Euro Stocks Break Out: Will Euro Currency Break Down?

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

Strong equity markets haven’t just been confined to the US in the last several weeks. In fact, Russian equities (cue conspiracy theories) have put up more than twice the gain of US equities since the election with the Micex up over 10%, and the US ETF of Russian stocks (RSX) up over 14%. Last week, European equities entered the fray as the STOXX 600 broke out above resistance around the 350 level to its highest level since the opening days of 2016. The chart for the STOXX 600 is looking quite constructive these days as the index looks to be breaking out of a multi-month consolidation range after breaking its downtrend back in August.

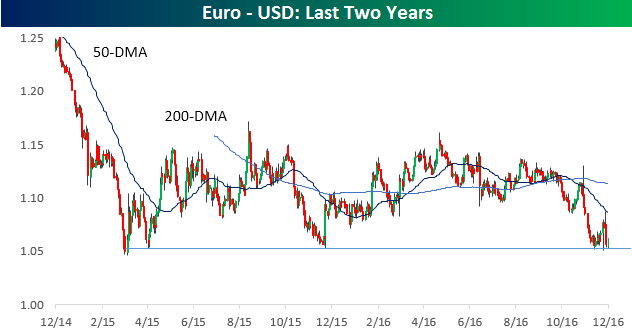

Although European stocks have been rallying, it has been on the back of a weaker currency. Therefore, if you are a US investor holding European stocks, the gains in prices have been offset by a weaker currency. Two years ago, the Euro was at 1.25 versus the dollar. Since then, it has declined over 15% to around 1.05 versus the dollar. This morning, the currency has seen a bit of a bounce at the 1.05 support level, but just like resistance weakens the more often it is tested to the upside, support also tends to lose strength the more often it is tested to the downside.

Bespoke Brunch Reads: 12/11/16

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Investing

Is the Yale Model Broken? by Alexandra DeLuca (AI-CIO)

A sure-fire method of outperforming used to involve some exposure to stocks and bonds but much heavier bets on illiquid private investment. While still working for some allocators, cheap beta and a dearth of alpha are turning many away from that angle. [Link]

Hedge Funds Get Big or Go Home by Lisa Abramowicz (Bloomberg)

A basic summary of the hedge fund industry landscape, with large firms attracting more flow of investment capital and charging less. [Link]

A Better Theory to Explain Financial Bubbles by Noah Smith (Bloomberg)

An overview of the “extrapolative expectations” theory of asset pricing, one that breaks the traditional assumption of modern economics (rational expectations). [Link]

Ratings

S&P Just Demolished One Big Distinction Between Emerging and Developed Markets by Sid Verma (Bloomberg)

The stability of developed market politics has always been a reasonable argument for higher ratings on bonds issued by those governments. But now, S&P sees little distinction from the chaotic evolution of politics in rich countries versus those in faster-growing, lower-income nations. [Link]

AAA Grades Return for Securities Backed by Riskier Mortgages by Matt Scully (Bloomberg)

In a significant post-crisis landmark, bonds linked to newly-issued mortgages without a government guarantee are being given a AAA rating. However, borrowers are hardly the subprime customers whose loans were stuffed in MBS in the mid-2000s; the average FICO for this deal is 712. [Link]

Foreign Affairs

What’s Bundespraesidentenstichwahlwiederholungsverschiebung? (BI/AP)

Austria’s word of the year, struck in famously compounding and confounding German, is “postponement of the repeat of the runoff of the presidential election”. [Link]

Hayao Miyazaki blasts animators on NHK over AI-generated ‘zombie’ clip by Roland Schichijo (Tokyo Reporter)

In a remarkably candid response to an animator’s experiment, famed Japanese animator Miyazaki (Spirited Away, Howl’s Moving Castle, Princess Mononoke) was incensed by the creation of a hypothetical creature that could feel no pain and thus walked using its head as a limb. [Link]

Decay

Has Appalachia Lost Fewer People Than East Germany? by Lyman Stone (Medium)

We’ll admit that we know not everyone likes reading enormous, data-driven demographic discussions about population, economic outcomes, and regional destinies. We do from time-to-time and if you do too you’ll enjoy this. [Link]

