Bespoke’s Morning Lineup – 1/5/21 – Georgia on Everyone’s Mind

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“the most important election that has taken place since the adoption of the federal constitution.” – Pittsfield Sun, 1813

The media and politicians have literally been telling us for centuries that “this election” is the most important of our lifetimes, and they’re at it again with Georgia. Given the implications for control of the Senate, this election is important in some respects, but if you really think it’s the most important election of your lifetime, we suggest you find a hobby.

Futures have been trading on either side of the flat-line this morning and are currently on the south side of unchanged. After the opening bell, we’ll finally start to get some important economic data with the ISM Manufacturing report at 10 AM Eastern. Economists are expecting a modest decline from last month’s reading of 57.5, but still a level well above 50 (56.5).

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, economic data out of Europe, an update on the latest national and international COVID trends, and much more

Whether it’s the most important election of our lifetimes or not, today’s run-off Senate elections in Georgia probably are the most important elections taking place today, and the race is extremely close. According to the website, electionbettingodds.com, Republicans are slightly favored to hold on to the Senate with 53% odds. As for the individual races, Republican Senator Perdue is slightly favored to retain his seat, while the current incumbent Republican Kelly Loeffler is a relatively sizable underdog against Democratic challenger Raphael Warnock. Given the closeness of both races, though, it entirely likely that tomorrow morning at this time we won’t know who will have control of the Senate in the upcoming session of Congress.

Daily Sector Snapshot — 1/4/21

Bespoke’s Matrix of Economic Indicators – 1/4/21

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

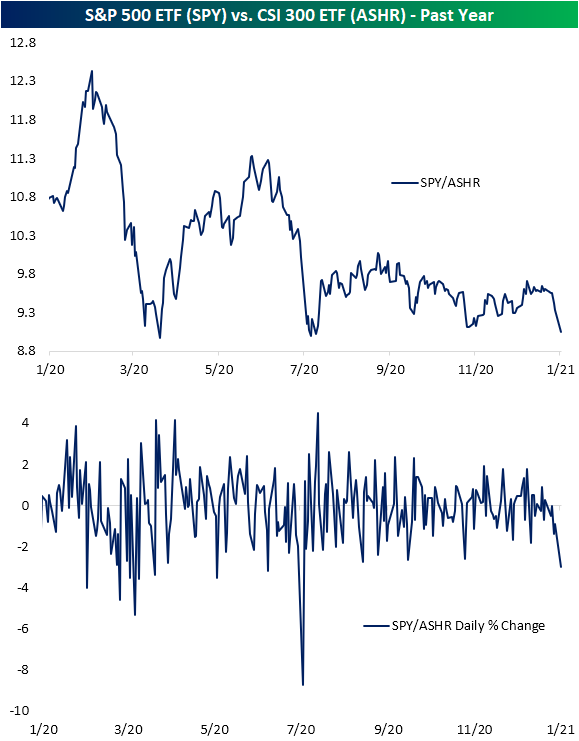

ASHR Arises While SPY Stumbles

US equities are stumbling out of the gate to start 2021 as the S&P 500 (SPY) is on pace to finish the first trading day of 2021 down 1.8%. Meanwhile, Chinese equities have caught a bid. The Xtrackers CSI 300 ETF (ASHR) is up 1.5% today. Today is actually set to be the third day in a row that ASHR has risen well over 1%, the first such streak since September. That brings ASHR to its highest level since August of 2015. That compares to SPY which is looking to have one of its worst days since late October.

On a relative basis, the ratio of SPY to ASHR has now hit its lowest level since July. In the same vein, the move in this ratio today is on pace to be the largest single-day decline since July 6th when ASHR had risen double digits in just one session. During the COVID Crash last year there were also a handful of days in which the ratio had experienced similarly sharp declines. But overall, today’s drop in SPY relative to ASHR stands in the bottom 4% of all daily moves since ASHR began trading back in 2013. Chinese equities have taken an early lead against US markets to start 2021. Click here to view Bespoke’s premium membership options for our best research available.

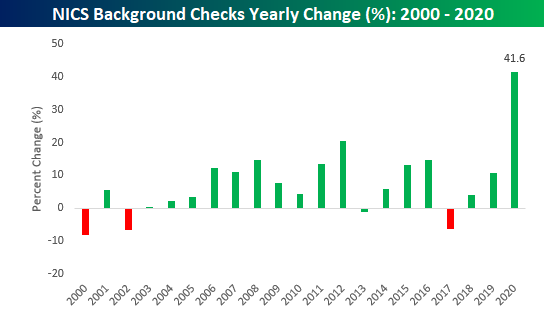

Stocking Up the Gun Safes

While 2020 will be remembered for any number of milestones, one that stands out is the explosion in gun sales. While financial markets may hate uncertainty, gun sales thrive on it. Fueled by the pandemic, civil unrest, and Biden’s victory in the November election, Americans sought out to purchase firearms at record rates in 2020.

The chart below shows monthly FBI background checks for the purchase of firearms. After surging during the pandemic, background checks initially peaked in June at a rate of 3.93 million. As tensions around the country cooled down and the virus numbers stabilized, the pace of background checks fell sharply over the next three months, but with Biden’s election in November, the pace of background checks quickly reversed course on concerns by gun owners of more restrictive policies with a Democratic administration. In December, those concerns helped to propel the number of background checks to a record 3.94 million.

On an annual basis, gun sales have steadily trended higher over the years, but the step-up in background checks in 2020 was unlike anything we’ve seen in at least 20 years.

For the year, total background checks surged over 40%. Since 2000, that’s more than twice the percentage increase of the next closest year (20.6% in 2012)!

Despite the large increase in background checks, the stocks of the two publicly traded firearms producers haven’t followed the upward trend. In the cases of both Smith and Wesson (SWBI) and Sturm Ruger (RGR), their stocks surged during the first half of the year as uncertainty was on the rise, but this latest wave of political uncertainty hasn’t provided nearly the same boost to their stocks. Like what you see? Click here for a free trial to any of one of Bespoke’s premium membership options.

Bespoke Market Calendar — January 2021

Please click the image below to view our January 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

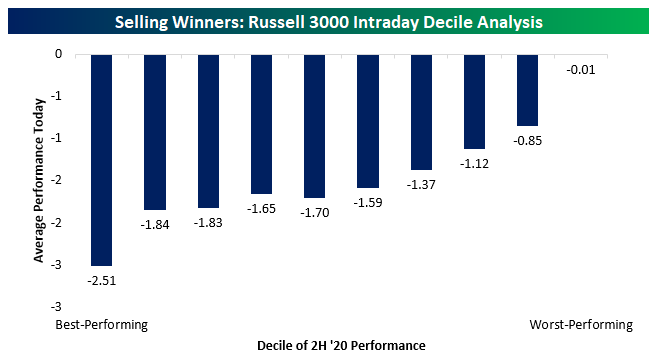

They’re Selling Winners Early In 2020

So far price action today is showing a pretty heavy New Years hangover for investors with markets dropping steadily across the first half of the first trading day of 2021. What’s interesting is how much this looks like profit-taking in the wake of a spectacular second half last year. Obviously, there was a big bounce off the lows back in March, but even stripping out that initial bounce by looking just at the second half of the year, there’s a clear pattern in today’s trading for big winners leading the way lower. In the chart below, we show the average intraday performance of stocks in the Russell 3000, grouped by their performance last year. This broad index includes both large and small-cap stocks. As shown, by far the biggest losers today are the stocks that were the biggest gainers in the second half of last year. Conversely, stocks that were at the bottom in terms of performance in the second half of last year are nearly unchanged so far today. Investors accumulated a lot of gains in the second half of 2020, and based on today’s performance, it appears as though they were waiting for the calendar to turn before locking in some of those gains. Like what you see? Click here for a free trial to any of Bespoke’s premium membership options, including our nightly Closer note that regularly features decile analysis of this kind.

Chart of the Day: January Intra-Month Returns

Bespoke’s Morning Lineup – 1/4/21 – Picking Up Right Where 2020 Left Off

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“An end is only a beginning in disguise.” – Craig D. Lounsbrough

It’s still early, but based on early indications in the market, 2021 is picking up right where 2020 left off. Futures are indicated higher, COVID numbers remain right at or near their highest levels of the pandemic, and President Trump is still dominating the headlines. Besides the year on the calendar, one of the few differences between now and 2020 is that bitcoin is trading down sharply from its highs over the weekend. Despite the 8% decline, though, it is still trading higher than where it closed out 2020.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, a recap of the latest PMI Manufacturing reports for the month of December, an update on the latest national and international COVID trends, and much more.

Heading into the first trading day of the year, the majority of sectors remain at overbought levels with just four that aren’t overbought (Utilities, Real Estate, Industrials, and Energy). Of those four sectors, two (Utilities and Industrials) now actually have “Good’ timing scores while every other sector enters 2021 at neutral levels.

Bespoke Brunch Reads: 1/3/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Security

GoDaddy Employees Were Told They Were Getting a Holiday Bonus. It Was Actually a Phishing Test. by Lorraine Longhi (The Copper Courier)

Lured with promises of a year-end bonus, employees of GoDaddy responded to an email from an internal domain only to find out they had failed a phishing test. [Link]

Insecure wheels: Police turn to car data to destroy suspects’ alibis by Olivia Solon (NBC)

With little precedent over privacy related to various data systems used in modern vehicles, privacy advocates and prosecutors are gearing up for a major conflict over whether the data cars carry can incriminate suspects. [Link]

Education

How Covid-19 Makes Teaching Reading Harder by Leslie Brody (WSJ)

Reading allowed is a challenge when teaching remotely, and that doesn’t include the challenges of faulty technology. Millions of children are at risk of falling far behind. [Link; paywall]

When the Great Equalizer Shuts Down: Schools, Peers, and Parents in Pandemic Times by Francesco Agostinelli, Matthias Doepke, Giuseppe Sorrenti & Fabrizio Zilibotti (NBER)

Educational inequality is already a huge challenge in the United States, and the pandemic is increasing the already wide gulf between students with resources and those without. [Link]

Hedge Funds

Human-Run Hedge Funds Trounce Quants in Covid Year by Hema Parmar, Katherine Burton, and Nishant Kumar (Bloomberg)

The dramatic volatility and rapid moves across the investment universe have made nimble human-driven funds better-performers than algorithmic traders in the hedge fund industry this year. [Link; soft paywall, auto-playing video]

Wrong-Way Bet on Covid Is Changing Oil-Trading Industry Forever by Alfred Cang (Bloomberg)

One of the biggest names in crude oil trading blew up in spectacular fashion, with billions in debt and nothing to show for it thanks to the collapse in demand for petroleum that led to a collapse in crude markets. [Link; soft paywall]

Books

Washington’s Secret to the Perfect Zoom Bookshelf? Buy It Wholesale. by Ashley Fetters (Politico)

The secret to a good Zoom bookshelf isn’t a wide library of books that you’ve read, but bulk orders intended only to meet the aesthetic needs of an office with a webcam. [Link]

Surprise Ending for Publishers: In 2020, Business Was Good by Elizabeth A. Harris (NYT)

Whether intrepid book buyers spent the pandemic reading or just telling themselves they were going to read, either way there has been an impressive wave of book buying this year. [Link; soft paywall]

Material Stories

How a ship-eating clam helped bring about the Industrial Revolution by David Fickling (Thread Reader)

An amazing rundown of how a desire to protect wood hulls lead to higher demand for copper, which led to more mines, and eventually led to the invention of the steam engine. [Link]

China’s Empire of Concrete by Mike Bird (WSJ)

Chinese municipalities long process of land privatization via sales of collectively owned property to the private sector have created a behemoth market that drives an impressive percentage of economic activity around the world. [Link; paywall]

Outflows

Cathie Wood’s Flagship Fund Posts Largest Outflow On Record by Claire Ballentine (Financial Advisor)

The most impressive asset-gathering story this year finished on a bit of a sour note, with tens of millions of assets flowing out of the ARK Innovation ETF (ARKK) at the end of the year. [Link]

Vaccination

Temperature Snag Delayed 144,000 Moderna Shots Bound for Texas by John Tozzi (Bloomberg)

Over 400 shipments of Moderna’s COVID vaccine sent to Texas had evidence that they had strayed above maximum storage temperature this week. [Link; soft paywall]

Social Media

The North Carolina Kid Who Cracked YouTube’s Secret Code by Lucas Shaw and Mark Bergen (Bloomberg)

A Greenville teenager dropped out of college to figure out exactly the best way to go viral. A bit over four years later, he is the king of YouTube. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!