B.I.G. Tips: Big Upside Reversals

Daily Sector Snapshot — 1/24/22

Triple Plays Taking A Snooze

A triple play is when a company reports better than expected results on the top and bottom line while also raising guidance. We consider these to be the gold standard for earnings, generally speaking, as they indicate a strong fundamental picture relative to expectations. Since the big banks kicked off earnings, though, triple plays have been hard to come by with only 5 of 92 total reports having been triple plays, and those five stocks have averaged a 1.61% decline on their earnings reaction days; slightly worse than the 1.56% average decline for all stocks reporting earnings so far.

Expanding the time frame, in the chart below we show the percentage of stocks reporting triple plays on a three-month rolling basis similar to the charts of beat rates in our Earnings Explorer tool. As shown, the pandemic has been a boon for triple plays as a result of a mix of pessimistic forecasts and strong rebounds. The percentage of stocks reporting triple plays over the past two years has been unlike anything in the history of our data going back to 2001. With that said, gravity has been hitting the triple play rate as it is heads into the current earnings season at the low end of the range since the fall of 2020.

With triple plays more frequent, they appeared to have lost their luster with weaker full-day changes on earnings than what was observed for most of the time prior to the pandemic. As the triple play rate has come down, stock price reactions have improved but are still on the weaker side relative to history. Currently, over the past three months the average triple play has rallied a little over 4% the day after earnings compared to 5.21% historically. Click here to view Bespoke’s premium membership options. You can monitor earnings triple plays on a daily basis with a Premium membership.

New Lows Expanding for the Nasdaq 100

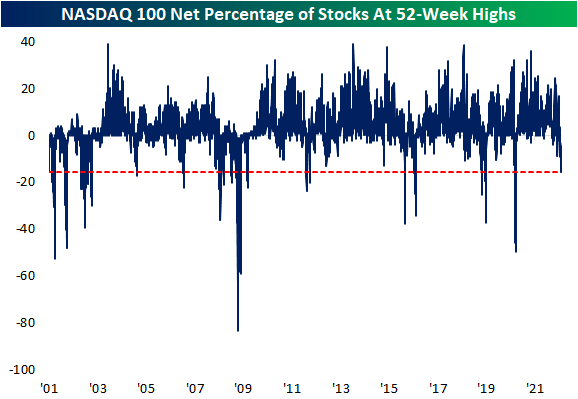

In an earlier post, we highlighted weak breadth for the S&P 500 Tech sector which now has just 9.2% of stocks above their 50-day moving averages. Pivoting over to the tech-heavy NASDAQ 100, another look at bad breadth is the new low in the net percentage of stocks setting new 52-week highs versus 52-week lows. As shown below, a net 15.68% of the NASDAQ 100 is at 52-week lows today which is the lowest reading since the COVID Crash in March 2020. At the lows during the COVID Crash, nearly half of the index hit 52-week lows. There have only been a few other times going back to the beginning of the data in early 2001 in which this reading got this low. The current reading is only in the 2nd percentile of the historical range.

The chart below shows the distance from 52-week high for all of the Nasdaq 100’s members. There are currently only a dozen names that are currently within single-digit percentage points from their 52-week highs, while the average stock in the index is now 25.2% below its 52-week high. Click here to view Bespoke’s premium membership options.

Bye Bye Moving Averages

As of mid-day, the only sector that is not down over 2% is Consumer Staples, and even that defensive sector is down over 1.5%. As a result of the big declines across the market recently, there has been a notable drop in the percentage of stocks trading above their moving averages. Just a little over a week ago, over half of S&P 500 stocks traded above their 50-DMAs. Today, that reading is closer to a quarter of the index. As for the individual sectors, the readings for Consumer Discretionary, Real Estate, and Technology have fallen into single digits. One area that is holding up remarkably well is Energy with over 90% of its stocks above their 50-DMAs. Consumer Staples is the only other sector with more than three-quarters of its stocks above their 50-DMAs.

