Daily Sector Snapshot — 6/7/22

Bespoke Stock Scores — 6/7/22

Chart of the Day – Bombed Out Stocks Rebuilding Bases

Solar ETF (TAN) Flares

Yesterday, the Biden administration announced plans for a new federal program to support solar panel manufacturing via removal of import tariffs. In response, solar stocks proxied by the Invesco Solar Energy ETF (TAN) ripped higher gaining 4.26% on the day. Although TAN actually saw an even larger 5.5% single-day gain just last Thursday, yesterday’s move does rank in the top decile of all daily moves on record for the ETF. Perhaps more importantly, that also marked the first time the ETF moved above its 200-DMA intraday since December. However, those gains did not hold as TAN moved a few cents back below its 200-DMA by the close, and today it continues to hover slightly below that moving average. We would also note those levels are smack dab in the middle of the past year’s range and are at similar levels to the low end of the second half of last year’s range. In other words, solar stocks may have gotten a boost from the news yesterday, but the technical picture is at a bit of a crossroads and not decisively positive.

As solar stocks struggle to decisively make a move above their 200-DMA, the First Trust Global Wind ETF (FAN) is only managing to move above its 50-DMA. Even though also a part of the clean energy space, wind-related clean energy stocks did not receive much of a bump from yesterday’s news as the group was only a modest 1% higher at the intraday highs compared to an over 7% gain for TAN at its highs. As FAN still needs to rally another 4.7% before joining solar stocks in testing its 200-DMA, the overall technical picture for FAN has been much less positive. The past year’s downtrend is more defined as the ETF has repeatedly failed to move back above its 200-DMA over the course of the past year with the most recent attempt being earlier this spring.

While solar shows a bit more promise than wind from a technical standpoint, overall the picture hasn’t changed much for clean energy as a whole. The largest clean energy ETF, the iShares Global Clean Energy ETF (ICLN), has likewise been stuck under its 200-DMA; having come up short yesterday following the rally off of the 52-week low last month and another failed attempt to move above its 200-DMA in April.

At the moment, clean energy stocks have failed in breaking out, but versus the broader market the move certainly stands out. In the chart below we show the relative strength line over the past five years for the Solar Energy ETF (TAN) versus the S&P 500 (SPY). Beginning in late 2018 that line was consistently on the rise followed by an enormous surge in the second half of 2020 through the end of the year. That steep rise in the line means this cohort of stocks experienced massive outperformance relative to the S&P 500. Of course, as fast as it went up, the line came crashing back to Earth in the first half of 2021 with further follow-through up until earlier this year. In late January, the relative strength line made its way back down to and successfully tested the longer-term and more gradual uptrend line off the late 2018 levels, and that continued to hold throughout the spring. In the past couple of weeks and especially after yesterday’s surge, the line has dramatically broken out of the past year and a half’s downtrend. Click here to learn more about Bespoke’s premium stock market research service.

Weakness in Retail

The broader retail space has been weak relative to the S&P 500 so far this year. Much of this weakness came after Target’s (TGT) and Walmart’s (WMT) earnings calls, in which management noted margin compression, inventory gluts in certain categories, shifting consumer preferences, and weakness in consumer spending as inflation in food and energy reduces discretionary budgets. Institutional subscribers can view our Conference Call Recaps on these two companies by clicking here. On a YTD basis, the VanEck Retail ETF (RTH) has underperformed the S&P 500 (SPY) by 4.5 percentage points, trading down by 18.2% as of today. A chart of the relative strength of RTH vs SPY over the last year is shown below.

Within the S&P 500, there are 21 stocks that make up the Retailing industry, and in the table below, we have outlined the performance of the 10 largest stocks by market cap. You’ll notice that companies like Costco (COST) and WMT aren’t listed, but that’s because they are actually part of the Food and Staples Retailing industry. As you can see, seven of these ten stocks are down more than the average S&P 500 member on a YTD basis, and six are further from their respective 52-week highs than the average S&P 500 member. However, only two of these stocks are below their pre-COVID highs, whereas more than a third of (35.8%) of S&P 500 components are below their pre-COVID highs.

