Bed Bath & Beyond (BBBY)

Coming into yesterday, Bed Bath & Beyond (BBBY) had fallen in reaction to ten of its last thirteen quarterly earnings reports. The stock exploded higher in reaction to this quarter’s report, however, with a one-day gain of 25.13% yesterday. As shown below, there have only been two other days in BBBY’s history that have seen a bigger one-day gain. On March 24th of this year, the stock jumped 28.25%, while back on March 30th, 2000, the stock rose 30.22%.

As the table shows, following prior 15%+ one-day gains for BBBY, the stock has typically pulled back over the next week, but over the next three months, the stock has averaged an additional gain of more than 26%.

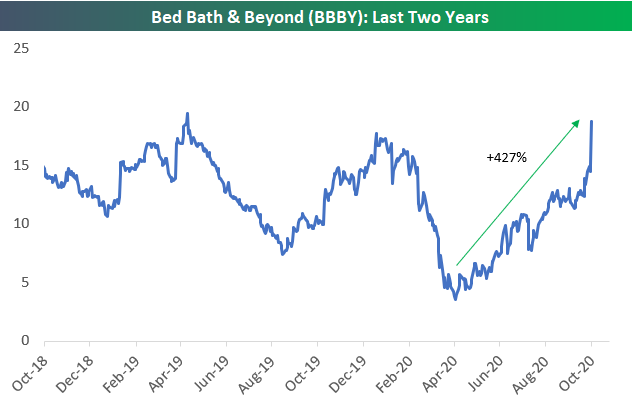

Since its low of $3.56/share back on April 2nd, BBBY is now up 427%!

The recent gains for BBBY have finally given shareholders a “higher high” on the long-term price chart. Yesterday’s gain pushed shares above highs seen last December. For a stock that went from $80 in late 2013 to the mid-$3s earlier this year, it’s a start! Now that this downtrend has been broken, technicians will be looking for a “higher low” to be established and a new uptrend to take hold. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 10/2/20 – October Surprise

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Every morning I jump out of bed and step on a landmine. The landmine is me. After the explosion, I spend the rest of the day putting the pieces together.” – Ray Bradbury

Just when you thought things couldn’t get more chaotic, we got the news late last night that the President, his wife, and an aide tested positive for COVID. Obviously, we wish the President and everyone else around the world who has come down with this virus a speedy recovery. Time will only tell how the President’s diagnosis will impact the election, but with the added amount of uncertainty, you can’t fault investors for taking some chips off the table heading into a weekend.

With the news regarding the President’s positive COVID test, you may have forgotten that there was a jobs report this morning. The results were mixed but more negative than positive with Non-Farm Payrolls missing expectations (661K vs 859K) due to a larger than expected decline in government jobs from the loss of census workers. The Unemployment Rate, however, came in a bit lower than expected at 7.9% versus expectations for a level of 8.2%.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

Earlier this week, we noted that the relative strength of the semiconductors had hit a new record high, which was a positive sign for the broader market. Taking a look at the semis from another angle, below we show the cumulative A/D line of the Philadelphia Semiconductor Index (SOX). After moving basically sideways for well over a month now, the SOX’s cumulative A/D line now looks to be breaking out of that range as it has moved to new highs in the last two days. Can the SOX itself be far behind?

Bespoke’s Consumer Pulse Report — October 2020

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Slight Shifts in Sentiment

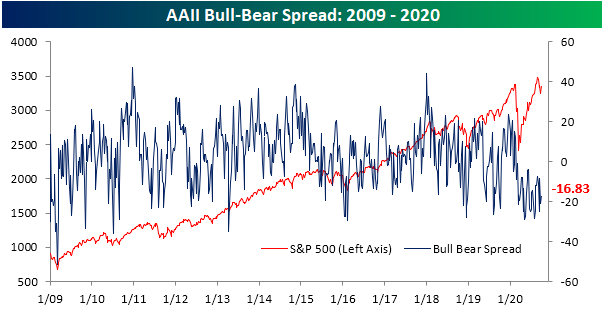

Over the past week, the S&P 500 has turned higher erasing a portion of September’s losses. With the index currently fighting to hold above its 50-DMA, bullish sentiment has risen slightly. AAII’s reading on bullish sentiment rose to 26.24% from 24.89% last week. While more than a quarter of respondents are reporting as bullish again, that is still less than nearly one-third total (32.02%) we saw two weeks ago.

Those gains in bullish sentiment took from the bearish camp. Bearish sentiment fell from 45.99% to 43.07%. Like bullish sentiment, that is right in the middle of the past few weeks range.

Of course, that means that the bull-bear spread remains deep in negative territory. The record steak of negative readings in the spread has now risen to 32 weeks long.

