Chewy (CHWY) Breaks Out

Online pet store Chewy (CHWY) is one of our “Stocks for the COVID economy.” Consumers still have to feed and tend to their pets even during a pandemic, and instead of going to the pet store, online delivery is the new norm. Who knows how many customers Chewy has added over the last month or so, but we’d guess it’s a lot. And with a platform that allows for “auto-ship” of products on a regular basis, we’d also guess that these new customers will be sticky.

CHWY fell 36% from a high in late February to its recent low in mid-March. Since making that intraday low on March 12th, however, the stock is up 76.5%, and it broke out to a new high last Friday. Start a two-week free trial to Bespoke Premium to see our list of “Stocks for the COVID Economy.”

Massive Moves for Homebuilder Stocks

Below is a snapshot of major US homebuilder stocks run through our Trend Analyzer tool. Our Trend Analyzer shows both the year-to-date percentage change for each stock as well as its 5-day percentage change.

Incredibly, a major homebuilder like KB Home (KBH) rose 48.35% last week, but it’s still down 47.5% year-to-date. M/I Homes (MHO) is up 41.28% over the last week but is still down 53.3% year-to-date. You see similar numbers up and down the list. And even after a huge rally last week, every homebuilder on the list is still 20% below its 50-day moving average or more. Toll Brothers (TOL) is another name that is still down nearly 50% year-to-date even though it rallied 37% last week. Ahead of the open this morning, TOL is trading 42.75% below its 50-day moving average. Start a two-week free trial to Bespoke Premium to use our Trend Analyzer across the spectrum of US stocks and ETFs.

Bespoke’s Morning Lineup – 3/30/20 – A Quiet Monday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Here’s one we haven’t seen in a long time. The S&P 500 and Nasdaq are both poised to open within 0.10% of their close on Friday. While global equities have been uncharacteristically stable this morning, crude oil is still experiencing extreme volatility and briefly traded below $20 to its lowest level in 17 years.

Read today’s Bespoke Morning Lineup for a discussion of the latest trends and statistics of the outbreak, overnight moves in the market, and a great state by state summary of the latest Covid-19 trends in the United States.

While things are far from certain, one encouraging trend we have seen in recent trends related to the Covid-19 outbreak is that the day over day percent change in global case counts and deaths has shown signs of starting to flatten from the mid-single digits to the low single digits. Due to the fact that the decline came on a Sunday (we saw similar declines on prior Sundays), we would caution against reading too much into this, but in a world where we’re grasping at straws for signs of hope, this one is worth watching. While global trends are slowing, as noted in this morning’s report, US trends have still shown no similar signs of improvement.

Bespoke Brunch Reads: 3/29/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2020 Annual Outlook special offer.

Coronavirus Op Eds

The Real Miami by Udonis Haslem (The Players’ Tribune)

A moving and concise statement of principles from Miami native Udonis Haslem calling attention to the unique challenges posed by COVID-19 for lower income communities. [Link]

How Long Will the Coronavirus Lockdowns Go On? by Scott Gotlieb (WSJ)

Testing, studies to identify blood antibodies, and novel medications can all help get the US outbreak of COVID-19 contained and life back towards normal. [Link; paywall]

Corona-nomics

Don’t ‘Reopen’ the Economy. Don’t Let It Crash. Put It on Ice. by Matthew C. Klein (Barron’s)

An argument that the best economic policy for addressing the COVID-19 outbreak is full underwriting of all business revenues by the Treasury for the duration. [Link; paywall]

Longer-run economic consequences of pandemics by Oscar Jorda, Sanjay R. Singh, and Alan M. Taylor (FRBSF Working Papers)

The authors look to history for insight into likely macroeconomic consequences of the current pandemic, concluding a large downward adjustment for the real interest rate lasting approximately 3 decades and a substantial increase in real wages over that period. Notably major wars tend to have the opposite effect. [Link; 15 page PDF]

Pandemic Pups

Dogs being trained to sniff out COVID-19: charity (Yahoo!/AFP)

