Chart of the Day: How Do Bad Quarters End?

Sentiment Worsens… Again

Even as the ten-year yield and crude oil have pulled back over the last few trading sessions and the S&P 500 has recuperated the losses from late last week, the percentage of respondents to the AAII survey considering themselves bullish fell for the third consecutive week. This week’s reading of 18.2% marks the lowest level since late April and ranks in the bottom 1.3% of all weeks going back to the start of the survey in 1987. On the bright side, the rate of decline in bullish sentiment has been on the decline as the percentage of respondents that considered themselves bullish fell by 11 percentage points two weeks ago, 1.6 percentage points last week, and now just 1.2 percentage points this week.

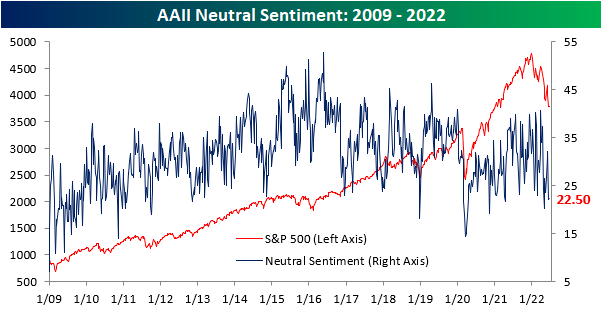

The percentage of respondents reporting neutral sentiment moved modestly higher, increasing by just 30 basis points to 22.5%. Click here to learn more about Bespoke’s premium stock market research service.

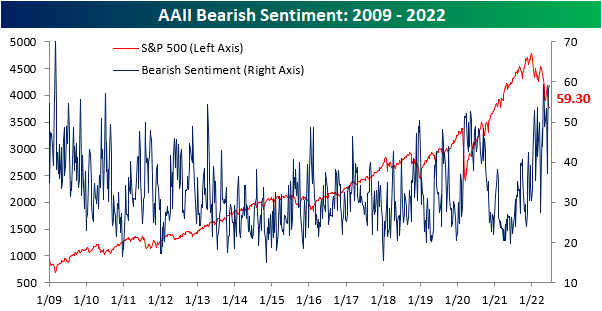

The percentage of respondents reporting bearish sentiment rose for the third consecutive week to 59.3%, the highest level since late April. The 4/28 reading was only 10 basis points higher than this week’s, so we are near the previous peak in terms of bearish sentiment. Apart from the late April reading, bearish sentiment had not topped 59% since early March of 2009. In fact, this week’s reading is in the 97th percentile of all readings since the survey began in 1987.

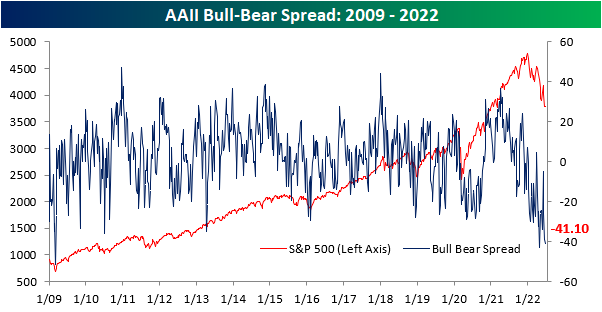

The bull-bear spread remains near historic lows, and there have now been 22 consecutive weeks in which the spread was below -10 (smoothed out by taking a four week moving average). We are now just four weeks away from setting a new record in this regard. The previous high was in 1991 when there were 26 consecutive weeks in which the bull-bear spread was under -10. Investors often view this as a contrarian indicator, as low readings in bullish sentiment leave upside for the market should sentiment bottom out and positive news emerge. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 6/23/22 – The Flying Powell

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Being on the tightrope is living; everything else is waiting.” Karl Wallenda

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Nine years ago today, people all over the world watched with bated breath as acrobat Nik Wallenda became the first person to walk across the Grand Canyon on a tightrope. Technically, it wasn’t actually the Grand Canyon, but a gorge right near the Grand Canyon National Park. However, the 1,800-foot highwire trek across the gorge that took place 1,500 feet above the ground (without a net) was impressive. Wallenda’s Grand Canyon crossing came barely a year after an even more widely watched event where he became the first person to walk a tightrope over Niagara Falls. Talk about an ability to strike a balance!

Nik Wallenda is just one of a long line of ‘Flying Wallendas’ that have for decades been known for their death-defying stunts that mostly involve high-wire acts without a net. Living on the edge is simply in their blood.

