B.I.G. Tips – Google Trends: Planes, Trains, and Automobiles

Bespoke’s Morning Lineup – 3/15/21 – Small Seeking Seven

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Capital isn’t scarce, vision is.” – Sam Walton

Small-cap stocks are looking to continue a big streak today with the Russell 2000 looking to extend its current winning streak to seven straight days. Right now, the streak’s prospects aren’t looking great as Russell 2000 futures, along with the Nasdaq, are marginally lower as Treasury yields rise.

The economic calendar is quiet today with Empire Manufacturing the only major report on the calendar. While consensus estimates called for a headline reading of 13.0, the actual print came in at 17.4, which was the highest level since October 2018.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, including a recap of moves in the rates market overnight, an update of moves in the Asian and European market, Chinese economic data, an update on the latest national and international COVID trends, including our series of charts tracking vaccinations, and much more.

Below, we show the intraday charts of the S&P 500, Nasdaq 100, Russell 2000, and the Philadelphia Semiconductor Index (SOX) over the last four weeks. For the first three indices, last week was a big one as they put an end to their streaks of lower highs last week. The one outlier was the SOX. It too rallied last week but not by nearly enough to break its own downtrend. For an index that historically acts as a leading indicator for the broader market, the relative underperformance of the SOX isn’t ideal.

Bespoke Brunch Reads: 3/14/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Cars

Standstill Traffic May Be the Only Thing Keeping Crash Deaths From Skyrocketing by Alissa Walker (Curbed)

Despite a pandemic-fueled collapse in the number of vehicle miles travelled, traffic deaths soared in 2020 as clear roads meant higher speeds and more death. [Link]

We Called 8 Dealerships Asking About EVs. Here’s What They Told Us by Adam Ismail (Jalopnik)

Whether or not dealerships embrace electric vehicles will be a key to how fast they roll out in the United States, and the early indication from this informal review of dealerships across the country. [Link]

Speculation

Young retail investors plan to spend almost half of their stimulus checks on stocks, Deutsche survey claims by Holly Ellyatt (CNBC)

A survey of retail investors suggest that the latest round of stimulus checks are in large part destined for the equity market, driven mostly by younger stock buyers. [Link]

The most frequently asked questions by Robinhood traders reveal ‘new type of uninformed equity-market participant’ by Andrew Keshner (MarketWatch)

During Robinhood platform outages, stocks that were widely owned by Robinhood traders became more liquid and less volatile, suggesting that high volume free to trade buyers and sellers on the platform are adding noise to market prices. [Link]

SPAC Pioneers Reap the Rewards After Waiting Nearly 30 Years by Amrith Ramkumar (WSJ)

Blank check companies were first introduced in 1993 but didn’t really catch on until the last few years; they’re now 70% of IPOs and have raised $75bn this year alone. [Link; paywall]

NFTs

The Whales of NBA Top Shot Made a Fortune Buying LeBron Highlights by Ben Cohen (WSJ)

Digital trading cards known as non-fungible tokens have proven to be a spectacular speculation, with unique clips (which are of course widely available on YouTube or other sites) trading for millions of dollars. [Link; paywall]

Why the NFT Craze Is a Bubble Waiting to Pop by James Surowiecki (Marker)

Unique digital assets are the latest mania fueled by blockchain technology and rabid speculator enthusiasm for the next big thing. [Link]

Tech

This Chip for AI Works Using Light, Not Electrons by Will Knight (Wired)

Instead of running electrons through transistors, a startup that got its beginnings at MIT is using light to build chips that have radically higher throughput potential…if they work. [Link; soft paywall]

Tesla Is Plugging a Secret Mega-Battery Into the Texas Grid by Dana Hull and Naureen Malik (Yahoo! Finance/Bloomberg)

A subsidiary of the electric vehicle company is developing a battery near Houston that can store 100 megawatts, enough to power 20,000 homes on a hot day in Texas. [Link]

POLITICO Playbook: Scoop: Biden taps another Big Tech trustbuster by Ryan Lizza, Tarra Palmeri, Eugene Daniels, and Rachael Bade (Politico)

The Biden Administration has made multiple appointments that suggest a tight focus on antitrust in the tech industry, with a White House economic advisor and a Federal Trade Commission member both falling inside that category. [Link]

Weird News

The bizarre tale of the world’s last lost tourist, who thought Maine was San Francisco by Andrew Chamings (SFGate)

Back in 1977, a German tourist got confused on a layover and mistook Bangor, Maine for San Francisco, sparking an international media frenzy over a very confused man who spoke no English. [Link]

Brood X cicadas are about to put on one of the wildest shows in nature. And D.C. is the main stage. by Darryl Fears (WaPo)

The Delaware Valley, central Midwest, Hamptons, and eastern Tennessee are all due to receive an unholy storm of cicadas this summer as Brood X emerges from its long slumber. [Link; soft paywall]

