ZEW Sentiment Getting Carried Away

Each month, ZEW surveys analysts to gauge how they’re feeling about economic growth around the world, both for the current period and going forward. We spend far too much time looking at global data to try and paint a sanguine picture about the state of the global economy, but some of the negativity is starting to get ridiculous. Today’s ZEW analyst survey saw very weak readings in both expected growth and current activity across a range of economies; of the two flavors (current and expected growth) across 7 major economies, only one (Japanese current growth) rose from July data to August data. All are down substantially year-over-year. UK growth expectations are at a record low!

In the table below we show expectations and current growth assessments by country, including the date the last time the gauge was as low as current. As shown, things are getting pretty ridiculous in some cases; UK expectations are one example and US expectations another. Start a two-week free trial to Bespoke Institutional to access The Closer and the rest of Bespoke’s suite of Institutional products.

The last time the ZEW series for US growth was this weak was back in October of 2008. It’s easy to forget just how grim things were at that point, so in the table below we re-visit some notable headlines from the WSJ each day of October, 2008. Compare and contrast that series of headlines to recent ones. To be sure, recent news from around the world has been disappointing for investors. But to put it in the same category as the headlines we’ve highlighted in red, which document the near-destruction of global financial markets and the worst collapse in economic activity since the Great Depression, is patently absurd. The ZEW surveys are indicative of an excessively bearish level of sentiment that is both understandable and a contrary signal for global growth, in our view.

