Chart of the Day – March Intra-Month Performance

Bespoke’s Morning Lineup – 2/28/22 – Down But Not Out

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The two most powerful warriors are patience and time.” – Leo Tolstoy

Some periods of time or more eventful than others, and this past weekend was one of the more news-jammed weekends we have seen in years as nearly the entire world has unified against Russia’s actions in Ukraine. Futures are lower this morning in reaction to the continued hostilities, but there are a ton of moving parts to contend with. Make sure to read this morning’s full recap of all the events in today’s Morning Lineup.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Despite the weak picture in the futures market, equity prices still remain well above their lows from last week, and within the commodity space, we’ve seen a similar picture play out. For both gold and WTI crude oil, last night saw early moves higher at the open, but neither commodity was able to rally enough to take out the intraday highs from last week. Besides the fact that they weren’t able to take out those highs, both commodities have also given up much of their early gains. Gold is now 3.4% off last week’s high of 1,976.5 per ounce while WTI is down 4.72% from its high of 100.54 per barrel. Those highs from last week will be key levels to watch. Nobody knows how things are will play out from here, but last week’s highs in gold and crude oil are important milestones to watch. As long as they are able to remain in place, the better sign it is that the worse of this crisis could be behind us.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 2/27/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Inflation

After Long Covid, U.S. Businesses Get Ready for Long Inflation by Shawn Donnan and Emma Kinery (Bloomberg)

Amidst extremely stressed supply chains, high commodity prices, and extremely tight labor markets, US businesses are getting more comfortable and used to the idea of raising prices to solve profitability challenges. [Link; soft paywall, auto-playing video]

Why This Economic Boom Can’t Lift America’s Spirits by Josh Mitchell (WSJ)

While the unemployment rate has plunged, consumer spending is booming, and wage gains are rapid, Americans are feeling much less optimistic about the economy compared to recent periods of weaker growth. [Link; soft paywall]

Crime

Miami Street Gangs See No Hope In Dope. They’ve Switched To Identity Fraud Fueled By Russian Hackers by Thomas Brewster (Forbes)

With stiff penalties and lots of competition (not to mention physical danger) in drugs, semi-organized criminals are turning to white collar crimes as lower hanging fruit. [Link; soft paywall]

Three men plead guilty to planning U.S. power grid attack, driven by white supremacy by Kanishka Singh and Sarah N. Lynch (Reuters)

A small terrorist conspiracy to violently attack the American power grid has led to guilty pleas from conspirators per plea agreements recorded this week. [Link; soft paywall]

China

Beijing Olympic Ratings Were the Worst of Any Winter Games by Tiffany Hsu (NYT)

It wasn’t just your imagination: this Olympics wasn’t good. China’s winter games drew only a little better than half of the viewership the prior games in Korea reported. [Link; soft paywall]

China Is About to Regulate AI—and the World Is Watching by Jennifer Conrad and Will Knight (Wired)

New rules introduced by Chinese regulators will change how algorithms that dictate pricing, determine search results, and power a galaxy of different consumer tech are managed, a first in the world. [Link; soft paywall]

Renewables

U.S. offshore wind auction bids top $1.5 billion, with more to come by Nichola Groom (Yahoo!/Reuters)

The largest-ever sale of offshore wind development rights in the US got major interest from 14 different companies despite efforts by homeowners to restrict development based on protection of views from summer homes. [Link]

Million-Dollar Home Listings Dry Up for Wealthy Suburban Buyers by Prashant Gopal (Bloomberg)

Large footprint suburban homes have evaporated off the market as dual-income Millennials seek breathing space with big budgets. The result is a massive price boom for the McMansion. [Link; soft paywall, auto-playing video]

Markets

Heavily Hedged Traders Have Been Awaiting a Stock-Market Storm by Vildana Hajric and Katie Greifeld (Yahoo!/Bloomberg)

Short interest has risen and put options have flown into the hands of speculators nervous about a market decline, making the drop in equities this week less painful than it might otherwise have been. [Link; auto-playing video]

Ukraine Swaps Signal 90% Chance of Default as Russia Attacks by Laura Benitez (Bloomberg)

Financial markets are pricing high odds of a default for Ukraine, but the aggressor is also being punished thanks to sanctions and fears over political disruption. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — The Putin Put?

This week’s Bespoke Report newsletter is now available for members.