Trainers working with Medical Detection Dogs and two British schools will test whether dogs can detect the coronavirus; canines have proven adept at detecting malaria in the past. [Link]

Newest Shortage in New York: The City Is Running Out of Dogs to Foster by Bailey Lipschultz and David R. Baker (Bloomberg)

One of the happiest consequences of millions of New Yorkers being locked in their homes: shelters are being cleared of dogs as lonely lockdowns inspire adoptions and fosters that have basically emptied shelters in the city. [Link; auto-playing video]

Americans are panic buying food for their pets by Nathaniel Meyersohn (CNN)

Dog and cat food sales are soaring as consumers stockpile supplies of chow for their companions along with canned and frozen food for themselves. [Link]

Pandemic Labor

Instacart’s Gig Workers Are Planning a Massive, Nationwide Strike by Lauren Kaori Gurley (Vice)

As demand has surged thanks to stay-at-home orders, delivery service workers are organizing a national wildcat strike Monday in an effort to get hazard pay, hand sanitizer, and paid leave amidst the worst pandemic in a century. [Link]

Perdue workers walk off production line in Georgia over coronavirus safety measures by Matthew Prensky (Delmarva Now)

Dozens of workers at a chicken plant in Georgia walked off the job this week in order to protest working conditions and their possible exposure to coronavirus in their workplace. [Link; auto-playing video]

Migrant Farmworkers Whose Harvests Feed Europe Are Blocked at Borders by Liz Alderman, Melissa Eddy, and Amie Tsang (NYT)

Seasonal workers that are the backbone of harvests across Europe won’t be able to pick fruit and vegetables given lockdowns on travel thanks to COVID-19, leaving farms wondering how to get food out of the fields. [Link]

Viral Media

The Evening News Is Back (DNYUZ)

Looking for basic information about the state of the world amidst a massive pandemic, TV watchers have flocked to the nightly news on broadcast channels, driving audience numbers to 20 year highs. [Link]

South Korea drive-in cinemas enjoy sales boom over virus fears (Yahoo!/AFP)

With Koreans taking social distancing very seriously, drive-in theaters are a convenient way to watch a movie without risk of creating a disease cluster. [Link]

The Bad News

11 Million in U.S. at Serious Risk If Infected With COVID-19 by Dan Witters and Sangeeta Agrawal (Gallup)

Using the prevalence of diseases which can raise severity of COVID-19, Gallup has estimated that about 4.5% of the population is likely to be in deep trouble if they contract the disease. [Link]

What It Looks Like From Space When Everything Stops by Eric Roston (Bloomberg)

A rundown of high-traffic areas around the world that are basically empty at the hands of the COVID-19 outbreak. [Link]

Epidemic Italy

February Champions League Soccer Match in Italy Now Described as a “Biological Bomb” by Elliot Hannon (Slate)

When 40,000 residents of Bergamo visited Milan for a soccer match, they unintentionally brought back a huge wave of viral infections which the beleaguered city is still trying to get a grip on. [Link]

Family Is Italy’s Great Strength. Coronavirus Made It Deadly. by Margherita Stancati (WSJ)

A higher share of families with multiple generations living under the same roof has made Italy uniquely at risk for a catastrophic toll from COVID-19. [Link]

The real death toll for Covid-19 is at least 4 times the official numbers by Claudio Cancelli Luca Forest (Corriere Della Sera)

The epicenter of COVID-19’s impact on Italy likely has many more COVID-19 deaths than have been officially reported, with 5 times as many deaths as would be typical for this time of year versus twice as many based on official reports of viral deaths. [Link]

Market Mayhem

Poof! Legendary Ronin Capital Disappears (UPDATED) by Paul Rowady (Alphacution)

Some details around proprietary trading firm Ronin Capital’s blow-up and the collateral damage it caused across markets. [Link]

RBC Seeks Fire-Sale Buyers for Seized Mortgage Debt by Liz Hoffman and Gregory Zuckerman (WSJ)

