Bespoke Stock Scores — 10/11/22

Inflation and Labor Still A Problem

The NFIB released its latest small business survey this morning with data as of the month of September. As we discussed in today’s Morning Lineup, the report showed sentiment rebounded in September although labor market indicators decelerated further. That was also reflected in the report’s survey of what businesses consider to be their most important problem. While those reporting ‘cost of labor’ as the biggest problem went unchanged, the percentage of respondents reporting quality of labor as their biggest concern dropped four percentage points to 22%. While there was an even lower reading as recently as July, it was the biggest drop since last December, and the current level has fallen out of the top decile of historical readings.

While the lower reading in labor market-related problems seems to reaffirm the slowing employment situation, inflation concerns ramped up modestly in September. 30% of businesses (versus 29% in August) reported inflation as their biggest concern. Additionally, another inflation-adjacent reading also rose with 5% reporting the cost or availability of insurance to be their biggest problem.

On a combined basis, government-related concerns saw a net lower reading last month as well. Concerns around requirements and red tape rose up to a 5% share of responses, but those gains were offset by a two percentage point drop in the share of respondents seeing taxes as their biggest issue. With inflation and labor concerns remaining front and center of small business problems, government-related concerns continue to be muted to a historic degree.

While the bulk of responses view labor or inflation as their biggest issues—62% of combined responses report one of these to be their biggest problem—there was a considerable pickup in those choosing “other” as their response last month. That reading rose from 5% to 8% bringing it from a 14th percentile reading all the way up to the 65th percentile. That is now the highest reading since May when it came in at an elevated 11%. Unfortunately, the report does not provide further detail as to what those “other” concerns specifically are but geo-political issues are likely part of the mix. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Google Search Trends

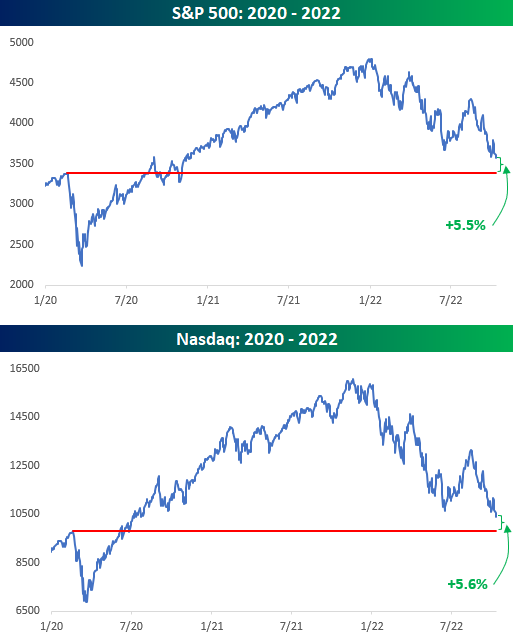

So Much for the Positive Wealth Effect

As the weakness in equities continues, we wanted to provide an update on where the major averages stand relative to their pre-COVID highs in February 2020. In the case of the S&P 500 and Nasdaq, they’re both still up, but the gains are quickly fading. It has now been just about two and a half years since the pre-COVID high for the S&P 500, and from that peak to this morning, the S&P 500 is up just 5.5% and the Nasdaq is up 5.6%. On an annualized basis, that works out to less than 2.5%. What’s that phrase people kept saying about irrational moves in stock prices?

As if equity market returns relative to the pre-COVID high weren’t pedestrian enough, keep in mind that once you take the impact of inflation into account, investors are actually now solidly in the red. The charts below show the performance of the S&P 500 and Nasdaq on an inflation-adjusted basis by adjusting historical prices based on headline CPI. After adjustments, the S&P 500 and Nasdaq are both down 7.7% from their February 2020 highs. As bad as the investing backdrop has been for equities, long-term US Treasuries have fared much worse than that. On a nominal basis, long-term US Treasuries have declined 28%, and after adjusting for inflation, the declines have been well over 30%. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 10/11/22 – The Roller Coaster Continues

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Sometimes the wheel turns slowly, but it turns.” – Lorne Michaels

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Equity futures were sharply lower this morning but have rebounded sharply in the last hour. There’s no specific catalyst to the move, but the BoE’s expansion of its bond-buying program has certainly helped. The monthly look at small business sentiment from the NFIB came in slightly higher than expected (92.1 vs 91.6) and increased slightly relative to August’s reading. There are no other economic data on the calendar today, but Cleveland Fed president Loretta Mester will be speaking at noon, and remember that in late September she made some rather hawkish comments suggesting that hell or high water wouldn’t deter the Fed from hiking rates to combat inflation.

