Bespoke’s Morning Lineup – 6/2/21 – Small Lead

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Do not anticipate and move without market confirmation—being a little late in your trade is your insurance that you are right or wrong.” – Jesse Livermore

It’s a quiet morning as there’s little in the way of major economic releases today. There were a handful of earnings reports overnight from the likes of Advanced Auto (AAP), Hewlett Packard (HPE), and Zoom (ZM). Futures have been trading with a modestly positive bias all night and remain that way this morning. In politics, President Biden is scheduled to meet with Republicans today to try and reach some sort of consensus on infrastructure so we’ll be watching this afternoon for any updates on that front.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of some notable earnings reports, major economic data out of Asia and Europe, a discussion of the Chinese Property market, and the latest US and international COVID trends including our vaccination trackers, and much more.

Relative to where they opened yesterday, both the S&P 500 and Nasdaq had disappointing closes finishing near their lows of the day. The small-cap Russell 2000, however, was a different story. While it also experienced a small pullback from its opening levels in early trading, it rebounded and finished near its highs of the day.

From a longer-term perspective, yesterday’s late-day strength in the Russell 2000 sets the stage today for a test of its downtrend from the early March high as it closed yesterday just below its downtrend line. In pre-market trading right now, the Russell 2000 is slightly positive, so as long as those gains can hold, the technical picture for small caps will look incrementally better.

