Daily Sector Snapshot — 9/20/21

Homebuilder Sentiment Surprise

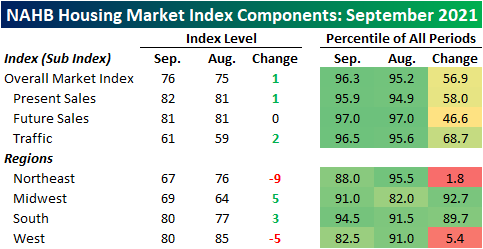

The NAHB released its September reading on homebuilder sentiment this morning. Rather than another decline down to 74 that was expected, the headline reading surprised to the upside coming in slightly higher at 76. We are now approaching the one-year anniversary since homebuilder sentiment peaked at its record high of 90 from last November. While little progress has been made in working back up to that high, the current reading remains at one of the strongest levels on record.

Both Present Sales and Traffic drove the headline index higher this month with the latter seeing the larger move higher of the two. Future sales, on the other hand, went unchanged for the second month in a row. Just like the overall market index, each of these components has pulled back from last November’s highs but remain at historically strong levels.

There was a more significant movement based on geography. Starting with the bad news, the Northeast and West experienced particularly large declines of 9 and 5 points, respectively. After that decline, sentiment in the Northeast is at the weakest reading since June of last year and the month-over-month decline ranks in the bottom 2% of all monthly moves. The drop in sentiment in the West similarly was one of the largest declines on record.

Meanwhile, the Midwest and South had much stronger showings this month. Not only were the indices for both of these regions in the top decile of all periods, but they also showed significant improvement in September. The 5 point uptick in the Midwest index ranks in the top decile of all moves while the 3 point increase in the South narrowly missed a 90th percentile move. Click here to view Bespoke’s premium membership options.

Chart of the Day: Down Mondays

Bespoke’s Morning Lineup – 9/20/21 – When it Rains, it Pours

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Failing to raise the debt limit would produce widespread economic catastrophe.” – Janet Yellen

Good Morning Subscriber,

After months of heat, it only seems fitting that problems are boiling to the surface just as Summer winds to a close this week. Between FOMC tapering, slower economic data, the upcoming debt limit, and China’s Evergrande, the problems are starting to mount. Futures opened lower last night, and originally the damage didn’t look like it was going to be too bad, but by 11 o’clock eastern time, things started to deteriorate.

The continuing collapse of Evergrande is obviously the main concern of investors around the world this morning. The fact that most of those Asian markets are closed for holidays today also makes it harder to discern what the overall impact is going to be and that only creates more uncertainty in other markets around the world that are open for trading today.

S&P 500 futures are near their lows of the morning and indicated to open down by over 1.5%, the 10-year yield is down nearly six basis points to 1.30% (it was actually lower than that last Wednesday), and the VIX is back above 25 and at its highest level since May.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

The numbers below are going to look worse in a couple of hours after the US market’s open, but the table below breaks down where sectors stand after last week and heading into this morning’s decline. Last week, both Materials and Utilities were easily the worst performers with declines of 3% or more. As a result of those losses, the Materials sector moved into oversold territory, while Utilities isn’t far behind. Industrials were down by only about half that much, but that was enough to put it into ‘Extreme’ oversold levels. Along with those three sectors, the only others that were below their 50-day moving averages (DMA) as of Friday were Consumer Staples and Communication Services. While only five sectors were below their 50-DMA as of Friday, there’s a good chance that by the end of the day today, either all or all but one of them (Consumer Discretionary) will be below their 50-DMAs. Change has a way of coming quickly in the market.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Bespoke Brunch Reads: 9/19/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

COVID

The unvaccinated and the orphans they leave behind by Renée Graham (Boston Globe)

With hundreds of thousands of Americans dying from the COVID pandemic, more than 100,000 children have been orphaned or lost at least one caregiver. [Link; soft paywall]

New Orleans Saints Covid-19 Cases Will Test NFL’s Pandemic Strategy by Andrew Beaton (WSJ)

Hoping that widespread vaccinations would reduce spread risk, NFL teams are required to test personnel weekly rather than daily. But that allows clusters of breakthrough cases (like the New Orleans Saints saw this week) to create a mess if they gain momentum. [Link; paywall]

College

Colleges Have a Guy Problem by Derek Thompson (The Atlantic)

Men dramatically outnumber women on college campuses…but why? This effort to dig into the causes, and concludes that it’s unlikely down to a single factor but a mix of cultural, historical, and economic forces. [Link; soft paywall]

College students reported record-high marijuana use and record-low drinking in 2020, study says by María Luisa Paúl (WaPo)

Time was that college meant binge drinking, and a lot of it. But many college kids are pivoting towards marijuana use instead, with nearly half of college-aged Americans reporting use last year. That’s about twice as large a share as those reporting binge drinking. [Link; soft paywall]

Real Estate

Rust Belt City’s Pitch for a Hot Housing Market: Free Homes by Ben Eisen (WSJ)

A struggling small town in Pennsylvania is hoping desperation among home buyers will make a pretty good deal seem irresistible: agree to fix up a house, and you get it for free. [Link; paywall]

Newsom signs long-awaited bills to increase housing density in California by Alexei Koseff (San Francisco Chronicle)

In addition to staving off a recall attempt this week, Governor Newsom also made it legal to build a duplex on any property zoned for single family housing statewide. The hope is that modest increases in density will free up housing supply in the famously challenged state. [Link; soft paywall]

Politics

Polling error: How one survey changed the Newsom recall campaign by Ben Christopher (CalMatters)

In late July, Democrats in one of the country’s bluest states started to worry their reasonably popular governor would get recalled. One poll specifically spurred a frantic effort to turn out voters, and appears to have led almost directly to the strong results for Newsom in the race, a fascinating example of electoral reflexivity. [Link]

Pests

Die, Beautiful Spotted Lanternfly, Die by Ginia Bellafante (NYT)

The northeast is facing an invasion from gorgeous bugs called spotted lanternflies, putting at risk grape crops and trees across the region. The solution? Put the boot to them. [Link; soft paywall]

Personal Finance

How You Feel About Money by Michael Batnick (The Irrelevant Investor)

A thoughtful review of how our personal experience drives us to think about money, both for good and ill, but in ways that need to be acknowledged and understood. [Link]

Taxes

ETF Taxation In The Crosshairs (NASDAQ)

Democrats are considering removing some of the tax benefits of ETFs, making the funds less likely to track their benchmark and creating tax liabilities for some investors. We note that this is only at the proposal stage and formal language has not even been circulated. [Link]

Fast Food

Taco Bell tests 30-day taco subscription to drive more frequent visits by Amelia Lucas (CNBC)

YUM is testing a program that would let users pick up a daily taco every day for 30 days at a cost of $5 to $10 per month, hoping that the loss leader will drive more frequent visits and purchases of other items. [Link]

Oil

Beijing to release state crude reserves by auctions to ease feedstock costs (S&P Global/Platts)

In an effort to alleviate tight crude supplies, China’s strategic oil reserve will release tens of millions of barrels and cap imports, in a major shift for short-term global crude demand. [Link]

Labor Markets

Spillover Effects from Voluntary Employer Minimum Wages by Ellora Derenoncourt, Clemens Noelke, and David Weil (SSRN)

When Amazon raises wages for its distribution centers, other local employers are forced to bump up pay as well to continue attracting workers. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Daily Sector Snapshot — 9/17/21

The Bespoke Report Newsletter – 9/17/21 – Too Cute?

This week’s Bespoke Report newsletter is now available for members.

It hasn’t happened very often this year but early Friday afternoon the S&P 500 was on pace to close below its 50-day moving average. A close below the 50-DMA is not something that market technicians like to see.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Bespoke Growth Basket: Update & Commentary, September 2021

Bespoke’s Morning Lineup – 9/17/21 – Slow Going into the Weekend

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you buy things you do not need, soon you will have to sell things you need.” – Warren Buffett

Futures are pointing to a modestly lower open this morning, and they’re right near the lows of the morning as European stocks opened the day higher and have steadily sold off throughout the morning session there. Two culprits are behind the weakness in Europe. The first is a hot CPI report which showed y/y increases of 3.0% versus 2.2% last month. The second is technical; after opening back up above its 50-DMA this morning, the STOXX 600 couldn’t hold on to that level after closing below it in each of the last two trading days.

The economic calendar is light today with the only report on the calendar being Michigan Sentiment, and economists are expecting a modest rebound following last month’s plunge.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With the S&P 500 on pace for its eighth down day in the last 10 trading days, there’s a good degree of trepidation on the part of investors lately. Look no further than this week’s sentiment survey from the American Association of Individual Investors (AAII) where bullish sentiment plunged as an example. One encouraging aspect of trading the last several days is the performance of semiconductors, a sector we consider to be a good barometer of the market’s direction. Yesterday, for example, the VanEck Semiconductor ETF hit a new record high and finished in positive territory for the sixth day in a row. Not only that, but in the last 20 trading days, the ETF has finished the day lower only four times.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.