Up until recently, Fed Chair Powell has been attempting his own ‘Wallenda act’ looking to strike a delicate balance between raising interest rates to fight inflation and avoiding throwing the economy into recession on the other. Just like Nik Wallenda’s walks over the Niagara Falls and The Grand Canyon, many out there say that it simply can’t be done. Powell, on the other hand, remained optimistic up until recently, arguing in mid-May that removing accommodation and raising rates could be achieved with a ‘softish’ landing in the US economy that may be a ‘little bumpy’ but ‘still a good landing’.

In the month since those May comments, though, Powell has sounded less confident, increasingly leaning on the recession side of the wire in order to prevent a fall further onto the side of inflation. Just yesterday, in Senate testimony, the Fed Chair noted that “We’re not trying to provoke, and don’t think that we will need to provoke, a recession, but we do think it’s absolutely essential that we restore price stability, really for the benefit of the labor market, as much as anything else.” Wallenda ultimately proved all his doubters wrong. Is Powell’s balance anywhere near as good?

Futures have been bouncing around this morning, but have mostly been in positive territory after yesterday’s rebound from a sharply lower open. Jobless Claims were just released and came in very slightly higher than expectations at 229K compared to forecasts for 226K. Continuing Claims, on the other hand, came in 5K lower than the consensus forecast of 1.32 million. Looking ahead to the rest of the day, Powell will testify in front of the House at 10 AM, and the EIA will release Natural Gas stockpiles at 10:30. The release of crude oil inventories, which were already delayed by a day due to the Juneteenth holiday, has been postponed indefinitely due to system issues.

In today’s Morning Lineup, there’s a lot covered as we discuss overnight moves in Asian and European markets, central bank moves, and overnight economic data from Asia and Europe.

Treasury yields are down this morning with the 10-year yield below 3.1% after topping out at just under 3.5% a little over a week ago. In the five trading days that ended yesterday (6/22), the 31 basis point decline in the 10-year yield was the largest since the COVID crash, although it followed what was the largest five-day increase in over five years.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 6/22/22

S&P 500 Sector Weightings Report – June 2022

Chart of the Day – Homebuilders Head to the Basement

Bespoke’s Morning Lineup – 6/22/22 – Giving it Back

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There are no easy fixes nor any short-term answers to the global supply and demand imbalances aggravated by Russia’s invasion of Ukraine.” – Mike Wirth, CEO of Chevron

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It was fun while it lasted. In the latest example of the two steps backward, one step forward market, most of yesterday’s rally, which wasn’t enough to erase the declines of the prior two trading days, is poised to get erased at the open. Besides the fact that it’s a weekday and the market is open, there isn’t much in the way of a catalyst for this morning’s weakness. Oil prices are sharply lower with WTI down nearly 5%. Unlike most other days this year where equities and US Treasuries have moved in tandem with each other, Treasuries are actually rallying this morning.

There’s no economic data on the calendar to speak of today, but it will be a busy day of Fedspeak with Powell testifying in front of the Senate while Barkin, Evans, and Harker will also be speaking throughout the trading day.

In today’s Morning Lineup, there’s a lot covered as we discuss overnight moves in Asian and European markets, central bank moves, activity in the metals markets, and overnight economic data from Asia and Europe.

The quote above came from a letter to President Biden from Chevron (CVX) CEO Mike Wirth ahead of a scheduled meeting on Thursday between Energy Secretary Jennifer Granholm and US oil executives. The letter argues that the Biden “Administration has largely sought to criticize, and at times vilify our industry.” Wirth goes on to note that “bringing prices down and increasing supply will require a change in approach” and that the industry needs “clarity and consistency on policy matters”. Closing out, Wirth encourages President Biden that in addition to Secretary Granholm, he also “send your senior advisors to this meeting, so they too can engage in a robust conversation.”

Whatever side of the debate you are on with regards to energy policy, the current state of tension between the Federal government and the US oil industry can’t continue. While expectations are low, Thursday’s meeting will hopefully be more than a photo-op for both sides and instead help to bring some clarity to the strategy moving forward.

This morning, the Biden Administration has proposed a three-month holiday from the 18-cent per gallon federal gas tax holiday. While it sounds nice, the majority of economists and industry insiders have said it will do little to ease pressure at the pump and may actually worsen the situation by increasing demand. One study from Wharton found that a ten-month holiday would save consumers between $16 and $47 in total. The current proposal is for just three months which would imply total savings that’s barely enough to cover a McDonald’s value meal!

Despite the weakness in equity futures this morning and confusion surrounding US energy policy, oil prices are sharply lower. At a level of $104 per barrel, WTI has now pulled back 15% from its recent closing high on June 8th and has also broken the uptrend that has been in place since late 2021. Outside of the oil industry, just about everybody is rooting for this chart to keep moving lower. None more than Fed Chair Powell.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.