Argentina’s Bad Hair Day

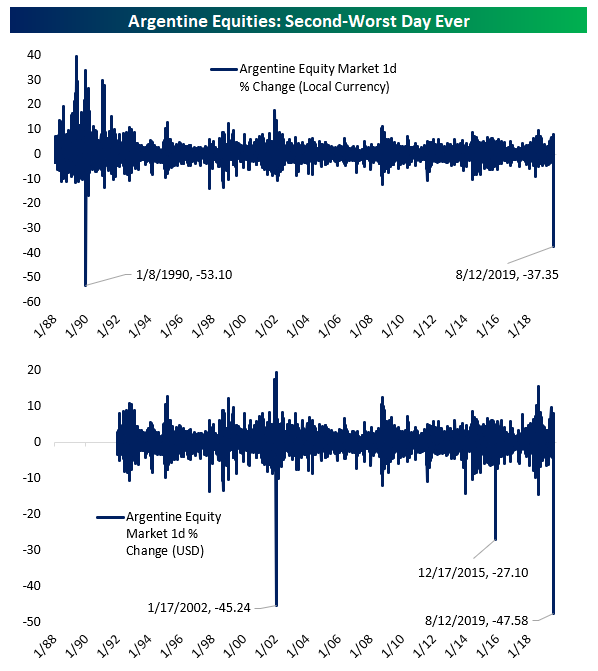

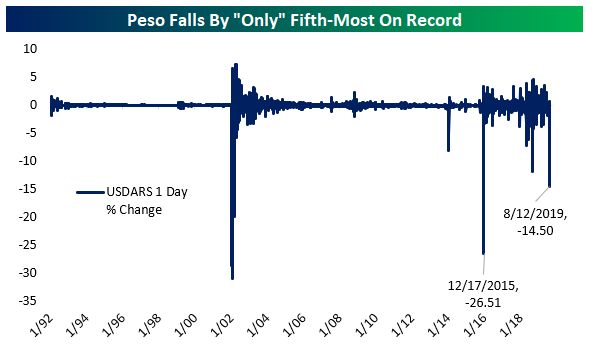

In our global macro note The Closer last night, we discussed the brutal start to the week for Argentina. As far as the global macro picture goes, it’s hard to find a bigger one-day trainwreck than Argentina. A higher-than-expected vote share for populists in the country’s presidential primary kicked off a staggering 37% decline in Argentine stocks priced in the domestic peso, the second-worst day since the 1980s. Priced in USD, it was also the second-worst day, though the January 2002 devaluation was a more significant loss (barely). Either way, investors have effectively gotten cut in half between the local currency declines in stock prices and the ~15% drop in the peso. For US-based investors, the drop in ARGT (the Global X Funds MSCI Argentina ETF) was 24%. For international investors, the dream is now that huge blows to financial markets from Peronist success will mean the populist Judicialist Party won’t unseat reform-oriented President Macri in the October general election. If Macri wins, Argentinian assets should return to where they traded last week or higher. Of course, voters aren’t beholden to financial markets, so if they decide that the costs to the currency, equity market, and funding of the Argentine economy are worth it to shift leftwards, then anybody reaching in to catch falling knives today will get cut. Start a two-week free trial to Bespoke Institutional to access The Closer and the rest of Bespoke’s suite of Institutional products.

It’s worth noting that the ARGT ETF is 22.3% weighted to MercadoLibre (MELI): Alibaba for Latin America. Tenaris, a steel manufacturer, is a 10% weight, while Globant (GLOB) and banks round out the names comprising more than half of ARGT’s market cap exposure. Check out the disastrous drop for ARGT yesterday in the chart below:

Machine Tool Orders: No Bounce Yet

This morning, we highlighted Japanese Machine Tool Orders in our recap of overnight data in The Morning Lineup. We watch Japanese machine tool orders (MTO) data closely because it’s very well-correlated to global activity, released with little lag, and infrequently revised. As such, it’s a very good high frequency global indicator. As shown in the charts below, MTOs were up slightly MoM for both domestic and foreign orders as well as on an overall basis. That’s positive, but we have to caution that small one-off bumps in monthly data have appeared regularly of late and unless the data can go a couple of months without another lurch lower, it’s hard to get worked up about what it means for the global economy. For now, the results are less bad than they could have been but still not a reason to assume a huge reversal of fears over recession. Start a two-week free trial to Bespoke Institutional for full access to Bespoke’s suite of global macro products.

Bespoke’s Morning Lineup — 8/13/19

Yesterday marked the second straight Monday with a 1%+ decline for the S&P 500. Since the bull market began, there have only been 4 other back-to-back 1%+ Monday declines, and the S&P averaged a nice gain of 3.24% over the next 4 trading days when that has happened. Will today be another “turnaround Tuesday” like we saw last Monday, or will the technicals continue to break down even further?

Find out in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Retail Reports, Argie-Bargie, JPY Jingle, Deficit Data – 8/12/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a quick brief on the technical outlook of the S&P 500’s rejection of the 50-DMA. We also show some market internals including how Industrials are lagging Utilities as well as earnings estimates. Staying on the topic of earnings, we take a look at retailers ahead of their upcoming quarterly reports. Then, we take a look at Argentina after today’s 37% decline in the country’s stocks. Moving on to currencies, we show why the move to new lows for USDJPY is not necessarily bearish before finishing with a look at the federal government’s budget statement.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bottom-Line Earnings Beat Rates Down This Season

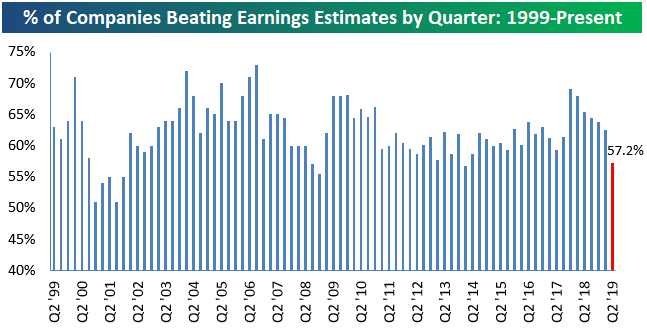

The unofficial Q2 earnings reporting period comes to an end on Thursday when Wal Mart (WMT) releases its numbers. More than 2,000 companies have reported earnings since the season began in early July, and 57.2% of them have beaten consensus analyst EPS estimates. As shown in the chart below, this quarter’s earnings beat rate is down significantly from recent quarters where 60%+ was pretty much a guarantee. If the current reading holds through Thursday, it will be the lowest beat rate since the Q1 2014 reporting period (April and May 2014).

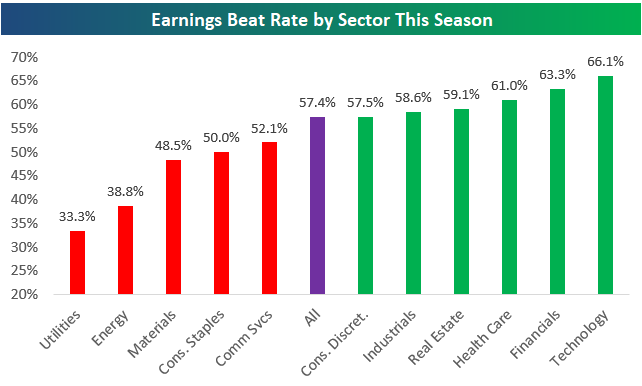

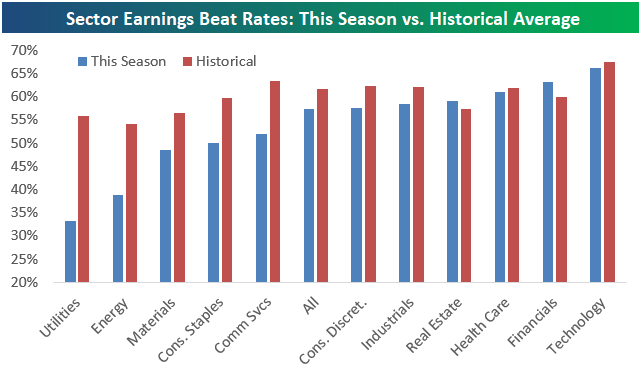

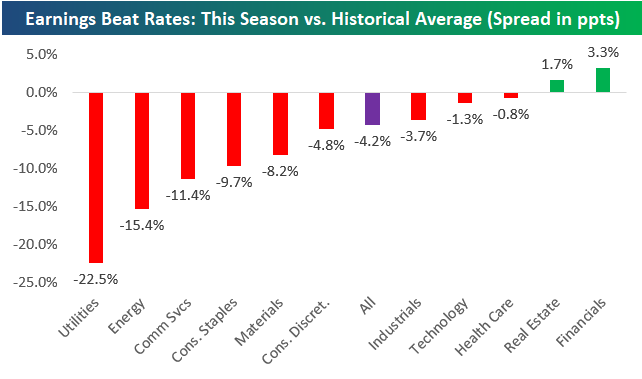

Below is a look at earnings beat rates by sector this season. Technology has the strongest beat rate at 66.1%, followed by Financials at 63.3%. Utilities and Energy have the weakest beat rates at 33.3% and 38.8%, respectively.

Below we show this season’s earnings beat rates by sector versus the sector’s historical earnings beat rate going back to 2001. All but two sectors have beat rates this season that are below their historical average. The Financial and Real Estate sectors are the only two that have seen stronger-than-normal beat rates. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer, Chart Scanner, Earnings Explorer and much more.