Tax Trouble

He Got $300,000 From Credit-Card Rewards. The IRS Said It Was Taxable Income. by Richard Rubin (WSJ)

A physicist who spent $6.4mm on gift cards which he rolled into money orders deposited to his bank. The transactions were so large and numerous that they were flagged by the Treasury Department, eventually leading to an IRS investigation. [Link; paywall]

Food & Drink

Union officials: Tate’s Bake Shop workers threatened with deportation if they unionize (Long Island News 12)

Undocumented workers for Long Island bakery Tate’s are being threatened with deportation in response to a unionization drive. Tate’s is owned by Mondelez. [Link; auto-playing video]

The True Cost of a Cocktail by John Debary (Punch)

Ever wonder why a drink at a cocktail bar hits your wallet so hard? A breakdown of the costs that a cocktail typically embeds in its high menu price. [Link]

Furniture

Booming furniture sales mean ‘unprecedented’ delays for sofas and desks by Abha Bhattarai (WaPo)

Huge demand for furniture to upgrade homes that Americans are spending far more time in than usual is driving an unprecedented disruption to supply chains. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – Roaring or Boring?

This week’s Bespoke Report newsletter is now available for members.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Daily Sector Snapshot — 3/12/21

Households’ Equity Market Exposure Continues To Rise

Last night the Federal Reserve updated its quarterly Flow of Funds (Z.1) report for Q4. The quarterly report measures income, savings, assets, and liabilities of various macroeconomic sectors. Looking at households specifically, we can measure aggregate exposure to stocks by looking at their holdings of equity investments relative to other assets. We note that this does not include mutual fund shares but it does include ETFs, closed-end funds, and REITs.

As shown below, the value of equity market assets held by households is up to 16.8/% of total assets, the highest since Q3 of 1969 and surpassing the 16.7% peak from the tech bubble. Looking at financial assets only, equity exposure is the highest since the 24.2% peak from 2000, but is nonetheless extremely elevated. We should note that while this signal is certainly a contrarian indicator, it doesn’t necessarily mean that equity markets must decline in value; there’s no reason that markets can’t continue to climb and raise the share of equity ownership further.

Things look different when we include household holdings of mutual funds and other exposure to equities. In the chart below we account for indirect allocations to equities. By this measure, Q4 equity market exposure rose to 38.0% of financial assets (versus the Q1 2000 peak of 38.3%). Equity exposure as a percentage of all financial assets hit a record, surpassing the old peak of 26.4% with a 27.0% reading in Q4. In short, households are very aggressively exposed to equity markets. This blog post is adapted from an analysis included in our nightly Closer report. Click here to start a free trial of Bespoke Institutional to get immediate access.

Bespoke’s Morning Lineup – 3/12/21 – More Yield Drama

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“If you work really hard, and you’re kind, amazing things will happen.” – Conan O’Brien

With US Treasury yields rising overnight, tech stocks are under pressure this morning, while DJIA futures are higher as shares of Boeing (BA) are taking off in the pre-market. At current levels, the 10 and 30-year US Treasuries are on pace to close at post-pandemic highs in terms of yields. The only other report on the calendar this morning is Michigan Confidence at 10 AM.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, including a recap of moves in the rates market overnight, an update of moves in the Asian and European market, European Manufacturing, an update on the latest national and international COVID trends, including our series of charts tracking vaccinations, and much more.

Overall breadth in the market has and continues to be strong. This morning’s example comes from the percentage of S&P 500 Industry Groups trading above their 50 and 200 moving averages. Starting with the percentage of Industry Groups above their longer-term 200-DMA, that reading currently stands at just above 90%. During the recent equity market sell-off, that reading dropped down to as low as 75.0% but has rebounded back towards its recent highs.

Relative to the shorter-term 50-DMA, the breadth reading isn’t quite as strong but still stands at a healthy two-thirds and is up from under 50% during the recent sell-off. Obviously, this is a more volatile reading, but the longer it churns around the 50% level, the more likely it is that we see these lower readings start to drag down the strong readings in the percentage of groups above their 200-DMA. Not much of a worry yet, but something to watch going forward.

Bespoke’s Weekly Sector Snapshot — 3/11/21

Two Sentiment Surveys Go In Opposite Directions

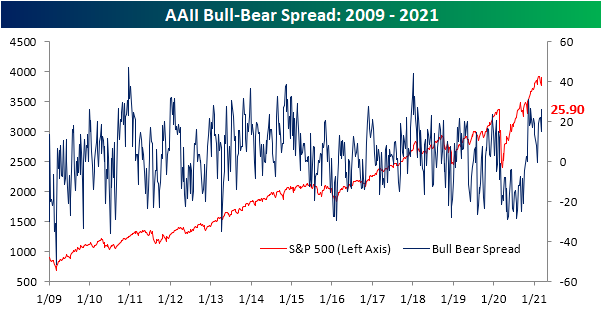

As equities have rebounded in the past week with the S&P 500 and Dow returning to all-time highs today, sentiment has gotten a boost. After falling in back-to-back weeks, bullish sentiment as measured by the AAII’s weekly survey snapped back rising 9.1 percentage points to 49.4%. That was the biggest one-week increase since the week of November 12th when it rose 17.88 percentage points, and it is also the highest level of bullish sentiment since then.

