Chart of the Day: Gold (GLD) One to Watch In 2020

2019 – A Most Positive Year

52.3%. That’s the percentage of all trading days throughout the S&P 500’s history since 1928 that have been up days for the market. Even though just barely more than 50% of trading days have been up days, it has translated into a price change of 18,157% for the S&P 500.

Casinos are wildly profitable using a similar format. They only have to win slightly more than 50% of all bets made to make a tremendous amount of money. The beautiful thing about investing in the stock market is that you get to be the casino for once!

2019 has been a great year for the S&P 500 with a gain of more than 28%. As shown below, the index only needed to trade higher on 59.3% of days to generate a 28% gain. But positive days occurring 59.3% of the time in a trading year is actually very rare. Only five other years since 1928 have seen up days more consistently with the most recent coming in 1995 when 61.9% of all trading days were positive. Sign up for Bespoke’s “2020” special and get our Bespoke Report 2020 Market Outlook and Investor Toolkit.

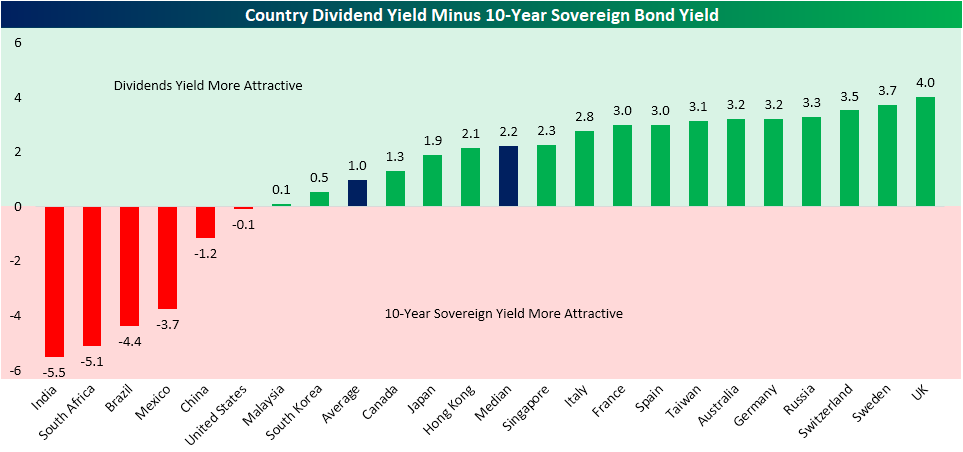

Dividend Yields Around the World

Looking at the dividend yields of 22 of the world’s largest economies, it may come as a surprise to hear that the United States currently has the second-lowest yield at just 1.83%. The only country with a lower dividend yield at 1.19% is India which is currently trading at 29.63 times earnings. In addition to India and the US, there are nine other countries with a dividend yield below the global average of 3.23%. Contrary to India’s high valuation and subsequent low yield, Russia currently boasts the highest dividend yield of 6.23% and the lowest valuation with a P/E ratio of just 6.68. That is even though the country was the second best-performing equity market in 2019 having risen over 43% year to date.

Given that interest rates remain historically low around the globe, and holding constant the varying levels of risk between a country’s stocks and bonds, equities generally continue to offer investors a higher return. The chart below shows the spread between the dividend yield and 10-year sovereign bond yield for each of the 22 countries previously discussed. As shown, there are only six countries, including the US, in which 10-year sovereign bonds are more attractive than the country’s stock market dividend yield. Given India’s low dividend yield, it is the country that most favors its 10-year sovereign bond (yielding 6.71%) while the opposite holds true for the UK given the dividend yield of 4.78% and the 0.78% yield on the 10-year Gilt. Sign up for Bespoke’s “2020” special to read the “International Markets” section of our 2020 Outlook report. We cover a number of additional fundamental, technical, and economic comparisons for countries around the world.