Daily Sector Snapshot — 6/1/21

Bespoke Stock Scores — 6/1/21

Meme Stocks Back in Focus

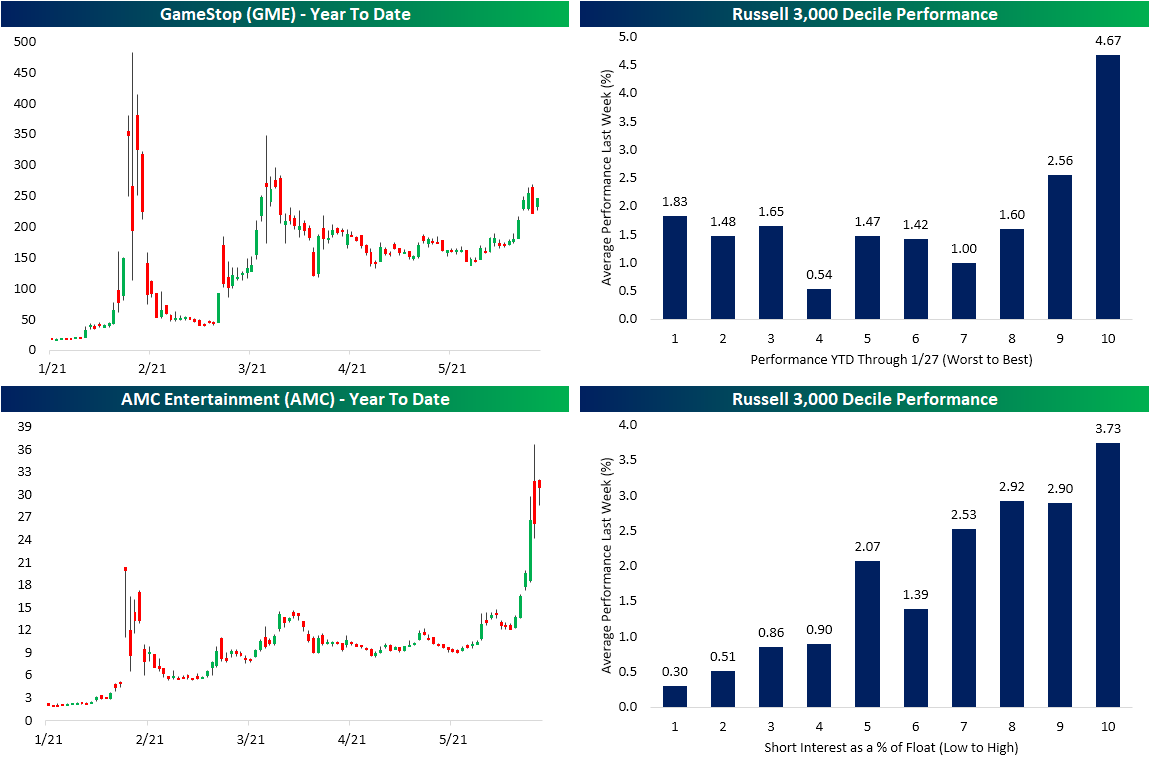

In the past week, the meme stocks like GameStop (GME) and AMC Entertainment (AMC) have come back in focus with each name making explosive moves to the upside which resulted in them being some of the top-performing stocks in the Russell 3,000 last week. In the case of GME, the stock was up over 50% on the week at the intraday highs on Friday. In spite of those big gains, GME was still left a few percentage points below the March closing highs and even further below the peak short squeeze highs from late January. Meanwhile, AMC saw an even more sensational move that left its prior highs in the dust. At its highs on Friday, AMC was sitting on an over 200% gain on the week which was just over 80% above the January 27th high. Similar to GME, the highs on Friday did not hold through the end of the day as the stock ultimately closed down 1.5% versus Thursday’s close. Starting off the shortened week, both GME and AMC are resuming huge moves higher with the stocks up 11.58% and 24.66%, respectively, as of this writing. Granted, even with those massive moves, both stocks are seeing an inside day.

Looking beyond two of the poster children of the short squeeze saga, performance last week was marked by a return to themes that were present in the period in January. As shown in the top-right chart below, the same stocks that were up the most year to date through January 27th (the day of the original highs of both GME and AMC) were again the top performers last week. That decile of Russell 3,000 stocks on average were up 4.67% last week. Another identical theme of performance to January observed last week was with regards to heavily shorted names. The deciles of the most highly shorted stocks—to which AMC and GME both still belong—were also some of the top performers last week. The decile of the most heavily shorted names rose 3.73% on average. Meanwhile, the least heavily shorted stocks on average only gained 0.3%.Click here to view Bespoke’s premium membership options.

Bespoke Market Calendar — June 2021

Please click the image below to view our June 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

Chart of the Day – June Intra Month Performance

Bespoke’s Morning Lineup – 6/1/21 – June Comes in Like a Bull

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Time is your friend; impulse is your enemy.” – John Bogle

June is coming in like a bull this morning as equity futures are all trading firmly in positive territory. Generally positive economic data out of Asia and Europe has been the catalyst, and investors will be looking for that trend to continue in the US with the Markit Manufacturing and ISM Manufacturing surveys of the US economy as well as Construction Spending at 10:00 and the Dallas Fed Manufacturing report at 10:30.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of some notable earnings reports, major economic data out of Asia and Europe, and the latest US and international COVID trends including our vaccination trackers, and much more.

The month of May closed out on a positive note for most sectors. Last week, eight of eleven sectors finished the week in positive territory. Leading the way higher, Consumer Discretionary, Communication Services, Real Estate, and Industrials all traded up over 2% while Utilities, Health Care, and Consumer Staples were the only three sectors to finish the week lower. With last week’s gains, the majority of sectors head into June at overbought levels, although Consumer Discretionary, which was the top-performing sector on the week, is one of just two sectors below its 50-DMA.

Bespoke Brunch Reads: 5/30/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Inflation

Reopening Is Inflation’s Cure, Not Cause by Jason M. Thomas (WSJ)

As patterns of supply and demand normalize after the pandemic, the price dislocations which have sent small categories of inflation soaring are likely to normalize into more familiar patterns that moderate the recent spike. [Link; paywall]

83% Of Americans Are Belt Tightening Due To Inflation Pressures by Walter Loeb (Forbes)

While consumer spending has boomed, Americans report they aren’t actually spending as much as they are, scared off by the high price of food and other goods. [Link; paywall]

Memorial Day

The First Decoration Day by David W. Blight (Newark Star Ledger/David W. Blight)

