B.I.G. Tips – Google Search Trends Revisited

Chart of the Day: Economic Indicator Diffusion Index on the Rebound

The Best and Worst Performing Stocks on Earnings

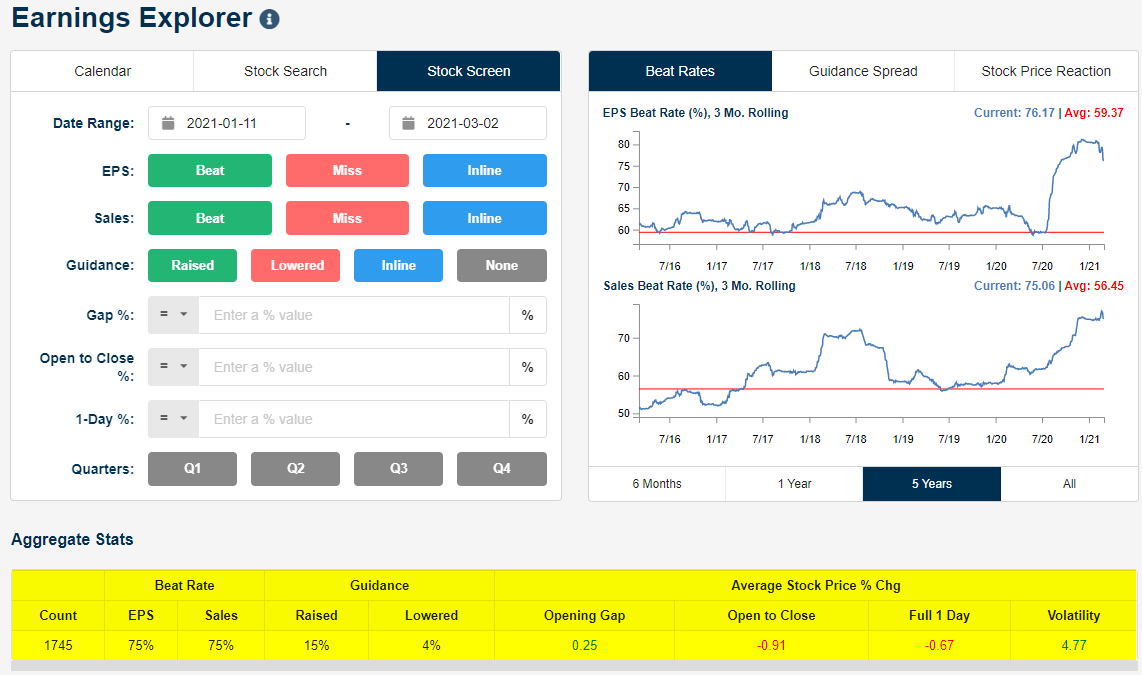

Our Earnings Explorer tool is a massive interactive database that contains historical information for thousands of companies and tens of thousands of quarterly earnings reports. You can start using the tool to hopefully trade more successfully around earnings with a two-week trial to our Bespoke Institutional package. Since mid-January when the most recent earnings season began, more than 1,700 companies have released their quarterly numbers. As shown in the snapshot from our Earnings Explorer page below, 75% of these companies beat consensus analyst EPS and sales estimates, while 15% raised forward guidance. On the negative side, just 4% of companies lowered guidance.

In terms of share price reactions to earnings reports, this season we saw the average stock open higher by 0.25% in reaction to its earnings report but then average a decline of 0.91% from the open to the close of trading. The gap higher of 0.25% and the open to close decline of 0.91% add up to a full-day decline of 0.67%. So even with relatively strong beat rates and positive guidance, investors have had a “sell the news” attitude over the last couple of months.

For those of you interested in individual stocks, below is a list of the 40 names that had the best one-day share-price reaction to earnings this season. You can use the “Stock Screen” page at our Earnings Explorer tool to generate lists just like the one below with a Bespoke Institutional membership. To make the cut, the stock had to gain at least 15% on its earnings reaction day like TAL Education (TAL), Digi International (DGII), NIC Inc (NIC), and Sonos (SONO) did. At the very top of the list is software company Teradata (TDC), which gained 37% on the day after reporting earnings on February 4th. Along with TDC, there were six additional companies that saw one-day gains of more than 30% in reaction to earnings this season. These six big winners were Glu Mobile (GLUU), RR Donnelley (RRD), Fisker (FSR), Bill.com (BILL), QuantumScape (QS), and PubMatic (PUBM).

The biggest stock to make the list was Netflix (NFLX) with a market cap of $243 billion and a one-day gain of 16.85%. That’s pretty good considering that the average stock to make the list has a market cap of just $12.8 billion. Other notables on the list include Canada Goose (GOOS), Hanesbrands (HBI), Groupon (GRPN), and Zillow (ZG).

Unfortunately, there were plenty of big losers this earnings season as well, and below is a list of the worst of the worst performers. The 40 stocks below all saw one-day drops of at least 14.9% on their recent earnings reaction days, with Ping Identity (PING) falling the most at -28%. Seven additional stocks fell more than 20% — MEDNAX (MD), Nautilus (NLS), Warrior Met Coal (HCC), TPI Composites (TPIC), SM Energy (SM), Zix Corp (ZIXI), and Twist Bioscience (TWST). Other notables on the list of big losers include Fastly (FSLY), Elastic (ESTC), Clarivate (CLVT), Harley-Davidson (HOG), Overstock.com (OSTK), and GoPro (GPRO). To dive deeper into our Earnings Explorer and access everything else Bespoke publishes throughout the trading week, start a two-week trial to our Bespoke Institutional package.

Bespoke Stock Scores — 3/2/21

Weak Tuesday After Big Gains on Monday

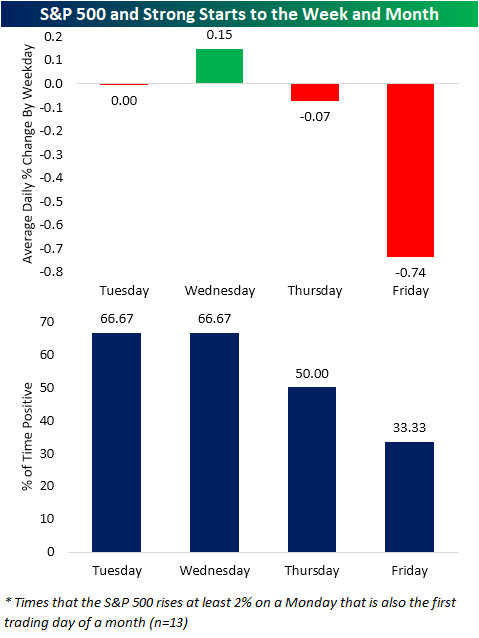

With the S&P 500 rallying 2.38% yesterday, the index notched its best first trading day of a month since last March when it rose 4.6%. As we noted in last night’s Closer, a strong start to a month has not necessarily been a great sign for the returns for the remainder of the month. Similarly, the next day has not been met with the best performance. As shown in the charts below, historically when the S&P 500 has rallied at least 2% on a Monday, Tuesday has seen a pullback with an average daily decline of 10 bps and positive returns only half the time. As for the rest of the week, Wednesday has been the only day to average a move higher with positive returns more than half the time. Thursday and Friday, on the other hand, have averaged declines of 6 and 7 bps, respectively, with positive returns only 48.68% of the time.

Of these instances, including yesterday, there have been 13 times that the 2% or larger gain on a Monday also happened to be the first trading day of a month. On the Tuesday after these past occurrences, the S&P 500 has on average been flat with positive returns two-thirds of the time. Once again, Wednesday is the only day with an average gain and like Tuesday has seen positive returns two-thirds of the time. As for the second half of the week, returns are again negative with the weakest day being Friday which has averaged a 74 bps decline with positive returns only a third of the time. Click here to view Bespoke’s premium membership options for our best research available.

There’s Gold and There’s Everything Else

Despite concerns over inflation, the last week hasn’t been particularly good for commodity prices. The snapshot below from our Trend Analyzer shows major commodity-related ETFs and where they’re trading relative to their trading ranges. Over the last five trading days heading into today, all of the commodities in the snapshot are down, but the biggest losers by far are the gold and other precious metals-related ETFs. The top six ETFs listed in the snapshot below are all tied to either gold or other precious metals and they’re all down over 4% in the last week. Of the other eight ETFs shown, just two are down even more than 2%.

While it has been a rough week for commodity-related ETFs, outside of the gold and precious metal ETFs, it’s been a great year with gains ranging from 6.5% for the DB Agriculture Fund (DBA) to 23.25% for the DB Oil Fund. The gold ETFs, meanwhile, are all down close to 10% while the Precious Metals ETF (DBP) has dropped almost 8% and the Silver Trust (SLV) is barely up (0.12%).

Looking at where each ETF is trading relative to its trading range, it’s been a tale of two markets as well. While most of the ETFs shown are in overbought territory or at least still above their 50-DMAs, the gold and precious metals ETFs are all at ‘extreme’ oversold levels. What happened to all the gold bugs? Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/2/21 – Dribbling Along

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“It is said that good things come to those who wait. I believe that good things come to those who work.” – Wilt Chamberlain

59 years ago tonight, Wilt Chamberlain set one of the greatest records in sports by scoring 100 points in a single game against, who else, but the New York Knicks! One often overlooked aspect of the 100-point game was that Chamberlain also set the record for most free throws made in a single game with 28 in 32 attempts even as his career average was closer to 50%. The most amazing aspect of the record, though, is that it wasn’t televised and there’s no video footage. There weren’t a lot of witnesses to it either as the Hershey Arena, where the game was played, was half empty that night, and there was no one from the New York Press even at the game.

In some ways, the night of March 2, 1962, was a lot like the market and investing. It’s usually the little things that often get overlooked (like free throws) that make a big difference in performance, and the biggest moves usually come when nobody is expecting them.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, an update on major market trends in Asia and Europe, an update on the latest national and international COVID trends, including our series of charts tracking vaccinations, and much more.

Monday was an encouraging day for the Nasdaq 100. After closing out last week below its 50-day moving average (DMA), there was a decent amount of concern on the part of the bulls over the weekend. Yesterday’s rebound, though, helped to put those concerns at ease, and the longer QQQ can hold above its 50-DMA, the more emboldened the bulls will become.

Daily Sector Snapshot — 3/1/21

Bespoke’s Matrix of Economic Indicators – 3/1/21

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Bespoke Market Calendar — March 2021

Please click the image below to view our March 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.