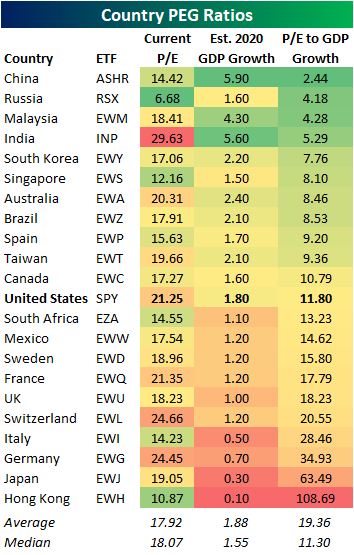

Country PEG Ratios Heading Into 2020

From Investopedia, a company’s PEG ratio “is used to determine a stock’s value while also factoring in the company’s expected earnings growth and is thought to provide a more complete picture than the P/E ratio.” Taking it a bit further, “While a low P/E ratio may make a stock look like a good buy, factoring in the company’s growth rate to get the stock’s PEG ratio may tell a different story. The lower the PEG ratio, the more the stock may be undervalued given its future earnings expectations. Adding a company’s expected growth into the ratio helps to adjust the result for companies that may have a high growth rate and a high P/E ratio.”

We like to calculate a PEG ratio of sorts for countries as well by taking the country’s stock market P/E ratio and its projected GDP growth. A country with a very low P/E ratio and high GDP growth (a low PEG ratio) would look very attractive using this measure, especially relative to a country with a higher P/E ratio and lower GDP growth.

Below is a look at how country “PEG” ratios look heading into 2020. At the moment, China appears to be the most attractive country with a P/E to GDP growth ratio of just 2.44. Forecast to grow 5.9% YoY, China has the highest expectations for GDP growth in 2020 while the current P/E ratio is one of the lowest of the countries shown. Historically, China has frequently taken the number one spot on this list. For Russia, growth is expected to be much more modest at 1.6% YoY, but the extremely low P/E of 6.68x earnings gives the country the second lowest PEG ratio. Last year, Russia also had the second-lowest ratio of the countries shown, and it was one of the best performing stock markets in the world in 2019.

India has by far the highest P/E ratio of all the countries shown, but its 5.6% expected GDP growth gives it a PEG of 5.29, which ranks fourth overall. For the US, its P/E ratio of 21.25 and estimated GDP growth of 1.8% gives it a PEG of 11.8, which is in the lower half of countries shown. At the bottom of the list is Hong Kong with an attractive P/E ratio of 10.87 but woeful growth expectations of just 0.10%. The weak GDP growth gives it a PEG of over 100! That is a massive drop compared to last year when it was just 3.9. Protests are clearly taking their toll. Sign up for Bespoke’s “2020” special to read the “International Markets” section of our 2020 Outlook report. We cover a number of additional fundamental, technical, and economic comparisons for countries around the world.

Bespoke’s Morning Lineup -12/24/19- Christmas Green

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

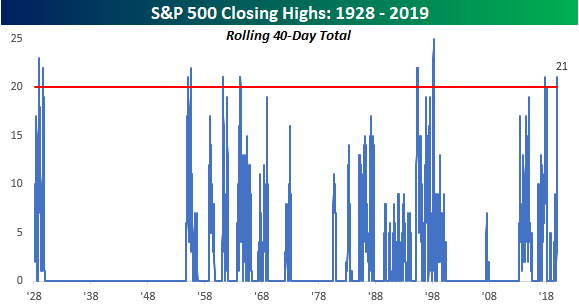

The Closer – Nine in a Row; Record High? Flip a Coin

Monday’s close was the 21st record closing high for the S&P 500 in the last 40 trading days. In other words, over the last eight weeks, investors have been getting record closes more often than once every other day! Pretty incredible.

In tonight’s Closer, we take a look at how the S&P 500 performed following prior periods where the index hit record closing highs more than half of the time over an eight-week period.

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

A Huge Jump in % of World Market Cap for One Country

On December 12th, the US stock market lost a full percentage point of its share of total world stock market cap. As shown below, the US’ percent of world market cap had been trending higher for most of 2019 as domestic stocks outperformed internationals. By the end of November, the US share of world market cap had gotten above 41%, but on December 12th, it fell to 39.66%. Can you think of what caused the dramatic drop?

If you immediately thought of the recent Saudi Aramco IPO, congrats. When Saudi Aramco went public earlier this month, its sheer size had a major impact on global stock market weightings. With a $1.9 trillion market cap, Saudi Aramco is easily the largest company in the world, topping the largest US company — Apple (AAPL) — by more than $650 billion. As shown below, the Saudi Aramco IPO pushed Saudi Arabia’s percentage of total world stock market cap from a mere 0.61% up to 2.8%. This means Saudi Aramco on its own makes up roughly 2.2% of total world market cap.

At 2.8%, Saudi Arabia now has the seventh largest stock market in the world behind the US, China, Japan, Hong Kong, the UK, and France.

