Trend Analyzer – 7/8/19 – Overbought but Off of Highs

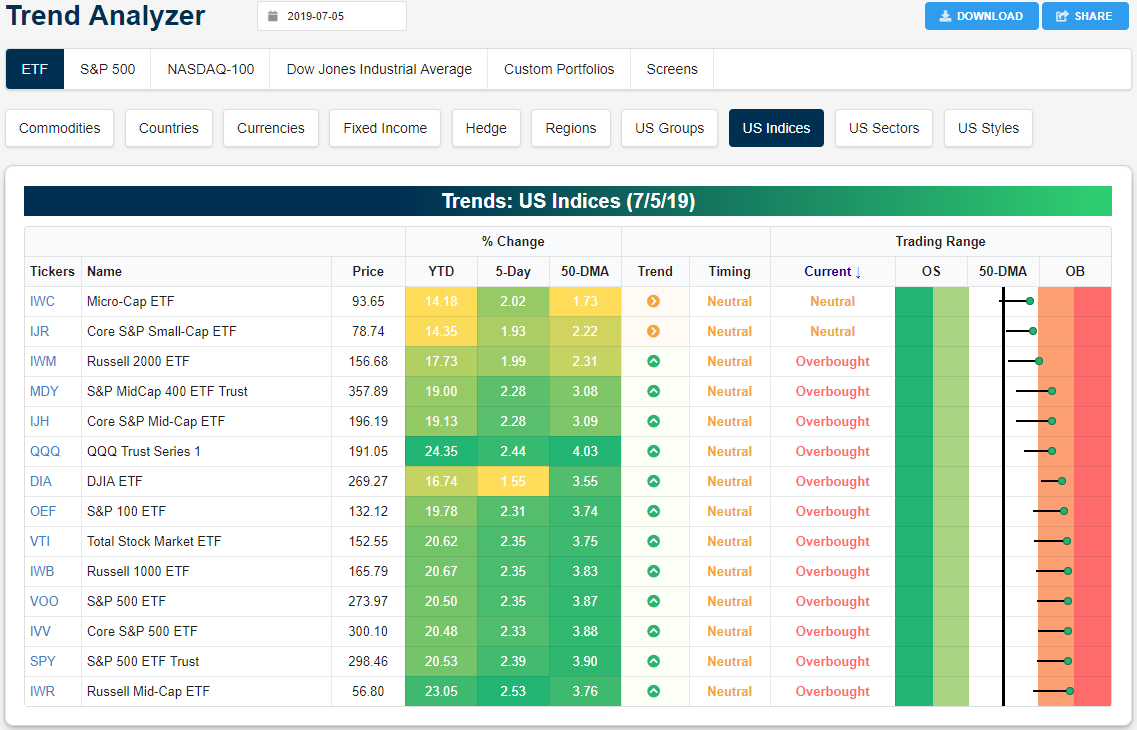

The major US indices saw their first declines of the month on Friday after a stronger than expected Nonfarm Payrolls report put a damper on hopes for rate cuts. Despite Friday’s declines, conditions are still firmly overbought across the board with twelve major index ETFs overbought—many approaching extreme levels—and two at neutral levels. While large caps have primarily been leading the way higher with gains of 2%+ over the last week, the Russell MidCap (IWR) has actually performed the best in the past week with a gain of 2.53%. Other mid-caps like the S&P MidCap 400 (MDY) and Core S&P Mid-Cap (IJH) have also been making solid moves higher, both rising 2.28% last week, but IWR has recently more resembled the large-cap indices that its mid-cap peers. Meanwhile, small caps have lagged a bit. Both the Micro-Cap (IWC) and Core S&P Small Cap (IJR) both remain at neutral levels and in sideways trends over the past six months as they still have yet to reach new highs.

As previously mentioned, small caps have struggled to make a solid push back to last year’s highs. Over the past six months, small caps have basically been flat with current levels at the upper end of this range and near a longer-term downtrend line. It is a similar picture for mid caps although they are currently much closer to prior highs. The moving averages for these indices are basically all flat if not sloped downwards. The only outlier is the Russell Mid-Cap (IWR) which was reaching new highs as recently as last week with a chart that looks more similar to large caps like the S&P 500 (SPY) than IJH or MDY. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer, Chart Scanner, and much more.