The US branch of Canada’s largest bank seized assets from a client that had financed the bonds via repo facing RBC, prompting margin calls and eventually a forced unwind with RBC taking ownership of the portfolio to cover its loans to a mortgage REIT. [Link; paywall]

Retail Revolution

Inside the Story of How H-E-B Planned for the Pandemic by Dan Solomon and Paula Forbes (Texas Monthly)

Iconic Texas grocer H-E-B (we highly recommend the fresh tortillas) has introduced a range of policies and strategies to protect customers and meet massive demand for staples amidst pandemic stockpiling. [Link]

U.S. Retailers Plan to Stop Paying Rent to Offset Virus by Lauren Coleman-Lochner, Natalie Wong, and Edward Ludlow (Bloomberg)

With revenues falling off a cliff, businesses are slashing payrolls and also daring landlords to kick them out and try to replace solid leases which may suffer only a month or two of disruption. [Link; soft paywall, auto-playing video]

Lux Life

Swiss hotel offers luxury quarantine package including $500 coronavirus test by Natalie B. Compton (The Seattle Times)

Very wealthy clients can access in-room testing, doctor visits, and nurse care at Le Bijou in a range of properties across Switzerland. [Link; soft paywall]

Possible Solutions

Coronavirus: Singapore app allows for faster contact tracing by Hariz Baharudin and Lester Wong (Straits Times)

Anonymized data on proximity and duration of contacts who may have had exposure to the coronavirus is offering a possible technical solution to the problem of contact tracing exposures related to the COVID-19 crisis. [Link]

Arizona man dies after self-medicating to prevent COVID-19 coronavirus (12News)

After hearing exhortations from the President to use chloroquine to treat COVID-19, a couple in Arizona was hospitalized (one died) after taking a related compound. [Link; auto-playing video]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 3/27/20

This week’s Bespoke Report newsletter is now available for members.

After falling more than 30% over the last four weeks, the S&P 500 had its 5th one-week gain of 10%+ since 1940 this week. We cover equity markets, the economic shutdown, and the government’s emergency support plan in this week’s newsletter. To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 3/27/20

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Daily Sector Snapshot — 3/27/20

How Much Cash For Households?