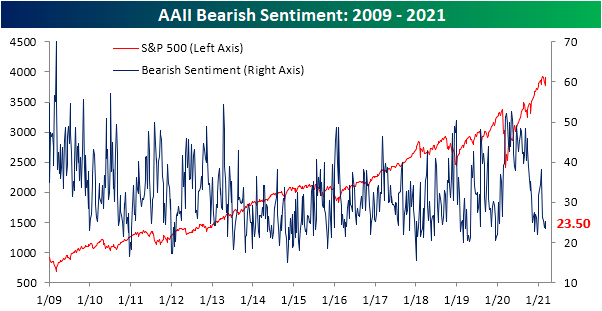

The declines in bullish sentiment of the prior two weeks saw neutral rather than bearish sentiment pick up the difference. This week again bearish sentiment went less changed than bullish or neutral. Bearish sentiment was only slightly lower falling 1.8 percentage points to 23.5%. That is the lowest level of bearish sentiment since the second to last week of 2020 when it bottomed out at 21.99%.

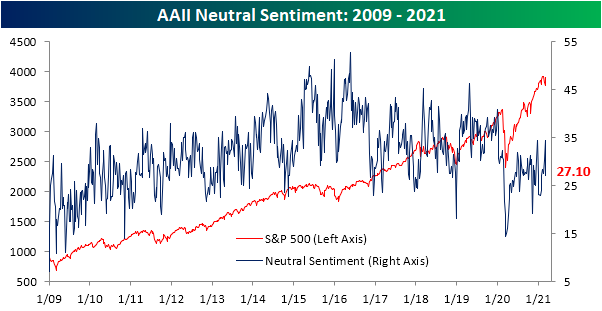

That means the gains in bullish sentiment took from the big decline in the percentage of respondents reporting as neutral. Only 27.1% of respondents reported as neutral this week, down 7.3 percentage points from the prior week. That was the largest single-week decline since the end of 2020 as sentiment is back to the same level as the start of February.

These changes in sentiment have meant that the bull-bear spread took a sharp move higher rising to 25.9. That is the highest level in the spread since the first week of December when it was slightly higher at 26.41. Prior to that, the only recent reading that was as high was November 12th which was the highest level in over two years.

While the AAII’s survey has reflected the bounce in equities over the past week, another sentiment survey is not yet reflecting this week’s price action. The Investors Intelligence survey of equity newsletter writers showed bullish sentiment fell 2.9 percentage points to 51%. That is the lowest level since the end of last May when it was 50.5%. Meanwhile, bearish sentiment rose 2 percentage points to 20.6%; the highest since early November. This survey also queries respondents on whether or not they are looking for a correction. With the Nasdaq having met the technical definition of a correction earlier this week (a 10% decline from a high), it’s not surprising that the highest share of respondents, 28.4%, reported that they are looking for a correction since late September. Click here to view Bespoke’s premium membership options for our best research available.

The Bespoke 50 Top Growth Stocks — 3/11/21

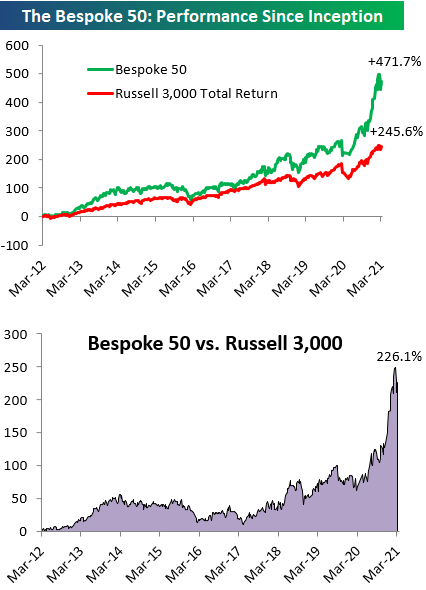

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” list is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 471.7% excluding dividends, commissions, or fees. Over the same period, the Russell 3,000’s total return has been +245.6%. Always remember, though, that past performance is no guarantee of future returns. (Please read below for more info.) To view our “Bespoke 50” list of top growth stocks, please start a two-week trial to either Bespoke Premium or Bespoke Institutional.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, fees, or dividends are not included in the performance calculation. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities.