Daily Sector Snapshot — 6/28/22

Shorts’ Relative Break Out

Alongside the broader equity market, the most heavily shorted names have likewise been rallying off their lows in the past several days (before today). As for how significant of a rally that has been, on a relative basis, the 100 most heavily shorted stocks versus the Russell 3,000 have broken out of the downtrend that has been in place since the height of the meme stock mania in January of last year.

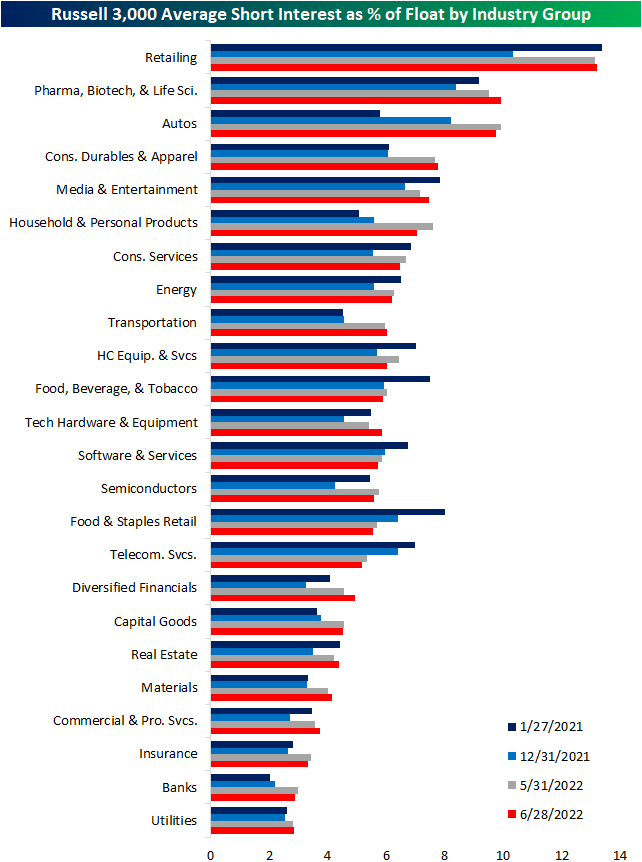

The latest short interest data as of June 15th was released yesterday, and the aggregate level of short interest for the whole of the Russell 3,000 rose from 5.1% of float as of the end of May to 5.67% in mid-June which is the highest level since last October. Below we show the average reading for the stocks of each industry group at various points in time since the historic short squeezes of January of last year. As shown, last year saw a general unwinding of short interest across industry groups, but the bear market this year has resulted in those readings starting to rise once again.

Some industries like Retail—which is also the industry with the highest average short interest reading—have seen their readings essentially return to Meme Stock Mania peak readings. Others like the Autos or Household and Personal Products industries are much more heavily shorted than they were a year and a half ago. That is not to say all industries have seen short interest rise. Food and Staples Retail, Software and Services, and Telecom Services, to name a few, currently have lower average readings on short interest than last year, at the end of last year, and the last report. In other words, while the aggregate level of short interest has been headed higher, there is some nuance as to which areas of the market have seen build-ups in short interest over the past year and a half.

