The Bespoke Report – 3/19/21 – Fed On Hold, Bonds Being Bold

While there’s been a lot of focus on the potential impact of rising interest rates on equity markets of late, we take a step back to look at the tale of the tape this week and why another asset class that is starting to move may be more worthy of attention than interest rates. We also discuss commodities, what Google Trends tell us about the economy and markets, review central bank decisions this week including a deep dive into the FOMC, and look back over the past six months of markets to a key turning point we call “the Big Shift”.

We also discuss US economic data, sentiment measures of the US market and global economy more broadly, global equity market performance, and more in this week’s Bespoke Report.

This week’s Bespoke Report newsletter is now available for members.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Daily Sector Snapshot — 3/19/21

Labor Shortages in the Third District

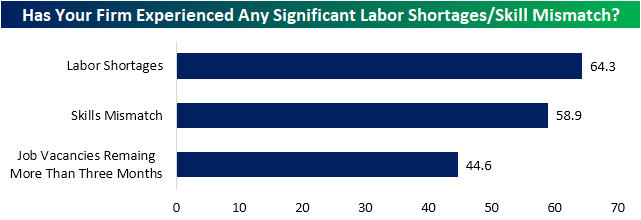

In addition to the usual Philly Fed indices released yesterday, the report also featured a handful of special questions all of which concerned employment and labor shortages. Overall, the results showed a surprisingly tight labor market: of responding firms, 64.3% reported that they currently are experiencing a shortage in labor while 58.9% reported that there is a skills mismatch. Given these issues with labor supply, 44.6% reported that there are job vacancies that have been open for more than three months.

The survey also asked whether these labor shortages were in general or specific to certain skills. Just 8.9% of firms reported that they are receiving qualified candidates. Meanwhile, over a quarter reported that they are seeing a significant shortage in qualified applicants for some skills and positions; another 17.9% reported that the shortage is so bad they are struggling to fill any position. Another 21.4% responded that it is still possible to fill positions with qualified applicants, although, it is getting harder to do so. In total, over two-thirds appear to acknowledge the labor shortage to some degree.

This has led to some inflationary pressures in terms of wages as a majority of firms are raising wages to entice new hires; 21.4% also reported that they are increasing recruitment incentives and 10.7% are increasing benefits. 42.9% are also reporting that they are settling for less-skilled workers; furthermore, 37.5% and 28.6%, respectively are providing more training to new or existing workers. 23.2% are also partnering with education institutions to align curriculums with their hiring needs. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Charts We’re Watching

Bespoke’s Morning Lineup – 3/19/21 – Hesitant Futures

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“If football taught me anything about business, it is that you win the game one play at a time.” – Fran Tarkenton

If football taught us anything, it’s that TV networks (and now streaming services) are still willing to pay an arm and a leg for the rights to broadcast games!

In markets today, futures are hesitantly higher as the major indices look to pick up the pieces from yesterday’s weakness. Obviously, the focus will once again be on US Treasury yields, but economic data won’t have an impact as the calendar is entirely clear.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, an update on Japanese inflation, capital flows in China, UK Consumer Confidence, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

2021 is shaping up to be one of those years. Yesterday’s 3% decline for the Nasdaq was the fourth daily move of 3%+ up or down already this year. The trading year is only 52 days old, but would you believe that there have only been 15 years in the last 50 that saw more 3% days in an entire year? While this year has been volatile already, keep in mind that last year the Nasdaq experienced 30 3%+ days (the most since 2008).

Through just the first 52 trading days of every year since 1971, there have only been seven other years that saw as many or more than four 3% days in the first 52 trading days of the year. Again, last year at this time there had already been 12 different 3% days, and the record was 16 in both 2001 and 2009.

The Bespoke 50 Top Growth Stocks — 3/18/21

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” list is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 471.7% excluding dividends, commissions, or fees. Over the same period, the Russell 3,000’s total return has been +245.6%. Always remember, though, that past performance is no guarantee of future returns. (Please read below for more info.) To view our “Bespoke 50” list of top growth stocks, please start a two-week trial to either Bespoke Premium or Bespoke Institutional.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, fees, or dividends are not included in the performance calculation. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities.

