Fixed Income Weekly – 12/7/16

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we take some time to discuss the relationship between yuan spot and the forwards/options market.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

ETF Trends: Fixed Income, Currencies, and Commodities – 12/7/16

Italy continued to lead the pack among country ETFs while natural gas prices have soared into the winter months on slightly colder weather. Steel, metals and mining, and oil services also continue to rally while gold miners have actually made a small comeback of late. Losing out are health care stocks: biotech, pharma, and health care are all weaker. Joining them are MLPs, semiconductors, and China.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Stocks Trump Bonds

Like our free content? You’ll like Bespoke Premium even more! Click here to start a no-obligation 14-day free trial now.

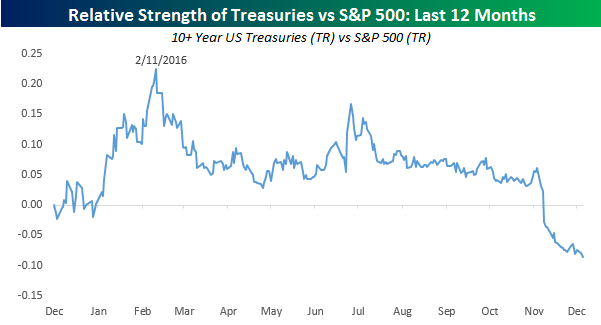

Ever since Donald Trump surprised markets and won the Presidential election a month ago, equities have been flying and bonds have plunged. You probably already knew that, but you may not have appreciated the magnitude of the divergence. In the four weeks that have passed since Election Day, the S&P 500 is up 3.6% on a total return basis, while US Treasuries with a duration of more than 10 years are down 7.5%. That’s a spread of over 11 percentage points. The last time we saw a performance spread that wide was earlier this year in February/March. Even more, a few days ago the performance spread between the two asset classes widened out above 13 percentage points, which is a gap we haven’t seen in more than five years.

Given the recent underperformance of Treasuries, what started out as a great year for Treasury holders has turned into a bear of a year. The chart below shows the relative strength of long-term (10+ years) US Treasuries versus the S&P 500 over the last twelve months. When the line is rising, it indicates that Treasuries are outperforming, while a falling line indicates underperformance. When the relative strength of Treasuries peaked on 2/11, the group was up 9.8% YTD compared to a decline of over 10% for the S&P 500 for a gap of nearly 20 percentage points. Those days of outperformance are long gone, though, and since then long-term US Treasuries have declined 8.1% while the S&P 500 has surged 23.1%!

Dynamic Upgrades/Downgrades: 12/7/16

Bespokecast — Episode 3 — Katie Stockton

In our newest conversation on Bespokecast, we speak with BTIG’s Chief Technical Strategist Katie Stockton. Katie is one of the top technicians around, and this is a wide-ranging discussion on technicals as an investment strategy that is both educational and instructive. Katie has a long career in markets and has been immersed in the discipline of technical analysis right from the beginning. In our hour-long conversation, we get her basic approach to technicals, background about the goals and toolkits that technicians use, and her current view of market technicals. We also discuss non-market topics, including the work-life balance for finance professionals with families. We had a fantastic time recording this conversation, and we hope you enjoy it!

In our newest conversation on Bespokecast, we speak with BTIG’s Chief Technical Strategist Katie Stockton. Katie is one of the top technicians around, and this is a wide-ranging discussion on technicals as an investment strategy that is both educational and instructive. Katie has a long career in markets and has been immersed in the discipline of technical analysis right from the beginning. In our hour-long conversation, we get her basic approach to technicals, background about the goals and toolkits that technicians use, and her current view of market technicals. We also discuss non-market topics, including the work-life balance for finance professionals with families. We had a fantastic time recording this conversation, and we hope you enjoy it!

To access this week’s podcast immediately, start a 14-day free trial to Bespoke’s research product. If you’ve already used your Bespoke free trial, you can gain access by choosing a membership option at our products page.

The Closer 12/6/16 – So Close To A Petroleum Trade Surplus, And Yet So Far

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we chart out the trade balance, update recent GDP tracking from the NY Fed and Atlanta Fed, and chart productivity figures updated for Q3 today by the BLS.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

