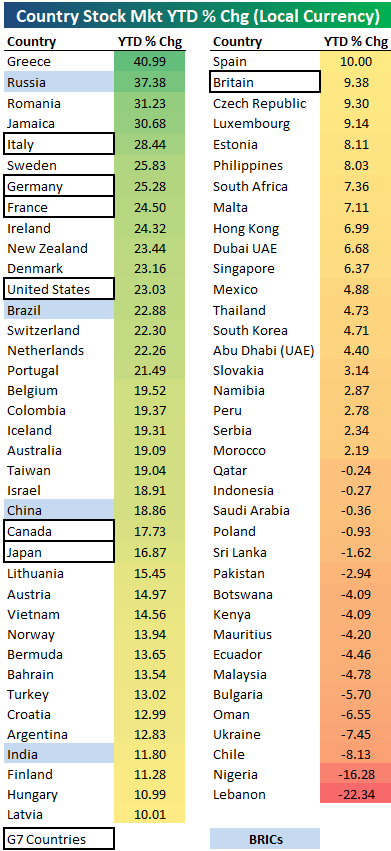

2019 YTD Country Stock Market Performance

The chart below was posted in our Bespoke Report newsletter last Friday and we’re re-publishing it on the blog today…

- The recent rally for equities has been on a global scale.

- While many rallies for the US market over the last few years weren’t accompanied by rallies elsewhere around the world, the current breakout has been broad based.

- Below we show the year-to-date performance (in local currency) for 75 country stock markets.

- Of the 75 countries, 58 (77%) are up on the year, and the average country is up double-digit percentage points (+10.8%).

- What’s most notable about global equity market performance is how strong the “major” countries have been.

- Six of the seven G7 countries rank in the top 25 this year, and four of the G7 are up 23%+, including the US.

- The major emerging market countries — the BRICs — all rank in the top half, with Russia up the 2nd most of any country at +37.4%.

- Only two countries are down more than 10% YTD — Nigeria (-16.3%) and Lebanon (-22.3%).

Year-to-date gains for equities can definitely include an asterisk given the low-base following last year’s big Q4 sell-off, but even 12 and 24-month returns are starting to look strong. Sign up for Bespoke’s “2020” special and get our upcoming Bespoke Report 2020 Market Outlook and Investor Toolkit.

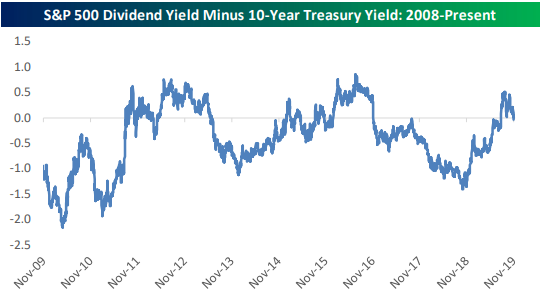

S&P Dividend Yield vs. 10-Year Treasury Yield

The big drop in Treasury yields seen for most of 2019 made equities more and more attractive from a dividend yield perspective. This is one of the reasons a sector like Utilities had been performing so well. Most Utilities stocks pay hefty dividends, which look pretty enticing when the 10-Year Treasury is yielding ~1.5%.

For a couple of months up until recently, the 10-Year yield got so low that the S&P 500’s dividend yield traded at a higher level. But the spread between the two flipped again last week as the 10-Year yield spiked back up to 1.94%. With the S&P 500’s dividend yield currently at 1.87%, Treasuries are back to being more attractive by 7 basis points. For reference, below is a chart of this spread over the last 10 years. Sign up for Bespoke’s “2020” special and get our upcoming Bespoke Report 2020 Market Outlook and Investor Toolkit.

To the Extreme

It’s not too often that we have the opportunity to invoke the name of a Vanilla Ice album to describe the market, but after the last five weeks of trading, US equities have reached overbought levels “To the Extreme.” While the escalating violence in Hong Kong and doubts over whether the US and China can come to even a phase one trade agreement are two reasons being cited for this morning’s weakness in equity futures, just as important is the fact that US markets are heading into the week at not only ‘Overbought’ but ‘Extreme Overbought’ levels.

As shown in the image below from our Trend Analyzer, eight of the fourteen US index ETFs we track closed out last week at ‘Extreme Overbought’ levels. As a result, all eight of these indices have ‘Poor’ timing scores. Mid and small-cap indices may not be as extended as their larger-cap peers, but they too are all overbought.

While US indices, in general, are broadly overbought, among individual sectors, the strength hasn’t been nearly as one-directional. Here again, the majority of sectors closed out last week at ‘extreme’ levels, but in this case, five sectors are at extreme overbought levels and another two (Utilities and Real Estate) are at extreme oversold levels. Just last week, sectors like Real Estate (XLRE) and Utilities (XLU) saw declines of over 3.5%, while Financials (XLF) and Energy (XLE) were up close to 2.5%. It’s not often that you see such wide performance divergences among individual sectors, but the spike we’ve seen in interest rates over the last couple of weeks has hurt rate-sensitive defensives and helped Financials especially.

Like US indices, international markets also finished off last week mostly at overbought levels after two-thirds of the country ETFs we track saw gains for the week. Countries heading into the week at the most extended levels include Malaysia (EWM), Israel (EIS), China (MCHI & GXC), Italy (EWI), Russia (RSX), and Singapore (EWS), and behind these countries all but six ETFs are overbought. China and Russia may be at extreme overbought levels, but Brazil (EWZ) and India (PIN), the other two countries that comprise the BRIC acronym, both traded down sharply last week and head into this week at neutral levels relative to their trading ranges. Sign up for Bespoke’s “2020” special and get our upcoming Bespoke Report 2020 Market Outlook and Investor Toolkit.

Bespoke’s Morning Lineup – 11/11/19 – Overbought to Start the Week

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Bespoke Brunch Reads: 11/10/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Economics

The New View of Government Debt by J.W. Mason (jwmason.org)

A review of changing attitudes towards government debt, with specific arguments about why widening government deficits haven’t led to higher interest rates during recent years. [Link; 20 page PDF]

The Inflation Gap by Annie Lowery (The Atlantic)

In addition to accessing fewer resources, consumers who are at the lowest end of the income scale also face higher prices over time than higher-income consumers. [Link; soft paywall]

Renewables

An Energy Breakthrough Could Store Solar Power for Decades by Adam Popescu (Bloomberg)

A novel molecule designed in Sweden offers a potential way to store energy from the sun for very long periods, and then conveniently release it, which may be more attractive than traditional renewable setups that include photovoltaic solar energy and industrial scale batteries. [Link; soft paywall]

Tesla will unveil its Cybertruck pickup on Nov. 21 in LA, Elon Musk says by Todd Haselton (CNBC)

Harried by upstarts like Rivian and eager to deliver further growth, Tesla is set to introduce its new pickup truck at an event in Los Angeles on November 21st. [Link]

Nuclear fusion is ‘a question of when, not if’ by Matt McGrath (BBC)

Fusion power is famous for always being just twenty years away, and the UK government is keeping up the proud tradition of those sorts of headlines courtesy of a new modest investment in fusion power. [Link]

South Australia’s stunning renewable energy transition, and what comes next by Giles Parkinson (Renew Economy)

A review of the massive shift in electrical sources in South Australia, which feature a massive uptake of renewables, new battery projects, and higher efficiency. The scope and scale of the shift is a very good sign for the ability to substitute low carbon technologies in other utilities around the world. [Link]

Social Media

China’s TikTok Blazes New Ground. That Could Doom It. by Li Yuan (NYT)

Americans – especially teens – have recently flocked to algorithmically-driven video app TikTok, but its Chinese ownership is opening up the service to investigation by the federal government. [Link; soft paywall]

Twitter hates me. The Des Moines Register fired me. Here’s what really happened. by Aaron Calvin (Columbia Journalism Review)

The complicated interplay of digital footprints, virality, and journalistic best practices traced out in this story are worthy of calm consideration and a longer think than knee-jerk outrage, knee-jerk backlash or the outrage, or even knee-jerk outrage about the backlash to the outrage. [Link]

Hot Takes

The World Has Gone Mad and the System Is Broken by Ray Dalio (LinkedIn)

A largely normative assessment about how darn confusing the world is these days, what with negative interest rates and big deficits and all the other strange things. [Link]

It’s Time to Take Down the Mona Lisa by Jason Farago (NYT)

Arguably the world’s most beloved painting, the Mona Lisa often underwhelms visitors to the Louvre, which apparently is a good enough reason to shut it away in a closet somewhere. [Link; soft paywall]

Investing

401(k) contribution limit increases to $19,500 for 2020; catch-up limit rises to $6,500 (IRS)

Contributions workers can make to retirement plans at work are rising in 2020, per a new release by the IRS. [Link]

‘Infinite leverage’ — some Robinhood users have been trading with unlimited borrowed money by Kate Rooney (CNBC)

Traders who use the Robinhood app were accidentally given access to enormous leverage in the form of options contracts and margin loans. [Link]

Investors reassess the hope-and-hype business model, causing stocks like GrubHub to plunge by Michael Santoli (CNBC)

High growth companies that have surged over the last year or so are being tossed aside as GrubHub, Wayfair, Etsy, and Pinterest plunge 20% or more in response to earnings. [Link]

Record Short VIX Positioning Reflects a Ton of Fear Elsewhere by Luke Kawa (Bloomberg)

While huge speculator shorts in VIX futures contracts may seem like a sign of offsides positioning, weak hands actually hold the other side: long VIX retail funds. [Link; soft paywall]

Medallion

The Making of the World’s Greatest Investor by Gregory Zuckerman (WSJ)

What happens when a mathematician tries his hand at trading currencies? Before fees, 66% returns per year for three decades, and unparalleled result. [Link; paywall]

Simons Questioned by Investors by Susan Pulliam and Jenny Strasburg (WSJ)