Between value and growth stocks yesterday, we saw a modest divergence where the S&P 500 Growth ETF (IVW) traded at a new low while the Value ETF (IVE) did not. At face value, that divergence would sound like a negative for growth stocks. Looking at the price charts of each ETF, though, shows that while the growth ETF made a new low yesterday breaking through its September and summer lows, the value ETF had already broken below its summer lows in late September. So yes, value has outperformed over the last few days, but the technical picture for both is lousy.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 10/10/22

B.I.G. Tips – Tesla (TSLA) Loses Its Charge

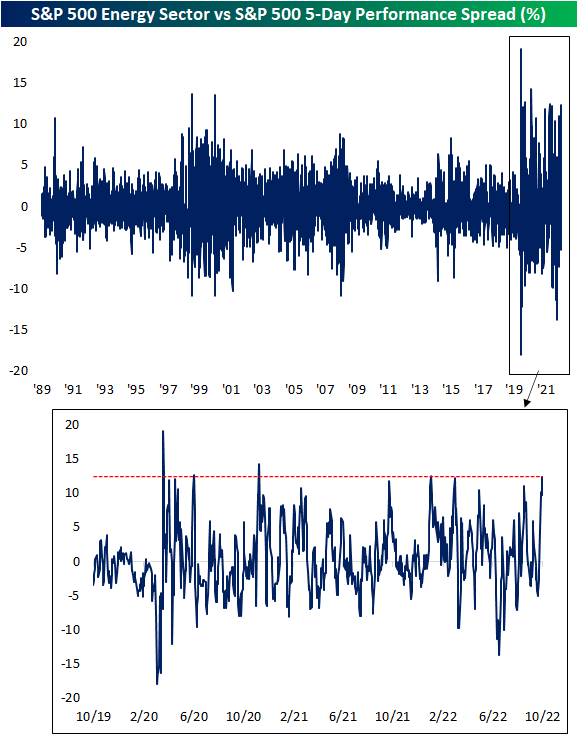

Energy Surges Without the S&P

Taking a glance across sector ETFs in our Trend Analyzer tool, performance last week through Friday’s close wasn’t fully lost as many sectors managed to hold onto their gains from earlier in the week while others like Real Estate (XLRE), Utilities (XLU), and Consumer Discretionary (XLY) finished more firmly in the red. As was the case earlier this year, the most standout sector has continued to be Energy (XLE). Although the sector has been pretty much trending sideways since the late spring and remains down double digit percentage points from its 52-week high, short term performance has been impressive. Last week the sector ETF rose 13.6% to move from one standard deviation below its 50-day to one standard deviation above. Meanwhile, every other sector remains oversold.

Compared to the S&P 500’s modest gains on the week, Energy’s outperformance has little precedence prior to the pandemic. Below we show the spread of the five day performance of the S&P 500 Energy sector and the S&P 500. Rounding out last week with a high of 12.4 percentage points, the spread hit the highest level since the first week of January. Prior to that, March, June, and November 2020 were the only other recent occurrences with as large of a spread. In our data going back to 1990, the only other time that Energy has outperformed the broader market by as much in a one week span was October 2000 and April 1999. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – It Doesn’t (At Least in the Past) Get Any Better Than This

Bespoke’s Morning Lineup – 10/10/22 – Treasury Market Closed

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“For the execution of the journey to the Indies I did not make use of intelligence, mathematics or maps.” – Christopher Columbus

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The bond market is closed today, so at least Treasury yields can’t go up. We wish we could say the same thing about yields across the Atlantic, though, where British gilt yields are all higher and getting back up near their closing highs from less than two weeks ago.

Equity markets are open for trading today, and after opening sharply lower last night, futures have rebounded to move close to the unchanged level. That’s the type of environment we’re in these days when just a modestly negative open to start the day is considered a win. With banks and the treasury market closed for trading, there is no economic data on the calendar today, so expect volumes to be on the light side.

How bad is sentiment out there? In looking through the various Bloomberg headlines this morning, the following three were all out one after the other:

- “Deutsche Bank Strategists See 12% Drop in US EPS Next Year”

- “MS Strategists See Bear Market Continuing Until Earnings Reset”

- “Goldman’s Kostin Sees Strong Dollar as Headwind for US Earnings”

Like the birds overhead, sentiment heading into earnings season has been moving south. Bulls can only hope that sentiment has moved south enough already.

Over the last several years, Columbus Day has seen some extreme market moves. The two best Columbus day performances for the S&P 500 were in 2008 (+11.58%) and 2011 (3.41%), and the one thing both of those years have in common is that they were lousy years for stocks heading into Columbus Day To the downside, the worst Columbus Day performance was in 2014 when the S&P 500 declined 1.65%, and no other year besides 2014 over the last 25 has seen a decline of more than 1%.

While the two best Columbus Days for the S&P 500 came in years when stocks were already down big YTD, there isn’t really much of an inverse correlation between YTD performance and Columbus Day returns. In the seven years over the last 25 when the S&P 500 was down YTD heading into the holiday, the median Columbus Day performance was a gain of 0.13% with positive returns four out of seven times (57%). In the 18 remaining years when stocks were up YTD heading into the holiday, the S&P 500’s median performance on Columbus Day was a gain of 0.05% with gains 10 out of 18 times (56%).

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.