In this week’s Bespoke Report we cover the crazy action seen across financial markets this week along with a look at bearish sentiment, valuations, seasonality, and more. To read this week’s full Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Daily Sector Snapshot — 2/25/22

The Bespoke Metaverse Index

Bespoke’s Metaverse Index tracks 40 companies with exposure to the continued rollout of the metaverse. We outlined seven components of the metaverse and selected the companies that have either spoken about their metaverse plans or have the capabilities to fulfill metaverse needs within these categories.

Bespoke’s Metaverse Index is available at the Bespoke Premium level and higher. You can sign up for Bespoke Premium now and receive a 14-day trial to read our Metaverse report. To sign up, choose either the monthly or annual checkout link below:

B.I.G. Tips – Death by Amazon – 2/25/22

In this note we update performance of our “Death By Amazon” and “Amazon Survivors” indices. The rebound from the COVID shock led to massive outperformance of retail-related stocks like those in our “Death By Amazon” index which made up its entire performance lag versus the broad market since 2012. Since November, that outperformance has trailed off dramatically as “meme” stocks that happen to be in the portfolio trail off and the broad market declines. Since inception, total returns for the DBA are roughly in-line with the overall market.

As for “Amazon Survivors,” since 2016 there’s been significant outperformance that is entirely driven by their performance in the recovery from the COVID drop. Over the past five and a half years, this group of stocks have substantially outperformed the market as a whole. More recently, though, the index has lagged, underperforming the broad market in a manner similar to the “Death By Amazon” index.

Our “Death By Amazon” index was created many years ago to provide investors with a list of retailers we view as vulnerable to competition from e-commerce. In 2016, we also created our “Amazon Survivors” index which is made up of companies that look more capable of dealing with the threat from online shopping. To see how the two indices have been performing lately and view the full list of stocks that make up the indices, please read our newest report on the subject available to Bespoke Premium and Bespoke Institutional members.

To unlock our “Death By Amazon” and “Amazon Survivors” indices, login or start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke’s Morning Lineup – 2/25/22 – Where it Stops, Nobody Knows

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Don’t blindly follow someone, follow market and try to hear what it is telling you.” – Jaymin Shah

After trading lower most of the night, futures have seen a significant turnaround leading up to the opening bell. Although not nearly as dramatic as Thursday’s intraday reversal, major US indices are currently looking at steady gains. Whether that holds into the closing bell ahead of the weekend remains to be seen. The catalyst behind this morning’s strength has been calls for diplomacy from China in settling the Ukraine conflict and apparent signals from Russia that they too are ready to have diplomatic talks. At the same time, though, the Russian military says it has seized control of a key airport outside of Kyiv.

Economic news this morning was generally positive Durable Goods, Personal Income, and Personal Spending all surpassing expectations while inflation data was mostly inline with expectations.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday, we noted that the Nasdaq 100 ETF’s (QQQ) positive reversal was just the third time in its history that the ETF gapped down more than 3% at the open and finished the day more than 3% higher. The other two days were in April 2000 and May 2001. Neither of those two prior days were followed by positive returns for US stocks. Widening out the criteria a little more, yesterday was only the 14th time that QQQ gapped down 2% at the open and finished the day higher. Once again, the vast majority of prior instances occurred during the dot-com bust, but they weren’t exclusively confined to that period, and there have also been a handful of prior occurrences since the end of the financial crisis that occurred late in market selll-offs as well. In other words, the jury is still out, and given the catalyst behind yesterday’s downside gap (a major geopolitical conflict) it’s probably not a good idea not to read too much into one day’s action.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Weekly Sector Snapshot — 2/24/22

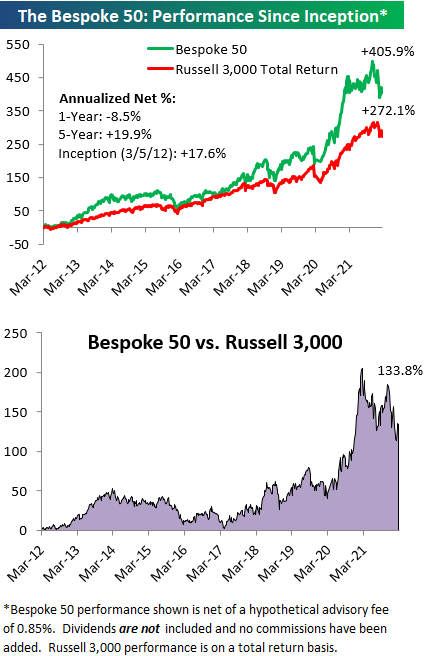

The Bespoke 50 Growth Stocks – 2/24/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.