Bespoke’s Morning Lineup – 2/26/20 – Looking For a Waypoint

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Investors are searching for a waypoint on the path of the coronavirus outbreak, and global futures have been all over the place with S&P 500 futures trading in a range of over 2% from their highs last night to their lows this morning. Currently, futures are indicating a slightly higher open, but those levels can and likely will change by the time you read this.

Read today’s Bespoke Morning Lineup for the latest on the impact of the coronavirus, how the outbreak is impacting economic data, and the latest stock-specific news.

Given the magnitude of the declines over the last several days, it’s hard to believe that many major US indices still aren’t oversold relative to their 50-day moving averages. In fact, despite falling more than any other major index ETF over the last five trading days, the Nasdaq 100 (QQQ) is still above its 50-DMA!

The Closer – Epic Drop in Stocks as Covid-19 Blasts Markets – 2/25/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, after the past two days’ brutal declines for stocks, we take a look at the moves in the VIX and credit spreads. We then review just how bad breadth has been and the negative reversal in today’s session. Turning to economic data, we review global trade activity and our Five Fed composite with the addition of the Richmond Fed’s data. We finish tonight’s note with an update on home prices.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Daily Sector Snapshot — 2/25/20

B.I.G. Tips – Big Drops From All-Time Highs

Dividend Stock Spotlight: Clorox (CLX)

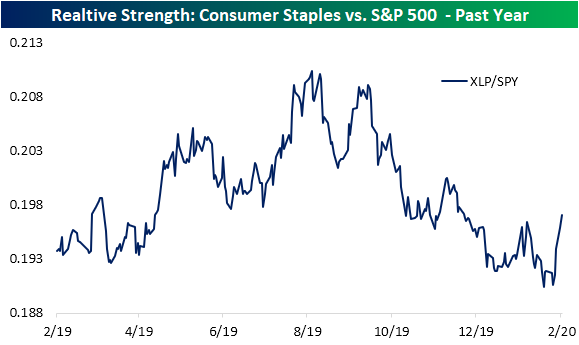

Safe havens like gold and US Treasuries have been surging but safe havens within the equities space, like Consumer Staples (XLP), have been unable to escape declines. While down about 3% over the past week, XLP, in addition to other defensive sectors like Utilities (XLU) and Real Estate (XLRE), have still managed to outperform the S&P 500. As shown in the relative strength chart below, the line over the past few days has risen sharply indicating outperformance of Consumer Staples versus the S&P 500.

One name worth mentioning within this sector is household cleaning product manufacturer Clorox (CLX). This is one of just 26 stocks in the S&P 500 that is trading higher today as of this writing. Since CLX has managed to shrug off the recent downturn, the stock has broken out of its sideways range between the low $160s and low $140s that has been in place for much of the past couple of years.

With a bullish technical backdrop, CLX’s fundamentals are looking more promising as well. The past few quarters have seen the company report negative year-over-year revenue growth for the first time since 2014. But the most recent quarterly report from earlier this month showed these declines slowed to a 1.6% YoY rate. Meanwhile, the recent run in price still leaves the price-to-earnings ratio well off of its highs and in the middle of its range of the past few years. Meanwhile, the price-to-book ratio remains historically low albeit on the rise over the past couple of years.

Given bond yields have continued to decline to record lows while equity declines have raised dividend yields, stocks now yield more than bonds by the highest margin in recent years as we discussed yesterday. The dividend yield of Clorox is the third-highest of the S&P 500’s Household & Personal Products industry group at 2.52%. That is also a higher yield than the 2.11% average yield for the broader Consumer Staples sector. Not only is CLX a high yielder but the dividend also seems to be a safe bet over the long run. The payout ratio remains at fairly healthy levels at 59.75%, meaning the company appears to have room to continue to pay shareholders and/or grow the dividend. On top of this, Clorox has a long history of uninterrupted dividend payments going back to the late 70’s. Not only has the company been paying shareholders for the past several decades, but it has also grown the dividend for 42 consecutive years, placing it in the club of Dividend Aristocrats (a group of stocks that have 25+ consecutive years of dividend increases). Start a two-week free trial to Bespoke Institutional to our full range of reports and interactive tools.

