Chart of the Day – First Hour Surges

Bespoke’s Morning Lineup – 10/17/22 – Maximum Indecision

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There is no more miserable human being than one in whom nothing is habitual but indecision.” – William James

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

A move by UK finance minister Jeremy Hunt to reverse most of the provisions of his predecessor’s ‘mini-budget’ have global equities and bond prices rallying this morning after Friday’s disappointing negative reversal. No major headlines out of China (good or bad) coming out of the country’s national party congress has also helped to contribute to the positive tone. So far, there hasn’t been much in the way of earnings flow, but earnings from Bank of America (BAC) were better than expected and the stock is trading up a bit more than the broader market. The only economic report of the day was Empire Manufacturing, and that report was weaker than expected coming in at -9.3 versus forecasts for a reading of -1.0. Given the massive swings of the last several days, what do you think an average investor’s confidence level is that the gains hold throughout the day?

For all the fireworks of the last two trading days, neither bulls nor bears really have much to show for it. On Wednesday, the S&P 500 closed at 3,577; by the week’s end, the S&P 500 was just six points higher at 3,583. In between those six points, though, there were some historic swings in equity prices. On Thursday, the S&P 500 gapped down over 2% but then quickly erased those losses before noon and kept rallying throughout the afternoon to finish up over 2.5%. On Friday, it looked as though bulls were going to get some follow-through as the S&P 500 rallied more than 1% in early trading. The positive momentum was fleeting, though, and within an hour of the highs, all the gains were erased, and by the end of the day, equities shed another 2.4% erasing nearly all of the prior day’s gains. In the span of two days, the S&P 500 had two extremely rare reversals in completely opposite directions.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 10/16/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Billionaire Whimsy

Elon Musk Has the World’s Strangest Social Calendar by Joseph Bernstein (NYT)

A categorization of the strange and fragmented social life enjoyed – or perhaps, not enjoyed – by the Tesla CEO, who hops from one fragmentary encounter to the next across a sea of private jet flights, galas, and VIP lounges. [Link; soft paywall]

‘I Am Energy’: Inside the Bang Billionaire’s Reeling Empire by Anders Melin (Bloomberg)

A heartrate-popping profile of an energy drink company taking on the giants of the industry fueled by the mashup of hype, energy, and shady dealings that scream “Florida” from top to bottom. [Link; soft paywall]

China

World Bank Cuts China Growth Forecast as Covid-19, Real-Estate Crunch Take Toll by Jason Douglas (WSJ)

The combination of collapsing property activity and restrictions on activity related to COVID-19 are suppressing Chinese growth that is also hampered by Fed tightening. [Link; paywall]

Ocean plastics: How much do rich countries contribute by shipping their waste overseas? by Hannah Ritchie (Our World In Data)

A ban on imports of plastic waste to China has helped push down global plastics trade volumes dramatically, helping to reduce the volume of plastic being transported by sea and therefore plastic waste that makes it in to oceans. [Link]

Labor Relations

Exxon’s Exodus: Employees Have Finally Had Enough of Its Toxic Culture by Kevin Crowley (Bloomberg)

A revealing narrative that illustrates how pressure on companies to decarbonize or behave more ethically often comes internally, rather than externally from investors following the precepts of ESG investing. [Link; soft paywall]

Medical Marvels

Human hibernation is a real possibility – this is how it might work by Alex Wilkins (NewScientist)

Our ancient ancestors may have hibernated, a common survival strategy among mammals. Dormant brain paths may be the key to recovering that ability which has since been lost. [Link; paywall]

How a Diabetes Drug Became the Talk of Hollywood, Tech and the Hamptons by Sara Ashley O’Brien (WSJ)

A drug meant to help manage Type 2 diabetes is being used off-label for weight loss; another drug that uses a similar active ingredient is approved for weight loss among those with clinical weight management challenges. [Link; paywall]

Policy

Biden Proposal Could Lead to Employee Status for Gig Workers by Noam Scheiber (NYT)

A proposed rulemaking by the Labor Department would create a test to determine whether gig workers are employees or contractors, opening up a potential requirement to pay benefits and minimum wages at scale. [Link; soft paywall]

It’s Official: The Fed’s in the Red by Tracy Alloway (Bloomberg)

Rising payouts of interest amidst a stable yield on portfolio securities mean the Federal Reserve is now recording operating losses on a weekly basis. [Link; soft paywall]

How California’s Bullet Train Went Off the Rails by Ralph Vartabedian (NYT)

Good old fashioned corruption turned a laudable effort at building a high speed rail link into a boondoggle of historic proportions. [Link; soft paywall]

Astrophysics

Black Hole Pukes Up Star Years After Eating It by Isaac Schultz (Gizmodo)

After gobbling down a star three years ago, a black hole spit back up material at half the speed of light. Scientists are trying to understand why. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Equity Risk Gauge

This week’s Bespoke Report newsletter is now available for members.

