The Bespoke 50 Top Growth Stocks

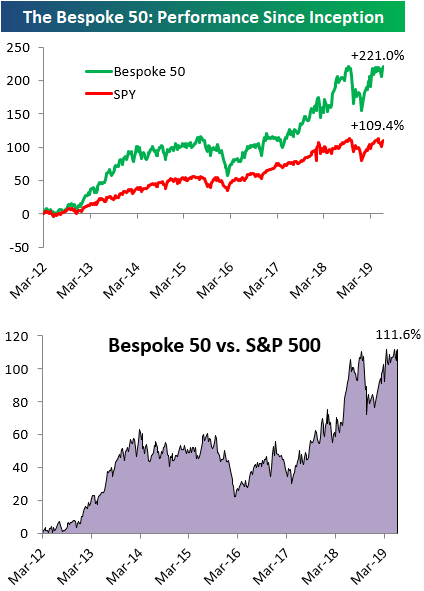

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 111.6 percentage points. Through today, the “Bespoke 50” is up 221.0% since inception versus the S&P 500’s gain of 109.4%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Morning Lineup – That’s No Bull

As one might expect given the big rally over the last several days, bullish sentiment on the part of individual investors ticked higher this week, but at just 26.8%, the latest sentiment survey from AAII shows that the vast majority of investors have been slow to get back in the pool as bearish sentiment remains elevated at 34.20% and the percentage of investors who just can’t make up their mind increased to 39%.

For today, all eyes are on Jobless Claims which came in at 222K versus estimates for a reading of 215K. Going forward, this afternoon’s earnings report from Broadcom (AVGO) will help to decide the path that semis take to close out the week. Please read today’s Morning Lineup for our latest take on events from overnight and this morning, including Industrial Production out of Europe and German Auto Exports.

Bespoke Morning Lineup – 6/13/19

On the subject of Industrial Production out of Europe, this morning’s print of a decline was right inline with expectations, but that doesn’t mean it was particularly good. As shown in the chart below, m/m readings have now only increased two times in the last eleven months!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer – State Equity Gains, CPI Wanes, No Deficit Pains – 6/12/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we show equity market returns broken up by the states that companies are headquartered in. With a busy day in macroeconomic data, we then look at today’s release of CPI data in addition to what the New York Fed’s Underlying Inflation Guage is showing. We also use monthly budget statement data released today to get a read on the impact of tariffs and government deficits. We finish with EIA Petroleum data which showed a build in inventories which sent oil prices lower today.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Fixed Income Weekly – 6/12/19

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we take a look at which parts of the fixed income markets are getting cheap thanks to the shift in short-term interest rates.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day – Yield Curve, Leading Indicators and Recessions

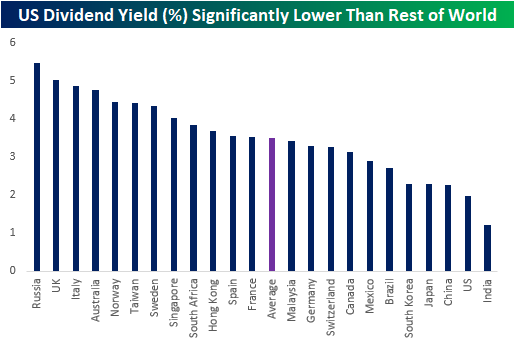

US Dividend Yields Significantly Lower Than Rest of World

When it comes to dividends, the US may not be the best country for investors to look for a higher yield. US equities currently have a dividend yield of only 1.98%, well below the average of 3.51% for the 22 other major global economies that we track in our Global Macro Dashboard. The only country with a lower dividend yield is India with a 1.21% yield. A potential reason for this comparatively low yield in these two countries is simply higher equity prices. India runs away with the highest valuation of their equities with a P/E of 28.56; the highest among the 23 countries in our Global Macro Dashboard. The US similarly is not cheap relative to the rest of the world as it possesses the fourth highest valuation of 18.33x earnings. That compares to a world average of only 15.72.

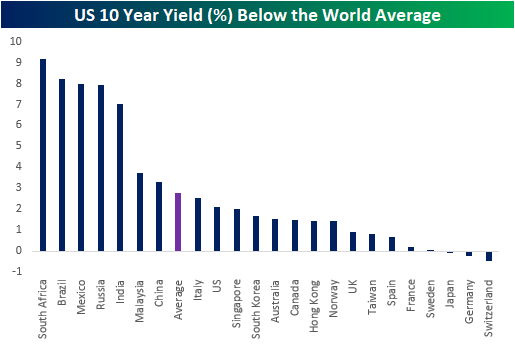

Over the past month, the yield on the 10 Year US Treasury Note fell considerably from over 2.5% at the beginning of May to 2.13% today. Unlike the dividend yield, the 10 year still holds up better than most of the world. The US has a higher yield than the comparable security for 14 other countries. Even with the yield coming down recently, it is still far more attractive than the negative yields on Japanese, German, and Swiss 10-years.