Bespoke’s Weekly Sector Snapshot — 3/18/21

Optimism Growing Across Indicators

Whereas last week saw a big upswing in bullish sentiment in AAII’s weekly survey, this week’s readings were a snoozefest. Neither bullish, bearish, or nor neutral sentiment moved more than 1% either up or down. That is the first time this has happened since last August. Of those small moves, bullish sentiment’s move was the largest, pulling back half of one percentage point. The bulk of that loss went to neutral sentiment as bearish sentiment only rose 0.1 percentage points. As a result, the bull-bear spread edged slightly lower to 25.3%. Regardless of that decline, sentiment remains overwhelmingly positive with the bull-bear spread still around some of the highest levels since early December at the high end of the past several years’ range.

While that survey did not see much of a move, the Investors Intelligence survey of equity newsletter writers saw bigger changes. Last week, inverse to the AAII results, the Investors Intelligence survey took a more negative tone. Turning to this week, the survey finally reflected equities general move higher over the past couple of weeks. Bullish sentiment in this survey rose 4.9 percentage points to 55.9%. That is only the highest level since the end of February. Meanwhile, bearish sentiment fell a full percentage point to 19.6%. While lower, outside of last week that is still the highest reading since the first week of November. Additionally, a smaller share (24.5%) of respondents reported that they are looking for a correction as that reading fell to the lowest level in a month.

One other additional sentiment reading also took a more optimistic shift this week. The National Association of Active Investment Managers (NAAIM) Exposure Index tracks the equity market exposure of active money managers. Index readings of -200 would indicate the average manager is leveraged short, -100 would be fully short, 0 is 100% cash or market neutral, 100 would be fully long, and 200 would be leveraged long. From the week of February 10th up through last week, the index had fallen 31.73 points to a low of 48.62. That means reporting managers had the lowest long exposure to equities since last April. But this week that has reversed in a big way as the index jumped 29.93 points.

That ranks as the thirteenth largest one-week uptick in the index since July of 2006. As shown below, the last increase that was as large if not larger than the past week’s move was fairly recent occurring in the week of February 10th when the index jumped 31.13 points. Prior to that, April of 2019 was the last move as large as this week’s rise.Click here to view Bespoke’s premium membership options for our best research available.

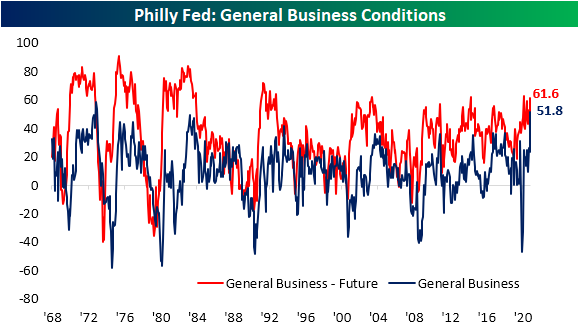

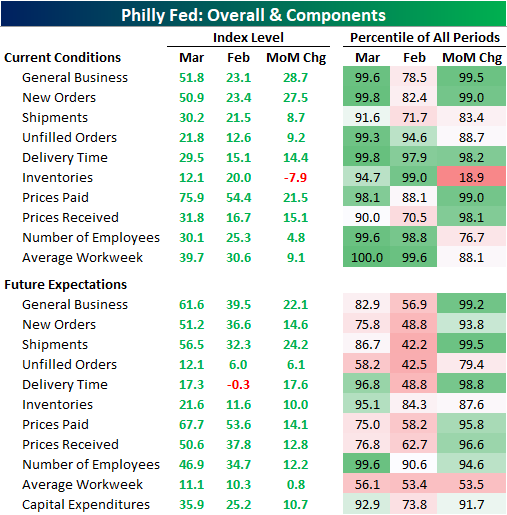

Historic Strength Out of Philly

It’s hard to get a report much stronger than this morning’s release of the Philadelphia Fed’s Manufacturing Report. The report showed the region’s manufacturing economy expanded rapidly in March across categories with similarly strong optimism with regards to the future. The headline number was expected to see only a 0.9 point increase from last month’s reading of 23.1. Instead, it more than doubled, leaping 28.7 points versus February’s reading. That is the largest one-month gain since the record 57.6 point increase in June of last year. Other than that, only September and October of 1980 have seen larger monthly moves in the data going back to 1968. Not only was the size of the move large, but at 51.8, the index reached the third-highest level on record behind March (58.5) and April (53.6) of 1973. Similarly, while not at the same sort of historic high, the expectations component of this month’s report also experienced a massive uptick that ranks in the top 1% of all monthly moves.

