The Closer: End of Week Charts — 7/5/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Golden Cross for Health Care (XLV)

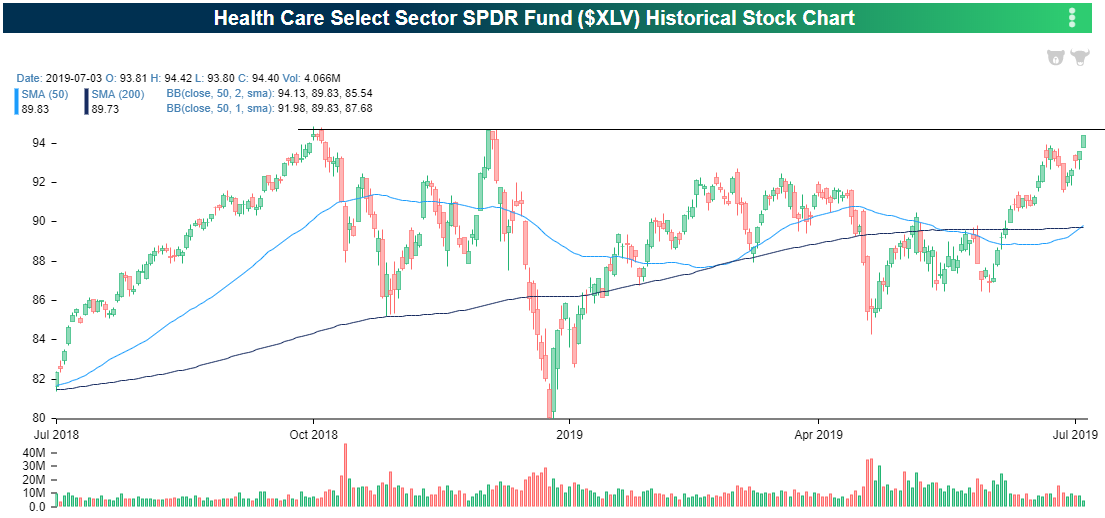

Health Care (XLV) has been the worst performing sector so far in 2019 with a year to date gain of under 10% while other sectors like Technology (XLK) has risen upwards of 30%. Although it still has a large amount of catching up to do with the other sectors, things have been improving over the past couple of months. The sector has put in a series of higher lows and higher highs since early May and is currently sitting just below 52-week highs. At Wednesday’s close, the sector ETF also experienced a technical “golden cross,” which occurs when the 50-DMA crosses above the 200-DMA as both moving averages are rising.

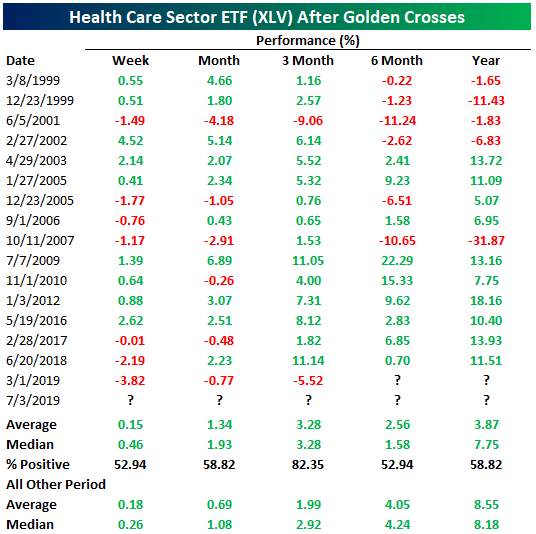

This was the 17th time in the Health Care Sector ETF’s history that it has experienced a golden cross with the last one was being only four months ago in March; the shortest span of time between golden crosses of all occurrences at only 124 days. Typically, golden crosses have not necessarily been indicators of consistent outperformance for XLV. In the week following a golden cross, gains have only been found a little better than half the time with worse than average performance; although median returns are in fact better than other periods. One month and three months out is when returns have been strongest and most consistent. Both are stronger than all other periods on an average and median basis. Three months out, gains have been notably consistent with XLV being higher 82.35% of the time. With a longer time horizon, looking 6 months to one year after a golden cross, XLV returns have been worse than normal. Granted, this is partially due to steep losses around 2000 and 2007. For one year out, huge losses of 31.87% from 2007 to 2008 weigh heavy on this average. For the current bull run, though, there has yet to be a golden cross where XLV was lower six months to one year out. Start a two-week free trial to Bespoke Institutional to access our interactive Security Analysis tool and much more.

Bespoke’s Sector Snapshot — 7/5/19

The Bespoke 50 Top Growth Stocks

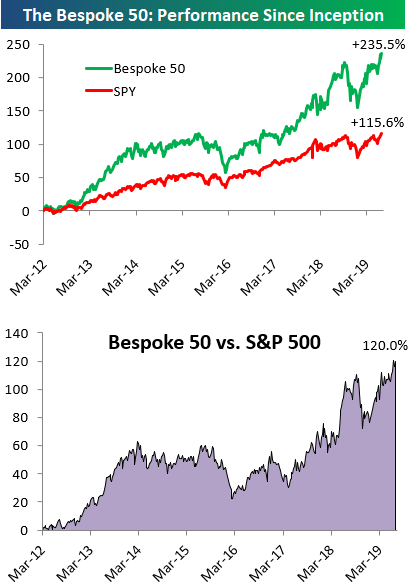

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 120.0 percentage points. Through today, the “Bespoke 50” is up 235.5% since inception versus the S&P 500’s gain of 115.6%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Chart of the Day: Strong Jobs Put Rate Cut Pricing Into Flux

Morning Lineup – Tap. Tap. Tap. Is this Thing On?

Trading desks are sparsely staffed this morning, and if you are reading this either at the office or on your way to work, we feel your pain. Questions we ponder on a day like today are why is the day before July 4th a shortened session, but the Friday after isn’t?

Anyways, the big June payrolls report is right on tap and should go a long way in letting us know if the futures markets have been correct in anticipating at least a 25 bps rate cut at the end of July.

In other news…it’s a summer Friday sandwiched between a holiday on one side and the weekend on another. There really isn’t much.

Read today’s Morning Lineup to get caught up on news and stock specific events ahead of the trading day and everything you may have missed since Wednesday’s close.

Bespoke Morning Lineup – 7/5/19

Believe it or not, today is only the 6th time in the last 45 years that July 5th has fallen on a Friday, but like today, each of the prior Friday, July 5ths also featured Non-Farm Payrolls (NFP) reports. In the two charts below, we have grouped the five prior events (1985, 1991, 1996, 2002, and 2013) based on whether the reported Non-Farm Payrolls reading that day was better or worse than expected.

Overall, market performance has generally been positive on these five days as the S&P 500 has seen an average gain of 0.65% with positive returns four out of five times, and on two of the five days, equities closed early on the day.

Out of the five NFP that fell on Friday, July 5th, three were weaker than expected. As shown in the first chart below, the S&P 500 finished the day higher on all three days with gains ranging from 0.2% all the way up to 3.67% on 7/5/02.

On the two days where NFP were better than expected, returns weren’t as positive. In 2013, the S&P 500 rose 1.02% when NFP came in ahead of forecasts, but in 1996, when the unemployment rate fell a surprising 0.3% percentage points and hourly wages saw their largest m/m percentage increase in 13 years, investors were spooked that the strength would lead to more hawkish rate policy from the FOMC. While a strong report of that magnitude is pretty much out of the question today, a significant beat relative to expectations is unlikely to be met with a positive reaction from the market.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

B.I.G. Tips – Chart Checkup

The Closer – Gapped Up To An Island – 7/3/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at what today’s surge into an island (low price above all other highs) means for stock prices going forward. We also discuss the ongoing surge in iron ore prices, record interest rate risk in corporate bond markets, today’s economic data, and how Q2 GDP is shaping up.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Avalara (AVLR) No Longer Sideways

Fixed Income Weekly – 7/3/19

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we argue overseas investors are part of the reason for declining UST yields.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!