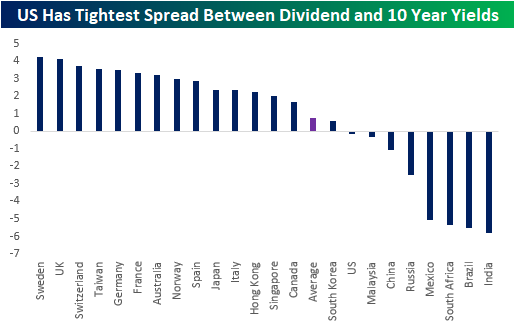

One more interesting dynamic of the US compared to the rest of the world is the very tight spread between the dividend yield and the 10 year. Currently, the dividend yield is only 15 bps lower than the 10-year yield for the US. Nine other countries similarly have a higher yield in their 10-year note. With such a low yield on dividends, India has the widest spread in favor of the country’s government debt, while on the other end of the spectrum, Sweden has the widest spread in favor of dividends. Start a two-week free trial to Bespoke Institutional to access our Global Macro Dashboard and much more.

Crunch Time For Semis

The next couple of days could prove to be very important for the semis. After falling just shy of 20% from its intraday high in mid-April to its intraday low at the end of May, the Philadelphia Semiconductor Index (SOX) rallied over 10% to yesterday’s intraday high before pulling back into the close. The fact that the SOX pulled back where it did is notable because it came right as the index had retraced 50% of the decline from the April highs. As shown in the chart below, the mid-point between April’s high and May’s low was 1,445.78, and yesterday’s high was less than five points lower at 1,440.8. Semis opened lower again this morning, so the longer the weakness persists, the more it will look like a failed rally. But if the group bounces from here or even marks time near current levels and then bounces, it would send a positive signal for the group and broader tech in general.

Using our Custom Portfolio tool that’s available to subscribers, we created the custom portfolio below of large-cap stocks in the SOX index to show where each semiconductor name stands relative to its normal trading range. If you’re a Bespoke Premium or Bespoke Institutional member, you can track this group going forward by clicking here to add it as a new custom portfolio. For each stock listed, we show the most recent closing price, how the stock has performed YTD and over the last five trading days, and where the stock is trading relative to its 50-DMA. On the right side of the table, we also include our proprietary Trend and Timing Scores along with where each stock is with respect to its trading range.

Looking through the list, the majority of stocks are up over 4% in the last week, so they’ve definitely had a nice few days. Despite the gains, though, just two stocks listed are trading at overbought levels, and only four are above their 50-DMA. Given they aren’t even close to overbought, the group clearly has more room to run. At the same time, though, if the rally fails to hold before the majority of members could even get back above their 50-DMAs, that wouldn’t say much for the group’s prospects. To use our Custom Portfolio and Trend Analyzer tools, start a two-week free trial to Bespoke Premium.