Given that strength in general business activity, it should come as no surprise that every index for current conditions came in the top decile of all readings with the same applying to some of the month over month moves. As for the indices regarding future expectations, the current levels are more modest relative to their historic ranges with only those for Delivery Times, Inventories, Number of Employees, and Capital Expenditures notably elevated. Like the current conditions indices, though, many of these saw moves that stand around the top 5% of all periods or better.

Demand was certainly a bright spot in this month’s report. The New Orders Index rose 27.5 points to the second-highest level on record. Like the index for General Business Activity, the only time that the New Orders Index was higher was back in March 1973. While the one-month gain still stands in the top 1% of all monthly moves, there was actually a larger increase just two months ago when the index rose 28.1 points. Given the rapid acceleration in New Orders, Unfilled Orders also has risen sharply and has only been higher four other times. The most recent of these was back in January, but once again, prior to that, you would need to go all the way back to 1973 or earlier for readings as high as now.

Considering the high level in new and unfilled orders, the reading in the Shipments Index was perhaps a bit more modest. In fact, the spread between the indices for Shipments and New Orders was at a record low in March. Although it is still at very healthy levels in the top 10% of all periods, at 30.5, the Shipments Index actually saw a stronger reading as recently as October. One potential factor in the difference between the growth in orders and products actually getting out the door could be related to supply chain disruptions. Higher readings in the Delivery Time Index indicate longer lead times. This month, the index rose up to 29.5 which is only a half-point below the record high in January. Meanwhile, the Inventories Index fell to the lowest level in four months.

As a result of all of this, prices (particularly prices paid) continue to accelerate at a rapid pace. The Philly Fed noted that over 77% of the responding firms to the survey reported higher input prices compared to 55% last month. That lead the Prices Paid Index to increase 21.5 points to 75.9; a level that has not been observed since early 1980. Expectations are also on the rise but are more toned down as that index rose 14.1 points to the highest level since only April 2018.

As for Prices Received, things are tamer albeit, at 31.8, this index is also at historically strong levels. While that is still several points below the higher level of 36.6 from two months ago, the last time readings above 30 were observed was back in the spring and summer of 2018.

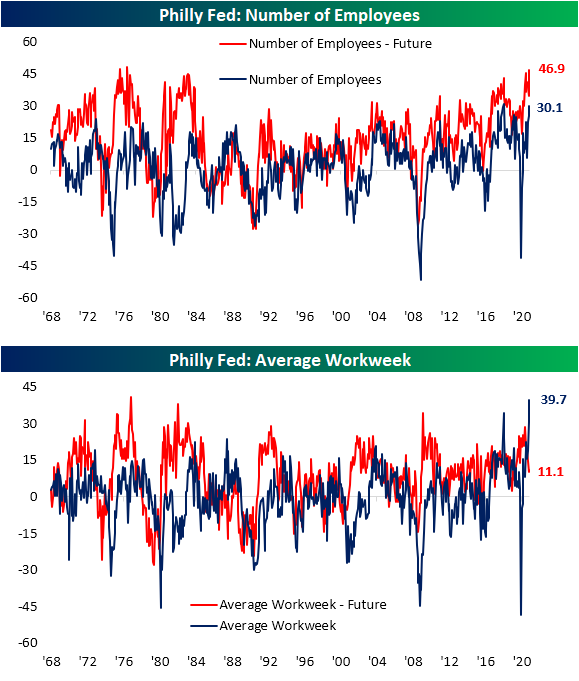

Today’s report also showed some very interesting trends concerning the labor market. The index for the Number of Employees rose to 30.1. The only time that it was higher was in May and June of 2018. The region’s firms also appear to want to continue to increase hiring down the road as the index for expectations reached 46.9. That is one of the highest levels on record with the last time such a level was reached being 1976. Even though firms are reporting more employees, the Average Workweek is skyrocketing. Last month, that index had reached 30.6 which was the second-highest reading on record. Fast forward to this month, the March print left both last month and the previous record of 34.2 from May 2018 in the dust. That increase in the average workweek is likely a result of firms doing more with less labor as they can’t fill certain positions. The special questions asked in the survey shed some additional light on this as 64.3% of companies reported labor shortages and 44.6% of job vacancies have been open for 3 or more months. Click here to view Bespoke’s premium membership options for our best research available.