High Scores for Housing

While economic data has generally leaned towards weakness in the past month, we have repeatedly highlighted that housing data has been a bright spot for the economy. Not only has this category’s macroeconomic data come in solid, but the stocks of housing-related companies have also been showing similar strength. Just this morning, homebuilder D.R. Horton (DHI) reported a strong quarter with an EPS and revenue beat and the stock traded up 3.3% in today’s session in response. Given these trends, other housing stocks in DHI’s industry, Household Durables, as well as the housing and construction-related Building Products Industry have become fairly attractive with heavy representation in this week’s Stock Scores.

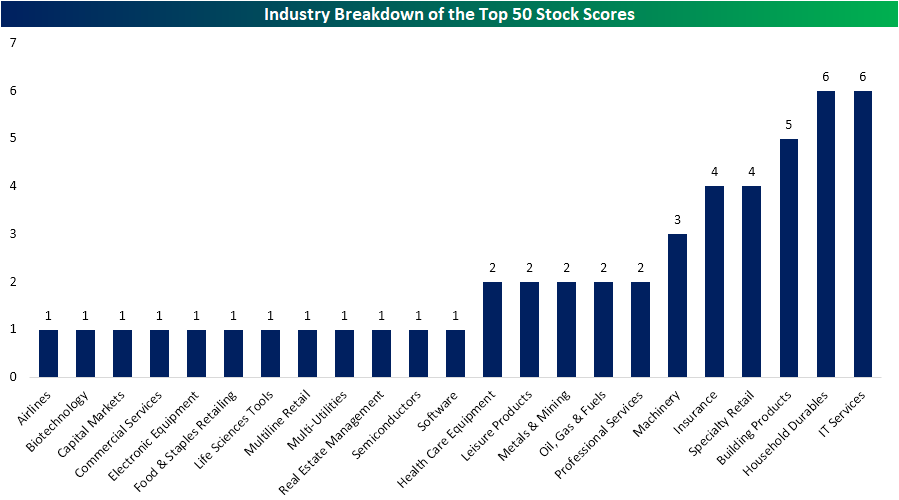

Our Stock Scores takes all 1500 stocks in the S&P 1500 and ranks them based on fundamental, technical, and sentiment factors. As shown in the chart below, of the 50 stocks with the highest total scores, Building Products and Household Durables had some of the strongest representation tied with the IT Services industry. Within the Building Products industry, 25% of its 20 members were in the top 50 stock scores this week while 6 of the 28 members of the Household Durables industry also made the top 50

We made a custom portfolio of stocks in the Household Durables and Building Products groups that ranked in the top 50 of our Stock Scores this week, so that members can track them. As shown below in the charts from our Chart Scanner, each of these stocks has been in solid uptrends over the past six months. Although some like KB Home (KBH) and Pulte Group (PHM) have more or less broken these uptrends, they have also still held up at their moving averages. Start a two-week free trial to Bespoke Institutional to access our interactive Stock Scores, Custom Portfolios, and more.

An Earnings Season to Remember

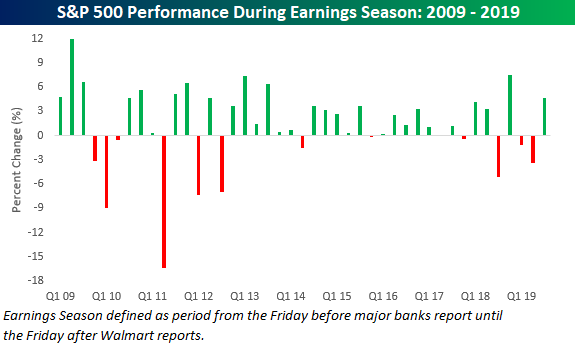

With just a few days left until the unofficial end of the reporting period, this earnings season is on pace to be one of the better ones of the last several years. The S&P 500 is currently up 4.7% since 10/4 (the Friday before the first of the major banks started to report). If we compare the current period to the prior six-week periods in other earnings seasons that encompassed the first of the major bank reports right up through Walmart’s (WMT) report, the only one with a more positive performance was the 7.6% gain in the Q4 2018 reporting period. Before that, you have to go all the way back to the 6.4% gain during the Q3 2013 period. The market has certainly come a long way from early October when it seemed to be a foregone conclusion that earnings results would be dismal while guidance would be even worse.

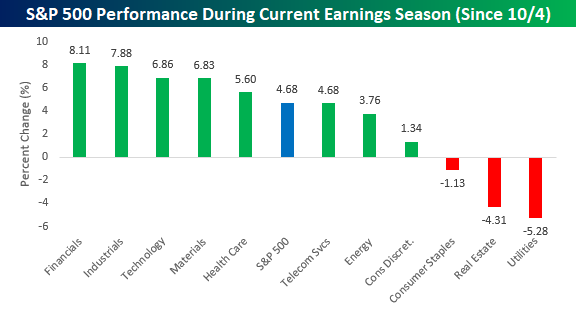

If you polled analysts/investors back in late September over which sectors would have the toughest earnings seasons, Financials and Industrials would have topped the list. With earnings season now winding down and these two sectors up roughly 8%, though, the list that these two sectors topped is actually the best performers! Meanwhile, the worst performers have been the high yielding defensive sectors that investors couldn’t get enough of during the summer. Sign up for Bespoke’s “2020” special and get our upcoming Bespoke Report 2020 Market Outlook and Investor Toolkit.

Small Business Optimism Bounces More Than Expected

Small business optimism increased more than expected in October, rising from 101.8 up to 102.4 compared to economist expectations for an increase to just 102.0. After a sharp drop from its high in August 2018, small business sentiment hasn’t rebounded much off its lows, but it is at least showing some sign of optimism.

We have pointed out in the past how drops in sentiment among small business owners have typically peaked well in advance of recessions, and looking at a long-term chart, every prior recession was preceded by a peak in this indicator. While that’s true, we would also note that there are also a number of periods early and mid-cycle where sentiment also declined by similar amounts but rebounded to make new highs. Therefore, we wouldn’t put too much into the recent decline as a high confidence indicator of an impending recession.

With regards to the biggest issues small business owners are facing, labor continues to be a big problem. In this month’s survey, one in four small business owners cited Quality of Labor as the most important problem, which was up from 23% last month. Behind Labor Quality, Taxes, Red Tape, Cost of Labor, and Competition were all cited by at least 10% of small business owners. Way on down the list are Inflation and Interest Rates which were cited by a total of only 3% of small business owners.

Below we show the historical percentage of small business owners who cited Labor Quality as their number one problem. Back in August, this reading hit a record high of 27%, but at 25%, it still sits at extraordinarily high levels. While labor costs have been held in check to this point, never before have employers had so much trouble finding qualified workers. Sign up for Bespoke’s “2020” special and get our upcoming Bespoke Report 2020 Market Outlook and Investor Toolkit.

Bespoke Stock Scores — 11/12/19

Chart of the Day: The Changing Tides of Weekday Patterns

Bespoke’s Morning Lineup – 11/12/19 – Not Every Market Headline Has to Be Trade Related

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Semis Surge, Credit Rally, Breakeven Blow-Out, Fedspeak – 11/11/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at just how strong semis have been this bull market as well as how credit spreads have changed over the past year. We then show just how Boeing (BA) and Walgreens (WBA) saved the Dow from a decline in today’s session. Next, we show the massive move in breakeven yields and the tone of FOMC speakers in recent weeks.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Dividend Stock Spotlight: AbbVie (ABBV)

The Health Care sector has rebounded recently, and pharmaceutical stock AbbVie (ABBV) has rallied right alongside the sector. Since reaching its multi-year low around $62 in the middle of August, which also coincided with support from the top end of its former trading range, ABBV has surged over 37%. While it is currently pretty extended at over 2 standard deviations above its 50-DMA, the rally has broken what had been an 18-month downtrend from early 2018.

One factor that weighed on the stock during that time was concerns over generic competition as the patent for the company’s arthritis drug Humira—which makes up the bulk of the company’s revenues—is set to expire in 2023. Despite that looming headwind, ABBV has made efforts to diversify its revenue sources including on-going discussions for the acquisition of Botox maker Allergan (AGN). Additionally, other product lines are experiencing considerable growth such as its cancer treatment Imbruvica which saw revenues over $1.25 billion in the most recent quarter; a 29.3% YoY growth rate.

Even with the massive surge, ABBV is still the highest yielding stock in the S&P 500 Health Care sector. Yielding 5.54%, the next highest dividend in the sector is Pfizer (PFE) which yields 3.9%. That dividend is more than twice the size of the average S&P 500 and Health Care sector stock. Earlier this month, the company announced that the quarterly payout would be raised another 10%. Given that the payout ratio now sits at 84.1%, the ratio is getting a bit high, but the company’s long dividend history makes this an easier pill to swallow. ABBV has now raised its dividend for 48 consecutive years (includes when the stock was part of Abbott Labs (ABT) from which it was spun off in 2013), making it a Dividend Aristocrat. Not only does ABBV belong to this group, but it also boasts the highest yield of all the aristocrats. For reference, ABBV’s stock goes Ex-Dividend on January 14th, 2020. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Chart of the Day: Clean Breadth

Annual Holiday Slowdown Upcoming?

The period from September through early October has historically been the most volatile time of the year for the US equity market, and then things slow down dramatically throughout the holiday season. Below is a chart showing the average absolute percentage change on each day of the trading year for the S&P 500 since 1928. The first two trading days of the year are historically two of the most volatile days with an average move right around +/-1%, but then things quickly stabilize. From the third trading day of the year all the way through day 160 or so, the average trading day has very consistently averaged a move right around +/-0.70%. But then daily volatility starts to pick up as the summer turns to fall.

We’ve actually just gotten past the most volatile time of the year when looking at the rolling 1-month average, and from now through year-end, vol typically drops like a rock. Sign up for Bespoke’s “2020” special and get our upcoming Bespoke Report 2020 Market Outlook and Investor Toolkit.