The Bespoke Report – 3/4/22 – War, Peace, And Prices

This week’s Bespoke Report newsletter is now available for members.

The invasion of Ukraine has sparked market volatility beyond equity markets, with historic moves in European fixed income this week alongside the biggest advance in wheat prices on record. We discuss the implications of the commodity price shock for equity markets and the Federal Reserve, which remains the elephant in the room when it comes to the outlook for stocks and the economy. We also review global economic data, the monthly jobs numbers released this morning, implications for the dollar’s rally in stocks, and more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

B.I.G. Tips – US Dollar Breakout

US Back on Top (Sort of)

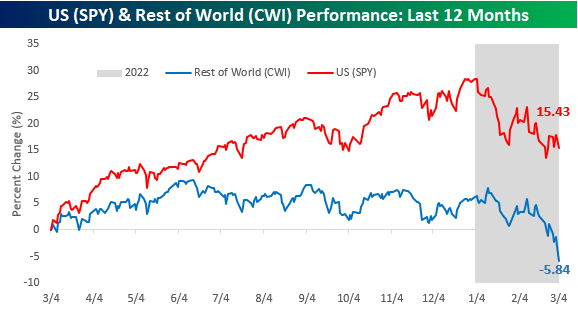

Heading into 2022, there was a ton of optimism towards international stocks. After years of underperformance, the feeling was that valuations had become so skewed in favor of international stocks that they were due for their day in the sun. When the calendar finally did flip, international stocks came out of the gate positively, and as US stocks pulled back, international stocks held up much better. The resilience of international stocks didn’t last long, though. As the Russia-Ukraine war has escalated, investors have been ditching international equities en masse, while US stocks have actually held up relatively well. Over the last year now, US stocks, as measured by the S&P 500 tracking ETF (SPY) are up over 15%. International stocks, on the other hand, as measured by the SPDR MSCI ACWI ex-US ETF (CWI) are now down over 5%!

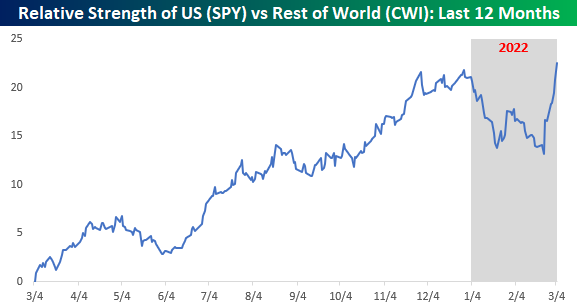

The relative strength picture between US and international stocks really illustrates how international stocks appear to have had their 15 minutes come and go. When 2021 ended, the relative strength of US stocks versus the rest of the world was right near a 52-week high. Once 2022 kicked off, though, US stocks saw a big slide in relative performance bottoming out on 2/23 – the day before Russia invaded Ukraine. Since that invasion, US relative performance has spiked higher and is right back to levels it started the year at. Investors have clearly fled to the relative safety of US stocks given the geo-political turmoil, so as long as these conditions remain, international stocks are subject to headwinds. If tensions do start to de-escalate, though, international equities may find themselves back in the spotlight again. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 3/4/22 – The Least Important Jobs Report in Years

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you’re changing the world, you’re working on important things, you’re excited to get up in the morning.” – Larry Page

Every month at about this time, the financial world stops everything to focus on what is often considered the most important jobs report in years. Today’s employment report looks like an exception, though. With Fed Chair Powell already telling the markets that March’s meeting will come with a 25 bps rate hike, the Russia Ukraine war intensifying, and commodity prices spiraling out of control, today’s report could be the least important jobs report in years.

Futures are sharply lower this morning following a big sell-off in Europe as war tensions escalate. The big headline last night was news of Russia attacking and seizing control of Europe’s largest nuclear power plant. While initial concerns of a nuclear accident have subsided, investors are coming to a realization that the longer this all drags on, the more damaging to the global economy it all becomes. European benchmark indices are currently down over 3%, while US futures are down about 1%.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Rising commodity prices have been the most direct impact of the Russia-Ukraine war, and crude oil is the most concrete example. Through this morning, WTI crude oil is up just over 20% on the week, and if these gains hold through the end of the day, it would be just one of five periods where crude rallied more than 20% in a week. In 1998, it got close to 20% but came up just short. As shown in the chart below, we’d also note that three of the prior four periods where prices spiked occurred during recessions. We’re at the point now where prices at the pump are higher on the way home from work than on the way in.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke 50 Growth Stocks – 3/3/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were 16 changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

B.I.G. Tips – Oil and Gold Go Into Orbit

Bespoke’s Weekly Sector Snapshot — 3/3/22

Bespoke’s Consumer Pulse Report – March 2022

AAII Sentiment Improves While Other Surveys Plummet

The S&P 500 has been fighting to regain some of its lost ground in the past week working its way out of oversold territory at yesterday’s close in the process. As a result, investor sentiment has taken a more optimistic tone this week as the AAII sentiment survey showed the percentage of respondents reporting as bullish climbed back above 30% for the first time since the first week of the year. In total over the past two weeks, bullish sentiment has now risen 11.2 percentage points. While improved, that still leaves bullish sentiment several percentage points below its historical average of roughly 38%.

The gains to bullish sentiment borrowed heavily from an extremely elevated reading in bearish sentiment. Last week over half of the respondents reported as bearish after a 10.5 percentage point increase week over week. This week that has dropped all the way down to 41.4%. That 12.3 percentage point decline was the largest drop since October 2019 when it fell 12.91 percentage points to a much lower 31%. This also marks the first time bearish sentiment rose double-digits then fell double digits in back-to-back weeks since February 2016.

In spite of the big drop to bearish sentiment, they continue to heavily outnumber bulls with an 11 point spread between bullish and bearish sentiment. That is improved from last week’s reading of -30.3 but remains at the low end of the recent range.

While the AAII survey results showed an improvement in sentiment, other sentiment surveys showed the opposite. The Investors Intelligence survey saw the lowest reading on bullish sentiment since February 2016 and the NAAIM Exposure index showed investment managers are basically market-neutral as the index saw the lowest reading since the COVID crash. Combining all of these readings into our Sentiment Composite, the gains to AAII sentiment in the past couple of weeks has brought the composite off the lows, but current levels are still some of the most bearish of the past decade. The only lower readings were in the spring of 2020 and early 2016. Click here to view Bespoke’s premium membership options.