Chart of the Day: Rates Lower, Stocks Higher

Trend Analyzer – 8/12/19 – Back Under

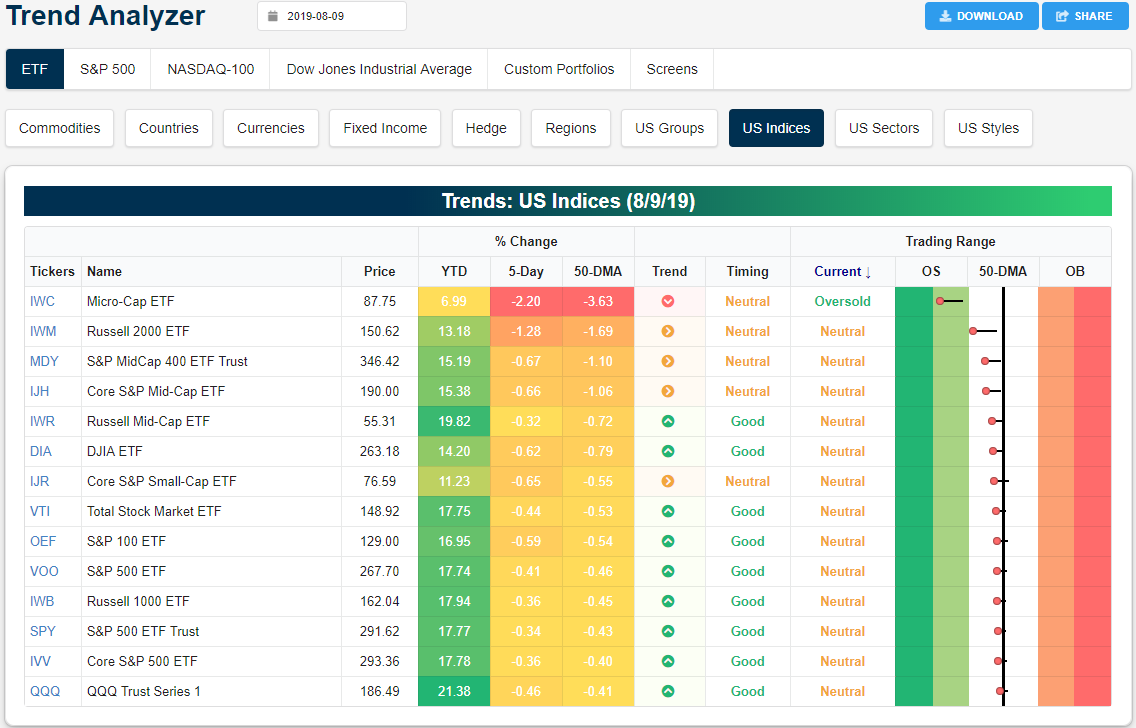

Friday’s declines brought the major US index ETFs back below their 50-day moving averages. Although these ETFs closed out the week lower, only the Russell 2000 (IWM) and Micro-Cap ETF (IWC) were down over 1%. IWC, in particular, continues to be the weakest of these major indices. Falling 2.2% last week, it is once again approaching extreme oversold territory. IWC is also still the only one to show a downtrend in our Trend Analyzer.

Using our Chart Scanner, you can see the fake-out of a break above the 50-DMA for the major index ETFs. Small caps are also looking to move below their 200-DMAs as IWC has already done so. As previously mentioned, although only IWC is in a downtrend in our Trend Analyzer, other small caps like the Core S&P Small-Cap ETF (IJR) and the Russell 2000 (IWM) have made a series of lower lows in the past six months. But the major distinction is last week’s declines did not bring IJR or IWM to a new low. Similarly, for the rest of the major index ETFs, which currently sit between their 50 and 200-DMAs, the recent volatility has also marked higher highs and higher lows. In other words, while the past couple of weeks have seen dramatic movements, they have yet to do any real damage to recent trends. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer, Chart Scanner, and much more.

Bespoke’s Morning Lineup — 8/12/19

Equity futures were higher overnight but have since sold off ahead of the open. The S&P 500 SPY ETF is currently trading down 0.50% in the pre-market. The 10-Year Treasury yield has fallen another 5 basis points down to 1.68%, causing the yield curve (10s/3s) to further invert. Protests in Hong Kong continue to strengthen, causing the Hong Kong airport to cancel all flights today.

Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Bespoke Report – 8/9/19

This week’s Bespoke Report newsletter is now available for members.

In this week’s newsletter, we provide our thoughts on where the market is headed after a volatile week that basically ended up flat. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!