The losses to bearish sentiment mostly went towards neutral sentiment as this reading rose to 30.69% from 29.11% last week. That brings neutral sentiment to its highest level since July 30th. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Astec Industries (ASTE)

Bespoke’s Weekly Sector Snapshot — 10/1/20

ISM Disappoints But Manufacturing Still Improving

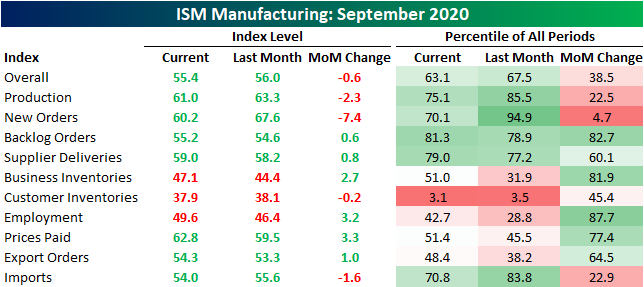

The Institute for Supply Management’s reading on the manufacturing sector released this morning disappointed coming in at 55.4 compared to last month’s 56.0 level and expectations for a reading of 56.5. The decline marks the first time that the ISM reading on manufacturing was lower month over month since April and also runs contrary to strength in other recent manufacturing indices like the Chicago PMI or the five regional Fed readings. Granted, that is not to say it is a weak reading. At 55.4, the index still indicates manufacturing activity expanded in September for a fourth month in a row at a healthy rate similar to what was last seen in late 2018/January 2019.

The commentary section anecdotally paints a mixed but interesting picture of the economy. There was plenty of mention of improving sales and orders with some seemingly at very strong clips, but that wasn’t the case for everyone. One comment from the Transportation Equipment industry claimed that “Business is booming” while another comment from the Petroleum and Coal Products industry stated bluntly that they have yet to see any improvement. Others paint a more modest picture of the rate of improvement such as the comment from the Fabricated Metal Products and Paper Product industries. Those are perhaps more consistent with the headline index. While these comments paint a somewhat mixed picture as to whether or not and at what pace conditions are improving, one common theme appears to be supply chains trying to work out some kinks. There is mention of a range of topics concerning supply chains including longer lead times, price increases, shortages, and curbed production due to COVID quarantines.

The hard numbers seem to back these claims up. Breadth was a bit mixed in this month’s report with the indices for Production, New Orders, Customer Inventories, and Imports all falling month over month. Despite those changes, the same indices remain in expansion/contraction as last month. The only indices to remain in contraction are those for inventories (which is not necessarily a negative) and Employment (just barely).

The 7.4 point decline in the index for New Orders was not as large at the 7.6 or 15.1 point declines in March and April, respectively, but it marked a substantial drop nonetheless which stands in the bottom 5% of all monthly moves. Granted one welcome difference between this most recent decline and the spring is at what level the decline came from. While those drops in March and April were indicative of sharp contractions in New Orders, the September reading still points to New Orders increasing at a healthy clip just at a slower rate than what was observed in August.

Given that New Orders continue to rise, the Backlog of Orders has likewise continued to rise. With manufacturing businesses continuing to have a full plate, the index for Backlog Orders rose to 55.2; the highest level since November of 2018.

Given the growing list of to-do’s, companies continued to increase production with that index continuing to sit in the upper quintile of all historical readings. At 61 versus 63.3 last month, though, the index does indicate that the improvements in production decelerated a bit from August. With the anecdotal evidence provided in the commentary section as well as the uptick to 59 in the Supplier Deliveries index (a reading well off the recent spike from earlier in the year but still at the high end of the historical range), there is at least some evidence that this slowed production improvement could be a factor of supply chain problems.

While production is improving and supply chains continue to face pressures, there still has not been much help on the employment front. The Employment index rose for a fifth straight month with this month’s reading of 49.6, but that also leaves it just shy of its first expansionary reading in 14 months. In other words, although the index is at multi-month highs, there continues to be more businesses reporting lower than higher levels of employment. The fact that it’s improving, though, is a welcome trend and one that could continue given the strong demand and shrinking inventories. Click here to view Bespoke’s premium membership options for our best research available.

How Current Returns Stack Up to History

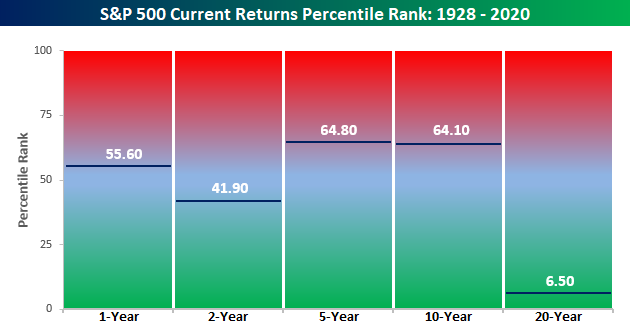

Even after September’s weakness, the S&P 500’s trailing 12-month total return stood at an impressive 14.9%. Given the events of the last 12 months, one could even say that performance is remarkable. What’s even crazier is that the S&P 500’s performance over the last 12 months is more than three times stronger than the 12 month period before that (+4.25%). The chart below compares the S&P 500’s annualized total returns over the last one, two, five, ten, and twenty years and compares that performance to the historical average return of the index over those same time periods.

