and are still pretty much in their uptrends, but in the past few sessions they’ve begun to test their uptrend lines and 50-DMAs as well. Start a two-week free trial to Bespoke Institutional to access our Chart Scanner tool and much more.

Triple Plays Not Holding Gains

With earnings season now in the rear view, the pace of quarterly reports has slowed considerably. Tomorrow will actually be the busiest day of the next month with just 28 reports. Given that not many companies are reporting, we have also only seen four triple plays in the past couple of weeks since earnings season ended on May 16th. An earnings triple play is when a company beats EPS estimates, beats revenue estimates while also raising guidance; we keep track of the 100 most recent triple plays on our website for subscribers, and we publish a number of premium reports throughout the quarter focusing on these earnings winners. Start a two-week free trial to Bespoke Institutional to access our Earnings Explorer, Triple Plays, Chart Scanner and much more.

Since the end of earnings season, Medtronic (MDT), Splunk (SPLK), Hibbett Sports (HIBB), and Anaplan (PLAN) have all reported earnings triple plays. Despite some nice gaps higher on their earnings day, most gains have not been able to hold. MDT and SPLK reported last Thursday and saw two very different responses. In what was MDT’s second straight triple play, the stock rose 3.24%. SPLK on the other hand—also no stranger to triple plays with this most recent report being its 19th in its last 29 reports—fell 7.33% in response. That is somewhat unusual but not totally unheard of as the stock has risen on average 4.43% and has fallen 36.8% of the time when it reports a triple play. Since these reports though, MDT has stopped short at resistance near $93.50 at February/March highs. Meanwhile, SPLK has continued to fall, and despite a bit of a bounce yesterday, is right around support at the $120 level.

Hibbett Sports (HIBB), which reported on Friday, saw a huge positive response to earnings rallying over 20%. This was the company’s second straight triple play. Given this massive run-up, the stock has come back down to Earth right around 2019 highs from before earnings. As of this writing, the stock has fallen over 4.5% further in today’s trading; filling some of its gap up. Finally, Anaplan (PLAN) reported before the opening bell yesterday and also saw a large gap higher with more buying throughout the day leading the stock to finish the day up 18.22%. Like HIBB, PLAN is down today over 6% and is filling some of this gap higher.

Fixed Income Weekly – 5/29/19

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we review the degree to which changes in yields predict recession and how much yield curves are currently pricing in recession.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day – Rebalancing?

If there was ever a time to “sell in May,” it was this year. Heading into today, the S&P 500 was already down over 4% on the month with three trading days left to go, and with today’s early weakness, we’re now on pace for a 5% decline for the month. Treasuries, meanwhile, have been surging. According to the BofA/Merrill Lynch index of long-term notes (10+ year maturities), US Treasuries were up over 4% MTD heading into the last three trading days of the month. While a 4% monthly decline for equities isn’t that rare (40 prior occurrences since 1990), when it’s accompanied by a rally in US Treasuries of the magnitude we have seen this month, it’s a lot less common. Since 1990, there have only been ten other months where the S&P 500 was down more than 4% heading into the final three trading days of the month while at the same time long-term US Treasuries were up over 4%.

In the table below, we have highlighted each of those ten prior periods along with how the S&P 500 has performed over the final three trading days of the month. The results are quite dramatic, suggesting we could be in store for a big move to close out the month of May.

Continue reading this Chart of the Day by logging in (if you’re already a member) or starting a two-week free trial to any of our research membership levels.

Global Equity Markets Oversold

As shown in our Trend Analyzer snapshot below of regional equity ETFs, all but two are trading in oversold territory, and all are solidly below their 50-day moving averages. But while US index ETFs have gotten more oversold over the last week (as indicated by the long tails to the right of each dot), we’ve actually seen some of the most oversold regional ETFs move higher within their trading ranges over the last week. The three emerging markets ETFs — IEMG, EEM, VWO — along with the MSCI All Country Asia ex Japan (AAXJ) were much more oversold last week at this time than they are now. At least it’s a start! Start a 2-week free trial to Bespoke Institutional for full access to our research and interactive tools.

US Equity Indices Now Solidly Oversold

As shown in our Trend Analyzer snapshot below, all six of the most closely watched US equity index ETFs are now trading in oversold territory. The dot in the “trading range” section of the snapshot shows where each ETF is currently trading within its range relative to its 50-day moving average. A move into the green shading of the chart represents oversold territory, which is more than one standard deviation below the ETF’s 50-day moving average. The dark green shading represents extreme oversold territory, which is between two and three standard deviations below the 50-DMA. The Russell 2,000 (IWM) small-cap ETF is the most oversold, while the remaining five are all in roughly the same position just above extreme territory.

Our Chart Scanner tool allows you to dive deeper into each ETF after getting an overhead view with our Trend Analyzer. The blue line in each chart represents each ETF’s 50-day moving average, while the purple line represents its 200-day moving average. You can also customize your settings to change the display of the moving averages and their colors. The Russell 2,000 (IWM) is at this point the only one that has traded below its 200-DMA, but the Dow (DIA) is the next closest to testing this key long-term support level. All of the six have rolled over from recent highs and have damaged whatever uptrends were in place. The negative technical set-up will continue until the 50-DMAs are re-taken once again. Start a 2-week free trial to Bespoke Institutional for full access to our research and interactive tools.