Bespoke’s Morning Lineup – July 4th Hangover Continues

After five straight days of gains and a number of record highs for the S&P 500 heading into July 4th, the post-holiday hangover for bulls continues this morning as US equities are poised for a second straight day of declines. The economic and earnings calendars are light today, so it could end up being a quiet summer day of trading as markets gear up for Powell testimony later this week and the start of earnings season next week.

Read today’s Morning Lineup to get caught up on news and stock specific events ahead of the trading day and a further discussion of the Deutsche Bank news over the weekend.

Bespoke Morning Lineup – 7/8/19

Friday’s better than expected jobs report put a dent in the narrative for rate cuts as far as the eye could see. However, while the market is now pricing in less than a 5% probability of a 50 bps rate cut at the July meeting versus something closer to a one-three chance at this time last week, there is still 100% certainty that the FOMC will cut rates by 25 bps at the July meeting. So, it’s not as though cuts have been taken off the table.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 7/7/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

We’ve Seen This Movie Before

Scientists are searching for a mirror universe. It could be sitting right in front of you. by Corey S. Powell (NBC)

Scientists in Tennessee are searching for an alternate, mirror universe using the behavior of subatomic particles to prove their theories. Don’t expect any gateways to open up any time soon, though. [Link]

Scientists Are Giving Dead Brains New Life. What Could Go Wrong? by Matthew Shaer (NYT)

Neuroscientists are experimenting with keeping brains alive long after their meaty vessels stop functioning, which doesn’t sound at all like the start of a zombie flick. [Link; soft paywall]

Conservation

Aggressive Goats Addicted to Human Urine Airlifted Out of Olympic National Park, WA (SnowBrains)

Many animals have a taste for salt, but goats in Olympic National Park have acquired such a taste for the salt and minerals in human urine that they became a threat to hikers and by extension themselves. [Link]

Poachers Are Invading Botswana, Last Refuge of African Elephants by Rachel Nuwer (NYT)

Botswana offers strong legal protections against poachers, but elephants are increasingly threatened even there, with poachers crossing a border that has traditionally offered protection to the massive mammals. [Link; soft paywall]

Vintage EPA photos reveal what US waterways looked like before pollution was regulated by Aylin Woodward (Business Insider)

A reminder of what natural environments used to be like before the EPA, featuring fetid water, trash dumped into rivers, and burning oil slicks. [Link]

Tree planting ‘has mind-blowing potential’ to tackle climate crisis by Damian Carrington (The Guardian)

While there are plenty of stories doom related to global warming, some of the solutions appear to be remarkably straightforward, including a program of simple reforestation and tree planting; that activity has room to remove two-thirds of emissions released by human activity if conducted at a large enough scale. [Link]

Tech Dystopia

Facebook, YouTube Overrun With Bogus Cancer-Treatment Claims by Daniela Hernandez and Robert McMillan (WSJ)

Part of the ongoing mess that is social media: deceptive and false information about health treatments which can lead to literal death if taken too seriously. [Link; paywall]

Design

For Better And Worse, We Live In Jony Ive’s World by Nikil Saval (The New Yorker)

A retrospective on the contributions of Apple’s head of design, someone who has had an almost immeasurable mark on the way the devices we use every day function and feel. [Link; soft paywall]

Economics

Consumers’ and Economists’ Differing Inflation Views Can Complicate Policymaking by Tyler Atkinson (Federal Reserve Bank of Dallas)

An analysis of consumer expectations shows that while economists tend to see inflation and unemployment as negatively correlated, consumers who are optimistic about the economy expect lower inflation and vice-versa. That presents a major challenge for policymakers, who aim to manage consumer inflation via economic slack. [Link]

US breaks record for longest economic expansion by Sylvan Lane (The Hill)

While it’s at least hypothetically possible that a US recession will be declared to have started this summer (we are near-certain that won’t be the case), as-of now the lack of a recession through June means the US now has a new record for the length of an economic expansion. [Link; auto-playing video]

Immigration

“Bodies and minds are breaking down”: Inside US border agency’s suicide crisis by Justin Rohrlich and Zoë Schlanger (Quartz)

Enforcing deterrence policies related to both unauthorized migration and legal asylum seekers is starting to place an enormous toll on CPB officers, with efforts to recruit new hires to the agency falling flat and existing personnel being worked into the ground. [Link; soft paywall]

