B.I.G. Tips – Weak Breadth

Bespoke’s Morning Lineup – 9/22/21 – Same Futures, Different Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We learn who we are in practice, not in theory.” – David Epstein – Range

After a day in which the S&P 500 finished trading right around the flatline after opening sharply higher, markets are doing a re-take today with futures higher by just about the same amount they were at this time yesterday. Unlike yesterday, though, investors will have to contend with a Fed policy statement, dot plots, and a press conference from Jerome Powell this afternoon. Powell pressers haven’t had a particularly positive impact on the market lately.

Outside the US, equities in Europe are higher across the board this morning, and the STOXX 600 is actually now flat on the week after gains yesterday and today have erased all of Monday’s drop. In China, equities finally opened for trading this week after a two-day mid-Autumn Festival holiday. While Chinese stocks opened the week lower, they rebounded throughout the day to finish down 0.70%. So, while Europe is flat and China is down less than 1% on the week, US stocks are down over 1.75%.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Lately, it seems as though plenty of good arguments can be made for being long or short the US dollar. Given the strong feelings on both sides of the trade, it probably shouldn’t come as too much of a surprise that the Bloomberg US Dollar Index is currently trading right in the middle of its one year range around 1,150 and at a level it has had difficulty meaningfully breaking above throughout the year. Whichever way the greenback breaks from its most recent run to 1,150 will likely have a major impact on which sectors/strategies outperform through the end of the year.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Chart of the Day – Historical Action on Fed Days

Daily Sector Snapshot — 9/21/21

Singles Miss Out on Housing Strength

Data on residential housing this morning surprised to the upside at the headline level in terms of both Building Permits and Housing Starts. Despite the better than expected results, the internals of the report weren’t great as all of the strength was in multi-family units. In fact, single-family Building Permits were only up 0.6% m/m and were down -0.1% y/y compared to a m/m gain of 15.8% and a y/y gain of 44.3% in multi-family permits. Similarly, single-family Housing Starts actually declined 2.8% m/m and only increased 5.2% y/y compared to multi-family units which rose 20.6% m/m and 52.7% y/y. An increase in multi-family units isn’t necessarily considered a bad thing, but single-family units tend to have more of an economic impact.

Overall, Housing Starts are still trending higher. On a 12-month moving average basis, Housing Starts have been surging in recent months and just came in at the highest level since May 2007. Housing data tends to roll over well in advance of recessions, so as long as Starts keep trending higher, it’s a sign of economic strength.

Looking more closely at single-family Building Permits and Housing Starts, the 12-month moving average of this metric has actually been starting to flatten out in recent months. Housing has been a pillar of the economy in the post-pandemic rebound, so this will bear watching going forward.

It’s always interesting to see how closely homebuilder stocks tend to track trends in Housing Starts, which we show below. Similar to the stall out in starts, we’ve also seen the iShares Home Construction ETF (ITB) start to stall out over the last few months. Click here to view Bespoke’s premium membership options.

Bespoke Stock Scores — 9/21/21

Dreamforce Kicks Off

Salesforce.com (CRM) kicks off its annual Dreamforce conference today. This is the 19th year of the event in which the company showcases its products and hosts various presentations by industry leaders. Like many conferences, in-person attendance is limited again this year with the event streamed online over the next few days. Unlike last year, the conference is back to its usual length of only a few days compared to the 2020 event that went on for nearly a month. The Dreamforce conference typically occurs in the fall but has happened as early as the end of August and as late as early December.

As for how Dreamforce impacts the stock, below we show how CRM’s performance leading up to, during, and after each year’s conference. The stock pretty consistently trades higher around the Dreamforce conference. If you exclude last year when the conference lasted for a much longer period of time, and the Slack takeover acted as a negative catalyst, CRM tends to move higher during the conference. The only notable period of weakness is the week after the conference ends. That period has averaged a 0.93% decline with positive performance less than half the time. Longer-term performance, though, has been more consistent to the upside. Note that because of the extended length of Dreamforce in 2020, performance figures at the bottom of both tables do not take 2020 performance figures into account.

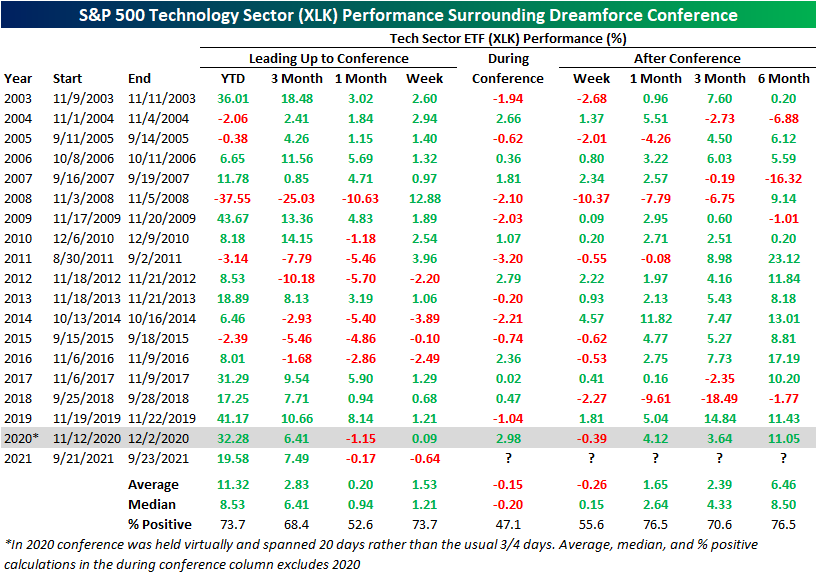

Salesforce.com is a giant in the Tech sector ranking as the eighth largest stock in the S&P 500 Technology sector. As such, the stock’s performance does hold some weight on the broader market. Below we replicate the table above but with the performance of the S&P 500 Tech Sector ETF (XLK). As with CRM, XLK has typically rallied leading up to the conference, but it tends to underperform CRM during the conference falling 20 bps on a median basis during the few days the event takes place versus CRM’s median gain of 0.51%. Following the conference, like CRM, XLK’s short-term performance over the next week is mixed to negative, but one, three, and six months later the stock has traded higher more than two-thirds of the time.Click here to view Bespoke’s premium membership options.

B.I.G. Tips – No Signs Of Credit Pain In Bank CDS

Chart of the Day – Over-what?

Bespoke’s Morning Lineup – 9/21/21 – Attempting a Turnaround

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You can’t predict, [but] you can prepare.” – Howard Marks

Markets are attempting to stage a turnaround Tuesday this morning with equity futures firmly in the green and Europe also trading firmly higher. Just release economic data has provided a boost as both Building Permits and Housing Starts for the month of August came in significantly better than expected, although the strength was attributable to multi-family rather than single-family units.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

After a rough options expiration week, this week didn’t start any better as the S&P 500 fell 1.7% yesterday. So how common is it for the S&P 500 to trade down more than 1% on the Monday following options expiration? Since the start of 2010, there have been eighteen other occurrences, and yesterday was the second time this year and the seventh time since the COVID outbreak in 2020; so they are occurring with a bit more frequency lately. That being said, a year before COVID it happened three months in a row spanning November 2018 through January 2019. Also, like 2020, there were five occurrences in 2011.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.