The S&P 500’s historical average 12-month return is 11.7%, so the current 14.9% gain exceeds that average by more than three full percentage points. Over a two-year window, though, the S&P 500’s annualized return of 9.4% is more than a full percentage point below the historical average. Looking further out, the S&P 500’s trailing five and ten-year annualized return has been much stronger than average, which makes sense given the long bull market we were in. Over a 20 year window, though, the S&P 500 is only just starting to work off some of the declines from the dot-com bust and as a result, the 6.4% annualized gain is four and a half percentage points below the long-term average of 10.9%.

Below we show how the current performance of the S&P 500 in each of the time frames shown compares to all other periods on a percentile basis. The S&P 500’s performance over the last year ranks just below the 56th percentile of all other periods, while the two-year performance ranks just below the 42nd percentile. Even as the five and ten-year periods have seen well above average returns, they still rank in just the mid-60s on a percentile basis. The S&P 500’s ranking over a 20-year time period is a completely different story ranking in single-digits on a percentile basis. Even with the equity market right near record highs, the last two decades have been forgettable for US equities. Click here to view Bespoke’s premium membership options for our best research available.

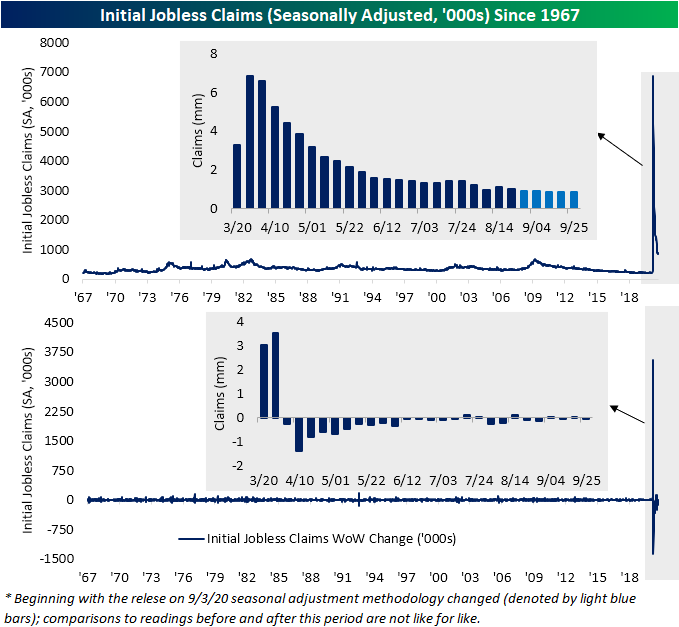

New Pandemic Low for Jobless Claims With A But

Ahead of tomorrow’s Nonfarm Payrolls number, seasonally adjusted initial jobless claims were all around improved this week. Claims fell 36K to 837K. With the caveat of there being different seasonal adjustment methodologies pre and post-September, that marks a new low for the pandemic, though, that is still much higher than any readings prior to 2020. Adding yet another caveat to this data, this week the state of California—the most populous and usually the biggest contributor to claims—also announced a two-week pause in the processing and reporting of claims so that the state can update some of its processes and catch up on a backlog. In other words, while this week’s reading was strong, the most recent data for the state that has held one of the largest weights on the total number of claims was estimated.

Non-seasonally adjusted claims were likewise lower this week, falling to 786.94K. That is the second time unadjusted claims have come in below 8,000K with an over 40K lower than the prior week. As with the adjusted number, that also marks a new low for the pandemic; just over 9K lower than the previous low of 796K from two weeks ago.

After remaining unchanged last week, continuing claims have also continued to fall with the seasonally adjusted reading falling below 12 million for the first time since the first week of April.

While regular state claims were lower, initial pandemic unemployment assistance claims rose by 34.5K. That increase offset the decline in regular state claims meaning the total between the two was unchanged from the previous week at 1.44 million. That is still around some of the lowest levels of the pandemic but is not quite at the same lows as regular claims alone. The same can be said for continuing claims. Total continuing claims (regular state claims plus PUA) rose to 24.3 million from 24 million in the most recent week. Again, in spite of the decline in regular state claims, that increase was thanks to a rise in PUA claims. In total, including all other programs like those for federal employees, veterans, extended benefits, and more, continuing claims for the week of September 12th stood at 26.53 million. That was an increase from 26.04 million the prior week which marked the lowest level of the pandemic. Click here to view Bespoke’s premium membership options for our best research available.