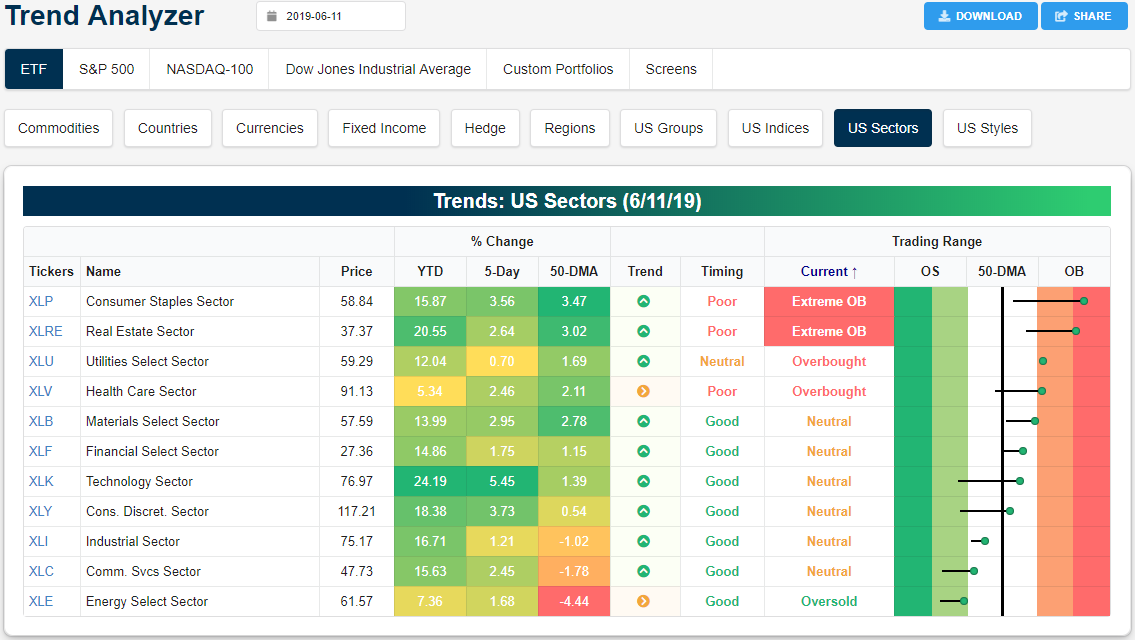

Trend Analyzer – 6/12/19 – Health Care (XLV) Coming Back

Even with declines yesterday, most of the major index ETFs have managed to hold above their 50-DMAs. Six of the fourteen currently sit under this moving average including the Nasdaq (QQQ), Russell 2000 (IWM), and Micro-Cap (IWC). This comes despite QQQ having the largest gains over the past week (4.85%) while IWC actually has seen the worst performance as the only one of these ETFs to sit in the red. Additionally, IWC is the only major index ETF that is oversold. Perhaps not to the same degree, but this weakness is being shared with other small caps as IWM and the Core S&P Small-Cap ETF (IJR) are teetering on oversold levels and both have seen less than a 1% gain over the past five sessions.

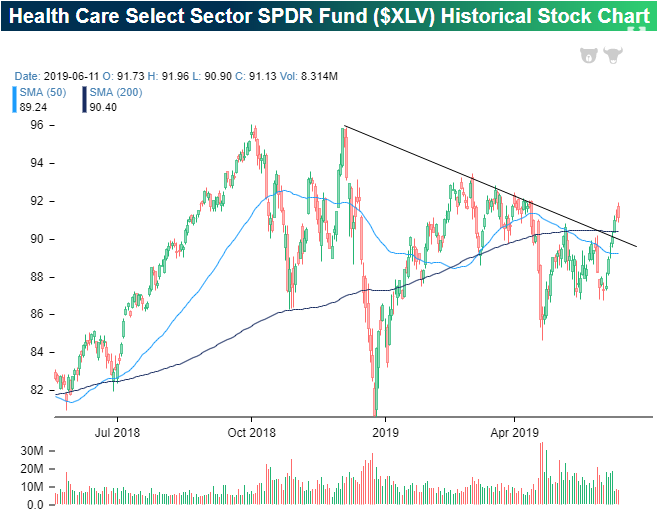

Moving over to the individual sectors, defensives remain broadly overbought with Consumer Staples (XLP) and Real Estate (XLRE) sitting at extreme levels even as they have not necessarily been the best performing sectors in the past week. XLP has been strong with the third best gains of all eleven sectors, but XLRE’s performance has been more middling and Utilities (XLU) has actually moved the least in the past week. Meanwhile, Technology (XLK) has rocketed out of oversold territory, rising 5.45%. While the move hasn’t been as rapid, Health Care (XLV), a sector which we have repeatedly highlighted the underperformance of this year, has begun to press higher. XLV has just entered overbought territory and is at an interesting spot from a technical perspective.

In the past several weeks, XLV has made a few higher lows and more recently has begun to break out to the upside. XLV has moved above both its moving averages as well as its downtrend line originating in the fall of last year, although this week it has paused at resistance from early April. While the past few days’ price action seems like the sector can move lower again, possibly retesting support at the 200-DMA and a recent high around $90, this sort of breakout can be a promising sign for the future of this year’s worst sector. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer and much more.

Bespoke’s Global Macro Dashboard — 6/12/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Morning Lineup – Bounce in Japanese Cap Ex; Beware of Consensus

The ‘pause’ in the rally from yesterday’s early highs is continuing this morning as equity markets around the globe are all trading moderately lower, including the US. Please read today’s Morning Lineup for our latest take on events from overnight and this morning, including the latest on protests in Hong Kong, Credit Growth in China, and some solid economic data from Japan and France.

Bespoke Morning Lineup – 6/12/19

Beware of the consensus. As data and economic models have proliferated throughout the years, investors have increasingly become reliant on them to predict future events. If the ‘market’ or excel model says it’s going to happen, then we are all too ready to take it as a given. A perfect example is the path of Fed policy. With the futures market increasingly pricing in the likelihood that the Fed will cut rates, that’s what everyone now expects. As of this morning, for example, the futures market was pricing in a greater than a three-quarters chance that the FOMC will cut rates between now and the end of July. Three weeks ago, those odds were less than 15%!

So, it’s pretty much guaranteed that the Fed will cut rates and cut them aggressively right? While it’s certainly possible that we may see rate cuts in the months ahead, keep in mind that the consensus often gets it wrong and sometimes incredibly wrong. A perfect example is the 10-year US Treasury yield. The chart below is from a Wall Street Journal article earlier this week and shows how when it came to the direction of long term interest rates in 2019, the consensus couldn’t have been more wrong.

The chart shows the path of the 10-year yield so far in 2019 compared to various forecasts from Wall Street and the economic community. At the end of 2018, not a single economist expected the 10-year yield to be below 2.5% and the average forecast was closer to 3.0%. Right now, the 10-year yield is under 2.12%!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.