In this week’s newsletter, we highlight some absolutely crazy market stats from the last few trading days and then introduce a new “equity market risk gauge” that clients can use to quickly understand our overall market view using eight key components.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Daily Sector Snapshot — 10/14/22

B.I.G. Tips – Mixed Retail Sales Bag

Bespoke’s Morning Lineup – 10/14/22 – Let the Games Begin

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Just before you break through the sound barrier, the cockpit shakes the most.” – Chuck Yeager

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Let the games begin. Today marks the unofficial start to earnings season as the major banks come out of the gate with what have generally been positive results. Of the seven banks reporting, five exceeded EPS forecasts, one (Morgan Stanley) missed and one was inline (US Bancorp). Besides the Financials, UnitedHealth (UNH) also reported and topped forecasts on both the top and bottom lines. It’s still early, but so far, no major disasters. JPMorgan Chase (JPM) is even poised to trade higher in reaction to earnings which, if it holds, would be something it hasn’t done in over two years!

Outside of earnings, it’s a busy day for economic data this morning with Retail Sales (mixed relative to expectations), Import Prices (lower than expected), Business Inventories, and Michigan Sentiment all on the docket between now and 10 AM. If that wasn’t enough, we’ll also hear from three different Fed officials (George, Cook, and Waller). So much for a quiet Friday.

In international news, the German economic ministry said that a recession likely started in Q3 and will last for three quarters. The political situation in the UK continues to be a mess as PM Truss will reportedly reverse her tax plans and allow the corporate tax rate to increase while at the same time sacking her finance minister. That news has pushed the yield on the 10-year gilt down 23 bps and below 4%.

US Futures are still in positive territory, but they are well off their highs, and if the last several weeks have told us anything, it’s that where the market starts the day and where it finishes usually varies widely.

75 years ago today, Chuck Yeager accomplished the ‘impossible’ becoming the first pilot to ever break the sound barrier. Up until that time, the thought among ‘experts’ was that once an aircraft approached the speed of sound it would break apart resulting in the death of the pilot. Not really the way anyone wants to go out. Yeager proved the experts wrong, but in the moments leading up to that point, he remarked that the cockpit of the aircraft starts to shake violently.

Based on Yeager’s description, the market looks like it’s trying to break its own sound barrier. After trading up over 1% in pre-market trading yesterday, the stronger-than-expected CPI erased all the gains and more. Shortly after the open, the S&P 500 had dropped nearly 4% from its pre-market highs before staging an epic rally of over 5%. Even in this ‘all or nothing’ type of market environment, reversals of that magnitude are rare.

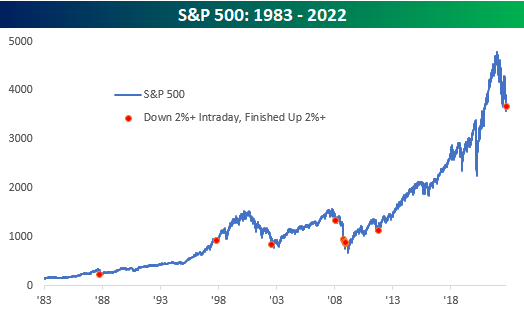

As shown below, prior to yesterday there were only nine other days since 1983 when the S&P 500 fell more than 2% intraday but finished the day up over 2%. The most recent occurrence was over eleven years ago on 10/4/11 and before that, there were five separate occurrences in 2008 alone! The three remaining reversals were in 2002, 1997, and 1987.

We’re not sure when or where the ultimate bottom in stocks will end up, but violent moves like yesterday tend to occur closer to lows than highs. It’s easy to remember the good parts of a bull market where stocks rally, but people usually forget that long-term rallies emerge out of chaos where investors become increasingly convinced that the only viable path if any exists at all, is lower. The early days of bull markets feel like anything but a sure thing.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Weekly Sector Snapshot — 10/13/22

The Bespoke 50 Growth Stocks — 10/13/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.