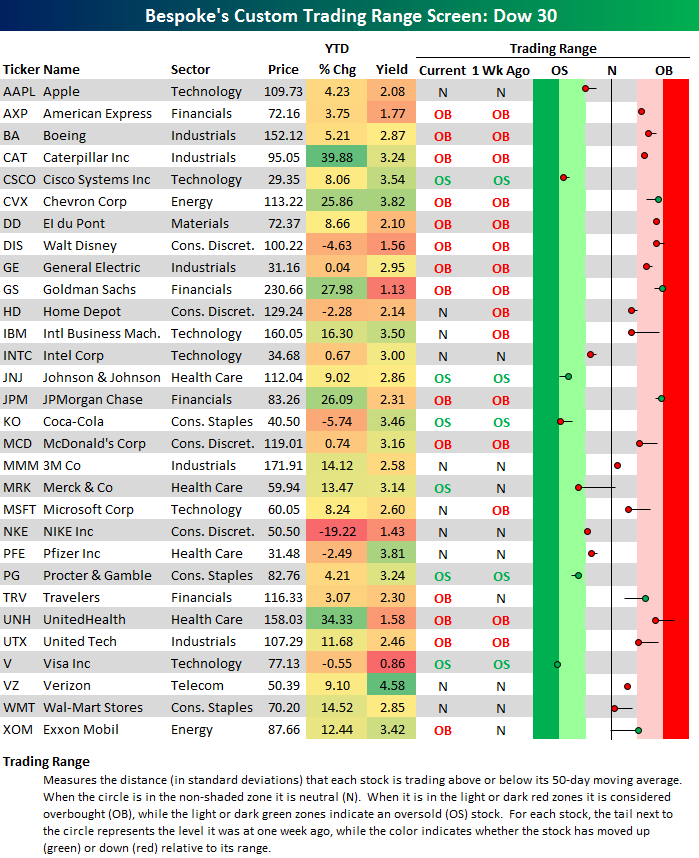

Dow 30 Trading Range Screen

Below is an updated look at our trading range screen for the 30 stocks in the Dow Jones Industrial Average. This screen allows you to quickly see where a large number of stocks are currently trading within their normal ranges. The dot represents where the stock is currently trading, while the tail end represents where it was trading one week ago. The black vertical “N” line represents each stock’s 50-day moving average, and moves into the red or green zone are considered overbought or oversold.

At the moment, 14 of the 30 Dow stocks are in overbought territory, with stocks like Chevron (CVX), Goldman Sachs (GS), and JP Morgan (JPM) trading at the most overbought levels. It should be noted, though, that no stocks are trading well into extreme overbought territory any longer, whereas a week or two ago, a boatload of names were at extremes. Most stocks in the index have moved slightly lower within their ranges over the last week. IBM, Merck (MRK), McDonald’s (MCD), and Microsoft (MSFT) are some of the names that have seen the biggest moves lower.

There are currently just six stocks in oversold territory — Cisco (CSCO), Johnson & Johnson (JNJ), Coca-Cola (KO), Merck (MRK), Procter & Gamble (PG), and Visa (V). Of these names, Visa is the most oversold.

For each stock, we also include its current dividend yield and year-to-date percentage change. This provides some additional context for the 30 index members. As shown, Caterpillar (CAT) is currently up the most year-to-date with a gain of just under 40%. UnitedHealth (UNH) ranks second at +34%, followed by Goldman Sachs (GS), JP Morgan (JPM), and Chevron (CVX). Only six stocks in the index are down year-to-date, and Nike (NKE) is down by far the most at -19%. Coca-Cola (KO) is down the second most at -5.74%, while Disney (DIS) ranks third worst at -4.63%.

Bespoke Premium and Bespoke Institutional members see a number of our trading range screens on a regular basis. Become a member today!

ETF Trends: International – 12/6/16

Energy-related ETFs continue to surge, with Oil-services related ETFs up over 15%. Underperformance continues to pile up for bonds and bond proxies like Utilities. Gold, China, Biotech, and momentum stocks are the biggest losers over the past two weeks. Low vol, consumer staples, and semis have also underperformed enormously.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Chart of the Day – ISM Commodities Survey Remains Subdued

Consumer Pulse: Perception of Personal Finances Ticks Down

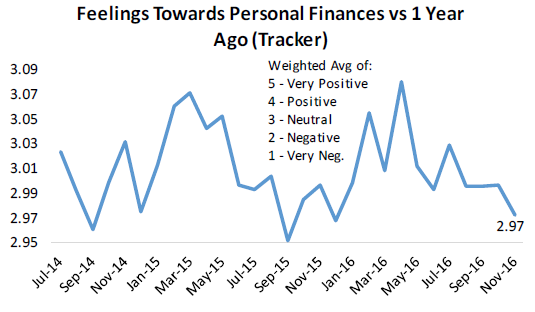

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years now, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now! Below we highlight the results of a question we ask regarding feelings towards personal finances compared to a year ago. This is one of literally hundreds of data points included in each monthly report.

Each month we ask our survey participants to rate their feelings towards their personal finances versus one year ago. As shown, after hitting a two-year high earlier this year, this reading has actually been trending lower. There was definitely a lot of uncertainty for consumers heading into the election, but our November survey ran right after the election, and it still ticked lower. So while a lot of economic data points that have come out over the last few weeks have shown a big boost in consumer and investor sentiment, this specific reading on personal finances is a bit of an outlier. We’ll certainly be interested to see how this reading looks in our December survey due out in a couple of weeks.