Given the plaudits of the prior article, a divergence between the performance of internal versus external funds during the financial crisis is probably worth considering. [Link; paywall]

Nasty Surprises

California hits Philly-area Amazon seller with $1.6 million sales-tax bill by Harold Brubaker (Philadelphia Inquirer)

A Pennsylvania third-party Amazon seller has been presented with a seven figure tax bill by the state of California, presenting a major wrench in both third party sellers’ business model and constitutional issues. [Link]

A ton of people received text messages overnight that were originally sent on Valentine’s Day by Jacob Kastrenakes (The Verge)

Last Valentine’s Day, a huge wave of text messages went undelivered. 9 months later, they’re showing up en masse around the country. [Link]

Throwbacks

Stuck in a loop: remembering the 20th anniversary of Burn All GIFs by Margarita Noriega (Glitch)

An ode to the value of the gif, a flexible and ubiquitous format for expressing references, emotions, and more, centered around the story of how we almost missed on .gif files thanks to a website called Burn All GIFs. [Link]

How Sesame Street changed television and my life by Kathleen Davis (Fast Company)

The central thesis of Sesame Street – that education and entertainment didn’t have to be separate beasts – has led to multiple generations of Sesame Street kids. [Link]

Working Ways

Microsoft experimented with a 4-day workweek, and productivity jumped by 40% by Lisa Eadicicco (Business Insider)

By cutting the workweek by 20%, a Japanese office of Microsoft reported a 40% gain in productivity and therefore a big uptick in output. [Link]

Politics

Democrats Cool on Wall Street Donors, and the Feeling Is Mutual by Joshua Green and Bill Allison (Bloomberg)

Huge online fundraising operations are allowing at least two Democratic candidates to swear off the big checks that have lured Democrats to Wall Street in recent cycles; it shouldn’t be any surprise that talk of wealth taxes is rearing its head at the same time. [Link; soft paywall]

Military Matters

Suicide Has Been Deadlier Than Combat for the Military by Carol Giacomo (NYT)

Each of the past six years have seen more suicides by military personnel than the total number of deaths in multi-decade presences in Afghanistan and Iraq, with more than 45,000 veterans and active-duty service members taking their lives. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report Newsletter — 11/8/19

This week’s Bespoke Report newsletter is now available for members.

Technicals are looking pretty positive for the US stock market, but what about sentiment levels and valuations? We answer this question and cover many more topics in this week’s Bespoke Report newsletter. To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 11/8/19

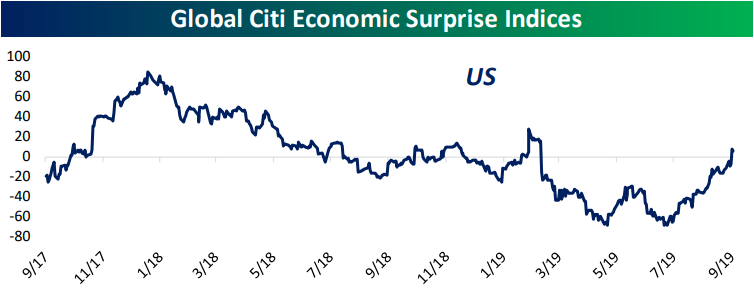

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Bespoke CNBC Appearance (11/8/19)

Bespoke co-founder Paul Hickey appeared on CNBC’s Closing Bell to discuss the recent outperformance of value versus growth. To view the segment, click on the image below. Sign up for Bespoke’s “2020” special and get our upcoming Bespoke Report 2020 Market Outlook and Investor Toolkit.

October 2019 Headlines

Chinese Stocks Showing Signs of Life

While US and Chinese trade talks are a constant in the news, you don’t really hear much about Chinese equities these days. While the Shanghai Composite Index got off to a blistering start in 2019, it gave up a good share of those gains in the Spring and has traded in a very tight range ever since even as global stocks break out. For a typically volatile index like the Shanghai Composite, the 9.9% range it has traded in over the last six months is relatively narrow. Since 1990, there have only been three other periods where the index’s six-month trading range was in the single-digits.

While the Shanghai Composite index has been lacking in vitality, smaller-cap Chinese stocks have been showing signs of life. The chart below shows the performance of the Chinese ChiNext Index, which is a segment of the Shenzhen stock exchange that is composed of smaller cap Chinese companies. Companies in this index face less stringent listing requirements and are often considered to be earlier in their corporate life-cycle than more established companies. In simple terms, the ChiNext index is often referred to as the Nasdaq of China.

Like the Shanghai Composite Index, the ChiNext Index had a strong start to 2019 but quickly gave up most of its early gains. Unlike the Shanghai Composite Index, though, the ChiNext index has recouped much of its losses from the Spring and is now just 4.5% below its 2019 high compared to the Shanghai Composite Index which is still down just under 10% from its YTD high. If the ChiNext can take out both its recent high from August and the highs from earlier in the year, Chinese equities, in general, will likely follow suit. Sign up for Bespoke’s “2020” special and get our upcoming Bespoke Report 2020 Market Outlook and Investor Toolkit.