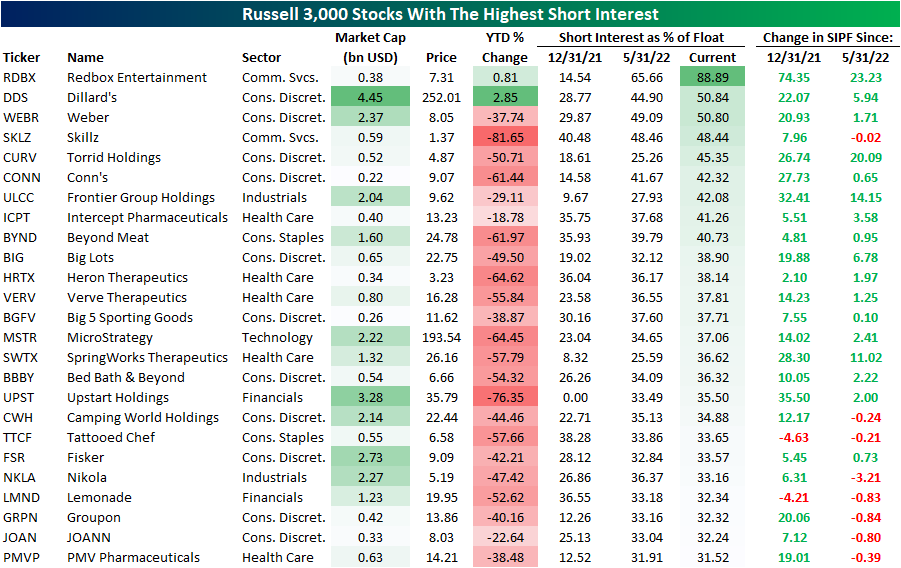

Taking a more granular look at which stocks in the index currently have the highest levels of short interest, recent SPAC, Redbox Entertainment (RDBX), tops the list with nearly 90% of its currently tradable shares sold short. Other than RDBX, there are only two other stocks with over half of float sold short: Dillard’s (DDS) and Weber (WEBR). While their short interest readings are similar, their performance year to date could not be more different. The former is one of the only names higher with a meager 2.85% gain whereas Weber (WEBR) has dropped 37.7%. Even though that is a huge decline, it is actually better than average for the whole of the 25 most heavily shorted names. The average decline year to date for this group is 45.8%. Although some names on this list have seen big increases in short interest between the latest updates, there are also a handful that have seen modest declines likely as existing shorts take profit following further declines. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – “Get Me Out”

Stocks with the Largest Price to Sales (P/S) Declines

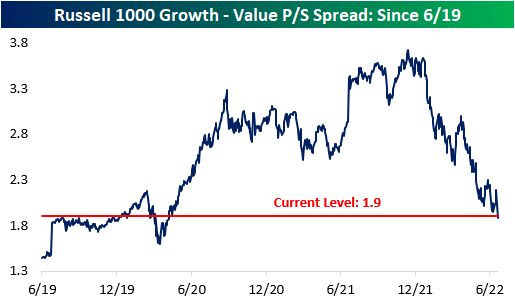

It’s no secret that there has been a massive pullback in valuation multiples, and stocks that had higher multiples have been hit much harder by the recent market pullback. This comes as rate hikes increase the discount rate and the era of “free money” comes to an end, which inherently lowers the risk appetite of investors. The chart below shows the price to sales (P/S) spread between the Russell 1000 growth index and the Russell 1000 value index. Naturally, growth stocks should always trade at higher multiples, but the spread became magnified throughout the pandemic. The spread peaked in mid-November 2021 at 3.7, but it has contracted by 1.8 points to 1.9 as of today’s open. Whereas the growth index has seen its P/S ratio decline by 36.4%, the value index has only seen a P/S decline of 13.0%. The growth index currently has a P/S ratio of 3.6, compared to 1.7 for the value index. The P/S spread between the two indices is now inline with pre-COVID levels, so the stretched growth multiples of the pandemic-era have come full circle. Click here to learn more about Bespoke’s premium stock market research service.