Not Even Triple Plays Are Safe

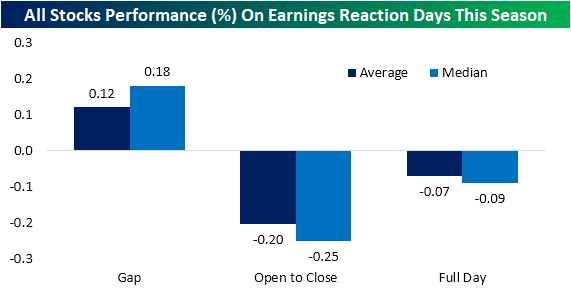

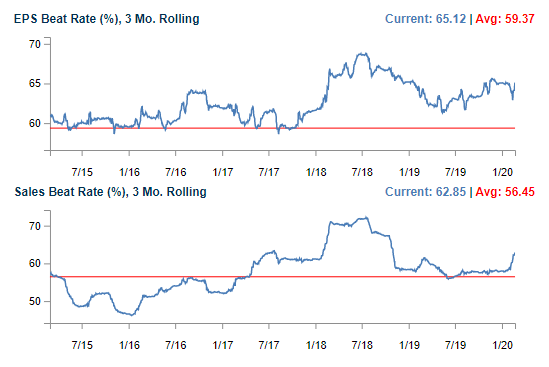

Since the beginning of 2020, one-day stock price reactions to earnings reports have been generally on the weak side. Despite gaps up at the open on both an average and median basis, stocks have faced selling from open to close to finish down 7 bps on average (median: 9 bps). That comes even though EPS and sales beat rates have remained fairly strong with both healthily above their long term averages as shown in the charts from our Earnings Explorer below.

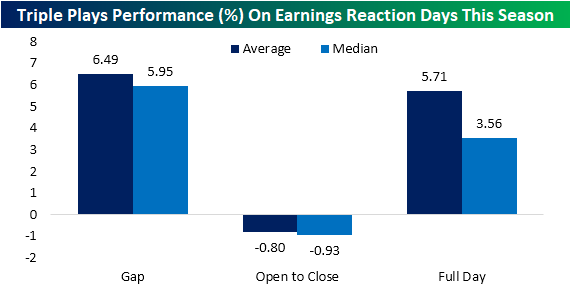

Although stocks broadly have been weak in reaction to earnings, stocks that have reported triple plays have seen stronger stock price reactions. A triple play is when a company beats EPS and sales estimates in addition to raising guidance. Of the 77 triple plays that have reported so far in 2020, the average gap up has been strong at +6.49%. Although there is some selling intraday, these stocks have finished up 5.71% on average by the end of the day after earnings.

While this has generally been the case this year, as headwinds from the coronavirus have ramped up in the past week, the dynamic of triple plays’ stronger response to earnings has fallen apart. On Friday, we noted that broader market selling had led the five triple plays of that day to turn sharply lower intraday despite solid gaps higher at the open. That has continued, if not worsened, this week. While intraday performance is a bit better than Friday, the gaps down of this week’s triple plays has been worse. In fact, of the six triple plays out since Monday only Cracker Barrel (CBRL) gapped up. On average, these six have fallen over 5% at the open in response to earnings with further selling on an average and median basis from open to close. In other words, selling the past few days has been pretty indiscriminate as even the positive catalyst of strong earnings have not been enough to pull in buyers.

In the charts below, we show six-month price charts of the stocks that have reported triple plays this week. As shown, most have gapped lower the day after earnings and have been met with further selling intraday with the exceptions of Kaman (KAMN) and National Storage Affiliates (NSA). In the cases of Guardant Health (GH), KAMN, and Sapiens (SPNS), uptrend lines or recent support have also been broken. On the other hand, the charts of Cracker Barrel (CBRL), Everquote (EVER), and National Storage Affiliates (NSA) are looking a bit more constructive despite the single day weakness on earnings. Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer, 100 Most Recent Triple Plays, and much more.

B.I.G. Tips – Analyzing the Selloff

Bespoke Stock Scores — 2/25/20

Americans Less Concerned than the Rest of the World?

When it comes to the Covid-19 coronavirus, sentiment over the potential for a global pandemic is in many ways just as important as the actual outbreak itself. After all, if consumers fear an imminent outbreak they will be more likely to curtail activity even before the onset of any spread. To that end, tracking search activity can provide a decent read into where sentiment regarding the coronavirus is now versus where it has been in the past. If people are worried about the coronavirus, they will be more likely to search for news and information on it.

On a global basis, search trends for ‘coronavirus’ peaked at the end of January and trended lower throughout February, but with recent news over the spread of the virus outside China, search activity began to rocket higher over the weekend and has been rising ever since. Just today, search trends topped their highs from late January, indicating that people are increasingly on edge.

One of the primary drivers for the increased concerns over the coronavirus was the spread in Italy over the weekend, and search data for the term in Italy really went parabolic in the last four days (second chart). While global searches for the term are only slightly above their January peak, searches in Italy are four times greater than they were at the end of January.

In the US, search trends for ‘coronavirus’ (third chart) have also started to move higher in the last few days. While search trends in Italy are more than four times the level they were at in late January, search trends in the US are still less than half of the level they were in late January. Now, if the US starts to see an increase in the number of confirmed cases in the coming days/weeks (not unlikely), it is highly likely that search volume here will also surge, but at this point, Americans have been relatively sanguine. Only time will tell if that is the right attitude or not. Get Bespoke’s most actionable ideas and analysis with a Bespoke Premium membership. Click here to start a two-week free trial.