Bespoke Stock Scores — 11/2/21

Record Decline in Gun Sales Continues

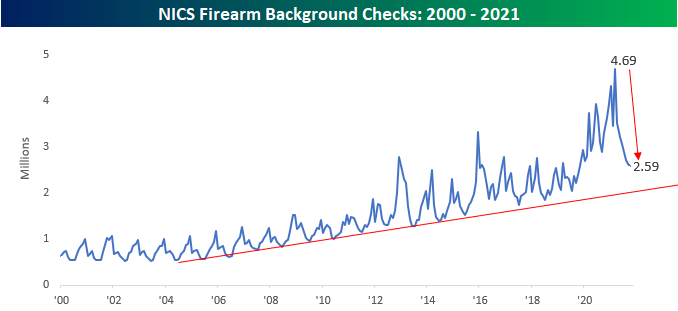

FBI background checks for the purchase of firearms continued their record streak of month/month (m/m) declines in October, falling from 2.626 million down to 2.593 million. Over the course of just seven months now, background checks have dropped by just over 2 million, or 44.8%, but even after that historic decline, total background checks remain above the upward trend they maintained in the 10+ years preceding COVID. While not typically viewed as a gauge of sentiment, one could make the argument that the steep declines in background searches required for gun purchases signals that levels of uncertainty on the part of Americans have been easing. After all, you’re probably less likely to go out and buy a gun when you’re feeling safe and secure!

On a y/y basis, total background checks are down just over 20% and near their lowest levels since early 2014. Similar to the period leading up to the current decline, total background checks during that period followed what had been a record y/y surge after President Obama was elected to a second term.

As mentioned above, claims have now declined on a m/m basis for seven straight months. Over the last 20+ years, this is now the longest streak of monthly declines, surpassing the prior record of six months from June 2013.

With the pace of background checks crashing back down to earth in the last several months, you would expect to see the stocks of gun manufacturers struggling, and to a degree, you’d be right. Both Sturm Ruger (RGR) and Smith and Wesson (SWCI) are well off their highs from the middle of the year, but they’re also not trading near 52-week lows either. RGR continues to trade above support despite looking like it’s starting to roll over at a lower high. SWBI briefly surged close to $40 in early July before quickly reversing, and while the stock hasn’t participated in the recent market rally, the pace of decline has certainly slowed. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/2/21 – Mixed Morning

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Don’t worry about failure; you only have to be right once.” – Drew Huston

Futures are mixed this morning as the S&P 500 is indicated to open marginally higher and the Nasdaq is looking to open lower. Interest rates are firmly lower at the front end of the curve and most commodities are lower. Bitcoin was flat for most of the night, but then saw a quick 3% rally right around 6 AM Eastern. The economic calendar is light today, but there are still plenty of earnings reports on deck for after the close.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

As the Fed begins its two-day policy meeting where it is widely expected to announce a tapering of its asset purchases, the long end of the treasury curve has remained extremely calm. While there was a bit of jump in yields in late September and into early October, the move higher ran out of steam right at its downtrend line and has now nearly made a roundtrip back to where it was to begin with.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 11/1/21

Bespoke Market Calendar — November 2021

Please click the image below to view our November 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

Chart of the Day – Up 20% Through October

Strong Months Beget Strong Months

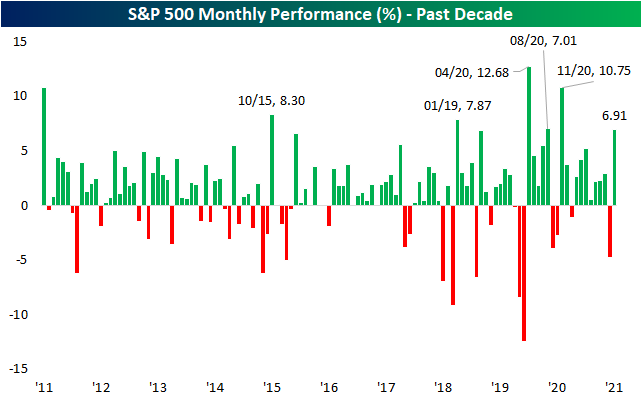

The S&P 500 capped off the month of October with further gains and more record highs. The month of October saw the S&P 500 rise 6.91%. Over the last decade, there have only been six months with as large of gains as October 2021. November of last year was the last of those months when the index rose 10.75%.

Going back through the history of the index, there have been 166 months on record in which the S&P 500 has rallied at least 5% during the month. On average, the first day of the following month has tended to outperform the first day of all months by 8 bps with positive performance 55.4% of the time. Similarly, the performance of the index over the whole next month has also tended towards outperformance with an average gain of 0.87% (positive performance 65.1% of the time) versus 0.64% for all months. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/1/21 – Positive Start to November

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If people knew how hard I worked to get my mastery, it wouldn’t seem so wonderful at all.” – Michelangelo Buonarroti

There are less than 45 trading days left in the year, and the major US averages are looking to pick up in November where they left off at the end of October. Today’s economic data includes the ISM Manufacturing report and Construction Spending at 10 AM. In addition to another busy week of economic data and Friday’s employment report, the key event of the week will be Wednesday’s FOMC policy statement and Powell press conference.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

The S&P 500 rallied more than 1% last week but at the sector level just over half of the eleven S&P 500 sector ETFs actually finished the week lower. None of the sector declines were more than 1%, but it does show that last week’s rally wasn’t a tide that lifted all boats. The two worst performing sectors on the week were Financials (XLF) and Energy (XLE), but they are still easily the top-performing sectors YTD and still two of six sectors that head into the new week at overbought levels.