U.S. life expectancy declines for the first time since 1993 by Lenny Bernstein (WaPo)

The CDC announced this week that death rates spiked for a number of demographics and causes across the country, sending the overall life expectancy for the US population down (marginally) for the first time in nearly a generation. [Link; paywall]

Property Taxes

Rationale for Texas’ Largest Corporate Welfare Program was a ‘Typographical Error’ by Patrick Michels (Texas Observer)

Back in the early 2000s, Texas decided to charge companies a lot less in property taxes, and the decision to do so was likely made because of a typographical error in a little-read business journal. [Link]

How Big-Box Retailers Weaponize Old Stores by Shannon Pettypiece (Bloomberg)

Assessing going concerns at the market value of shuttered stores elsewhere in a state is causing havoc on the finances of small towns and counties across America. [Link; auto-playing video]

Politics

Trump Team Broadly Backs Efforts to Rein In Fed, Hensarling Says by Rich Miller (Bloomberg)

Congressional Republicans are fired up about the idea of restricting monetary policy to a rule of the Fed’s own choosing. The specific tack a Trump administration takes towards the Fed is still an open question, though. [Link]

Google Looks for ‘Conservative Outreach’ Manager After Trump Election Win by Mark Bergen (Bloomberg)

Google is hiring a lobbyist (the role of its “Public Policy” team) in DC. Given the size and scale of the company’s operations, that’s probably not a horrible idea…though there’s no word on the impact on efforts to drain any swamps. [Link]

Strange News

On the Internet, to Be ‘Mom’ Is to Be Queen by Jessica Bennett (NYT)

Who knew that parents were cool? For many in the burgeoning post-Millennial generation, mothers are especially viewed as a symbol of cache. [Link; soft paywall]

Sofía Vergara sued by her own embryos by Emily Smith (NYP Page Six)

A former fiancé is suing the “Modern Family” star on behalf of two fertilized embryos. We’re still having a hard time keeping the ins and outs of this one straight. [Link]

Sterling Flash Crash

Citi trader deepened October’s pound ‘flash crash’ by Katie Martin and Caroline Binham (FT)

While not causing the sudden drop in GBP a couple months ago, Citi’s desk definitely made volatility in the seconds that sterling spent at multi-decade lows worse. [Link]

Pounded By The Pound: Sports Direct’s Hedges and the Cable Flash Crash by Josh Giersch (Josh Reviews Everything)

A former FX options traders’ analysis of one corporate hedge that went decidedly sour thanks to the huge sterling plunge described above. [Link]

Trade

The (No Longer) Almighty Soybean by Brad Setser (Council on Foreign Relations)

Starting with soy but moving on elsewhere in the US goods trade universe, Setser makes a compelling case that the US trade deficit is getting ready to widen quite dramatically in coming months and quarters. [Link]

The Bespoke Report — Santa Trump

Before getting to our weekly Bespoke Report and our asset class performance matrix, we want to tell you about our upcoming 2017 Outlook Report. This is our most popular report each year, and it’s a must-read for any serious investor. If you’re not yet a Bespoke subscriber, you can get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