Below we show current country stock market weightings compared to where they stood at the start of 2019, on Election Day 2016, and ten years ago at the end of 2009.

Saudi Arabia has seen the biggest increase of any country this year, while the US’ share is up the second most at +1.23 percentage points. (Prior to the Aramco IPO, the US had gained roughly 2.2 percentage points on the year.) China’s share has also gained in 2019, but its weighting has fallen 1.89 percentage points since Trump was elected, while the US has seen its share rise 3.28 percentage points over the same time frame.

Hong Kong has lost the most market share this year with a drop of 0.67 percentage points (6.95% down to 6.28%). Other countries that have seen their percent of world market cap decline in 2019 include Japan, the UK, India, and South Korea.

Over the last ten years, the US has seen by far the biggest increase in weighting at +9.89 percentage points. The only other countries to make notable gains this decade are China (+2.07 ppts) and Saudi Arabia (+2.10 ppts). Most other countries have lost share this decade, with the UK down the most at 2.52 percentage points. At the end of 2009, the UK had a solid 6.47% weighting of world market cap, but it’s down in the 3s now. Sign up for Bespoke’s “2020” special to read the “International Markets” section of our 2020 Outlook report.

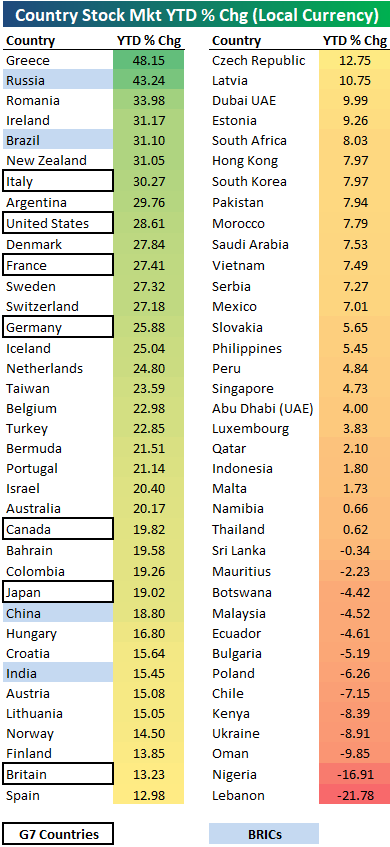

2019 Stock Market Performance Around the World

Below is a snapshot of 2019 stock market performance around the world. The table shows the year-to-date percentage change (in local currency) for the major stock markets of 74 countries.

It has been a great year for global equities with the average country up 12.45% year-to-date. Of the 74 countries, 61 are in the green while just 13 are in the red.

The top performing country in the world in 2019 is Greece with a gain of 48.15%. Russia ranks 2nd with a gain of 43.24%, followed by Romania (+33.98%), Ireland (+31.17%), and Brazil (+31.1%).

Notably, all of the developed “G7” countries and all of the BRICs rank in the top half this year when it comes to performance. Italy has been the top G7 country with a gain of 30.27%, but the US is not far behind in 2nd with a gain of 28.61%.

On the downside, Nigeria and Lebanon are the only two countries that fell more than 10%. Sign up for Bespoke’s “2020” special and get our Bespoke Report 2020 Market Outlook and Investor Toolkit.

Bespoke’s Morning Lineup – 12/23/19 – Nasdaq Goes For Nine in a Row

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Bespoke Brunch Reads: 12/22/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2020 Annual Outlook special offer.

Politics & Policy

Don’t Be Afraid of Political Fragmentation by Pepjin Bergsen (Chatham House)

Many European political systems are seeing their parties splinter into smaller and smaller groups, the opposite of the two-party system in the United States. But the shift can be managed quite effectively so it doesn’t result in gridlock, as exemplified by the Dutch experience. [Link]

Furor over the Fed: Presidential Tweets and Central Bank Independence by Antoine Camous and Dmitry Matveev (Bank of Canada Staff Notes)

In a new paper, researchers argue that while markets have been influenced by the President’s recent efforts to influence monetary policy, the FOMC has not yielded to pressure from the President. [Link; 27 page PDF]

Tech Wreck

The Decade Tech Lost Its Way (NYT)

A compendium of the stories which drove the arc of the technology industry from hero to villain across the last 10 years of growth, scandals, and memes that defined the technology industry. [Link; soft paywall]

Social Media

Facebook Is Still Prioritizing Scale Over Safety by Alex Kantrowitz (BuzzFeed News)

