December Fed Days — Volatile and Relatively Bullish

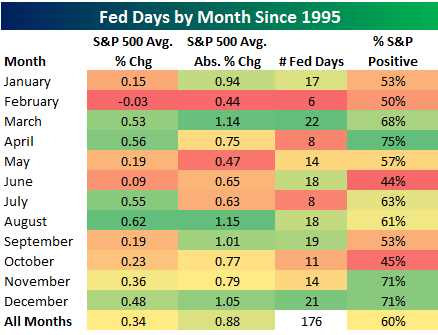

Yesterday we published a B.I.G. Tips report looking at Fed rate hikes after long pauses that actually throws a splash of cold water on the thesis that equity prices are set to surge even further. If you’re not yet a member, you can sign up for one month of Bespoke Premium at this page to see the report ahead of today’s FOMC announcement. It’s an actionable piece of analysis. With today being a Fed Day, below is a breakdown of the S&P 500’s performance on Fed Days by month since 1995. As shown, the S&P 500 has historically averaged a gain of 0.34% on all Fed Days, but the index has done even better on the 22 December Fed Days we’ve seen over the last 20+ years. The S&P has averaged a gain of 0.48% on December Fed Days with positive returns 71% of the time.

December Fed Days have historically been slightly more volatile than normal as well. The average absolute change for the S&P on all Fed Days since 1995 has been +/-0.88%, but December Fed Days have seen an average absolute change of +/-1.05%.

Looking at the table, you’ll see that February has historically been the only month where the S&P has averaged a decline on Fed Days, but there have only been six February Fed Days since 1995. August Fed Days have been the most bullish, with the S&P averaging a one-day gain of 0.62%.

Once again, if you’re not yet a member, sign up for one month of our Bespoke Premium service to have a look at our more in-depth FOMC analysis.

ETF Trends: Fixed Income, Currencies, and Commodities – 12/14/16

Steel and metals are both found among the worst performers over the past five days, along with bonds, Chinese equities, solar stocks, and gold miners. Oil, Russia, Utilities, and pharma are all performing quite well recently. In other words, recent price action has reversed a number of major post-election trends.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Normal Holiday Dip for Home Improvement Retailers like Home Depot (HD) and Lowe’s (LOW)

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

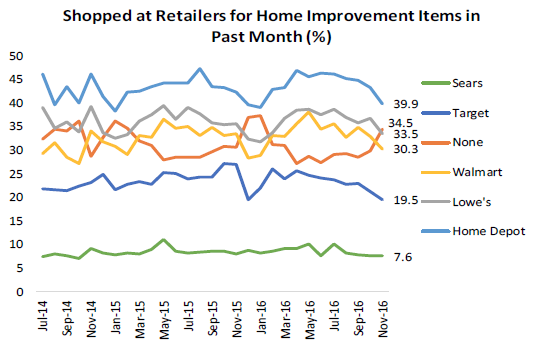

Below we highlight the results of a question we ask regarding shopping at retailers for home improvement items, which is just one of literally hundreds of data points included in each monthly report. Unlike much of our online retailers data, brick and mortar retailers (specifically those selling home improvement items) have recently seen stiffer competition with a tighter distribution among the top three retailers (Home Depot, Lowe’s and Wal-Mart). However, there still seems to be a hierarchy among which are the most and least popular. Home Depot (HD) consistently stands above the rest followed by Lowe’s (LOW) and Wal-mart (WMT), while laggerds in this space include Target (TGT) and Sears (SHLD). It is also worth noting that for the most part these retailers typically move in the same direction from month to month. In this most recent survey, we saw decreases in shopping for home improvement items across the board as the busy holiday season forces home-owners to spend elsewhere and hold off or pause their home improvement projects.

Our full November Pulse report has additional research on sales and activity, including data on groups like consumer electronics (AAPL, MSFT, etc.), social media (FB, TWTR, LNKD), streaming media (NFLX, AMZN), and much more. If you’re not yet a Pulse member and want to see the full report, click here to start a 30-day free trial now!