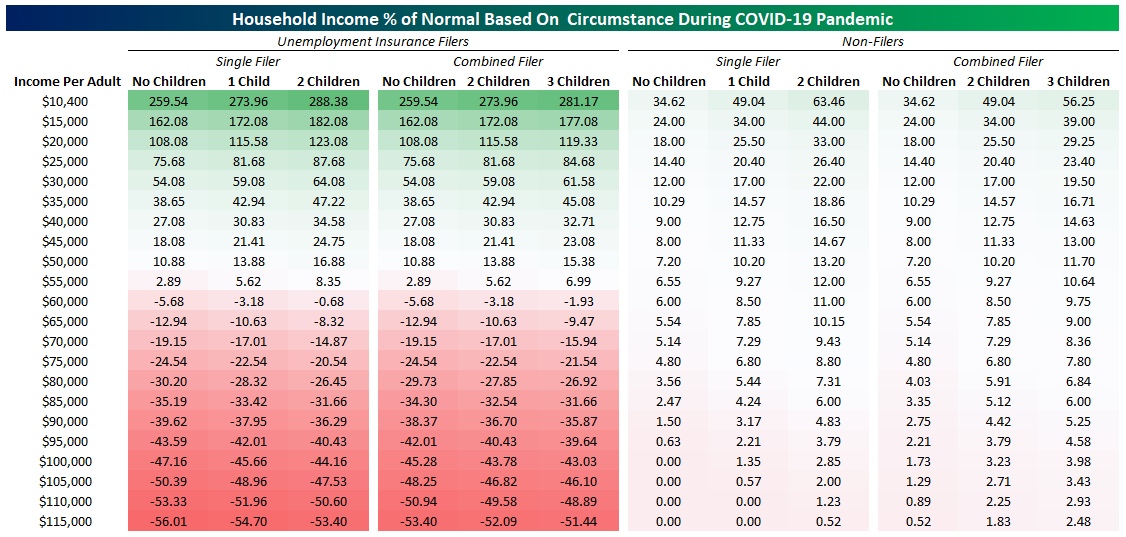

This morning the US House of Representatives is planning to pass the $2 trillion dollar economic stimulus package voted out of the Senate 96-0 earlier this week after intensive negotiations between the White House, Senate (including both Majority Leader McConnell and Minority Leader Schumer), and the House (Speaker Pelosi). The bill is enormous, with dozens of provisions ranging from modest grants to specific hospitals or other institutions to huge sweeping programs like cash rebates or corporate lending. We wanted to focus on two key aspects and see how much cash households can expect from the bill. To make things easier, we’re using New York State unemployment benefit amounts, assuming joint filers both work and earn the same amount of income, and ignoring head-of-household filers. We also use big, round numbers, so it’s important to stress this is an illustrative example. Actual benefits may vary substantially, but this is a rough set of guideposts.

The first key benefit is a cash rebate of $1200 per adult (plus $500 per child). This amount is phased out above an annual income of $75,000 per person ($75,000 per single filer, or $150,000 for joint-filers). The second benefit adds $600 to state unemployment payouts per beneficiary per week and extends those benefits for four months. We should also note that in addition to the $600, the new bill expands the scope of who can apply for unemployment insurance, though that fact is not relevant to our calculations. In the table below, we show the dollar amount of payments in unemployment insurance as would typically be the case plus the cash payment and expanded unemployment benefits passed by the Senate bill, varying by household circumstance. As shown, while workers who do not end up on unemployment insurance roles don’t get a huge cash payout, amounts can still be large. Phase-outs over $75,000 in annual earnings mean childless filers making six figures get nothing, and having children makes a big impact for the total cash taken home by households who get these checks. For workers who receive unemployment benefits, the amount of cash put up by the government to keep people afloat is genuinely impressive: for a single filer that was earning minimum wage and working 40 hours per week (~$15,000 per year), the next four months offer about $13,000 in cash payments. There are similar amounts of cash handed out to anybody that loses their job, although number of children and size of income varies substantially.

With similar cash support for fired workers by income, on a relative basis this bill is extremely progressive. For adults earning roughly $20,000 per year or less, the bill more than replaces income lost from the pandemic. For example: adults making $15,000 will have income 162% higher than they otherwise would if they file for unemployment inusrance. Any household with average adult income below $55,000 will receive higher income than they otherwise would. Of course, that’s why this bill is “stimulus”; it’s trying to encourage consumer spending. It’s also notable that those who don’t file for unemployment insurance universally come away better off because our analysis assumes they do not lose income.

Bespoke Morning Lineup – 3/27/20 – Another Corona Friday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

It’s looking like another one of those Corona Fridays for US equities as futures are trading down around 3% piggy-backing off the declines we’re seeing in Europe. News that UK Prime Minister Boris Johnson has tested positive for the virus isn’t boosting sentiment either. Here in the US, there are also concerns that the House vote on the relief bill will be forced to an in-person vote instead of unanimous consent and that would force members to return to DC from their districts and delay the ultimate passage. On the House bill, we should know by noon whether the bill will be able to be passed today, but given it’s a Friday and the market is closed for the next two trading days, it’s hard to convince investors to hold equities into a weekend where the headlines are more likely to be bad than good.

Read today’s Bespoke Morning Lineup for a discussion of the latest trends and statistics of the outbreak, overnight moves in the market, and the plunging levels of confidence just released in Italy.

The S&P 500’s 17%+ rally in the last three trading days is the strongest rally for the index since the 1930s, and one of only a handful where the S&P 500 even rallied 10% during a three-day period. The last such occurrences of a 10%+ move were in March 2009, November 2008, October 2008, and then October 1987.

The Closer – Rebalancing Boosts Bulls – 3/26/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a few reasons not to trust the current rally before turning to today’s strong 7 year auction. We then show what today’s initial jobless claims number means for the macroeconomic picture in Q2. We finish tonight with a theory as to why stocks have ripped higher this week.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!