Recalling the origin of Memorial Day, which started as a march honoring Union war dead on the grounds of what used to be the slaveholders’ race track in Charleston, South Carolina. [Link]

Auto Industry

Cars Are About to Get a Lot More Expensive by Anjani Trivedi (Bloomberg)

With the used car market jammed with demand as well as semiconductors and other basic input commodities coming up in short supply, auto manufacturers are getting a golden opportunity to raise prices. [Link; soft paywall]

Tesla Model S Reaches Parity With Gas-Powered Cars In Test Drive (Value Walk)

A recent road test saw the Tesla Model S travel over 300 miles at 75 miles per hour, a first for the electric vehicle company and a key range achievement relative to the performance of internal combustion engines. [Link]

Investing

Dow Jones Industrial Average Celebrates 125 Years as Wall Street’s Bellwether by Karen Langley and Peter Santilli (WSJ)

This week saw the venerable Dow Jones Industrial Average introduced, starting a history that has weathered every bull and bear market since. [Link; paywall]

Bank of America’s Merrill Lynch to Ban Trainee Brokers From Making Cold Calls by Rachel Louise Ensign (WSJ)

While cold LinkedIn messages are still okay, advisor trainees in the Thundering Herd will no longer be encouraged to give prospective clients an uninvited phone call. [Link; paywall]

A New ETF Taps Investors’ Fear of Missing the Latest Hot Stock Trend by Evie Liu (Barron’s)

FOMO will try and hold stocks that are currently on the market’s radar but doesn’t hold stocks like COIN or any of the SPAC stocks which have made such a big splash in both directions over the past year. [Link; paywall]

Tech

A Cynic’s Guide To Fintech by Dan Davies (Medium)

While this rundown is over half a decade old, it helps to point out the relatively limited scope that fintech companies can operate in with a durable competitive advantage. [Link]

How 5G May Improve Early Warnings of Severe Weather by Marco Quiroz-Gutierrez (WSJ)

Changes in the signals of cellphone towers can be used to measure humidity shifts, a key data point that may help meteorologists develop more accurate and timely weather models which can speed up warnings. [Link; paywall]

Facebook Reverses Ban on ‘Man-Made’ COVID References After Biden Orders Review by Alex Noble (Yahoo! News)

As the discourse shifts, Facebook has lifted a blanket ban on asserting that COVID was created in a lab, a claim that has been latched on to by the conspiratorial fringe since the first days of the pandemic. [Link]

Pot

Positive Marijuana Tests Are Up Among U.S. Workers by Matt Grossman (WSJ)

2.7% of the 7 million drug tests conducted by Quest Diagnostics for employers came back positive for marijuana as a rising share of the national labor force lives in states where recreational marijuana use is legal. [Link; paywall]

Real Estate

In Tight Housing Market, Thousands of Homes Are Reserved for Certain Buyers by Nicole Friedman (WSJ)

With so much demand, sellers are able to sidestep the public sales process to show homes to a select group of buyers, though such “pocket listings” account for only 3% of sales this year. [Link; paywall]

Cardio

The Cardiovascular Secrets of Giraffes by Bob Holmes (Smithsonian Mag)

To make sure blood circulates their extremely tall bodies, giraffes have to have very high blood pressure, but they don’t suffer most of the maladies that come with high blood pressure in humans. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 5/28/21 – MoMo Makes A Comeback

This week’s Bespoke Report newsletter is now available for members.

High volatility stocks with big retail participation (so-called “meme” names) made a big come back this week and Chinese equities broke out. We discuss these moves along with the receding COVID pandemic, an increase in investors looking for a correction, a fresh decline in crypto markets, renewables power uptake in the US and how renewables stocks have been performing, earnings Triple Plays, very strong economic data across the world economy, surging gas prices and the oil production picture in the US, booming house prices but slowing new home sales, surprisingly affordable prices for new homes, solid consumer confidence, booming manufacturing activity from regional Fed surveys, revised US GDP in Q1, core PCE inflation numbers in the US, the outlook for an infrastructure package from Congress, and more in this week’s Bespoke Report.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!