Sanctions

To Evade Sanctions on Iran, Ships Vanish in Plain Sight by Michael Forsythe and Ronen Bergman (NYT)

Chinese ships are evading sanctions placed on Iran by the United States by turning off transponders when they are nearing the Strait of Hormuz. [Link; soft paywall]

Investing

As Stocks Hover Near Records, Growth Worries Linger by Akane Otani (WSJ)

With the economic expansion hitting a record length his month and stocks at all-time highs, investors continue to struggle with the outlook. [Link; paywall]

80% of the stock market is now on autopilot by Yun Li (CNBC)

We are extremely skeptical that JPM claims showing 80% of the market is invested in either passive strategies or quantitative funds. Per the Fed’s Z.1 report, domestic equity ETFs hold $2.2trn in domestic equity assets and mutual funds hold $7.7trn in equity assets, versus $17.5trn in direct household and nonprofit equity exposure that includes ETFs with another $8.8trn in total mutual fund exposure, making the outstanding ETF and mutual fund numbers far too small. That said, the market is increasingly trading on passive factors. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Closer: End of Week Charts — 7/5/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Golden Cross for Health Care (XLV)

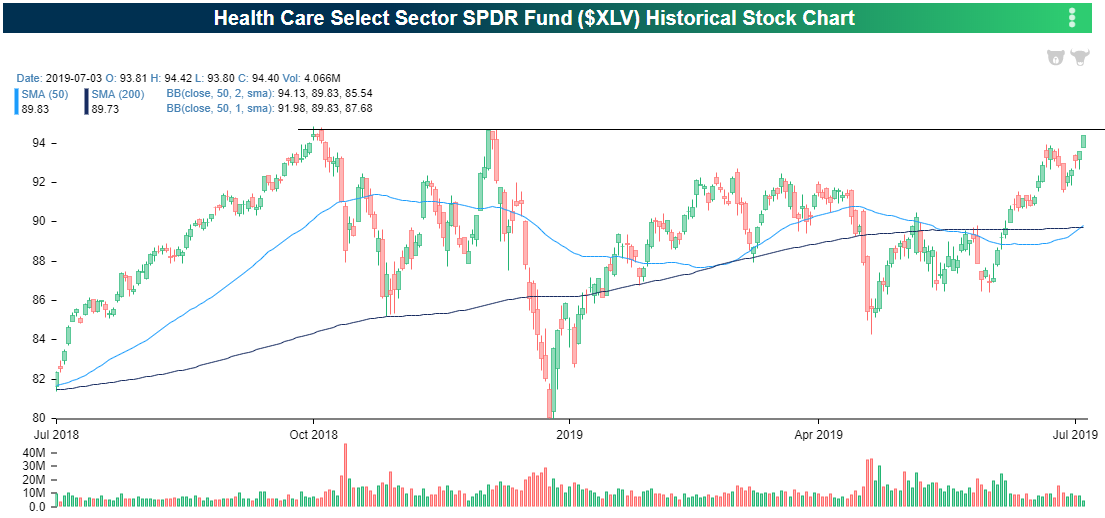

Health Care (XLV) has been the worst performing sector so far in 2019 with a year to date gain of under 10% while other sectors like Technology (XLK) has risen upwards of 30%. Although it still has a large amount of catching up to do with the other sectors, things have been improving over the past couple of months. The sector has put in a series of higher lows and higher highs since early May and is currently sitting just below 52-week highs. At Wednesday’s close, the sector ETF also experienced a technical “golden cross,” which occurs when the 50-DMA crosses above the 200-DMA as both moving averages are rising.