Even in the top-performing sector last week – Consumer Discretionary (XLY)- the rally was far from even. The sector’s 4.36% surge was primarily all due to the rally in Tesla (TSLA) which surged over 20%. On an equal-weighted basis, the sector’s performance was much more muted at just 0.45%.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 10/31/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Climate

Unlimited Sand and Money Still Won’t Save the Hamptons by Polly Mosendz and Eric Roston (Bloomberg)

How the federal government is investing billions to give some of the most expensive coastal real estate in the world a chance at survival amidst rising seas and intensifying storms. [Link]

The Engineer Who Made Electric Vehicles Palatable for the Pickup-Truck Set by Alejandro De La Garza (Time)

A profile of the veteran Ford engineer who is driving the company towards widespread battery-electric adoption that will be predicated on selling millions of electric pickups she helped design. [Link]

Economic Research

Labour markets and inflation in the wake of the pandemic by Frederic Boissay, Emanuel Kohlscheen, Richhild Moessner and Daniel Rees (BIS Bulletin)

A helpful cross-country analysis of the very different labor market shifts brought on by the pandemic. The US saw an unusual uptick in average hours worked but much more unemployment, while other developed markets typically reduced labor activity via fewer hours. [Link; 9 page PDF]

A C-Shaped Recovery? by JW Mason (JW Mason)

Unlike in a typical recession, a massive policy response meant that real incomes actually rose during this recession, and the biggest gains came at the bottom of the income distribution, a complete mirror image of the typical downturn. [Link]

Monitoring the Inflationary Effects of COVID-19 by Adam Hale Shapiro (FRBSF Economic Letter)

A somewhat dated (from August 2020) but useful analysis of COVID-related inflation and disinflation that uses volume changes to identify which categories of prices are being driven by supply versus demand shifts. [Link]

Strange Pastimes

Crypto Investors Are Bidding to Touch a 1,784-Pound Tungsten Cube Once a Year by Edward Ongweso Jr (Vice)

Just when you thought the NFT craze couldn’t get any weirder, and Illinois company is selling one that allows users to touch a big cube of metal. [Link]

Inside the jaw-clenching world of cricket fighting in China by Emily Feng (NPR)

A thousand year old tradition in China involves setting bugs against one another while a referee watches closely to pick a winner. The little insects are rarely injured by their grappling, and owners never allow fights to the death. [Link]

Tech, For Good Or Bad

For the First Time, Drones Autonomously Attacked Humans. This Is a Turning Point. by Kyle Mizokami (Popular Mechanics)

While somewhat dated, this article is still an important milestone in the evolution of warfare: the first time a drone has made a decision to attack and kill a human without another human being involved. [Link]

3-D Printed Houses Are Sprouting Near Austin as Demand for Homes Grows by Nicole Friedman (WSJ)

New technology is being deployed to help reduce the costs of home construction, with builder Lennar (LEN) hoping to free up more supply with the new approach. [Link; paywall]

You Could Be Competing With Bots to Buy Gifts This Christmas by Joshua Hunt (Bloomberg)

Inside the desperate competition for sneakers sold by retailers that pit botnets versus consumers looking to buy shoes for themselves. [Link; soft paywall]

Oops

Covid cases: Immensa lab failures preceded huge spikes in South West as large number of positives were missed by Thomas Saunders (iNews)

As much as a quarter of the positive COVID tests in South West England were missed thanks to an error at a lab that generated more than 40,000 false negative test results in September and October. [Link]

Demographics

The First Population Bomb by Davis Kedrosky (Substack)

How a massive surge in population preceded the fastest economic growth of England’s industrial revolution, driven by a range of factors from earlier marriages (thanks to better labor incomes) to longer life expectancy. [Link]

Cigarette Sales Rose in 2020 for First Time in 20 Years by Talal Ansari (WSJ)

With less money spent on travel, gas, and entertainment, more money got spent on cigarettes, driving the first annual increase in cigarette volumes for more than two decades. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report Newsletter – 10/29/21 – Over the Hump

This week’s Bespoke Report newsletter is now available for members.

With the peak of earnings season ahead, including reports from the five largest companies in the S&P 500 (at the time), investors were looking at quite a hill to climb heading into this week. Based on past precedent, expectations weren’t great. In the past, when the five FAAMG stocks (Facebook, Apple, Amazon, Microsoft, and Alphabet) have reported earnings in the same week, their performance and the performance of the S&P 500 during that week has generally been poor. In the five prior occurrences where this occurred since 2015, the S&P 500 was down during that week four out of five times, and the only positive return was a modest gain of 0.14% in the week ending 4/30/21.

This week came and went, and the bulls were unfazed by the challenge. Despite mixed reports from the companies reporting– three of which were down on their earnings reaction days– the S&P 500 managed to rally more than 1% and hit record intraday highs on four of the week’s five trading days.

In this week’s Bespoke Report, we discuss all the issues impacting the market this week along with what to expect in the final two months of the year. To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.