Worlds Apart: YTD Sector Performance

If you want to see an example of where the term winners and losers couldn’t be more applicable, take a look at the performance of S&P 500 sector ETFs on a YTD basis. The chart below is derived using performance numbers from our Daily Sector Snapshot report, which provides investors with an easy-to-read matrix of technical analysis, breadth and internal readings, and fundamental data points. It’s the perfect way to get an aerial snapshot of both current readings and the way they’ve been trending for each of the major sectors. This perspective also allows investors to see how sectors stack up versus each other as well as relative to themselves on a historical basis.

2020 has clearly been a case of the have and have nots. On the haves side, Technology (XLK) and Consumer Discretionary (XLY), which is basically Amazon (AMZN) and a few other retailers, top the list. Rounding out the top three, Communication Services (XLC) is the only other sector up over 10% and outperforming the S&P 500. On the have-nots (or in this case, the ‘nearly halves’) side, we have Energy leading the way lower with a decline of 41%, followed by Financials (XLF) which is down 21.2%.

There was a time not long ago when Energy and Financials were considered the life-blood of a capital intensive economy, but these two sectors have been deemed irrelevant by the market in the current work-from-home world where interest rates are zero and money is practically free. Instead, Communications, Technology, and Retailers with a strong online infrastructure are the ever-important cogs in the digital economy. Today, it may seem that this is a secular shift in the shape of our economy, which in many respects is true. But don’t count out the old leaders just yet. Someday, ‘going to work’ will once again mean more than just rolling out of bed and over to your desk chair. In that environment, people and goods will increasingly move, capital intensive infrastructure projects will be undertaken and interest rates just might move higher. Click here to view Bespoke’s premium membership options, including the must-have Daily Sector Snapshot report.

Bespoke’s Morning Lineup – 8/24/20 – Another Monday Rally

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Behind every stock is a company. Find out what it’s doing.” – Peter Lynch

Sundays may be for “Meet the Press”, but if its Monday, it’s a market rally. US futures are following the rest of the world higher this morning with all the major averages looking at gains of nearly 1% at the open. European equities are even stronger with most benchmarks trading up over 2%. Breadth, which has been a nagging issue in the US over the last couple of weeks, is strong in Europe with advancing stocks outnumbering decliners by more than 9-1.

News driving stocks higher today is mostly due to hopes of a fast-tracked vaccine by as soon as Election Day. The economic calendar is quiet to kick off the week. The only US data point is the Chicago Fed National Activity Index which came in well below forecasts. Economists were expecting a headline reading of 3.70 for July, but the actual reading came in at just 1.18. We would note, though, that June’s reading was revised sharply higher (from 4.11 up to 5.33).

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

In this “Monday rally” for US equities, the Nasdaq 100 is on pace to open up roughly 1%. A gain of that magnitude is right in line with what has become the norm over the last several weeks as the index has traded higher by at least 1% on eight of the last ten Mondays. The only exceptions were on 7/13 (-2.2%) and 8/10 (-0.55%). A 1%+ gain today would make it nine of eleven.

Given all the focus on narrowing breadth in the market lately, we wanted to see if that trend was evident during these Monday rallies as well. The chart below shows the number of advancing issues in the Nasdaq 100 on each of the days listed above. For the eight Mondays days in the last ten weeks where the Nasdaq 100 rallied more than 1%, the average number of advancing issues per day was 78.5, but each of the last two saw daily readings of just 72. Additionally, the last two occurrences rank as tied for the second weakest of the eight prior days. Based on these two factors, it’s certainly valid to say that breadth has been narrower more recently. At this point, though, it’s hardly a glaring divergence, and unless we were already looking for signs of narrow breadth in this relationship, it probably wouldn’t have stuck out.

Bespoke Brunch Reads: 8/23/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Biome Stories

‘Murder Hornets’ in the U.S.: The Rush to Stop the Asian Giant Hornet by Mike Baker (NYT)

So-called ‘murder hornets’ get a lot of hype as a threat to humans, but they are a very real threat to already-struggling pollinators like bees, which have suffered massive population loss in recent years and don’t need another competitor. [Link; soft paywall]

How the World’s Largest Garbage Dump Evolved Into a Green Oasis by Robert Sullivan (NYT)

Arthur Kill was the world’s largest garbage dump, but returning the site to nature wasn’t actually that complicated: it was covered up and left for nature to work its magic. The result is a near-paradise after just 20 years of lying fallow. [Link; soft paywall]

Economic Research

Germany is beginning a universal-basic-income trial with people getting $1,400 a month for 3 years by Adam Payne (Business Insider)

120 German volunteers will get a €1,200 monthly payment for three years, with their outcomes studied by social scientists in an effort to assess how the larger population might respond to a more universal policy of the same kind. [Link]

Market Function Purchases by the Federal Reserve by Kenneth D. Garbade and Frank M. Keane (NY Fed Liberty Street Economics)

A history of historical interventions in the US Treasury market by the Federal Reserve, showing that recent purchases to stabilize markets during the COVID shock was unprecedented in size and scope. [Link]

CRE Innovation

WWE Turning Orlando’s Amway Center Into ‘WWE ThunderDome’ for TV Production Going Forward by Just Barrasso (SI)

WWE events are now being held on a semi-permanent basis in Orlando’s Amway Center, which has been upgraded in numerous ways to adapt to the conditions of the COVID pandemic. [Link]

REI looks to sell brand new Seattle-area HQ as pandemic forces retailer to rethink remote work by Taylor Soper (GeekWire)

A brand new Bellevue, WA headquarters for REI is being abandoned thanks to a near-100% work from home policy driven by COVID; specifically, the company says that having a distributed workforce “will have immediate, positive impacts on our ability to attract and retain a divers and highly skilled workforce”. [Link]

New York Stories

Movers in N.Y.C. Are So Busy They’re Turning People Away by Julie Satow (NYT)

Moving companies report “double the volume of customers – maybe more” this summer thanks to departures from the city for local suburbs, turnover in apartments within the city, and people moving out of the Tristate area entirely. [Link; soft paywall]

What Happened When Homeless Men Moved Into a Liberal Neighborhood by Daniel E. Slotnik (NYT)

COVID’s arrival meant homeless shelters had to reduce capacity, and as a result New York City bid up empty hotel rooms to house people formerly in crowded shelters. But in a deep Democratic stronghold, this modest form of redistribution was met with aggressive and painfully harsh resistance. [Link; soft paywall]

Lost and Found

30-year-old stash of beer and gum found in library’s mystery section by Ben Hooper (UPI)

Stashed in the mystery section of the Walla Walla, WA public library 30 years ago: five cans of beer and a packet of Godzilla Heads gum, untouched for at least three decades. [Link]

‘The mystery is over’: Researchers say they know what happened to ‘Lost Colony’ by Jeff Hampton (The Virginian-Pilot)

The so-called Lost Colony of Roanoke Island likely moved with friendly Croatoan indigenous people, with evidence suggesting that colonists intermarried with their hosts and thrived despite their status as “lost”. [Link]

Voting

The 2018 Voting Experience: Polling Place Lines by Matthew Weil, Charles Stewart III, Tim Harper, and Christopher Thomas (Bipartisan Policy Center)

In 2018 voters faced huge increases in vote times, with lower-income and non-white voters facing substantially longer waits in the first election following the removal of Voting Rights Act protections by the Supreme Court. Voters in precincts that were >90% non-white average wait times of 32.4 minutes, more than six times the 5.1 minute average wait time for voters at precincts that are >90% white. [Link]

Kids These Days

Where Has Your Tween Been During the Pandemic? On This Gaming Site by Kellen Browning (NYT)

Roblox is the most popular online world for children stuck at home during the pandemic with a massive windfall to developers that built games as part of the platform. [Link; soft paywall]

Convenience Business

With Seasonal Products Making an Early Return This Year, Consumers Weigh In on Sweet Spot for Promotions by Alyssa Meyers (Morning Consult)

An amusing poll that shows consumers generally prefer companies hold off on seasonal product promotions until the actual season they’re associated with. [Link]

Jimmy Butler’s $20 coffee hustle is the best business in the NBA bubble by James Dator (SBNation)

The NBA bubble created a unique kind of scarcity, and ballhandling entrepreneurs are stepping into the gap. Jimmy Butler is probably the most successful, running an amusingly simple coffee stand out of his room at Disney World. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Bucking Trends, ZIRP With No End

This week’s Bespoke Report newsletter is now available for members.

US large cap stocks continue to trend higher, even as small caps have retreated to support and other global equities have broken post-COVID uptrends to the downside. All is not lost, though, after an incredibly strong earnings season and with COVID retreating in the US…for now. This week we’re also watching the possibility of a double hurricane in the Gulf of Mexico, booming housing markets and the lumber they’re desperately bidding for, upticks in COVID case counts for a number of other countries, and booming e-commerce sales from major retailers. We discuss all these items in detail along with economic data in the US and around the world, new all-time highs for US stocks, and the outlook for Federal Reserve policy in this week’s Bespoke Report.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Daily Sector Snapshot — 8/21/20

State COVID vs. Unemployment

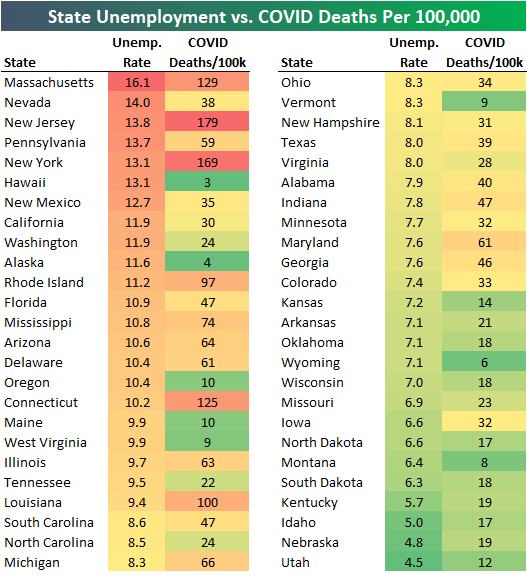

There have been plenty of jabs thrown between state governors since COVID began back in late February. While COVID is still ongoing, we can compare state performance numbers at this point by looking at COVID deaths per 100,000 along with state unemployment rates.