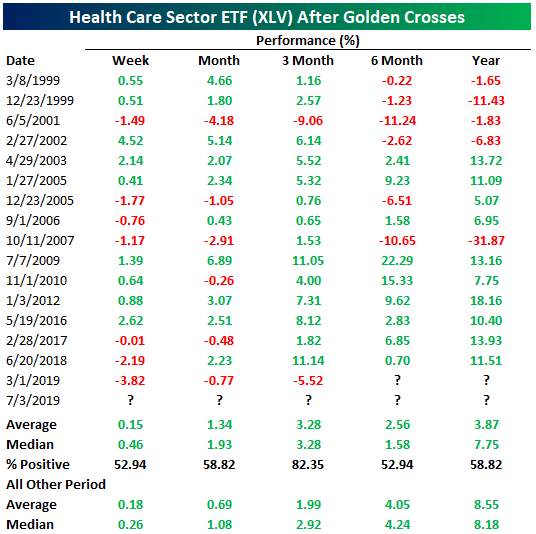

This was the 17th time in the Health Care Sector ETF’s history that it has experienced a golden cross with the last one was being only four months ago in March; the shortest span of time between golden crosses of all occurrences at only 124 days. Typically, golden crosses have not necessarily been indicators of consistent outperformance for XLV. In the week following a golden cross, gains have only been found a little better than half the time with worse than average performance; although median returns are in fact better than other periods. One month and three months out is when returns have been strongest and most consistent. Both are stronger than all other periods on an average and median basis. Three months out, gains have been notably consistent with XLV being higher 82.35% of the time. With a longer time horizon, looking 6 months to one year after a golden cross, XLV returns have been worse than normal. Granted, this is partially due to steep losses around 2000 and 2007. For one year out, huge losses of 31.87% from 2007 to 2008 weigh heavy on this average. For the current bull run, though, there has yet to be a golden cross where XLV was lower six months to one year out. Start a two-week free trial to Bespoke Institutional to access our interactive Security Analysis tool and much more.

Bespoke’s Sector Snapshot — 7/5/19

The Bespoke 50 Top Growth Stocks

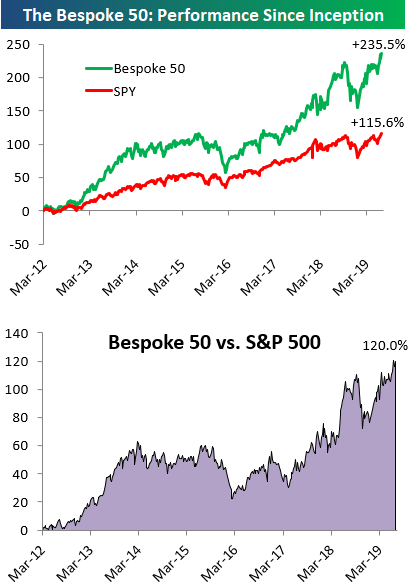

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 120.0 percentage points. Through today, the “Bespoke 50” is up 235.5% since inception versus the S&P 500’s gain of 115.6%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Chart of the Day: Strong Jobs Put Rate Cut Pricing Into Flux

Morning Lineup – Tap. Tap. Tap. Is this Thing On?

Trading desks are sparsely staffed this morning, and if you are reading this either at the office or on your way to work, we feel your pain. Questions we ponder on a day like today are why is the day before July 4th a shortened session, but the Friday after isn’t?

Anyways, the big June payrolls report is right on tap and should go a long way in letting us know if the futures markets have been correct in anticipating at least a 25 bps rate cut at the end of July.

In other news…it’s a summer Friday sandwiched between a holiday on one side and the weekend on another. There really isn’t much.

Read today’s Morning Lineup to get caught up on news and stock specific events ahead of the trading day and everything you may have missed since Wednesday’s close.

Bespoke Morning Lineup – 7/5/19

Believe it or not, today is only the 6th time in the last 45 years that July 5th has fallen on a Friday, but like today, each of the prior Friday, July 5ths also featured Non-Farm Payrolls (NFP) reports. In the two charts below, we have grouped the five prior events (1985, 1991, 1996, 2002, and 2013) based on whether the reported Non-Farm Payrolls reading that day was better or worse than expected.

Overall, market performance has generally been positive on these five days as the S&P 500 has seen an average gain of 0.65% with positive returns four out of five times, and on two of the five days, equities closed early on the day.

Out of the five NFP that fell on Friday, July 5th, three were weaker than expected. As shown in the first chart below, the S&P 500 finished the day higher on all three days with gains ranging from 0.2% all the way up to 3.67% on 7/5/02.

On the two days where NFP were better than expected, returns weren’t as positive. In 2013, the S&P 500 rose 1.02% when NFP came in ahead of forecasts, but in 1996, when the unemployment rate fell a surprising 0.3% percentage points and hourly wages saw their largest m/m percentage increase in 13 years, investors were spooked that the strength would lead to more hawkish rate policy from the FOMC. While a strong report of that magnitude is pretty much out of the question today, a significant beat relative to expectations is unlikely to be met with a positive reaction from the market.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.