B.I.G. Tips – Retail Sales Get a Reality Check

Dynamic Upgrades/Downgrades: 12/14/16

Dow Now Overbought 24 Trading Days and Counting

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

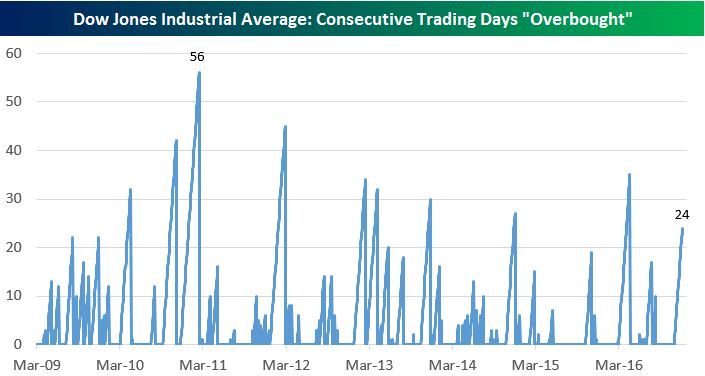

The Dow Jones Industrial Average has now closed in “overbought” territory (more than one standard deviation above its 50-day moving average) for 24 consecutive trading days, which is also the number of trading days we have seen since Election Day. Below is a chart showing consecutive “overbought” closes for the Dow since the current bull market began back on March 9th, 2009. As shown, while 24 consecutive “overbought” days is one of the longer streaks we’ve seen over the last 8 years, there have actually been 9 streaks that have gone on longer.

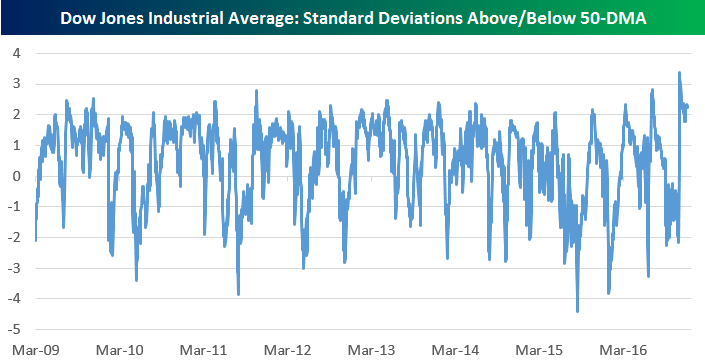

While the Dow’s current streak of consecutive “overbought” days is only the 10th longest streak of the bull market at the moment, it’s likely going to last quite a bit longer because of just how extended the index still is. Below is a chart showing the number of standard deviations that the Dow has traded above or below its 50-DMA on a daily basis since March 2009. As shown, the post-election surge recently took the index to its most overbought level of the entire bull market when it crossed above three standard deviations. Even through yesterday, the Dow was still more than 2.25 standard deviations above its 50-DMA, so it’s now going to take either a significant drop or a multi-week period of sideways trading for the index to move from “overbought” back to “neutral.” One way or the other, though, this streak will end.

The Closer 12/13/16 – Import Prices, Small Cap Surge

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review recent changes in import prices, flows in to small cap ETFs, and the relative bullishness of options markets on small caps versus large caps.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

S&P 50-Day Moving Average Spread Approaches +5%

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

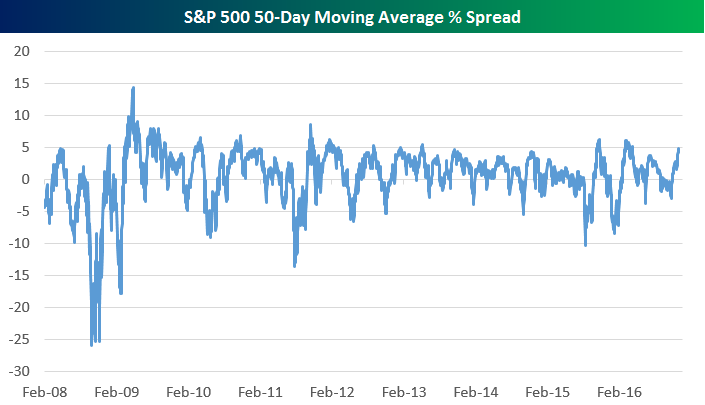

We know it’s easy to get caught up in “rally mode,” but always remember that prices do go down from time to time. Earlier today we published two B.I.G. Tips reports looking at year one of the Presidential Election Cycle and Fed rate hikes after long pauses that actually throw a splash of cold water on the thesis that equity prices are set to surge even further. If you’re not yet a member, you can sign up for one month of Bespoke Premium at this page to see the two reports. We think it’s worth pointing out that the S&P 500 is currently 4.8% above its 50-day moving average. Below is a chart of this S&P 500 “50-day moving average spread” reading going back to early 2008. While 5% is not the be-all, end-all that marks a top, as you can see, it is a level that has typically marked a near-term peak in this reading over the last five years. Just something to keep in mind as we approach the new year.

Forget 20,000, What About S&P $20 Trillion?

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

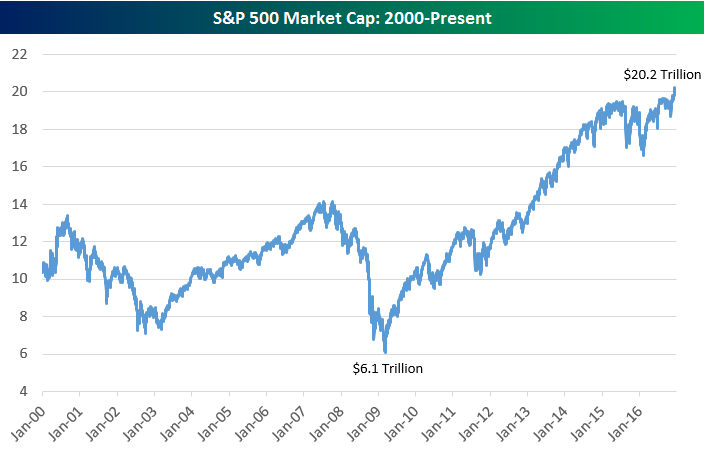

Dow 20,000 is currently the “talk of the Street” with the index trading less than 100 points from this psychological milestone that has never been reached. But a much less widely followed milestone that also has a “20-handle” has come into play during the “Trump Rally” as well. What is it?

Last Wednesday, the combined market cap of the S&P 500’s members crossed $20 trillion for the first time ever. Below is a chart showing the S&P 500’s market cap going back to the turn of the millennium. After touching a low of $6.1 trillion at the lows of the Financial Crisis in early 2009, the S&P’s market cap has risen by more than $14 trillion to its current level of $20.2 trillion. Beat that Dow 20,000.

Dow Jones Thousand Point Thresholds

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

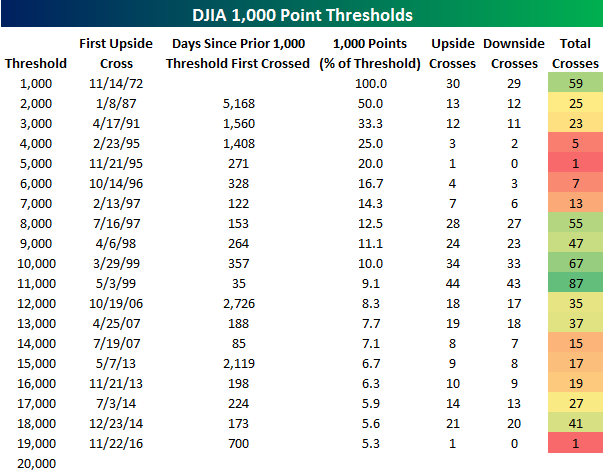

With the Dow Jones Industrial Average (Dow) getting ever so close to 20,000 after only first crossing 19,000 to the upside 21 days ago, we wanted to provide a look at prior 1,000 point thresholds in the DJIA and how many times the index has crossed above (and below) each one of them. The table below lists each 1,000 point threshold for the DJIA from 1,000 to 20,000. For each level we have included the date the DJIA first crossed each 1,000-point threshold to the upside, the number of days that elapsed between the first cross of that 1,000-point threshold and the prior one, what percentage 1,000 points represents of each threshold, and then finally how many upside, downside, and total crosses each threshold has seen.

Looking at the table, a couple of trends are worth highlighting. The first is that with each 1,000-point threshold the DJIA crosses, the percentage that 1,000 points represents declines. For example, when people were focused on Dow 10,000 in 1999, 1,000 points represented 10% of the index. At 20,000, though, 1,000 points only represents 5%. That’s just basic math but is important to remember. A second notable aspect of the table worth pointing out is that even though equities remain in one of their longest bull markets on record, the road from 18,000 to 19,000 was a relatively long one. Even though it represented a gain of just over 5%, it took the DJIA nearly two years to get to 19,000 after first crossing 18,000. Of the 18 other 1,000 point thresholds shown, the time that elapsed between 18K and 19K was the sixth longest. In other instances, long gaps between thousand point thresholds were due to either a bear market or the fact that 1,000 points represented a large percentage of the index. From 18K to 19K, though, neither of those factors played a role. Instead, the market just did nothing for over a year.

After taking 700 days to get from 18K to 19K, the DJIA is moving a lot quicker in trying to get to 20K, and if it gets to 20K between now and Christmas, it will be the shortest amount of time between 1,000 point thresholds in the index’s history. 19K is also one of only two 1,000-point thresholds the DJIA has never closed below after first crossing it to the upside. Obviously, it has only been three weeks, so that could change, but at this point, 19K and 5K are the only two 1,000-point thresholds that have never experienced a downside cross.