In the table below we show state unemployment rates as of July 2020 along with COVID deaths per 100,000 people (as of 8/21/20). As shown, Massachusetts currently has the highest unemployment rate at 16.1%, followed by Nevada at 14%, New Jersey at 13.8%, Pennsylvania at 13.7%, and New York and Hawaii at 13.1%.

Massachusetts, New Jersey, and New York have some of the highest unemployment rates and by far the highest COVID deaths per 100,000, but Nevada, Pennsylvania, and Hawaii have high unemployment rates yet much lower COVID deaths per 100,000. While New York and Hawaii have the exact same unemployment rates, New York has 169 COVID deaths per 100,000 while Hawaii is at just 3 deaths per 100,000.

States with the lowest unemployment rates have some of the lowest COVID deaths per 100,000.

If we provide a scatter plot of the data in the table above, you can see a pretty clear trend line between state unemployment rates and COVID deaths per 100,000:

Because of the nature of the virus, it’s obvious that states with higher population densities are more at risk. New Jersey has the highest population density in the country, and it’s also the state with the highest number of COVID deaths per 100,000. Rhode Island, Massachusetts, and Connecticut are the next most populated states in terms of people per square mile, and these states all have high COVID deaths per 100,000 as well. States like Florida, Ohio, and California have managed to keep their COVID deaths per 100,000 under much better control so far even with pretty high population density. Click here to view Bespoke’s premium membership options for our best research available.

Largest S&P 500 Stocks + Tesla (TSLA)

Tesla (TSLA) is now up 50% over the last 10 calendar days dating back to August 11th. This has propelled the company way up the list of the largest US companies.

Below is a table of the largest stocks in the S&P 500 with Tesla (TSLA) included. As shown, Tesla’s $382.7 billion market cap would rank it as the 9th largest stock in the S&P 500 were it in the index.

On August 11th, Tesla’s market cap was just $256 billion, so over the last ten days it has leapfrogged companies like Walmart (WMT), Home Depot (HD), JP Morgan (JPM), Procter & Gamble (PG), Mastercard (MA), and NVIDIA (NVDA). Next up would be Visa (V) and Johnson & Johnson (JNJ), which have market caps just under $400 billion. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 8/21/20 – One Down, One to Go

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“An investment in knowledge pays the best interest.” – Benjamin Franklin

The Democrats have had their turn, and now the attention will turn to the Republican Party next week. After that, the race starts! Whether it was the fact that the convention was confined to the virtual world or something else, the typical bounce that a ticket sees during their convention hasn’t materialized this year. In the last week, Biden’s odds for winning the election in November have actually declined a bit, while the odds of the Democratic party taking control of the Senate have seen a larger drop, falling from 61.2% down to 56.3%. The lack of a bounce is good news for Republicans, but with their convention also taking on a more subdued tone next week, there’s no guarantee that the Trump ticket will see a bounce either.

In markets this morning, futures have been dropping all morning and aren’t far from their lows of the day. While Asia was positive overnight, European equities started the day modestly lower and have been weakening all morning. Weak economic data in Europe and trade issues with China are all weighing on sentiment.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, updated flash PMI readings for August, trends related to the COVID-19 outbreak, and much more.

For a month that usually isn’t great for the market, this August has been shaping up just fine. Through Thursday’s close, the S&P 500 was up 3.5% so far in August. For the first 20 days of August, this month has been the strongest since the 4.26% gain in 2000, and going back to 1945 there have only been eleven other August months that saw a stronger performance in the first 20 days of the month.

B.I.G. Tips – Death by Amazon – 8/20/20

Amazon (AMZN) is up to 5.7% of the S&P 500’s market cap. While other large tech-adjacent names have had a similarly large impact on the aggregate market this year, the e-commerce giant remains somewhat unique for its scale and penetration into every possible market. At the same time, it’s interesting to note that many other retailers have been able to thrive in this environment. Target (TGT), Wal-Mart (WMT), Home Depot (HD), and Lowe’s (LOW) are all examples of retailers that have leveraged a combination of unique offerings and extremely rapid digital sales growth. 100% YoY sales growth for digital channels is the norm for many major retailers at this point. Unfortunately, while some companies have been able to thrive in the current environment, smaller and more specialized retailers haven’t been able to drive traffic as well. Two recent de-listings removed from our index this month (ASNAQ and TLRDQ) are examples of stocks that haven’t been able to keep up.

Our “Death By Amazon” index was created many years ago to provide investors with a list of retailers we view as vulnerable to competition from e-commerce. In 2016, we also created our “Amazon Survivors” index which is made up of companies that look more capable of dealing with the threat from online shopping. To see how the two indices have been performing lately and view the full list of stocks that make up the indices, please read our newest report on the subject available to Bespoke Premium and Bespoke Institutional members.

To unlock our “Death By Amazon” and “Amazon Survivors” indices, login or start a two-week free trial to either Bespoke Premium or Bespoke Institutional.