Internal incentives at Facebook direct employees to grow the business, despite concerns that the focus on growth is creating scandals that damage the company longer-term. [Link]

An eight-year-old U.S. YouTuber earned $26 million in 2019 by Trevor Mogg (Digital Trends)

Focused on toys but dabbling in a variety of subjects “Ryan’s World” is a YouTube channel with 23mm followers and 34bn views, earning the family that runs it tens of millions of dollars per year in ad revenues. [Link; auto-playing video]

The Best Things In Life Are Free

How I Eat For Free in NYC Using Python, Automation, Artificial Intelligence, and Instagram by Chris Buetti (Medium)

An inventive bit of code has made it easy to swap social media posts for free meals all over the city, and what’s really impressive is that it’s been entirely automated by its inventor. [Link]

Retailers Gave You Free Returns and You Ruined It by Donald Moore (Bloomberg)

Aggressive consumer behavior around free returns can include ordering numerous sizes, wearing and returning, and other major abuses can lead to blacklists at some online retailers who are tired of the costs. [Link; soft paywall]

Explainers

The WIRED Guide to 5G by Klint Finley (Wired)

Not sure what all this “5G” business means for your phone, your investments, or anything else? Wired has you covered with this helpful rundown on the technology. [Link; soft paywall]

What Trump has done to the courts, explained by Ian Millhiser (Vox)

Thanks to a compliant caucus of Senate Democrats, the President has been appointing huge numbers of federal judges to lifetime appointments at all levels of the judiciary and across the country. What’s especially noteworthy is their very young age, which means they will have a large impact on federal legal interpretation for decades to come. [Link]

Hedge Funds

Renaissance Employees Could Face Clawbacks Over Hedge Fund’s Tax Maneuver by Gregory Zuckerman and Richard Rubin (WSJ)

Employees who invested in RenTech’s hedge funds via their 401(k) or IRA plan without paying fees may be forced to pay large tax penalties to the IRS as a result of the practice. [Link; paywall]

Pigs

Chinese Gangs Use Drones to Spread African Swine Fever by Jordan Schneider (ChanEconTalk)

With state and local governments paying out compensation for herds of pigs impacted by African swine fever, local gangs have sprung up to take advantage of the new market and spread the disease to local herds. [Link]

History

How the West “Invented” Fertility Restriction by Nico Voigtländer and Hans-Joachim Voth (American Economic Review)

A fascinating review of why unusually late marriage ages for European women (a factor that has broadly benefitted European development) may have come about: more animal husbandry, caused by the high impact of the Black Death. [Link; 39 page PDF]

Suburbs

New York City Suburbs Lure Millennials With Luxury Digs, Ax-Throwing Bars by Prashant Gopal and Vildana Hajric (Bloomberg)

With younger people priced out of Manhattan and Brooklyn, two Westchester County cities are developing new buildings and amenities to attract residents fleeing the prices and cramped square footage of the central city. [Link; soft paywall]

Brexit

Violence in Northern Ireland Rising Amid Political Paralysis by Ceylan Yeginsu (NYT)

With the future of the Good Friday Agreement in doubt thanks to Brexit, sectarian and vigilante violence in Northern Ireland is once again on the rise after decades of improvement. [Link; soft paywall]

Crypto

Jilted investors want cryptocurrency boss’ body exhumed by Paulia Froelich (NY Post)

When he died from complications of Crohn’s, crypto entrepreneur Gerald Cotton took with him the passwords for millions of dollars worth of stored coins, prompting investors to demand a confirmation. [Link]

Opioids

Sackler-owned opioid maker pushes overdose treatment abroad by Claire Galofaro and Kristen Gelineau (AP)

The maker of OxyContin is trying to profit from the swelling of the opioid crisis by selling an overdose treatment abroad, benefitting from both the ascent and consequences of the drugs’ catastrophic abuse. [Link]

Labor Markets

Vox Media to cut hundreds of freelance jobs ahead of changes in California gig economy laws by Ari Levy and Alex Sherman (CNBC)

Freelancers working for Vox Media’s SB Nation site will lose their jobs after the passage of a new California law forces employers to reclassify contractors as employees. New full-time employees on a different team will take over the duties next year. [Link]

Goodbyes

Joe Hammond’s final article: ‘I’ve been saying goodbye to my family for two years’ by Joe Hammond (The Guardian)

Two years after being diagnosed with motor neuron disease, UK columnist Joe Hammond says goodbye to his readers and his family in a heartbreaking documentation of his slowly ending life. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!