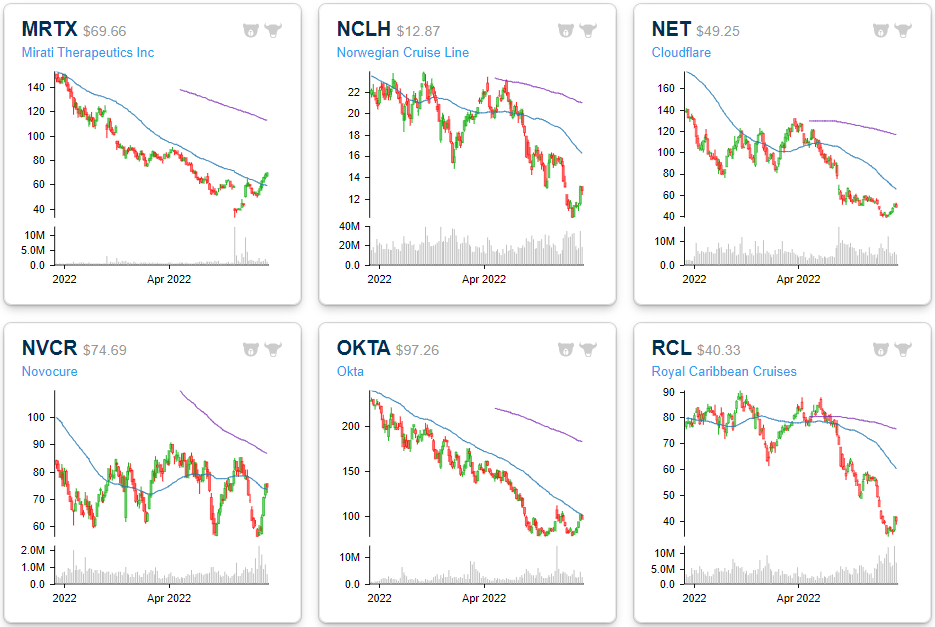

Dissecting this further, we took a look at the 20 Russell 1000 stocks that have seen their P/S multiples compress the most since their respective 52-week highs. Leading this group is Lucid (LCID), which has seen the P/S ratio decline by a whopping 275,309 points. This comes as sales increased substantially and the price declined significantly (-68.2% since the 52-week high). Even still, LCID’s P/S ratio remains in the stratosphere at 359. Next on this list is Norwegian Cruise (NCLH) and Carnival (CCL), which have experienced a similar phenomenon. Sales fell off a cliff for the cruise lines following COVID, causing their P/S ratios to spike. As sales have returned on the re-opening and share prices have continued to decline, P/S ratios have fallen significantly. The largest decliners in share price since their respective 52-week highs on this list are Upstart (UPST), DocuSign (DOCU) and Unity Software (U), which have declined by 90.4%, 79.0% and 78.9%, respectively. Upstart has seen its P/S ratio fall from 37.8 down to 3.0. The median stock on this list trades 10.8 times LTM sales, which is still aggressive to say the least. Most stocks topped out either last summer or in October/November.

The six month price charts below are available using our Chart Scanner tool. You can click here to view a custom portfolio of these twenty stocks if you’re already a subscriber. As you can see, the vast majority are in sustained downtrends. However, if interest rate pressures subside and risk appetites increase, these twenty names could benefit through multiple expansion. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 6/28/22 – Stocks, Oil, and Yields All Higher

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“When the final result is expected to be a compromise, it is often prudent to start from an extreme position.” – John Maynard Keynes

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Just like yesterday, futures are higher this morning but off their highs from earlier this morning. Surprisingly, the rally has been accompanied by rising oil prices and higher treasury yields, but news that China has cut the required quarantine time for incoming travelers in half has investors optimistic that the country may further loosen its zero-COVID policy. Hopefully the outcome today is better than yesterday.

In economic news, Wholesale Inventories rose 2.0% which was below consensus forecasts but the level still remain elevated relative to history with May being the fourth straight month of 2% readings or higher.

In today’s Morning Lineup, we discuss the news coming out of the G7 meetings, overnight moves in Asian and European markets, and a look at polling numbers ahead of the mid-term elections.

Despite strength this morning, commodities have succumbed to profit-taking recently, and the majority of the ETFs tied to the sector have seen declines over the last week. Leading the way to the downside, Natural Gas (UNG) and the DB Agriculture Fund (DBA) have seen declines of over 5% in just the last week putting them into oversold levels. While the weakness in commodities has been a welcome development and sparked optimism that inflation pressures may finally be starting to roll over, the majority of these same ETFs are still up sharply YTD. UNG is up over 77% YTD even after the 6.6% decline in the last week, while the Commodity Total Return ETN (DJP) still sits on a gain of over 25%. In order for investors to really be confident that commodity price pressures have really turned the corner, we’ll need to see the weakness that has characterized the end of the quarter follow through into the second half.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 6/27/22

Bespoke’s Paul Hickey on Fox Business

Bespoke co-founder Paul Hickey appeared on Making Money with Charles Payne this afternoon to discuss Fed policy, investor sentiment, the mega-caps, and homebuilders. You can view the segment here or by clicking the image below. Learn more about Bespoke’s membership options if you’re new to the site!

Stocks on 7+ Month Losing Streaks

The US stock market has been weak and in a downtrend since late 2021, and there are some individual names that haven’t been able to post a positive month in quite some time. Of all S&P 1500 members, there are actually eight stocks with a market cap of at least $2 billion that are on a monthly losing streak of seven or more months. Six of these eight names are members of the Consumer Discretionary sector (the worst performing sector on a YTD basis), which is down 27.8% in 2022 (as of Friday’s close). The largest company on this list is Nike (NKE), which reports after the close today. The stock would need to gain about 7.5% through the end of the month to break its seven month losing streak. The average stock on this list would need to gain 6.7% through the close on 6/31 to break their respective streaks. Etsy (ETSY) is the closest to breaking its streak, needing to gain just 0.9%, while Under Armour (UAA) is the furthest, needing 13.7%. On a YTD basis, these stocks are down an average of 41.4% (median: -35.0%), meaning they would need to gain ~70% through year’s end to finish 2022 in the green.

Below is a quick look at one-year price charts for these eight stocks. (You can click here to create a custom portfolio of these names if you’re a Bespoke client.) Unsurprisingly, these stocks on 7+ month losing streaks are trading in pretty steep long-term downtrends, and they’ve got a lot of work to do to get back to where they were trading late last year. New uptrends can’t emerge until these long monthly losing streaks finally come to an end. Click here to learn more about Bespoke’s premium stock market research service.