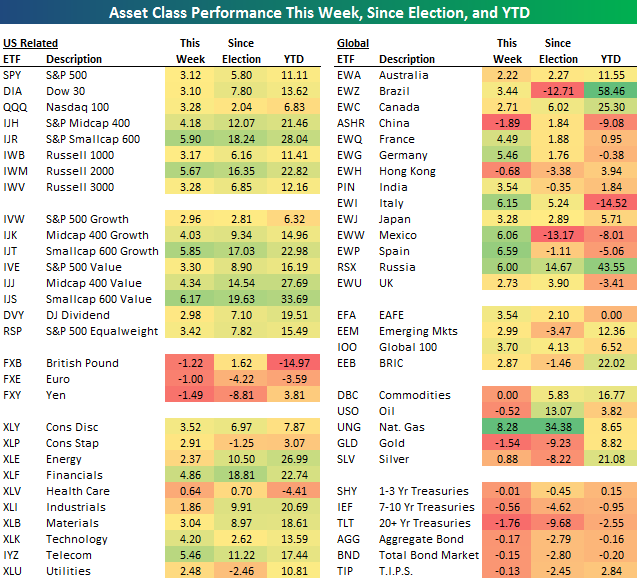

Below is a look at the recent performance of various asset classes using our key ETF matrix. This matrix is highlighted on page 1 of this week’s Bespoke Report newsletter, which was just sent to Bespoke Premium subscribers. As shown in the matrix, US equities continue to surge since the November 8th election, and Financials are leading the way. At the same time, Treasuries continue to drop precipitously.

If you’d like to see the rest of this week’s Bespoke Report newsletter, take advantage of our one-month Bespoke Premium free trial offer that includes our 2017 Outlook Report. Sign up now at this page.

Have a great weekend!

Quick View Chart Book – 12/9/16

Every weekend, Bespoke Premium and Bespoke Institutional clients are emailed our S&P 500 Quick View Chart Book which contains one year price charts of every stock in the S&P 500. If you like following chart patterns, there simply isn’t a faster way to peruse all 500 components of the S&P 500. Looking at this week’s Chart Book, we couldn’t help but notice that the price charts for practically all the stocks in the S&P 500 Utilities sector look nearly the exact same; they ran up through July and has been trending lower ever since. Since the election, the pace of declines has only picked up steam. Take a look for yourself, by clicking the image below, which will take you to the section of our Chart Book containing the Utilities sector (open to everyone). Practically every single chart looks the same!

As mentioned above, there simply isn’t a faster way to scan the chart patterns for all 500 stocks in the S&P 500 than our weekly Quick View Chart Book. To get weekly access to this report, sign up for a monthly Bespoke Premium membership and get 10% off for life ($89/month).

The Closer 12/9/16 – End of Week Charts

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

Consumer Pulse: Views of Stock Market

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

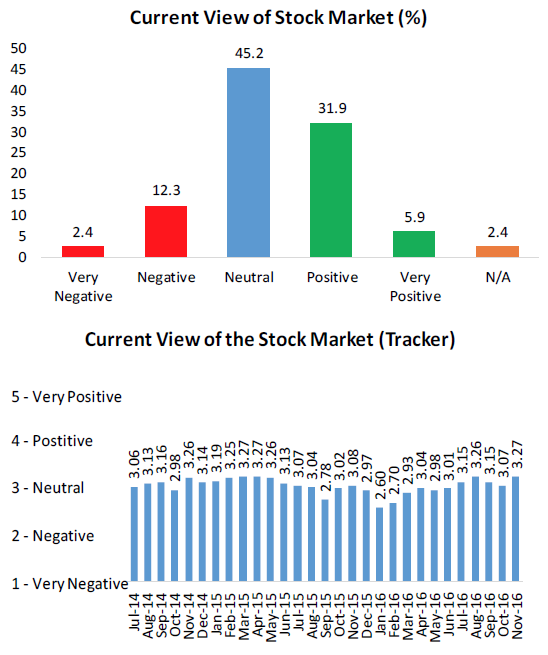

Below we highlight the results of questions we ask regarding current views of the stock market, which is just one of literally hundreds of data points included in each monthly report. The first chart shows this month’s reading with each response broken out for the subset of respondents who report themselves as investors and their view of the stock market. While roughly 45% of respondents have a neutral view of the market, about 38% have a positive view and only about 15% have a negative view. It is worth noting the breakdown of these responses because although this month’s reading is the strongest we’ve seen in our survey’s history, it is still only slightly above neutral.

The second chart shows our highest ever unrounded tracker reading (3.274) with only two readings from spring of 2015 matching this number on a rounded basis. Previously, those high ratings for stock market optimism occurred right near an intermediate term peak in the market that stood for over a year. Based on our survey’s history and the recent price action since the US elections, we think it’s fair to describe this enthusiasm for equities as a contrarian signal that things might be getting carried away. Whether it’s the election of a Republican, simply price action, positioning or seasonality, the current run higher in equities seems slightly excessive and the enthusiasm shown by our respondents seems to confirm that suspicion. However, again it is worth taking into account that although this is the strongest reading we have seen to date, it still comes in only slightly above 3, which is a neutral rating.

ETF Trends: Hedge – 12/9/16

Small caps continue surging with EES, IJS, IWN, IWM, IJT, IWC, IWO, and DES all ripping higher over the past week. If you’ve been long small-cap stocks, it’s been almost impossible to be wrong.The dollar has been strong over the last few days, and the biggest declines of the ETFs we track have been in yen, sterling, gold, and euro. Bonds continue to underperform as well.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Big Test for EEM

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

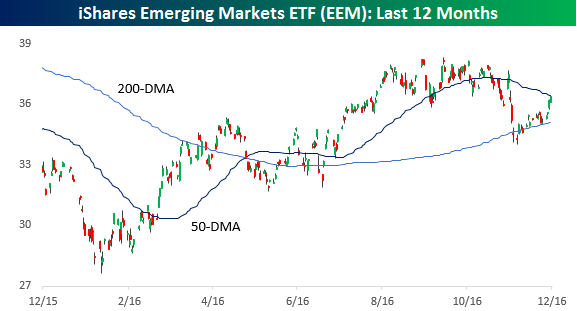

While students at most colleges and universities are busy prepping for upcoming finals, the ETF that tracks emerging markets is getting ready for its own big test of a key moving average. In the immediate aftermath of the election, emerging market equities were one of the biggest losers, swiftly falling over 9%. However, after more or less holding support at the 200-DMA the iShares Emerging Markets ETF (EEM) has rallied back close to 7%. At yesterday’s close, though, the ETF finished the day right below its downward sloping 50-day moving average. Whether or not it can pass this test will be a key driver of sentiment for the sector in the coming weeks. There are countless examples in the annals of chart history where stocks or indices have shown this pattern only to stall out right about here and go on to make lower lows. Therefore, if EEM can take out its 50-DMA, it will set the stage for a strong close to the year.

One fact that could be working in the sector’s favor is a recent report from Standard and Poor’s, which stated that:

“We believe it may no longer be possible to separate advanced economies from emerging markets by describing their political systems as displaying superior levels of stability, effectiveness, and predictability of policy making and political institutions”

The above was the same line of reasoning we believed justified higher valuations for US assets in the aftermath of the Brexit vote and is a view we continue to hold following political instability in Europe. Additionally, while the comments from S&P seem to suggest that advanced economies should no longer warrant higher valuations relative to emerging markets, that narrowing would likely come as a result of valuations meeting somewhere in the middle (higher valuations in emerging markets and/or lower valuations in advanced economies).

The “Goldman Sachs” Industrial Average

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

US stocks have had quite a rally in the last month, but in the large cap space the clear leader has been the Dow Jones Industrial Average (DJIA). While much of the strength in the DJIA has been chalked up to the index being full of old-line industrial stocks that stand to benefit from a Trump victory, practically all of the outperformance can be summed up in two words – Goldman Sachs (GS).

Because the DJIA is price weighted, stocks in the index with the highest share prices have the highest weighting, while stocks with the lowest share prices have the lowest weighting. Yes, this is a ridiculous method of weighting an index, but the DJIA has withstood the test of time, so who are we to argue. Plus, it’s not like we haven’t seen other methods of weighting over the years that weren’t just as peculiar.