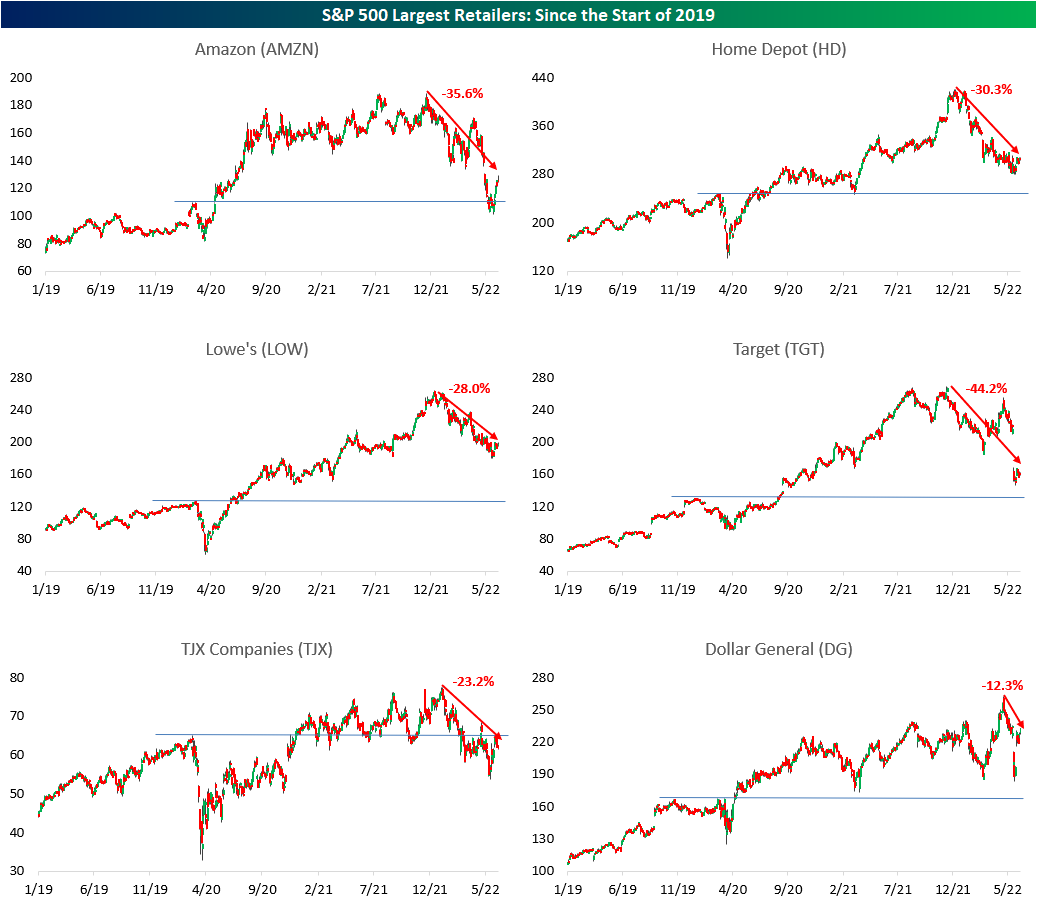

Below are charts of each of the 10 stocks listed above since the start of 2019. Included on each chart is the percentage that each is off its 52-week high. As you can see, AutoZone (AZO), Dollar Tree (DLTR) and Dollar General (DG) have held up relatively well amidst broader market weakness, likely due to their positioning on the value chain. The market seems to believe that consumers will move down the value chain amidst rising inflation, which makes our latest Little Known Stocks Report even more compelling. Click here to become a Bespoke premium member today!

Bespoke’s Morning Lineup – 6/7/22 – Off Target…Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The only thing you can be sure of is that there are times when large numbers of stocks are priced too high and other times when they’re priced too low.” – Benjamin Graham

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Everything seems to be trading lower this morning. Futures were already lower overnight, but Target’s (TGT) second profit warning in less than three weeks has dragged them lower. TGT is trading down over 9%, which is even more than the 6% that Bitcoin is trading down following proposed legislation in the Senate to regulate cryptocurrencies. Although the two senators bringing forth the legislation both just noted in an interview that they could see bitcoin as a diversified part of investor retirement portfolios.

In today’s Morning Lineup, we discuss the latest proposed crypto legislation (pg 4), the larger than expected rate hike in Australia (pg 4), market activity in Asia and Europe (pg 4), TGT’s warning (pg 5), and economic data out of Europe (pg 5).

TGT has long been considered one of the most well-run retailers in the United States, so when a company of its caliber is forced to revise guidance less than three weeks after already significantly cutting guidance, you can only imagine how hard this environment has been for businesses across the economy. In its announcement this morning, TGT pointed to a ‘rapidly changing environment’, ‘external volatility’, and ‘unusually high transportation and fuel costs’ as reasons for lowering Q2 margin guidance from 5% down to 2%. On the bright side, the company said that the actions it was taking now should help improve long-term margins in the second half of the year and that demand remained generally strong. You can’t fault the company for taking proactive steps to address conditions, but there’s no guarantee that the environment is suddenly going to stop ‘rapidly changing’, or that external volatility will suddenly abate, and it certainly doesn’t seem like transportation and fuel costs are going to decline from their ‘unusually high’ levels.

With the stock indicated to gap down close to 10% this morning, TGT has now declined 46% from its high less than seven months ago. For a stock that had a market cap of more than $125 billion late last year, a decline of this magnitude is significant, to say the least. TGT remains just about 10% above its pre-COVID peak so we can’t yet add it to the list of stocks that have unwound all of their post-COVID gains, but it’s getting close.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 6/6/22

Chart of the Day – Ironing Out Moving Average Crossovers for Apple (AAPL)

May 2022 Headlines

Bespoke’s Morning Lineup – 6/6/22 – On the Rebound

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The eyes of the world are upon you. The hopes and prayers of liberty-loving people everywhere march with you.” Dwight D Eisenhower

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It’s a bounceback Monday for the markets to kick off the week as news regarding China’s COVID restrictions and the country’s crackdown on the tech sector may be easing. Nasdaq futures are leading the charge higher, but the S&P 500 is also indicated to open up by over 1%. Oil is modestly higher, although off its earlier highs, Treasury yields are slightly higher, and crypto is sharply higher.

In today’s Morning Lineup, we discuss weekend developments in the Russia-Ukraine war (pg 4), the upcoming UK no-confidence vote (pg 4), and economic data out of China and the rally in that country’s tech sector (pg 5).

The week is starting off on a positive note for equities, but remember that today’s levels at the open still won’t be enough to erase last Friday’s declines. Additionally, all of the major averages are still trading below their 50 and 200-day moving averages, and they remain mired in pretty well-defined downtrends with a series of lower highs and lows. The only one of the three indices listed below that has broken its short-term downtrend is the Nasdaq 100, but it’s also seen the steepest declines. As we head into the new week, the Russell 2000 is down in six of the last seven weeks, and the Nasdaq 100 and S&P 500 are down in eight of the last nine weeks.

As far as individual sectors are concerned, it remains a case of Energy (XLE) and everybody else as the former is the only sector in overbought territory. The only other sectors even above their 50-DMAs at this point are Materials (XLB) and Utilities (XLU). If there’s any silver lining at this point, it’s that while most sectors remain below their 50-DMAs, only one (Consumer Staples, XLP) is actually at oversold levels.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.