Demand Destroyed in Dallas

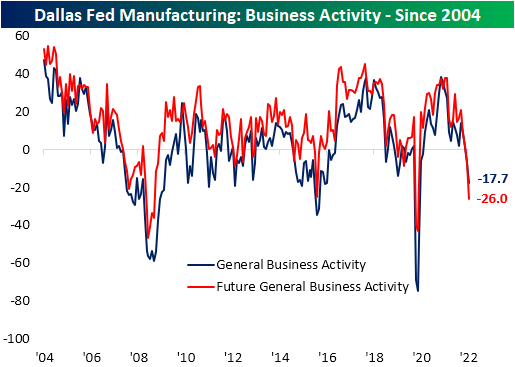

Economists were not anticipating a particularly strong Dallas Fed Manufacturing Activity reading as forecasts were calling for it to remain in contractionary territory at -6.5 (though that would have been an improvement versus last month’s -7.3 reading). Instead of the modest improvement that was expected, the index plummeted further hitting a new cycle low of -17.7. The region’s manufacturing economy experienced the largest decline in activity since the spring of 2020. Before that, 2016 was the last time this index was this low.

Looking across the categories of the report, there was little to like. Demand took a big hit with production slowing down in tow. Meanwhile, supply chains appeared to face increased stress contrary to other readings on that space over the past few months. Expectations painted a significantly soured outlook with several near record month-over-month declines as the indices reached low single digit percentile readings.

As mentioned above, Texas area manufacturers appeared to have reported a significant slowdown in demand as the index for New Orders dropped double digits and into the first contractionary reading since May 2020. Dropping hand in hand was the New Orders Growth Rate and Unfilled Orders. For the latter, the decline in expectations actually surpassed the spring of 2020 low and is now only one point above the December 2008 record low. Shipments was the only one of these indices to narrowly remain in expansion in June.

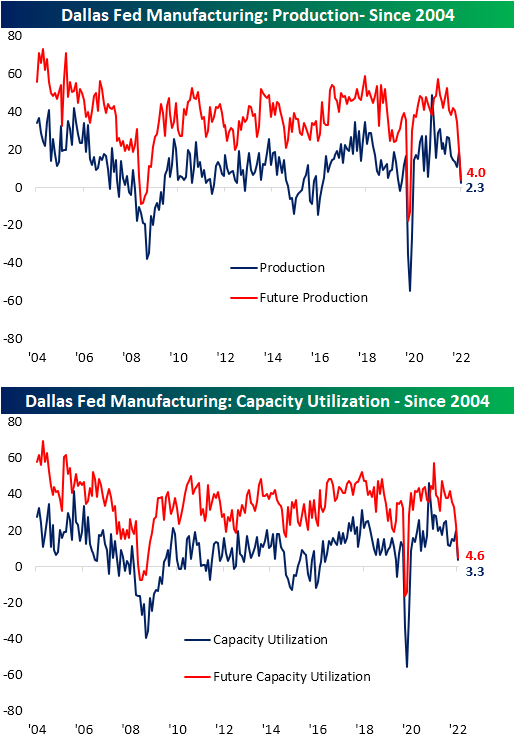

Manufacturers have quickly responded to that demand destruction by cutting back on production and capacity utilization. Expectations have seen even larger declines, although each of these indices, for the time being, remain at expansionary rather than contractionary levels.

High prices and long lead times have been thorns in the side of businesses throughout much of the pandemic, and for better or for worse, that trend appears to be turning around. Both Prices Paid and Received pulled back across expectations and current conditions in June. Both indices have now erased most of the moves higher since Q1 of last year.

Supply chain indices had a bit more puzzling and inconsistent of a print. After massive improvements last month that was echoed throughout several other data points external to this report, current conditions for Delivery Times returned right back up to where they were earlier this year. In fact, the 15.6 point month over month surge was the second largest on record behind the 21 point jump in March of last year. However, the expectations index lends some evidence that it may be a one-off increase. Expectations cratered with the largest one month decline on record. Not only was the move massive, but at -17.7, it is the lowest reading since March 2009. Inventories saw a similar move with current conditions indicating a large build in inventories as expectations called for a substantial decline further down the road. Given the weaker readings on New Order Expectations, that decline in Inventory Expectations is likely more of a function of expected improvements in supply chains.

Apart from the large declines across expectations indices, another indication of increased pessimism could also be found in the Outlook Uncertainty index. This is a more recent series included with the report dating back to only the start of 2018. As shown below, after spiking during the first half of 2020, it normalized up until last summer when it began to rise again, albeit more gradually. This month saw the index breakout in a big way as it experienced the second largest month-over-month increase on record behind March 2020. Click here to learn more about Bespoke’s premium stock market research service.