Morning Lineup – China on the Offensive

US futures have been weakening all morning continuing a trend that has for the most part been in place all night. Besides the usual back and forth rhetoric between the US and China over trade (this time China threatening to limit exports of rare earth metals to the US), weak data out of Europe, falling Treasury yields, and cratering oil prices aren’t helping sentiment as we head into the opening bell.

Make sure to check out today’s Morning Lineup for a recap of overnight earnings news, weak confidence data out of South Korea, the surge in German jobless claims, and other market-moving economic data out of Europe.

Yesterday marked the first time this year that the S&P 500 was up over 0.5% at some point intraday and then sold off to finish the day down by over 0.75%. This is notable for two reasons. First, it just goes to show how strong the equity market has been so far this year. For nearly the first five full months of the year intraday sell-offs of any discernible magnitude had been nearly non-existent during normal trading hours. Just as important, it suggests that the corrective phase the market has been in since early 2018 remains alive and well.

The chart below shows the S&P 500’s performance over the last five years and in it we have included red dots to show every day during this period that the S&P 500 was up 0.5% at some point intraday only to give it all back and more, finishing the day down at least 0.75%. All of the days fitting these criteria have been clustered into two periods. Of the now 19 occurrences since the start of 2014, the first ten were all clustered around a 15 month period spanning December 2014 through February 2016. Then from March 2016 right up through the last day of February 2018 there wasn’t a single occurrence. Since that drought ended, though, we’ve now seen nine occurrences over a similar 15-month span.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – Put-Call Not Peaked, Bonds Overbought, Home Prices Picking Up – 5/28/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at what the put-call ratio is signaling for equities. We also look at the underperformance of TLT following similar overbought readings to what it is currently showing, and the outperformance of European Tech. We then turn our attention to economic data with an updated look at our Five Fed Manufacturing composite given today’s disappointing Dallas Fed’s manufacturing activity gauge. Next, we expand on an earlier post highlighting how recent Conference Board Consumer Confidence reports have come in far more optimistic. We finish by showing the acceleration in home prices with today’s release of the Case-Shiller indices.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Off-Season Earnings Trends

Earnings season has died down quite a bit from a few weeks ago, but our rolling averages on beat rates and guidance are still moving of course. You can think of earnings and revenue beat rates as a “present situation” reading. The rolling 3-month EPS beat rate shows the percentage of companies that have beaten consensus analyst earnings estimates over the last three months. The rolling 3-month sales beat rate shows the percentage that have beaten revenue estimates. (These charts are updated daily in the Tools section of our website for Premium and Institutional members.)

As shown below, both EPS and revenue beat rates continue to trend lower after reaching extremely elevated levels last summer. At this point the sales beat rate is just barely above its long-term average.

If beat rates represent the “present situation,” then our guidance spread is an “expectations” reading. The guidance spread represents the difference between the percentage of companies raising guidance and lowering guidance on a rolling 3-month basis. And while beat rates have been trending lower recently, our guidance spread has been trending higher back up to the historical average.

As shown below, companies started to get much more optimistic about their futures in late 2017 right around the time that the GOP tax reform legislation was passing Congress. From late 2017 through mid-2018, our guidance spread was at the top end of its historical range. Then it began to crater in July and August, and it fell deeply into the red in early 2019. It finally bottomed out towards the end of Q1, however, and it has been trending higher ever since to the point where it’s now just a notch below its historical average, which is slightly negative at -2.97%. While the current reading is still negative, it’s on the right track.

Start a 2-week free trial to Bespoke Institutional for full access to our research and interactive tools.

Confidence Rebounds

Despite rising trade tensions with China, rising geopolitical concerns with North Korea and Iran, and a weak stock market, US consumers remain surprisingly confident. In the latest read for the month of May, Consumer Confidence rose much more than expected, hitting a level of 134.1 up from last month’s reading of 129.2 and much higher than the consensus forecast of 130. At current levels, overall sentiment isn’t far from its peak reading of the cycle (137.9) from last October.

While the gap between consumers’ perception of their Present Situation and Expectations remains uncomfortably wide, both measures saw comparable increases this month. In the case of the Present Situation component, though, that reading is at a new high for the cycle (highest since December 2000).

The main reason consumers remain so confident in the face of macro headwinds is that the job market remains so strong. The percentage of consumers responding that jobs are ‘plentiful’ rebounded to 47.2% in May, which is a new high for the cycle and the highest monthly reading since January 2001.

To us, the most surprising aspect of this month’s report is the fact that sentiment towards the stock market improved. Even though all of the major US equity indices are down in May, the percentage of consumers expecting stock prices to rise increased to 42% from 37.3%, while the percentage of bearish consumers dropped to 22.2% from 24.4%. From a contrarian perspective, it would be much more preferable to see sentiment turning more cautious as stock prices declined. Start a 2-week free trial to Bespoke Institutional for full access to our research and interactive tools.