The readings with regards to the longer-term 200-DMA have held up better. 41% of the S&P 500 is above their 200-DMAs, but that too is down considerably versus the start of the year when three-quarters of the index was above their moving averages. Once again, Energy stands out with a far healthier reading at 90.5%, but that is actually the first sub-100% reading for Energy since January 6th. Real Estate, Financials, Consumer Staples, and Utilities have the next strongest readings. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 1/24/22 – More Red

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Control your own destiny or someone else will.” – Jack Welch

Futures were briefly in the green at the open last night, but that positive tone didn’t last long. Futures are not only in the red, but the pace of the decline has been picking up steam with S&P 500 futures down 1% and the Nasdaq down about 1.5%. There were a number of times in the last year when it felt like the market could do nothing but go up. Now you know how it feels the other way around.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

How steep of a drop for the Nasdaq has it been over the last several days? The chart below measures the Nasdaq’s spread versus its 50-day moving average (measured in standard deviations) on a daily basis going back to 2009. As of Friday’s close, the Nasdaq was 3.3 standard deviations below its 50-day moving average which represents the most oversold level since the second half of March 2020 during COVID crash, and since the end of the Financial Crisis in 2009, there have only been a handful of other times that the spread was wider than it is now. We covered more on this topic in today’s Chart of the Day, which will be emailed out shortly.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day – Nasdaq Extremes

B.I.G. Tips – Nasdaq Pain

Bespoke Brunch Reads: 1/23/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Commodities

Permian Basin: high oil price breathes new life into US shale by Myles McCormick (FT)

An on-the-ground report from the heart of US shale country and the good times that are rolling – for now – in West Texas as oil prices run far above break-evens for local producers. [Link; paywall]

Steelmaker CEO Warns North America Market a ‘Falling Knife’ by Joe Deaux (Bloomberg)

Canadian steelmaker Stelco is seeing a sharp drop in demand and building inventories amidst falling steel prices thanks to weak activity in construction and automaking industries and high production from mills [Link; soft paywall]

Government

Police in this tiny Alabama town suck drivers into legal ‘black hole’ by John Archibald (AL.com)

A horror story from a small suburb outside of Birmingham that has turned its police force into a revenue collection agency, complete with shocking over-spending by the department and invented charges designed to justify their budget. [Link]

The strange case of the casino, the Senate leader and the defense bill by Mark Satter (Roll Call)

An effort South Carolina’s Catawba Indian Nation to build a casino in North Carolina has led to strange Congressional bedfellows and a unique example of how the modern Congress functions: interest groups first, regular order out the window. [Link]

Sold To You

Robinhood and Democracy Promotion by Ranjan Roy (Margins)

A feature for Robinhood users that granted them exclusive access to IPOs has created massive losses for retail investors who opted in, blurring the lines between regular customer communications and marketing for the brokerage platform. [Link]

Renaissance Investor Exodus Nears $15 Billion Despite 2021 Gains by Hema Parmar (Bloomberg)

While Renaissance Technologies’ flagship fund delivered 20% returns in 2021, investors aren’t pleased thanks to underperformance versus the fund’s Medallion fund; billions have flowed out of the fund’s public vehicles over the past year. [Link; soft paywall]

Bonds

German Benchmark Bond Yield Briefly Turns Positive for First Time Since 2019 by Anna Hirtenstein (WSJ)

Increases in US Treasury bond yields have helped push up the yields on global government debt, and it actually costs Germany money to borrow in nominal terms now for the first time in almost two years. [Link; paywall]

Bond Market Forecasts Bad Economic News by Greg Ip (WSJ)

While we wouldn’t necessarily frame it as “bad news”, bond prices don’t reflect much worry over inflation or high policy rates needed to combat that inflation. [Link; paywall]

Puzzles

The Best Starting Words to Win at Wordle by Harry Guiness (Wired)

If you’ve gotten deep in to Wordle, you might want to brows this article which helps narrow down the field with some optimal guesses. [Link]

COVID

‘Nocebo’ effect blamed for two-thirds of COVID vaccine symptoms: Study by Hannah Sparks (NYP)

A study of vaccine side-effects report suggest that about two-thirds of side-effects from vaccines were psycho-somatic, given the level of side-effects reported by those who received placebo vaccines during clinical trials. [Link; auto-playing video]

This Week In Tech

‘It’s All Just Wild’: Tech Start-Ups Reach a New Peak of Froth by Erin Griffith (NYT)

More than 900 tech start-ups are unicorns, and investors are getting in to massive scrums over the right to buy in to the latest hot deal. [Link; soft paywall]

Sobriety

I Got Sober in the Pandemic. It Saved My Life. by Danielle Tcholakian (Jezebel)

A wonderful essay about finding community and escaping demons amidst the pandemic, with a little help from caring friends and none at all from booze. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 1/21/22 – “Thank You Sir, May I Have Another”

This week’s Bespoke Report newsletter is now available for members.

In The Bespoke Report this week we discuss the huge rotation out of growth and in to value stocks, preview earnings season, discuss the “buy-the-dip” mentality from US markets, review valuations, discuss the drivers of emerging markets outperformance, highlight the divergence between stock prices and analyst estimates by sector, review economic data from the US and around the world this week, and more.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.