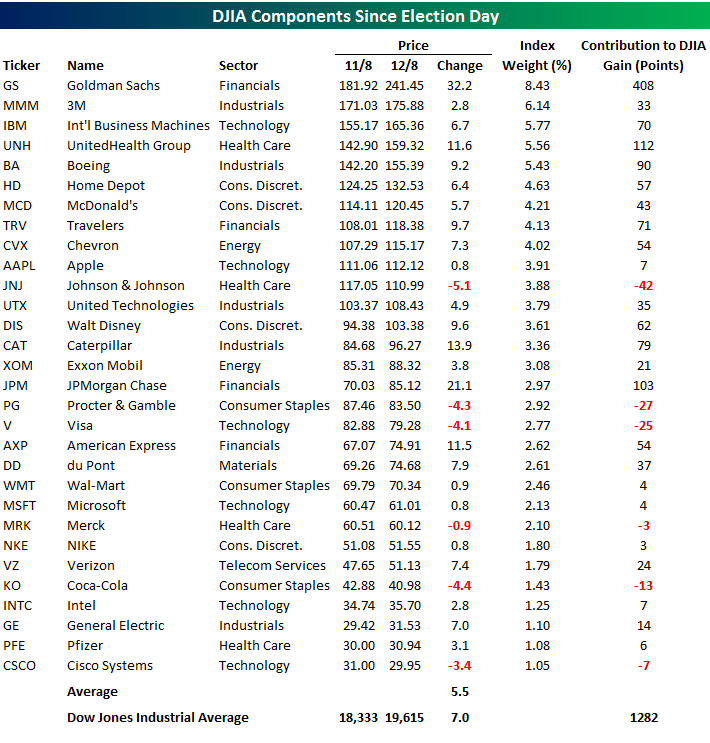

The table below lists each of the DJIA’s current components sorted by their current weighting in the index along with their performance since Election Day and how many points each stock has contributed to the DJIA’s overall gain since Election Day. At the top of the list is GS, which has an 8.4% weighting in the index. Not only is Goldman the most heavily weighted stock in the Dow, but it is also far and away the best performing stock in the index since Election Day. In fact, of the 1,282 points that the DJIA has added in the last month, Goldman accounts for 408 of those points, or 32% of the gain. The next biggest contributor since election day — UnitedHealth (UNH) — has only added 112 Dow points. Without Goldman, instead of being up 7% since Election Day, the DJIA would be up less than 5%.

Looking at the current weightings of the index, the DJIA is looking increasingly top heavy. Not only does Goldman by itself account for over 8% of the index, but the top five stocks in the index account for a staggering 31% of the index. At the other end of the spectrum, major US stocks which are among the largest in terms of market cap have weightings of less than 2%. Take General Electric (GE), for example. While it is one of the ten largest US companies in market value, its weighting in the Dow is barely 1%. Put another way, the stock could go to zero and it would have less of an impact on the Dow than a 15% drop in Goldman.

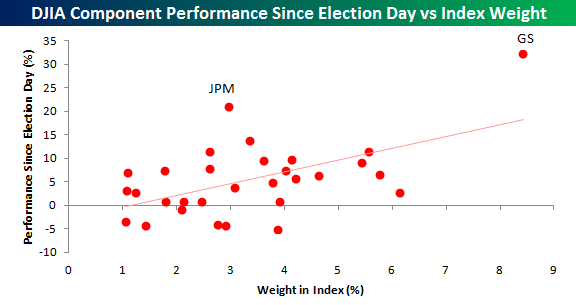

Like Goldman, which is both the most heavily weighted stock in the DJIA and the top performer, a little bit of a trend has developed where the higher priced stocks in the index have been among the index’s best performers while the lower priced stocks have underperformed. Of the six stocks in the index that have traded lower since the Election, five are in the bottom half of the index in terms of share price (and therefore weighting). So what are the ramifications of all this? While there’s a good chance that there’s nothing to worry about regarding the index’s top heavy-ness, it has created a situation where a lot of the DJIA’s ‘eggs’ are in a limited number of baskets. The only way to alleviate this situation would be through a combination massive underperformance of the index’s high priced stocks along with major outperformance of the index’s low priced stocks, or through stock splits. In the case of those top five stocks which currently account for at least 5% of the index by themselves and nearly a third of the entire DJIA combined, if each of them issued a 2-1 split, their combined weighting would fall to 18.6%. Furthermore, none of the five would have a weighting in the index above 5%, while the most heavily weighted stock in the index would be Home Depot (HD) at 5.5%.

The Closer 12/8/16 – The Alphabet: E, C, B to Z

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, review the ECB policy changes made today as well as the release of the Fed’s Flow of Funds (Z.1) report showing the balance sheet of US macroeconomic sectors.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!