B.I.G. Tips – Sentiment: 102 Weeks and Counting

Chart of the Day: Sell Brazil?

Homebuilder Sentiment Surges to a 10+Year High

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

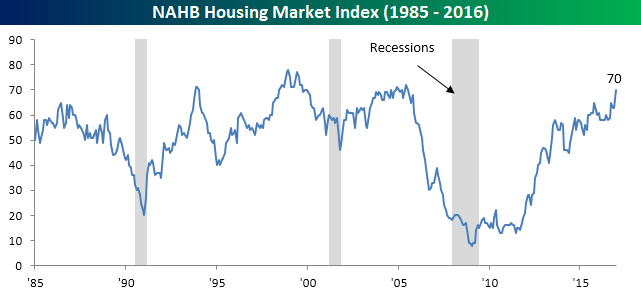

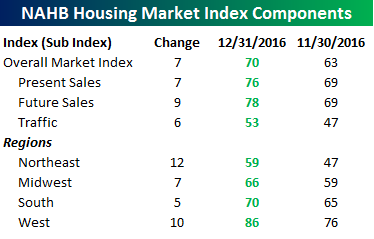

We’ve seen a lot of improvement in economic data over the last several weeks, but December’s reading on homebuilder sentiment may have taken the cake. While economists were forecasting this month’s reading to come in unchanged from November’s reading of 63, the actual reading surged to 70. That’s the highest reading since July 2005, and it’s tied for the second largest beat relative to expectations going back to 2003.

The table to the right breaks down this month’s report by present and future sales, traffic, and regional sentiment. As shown, it was green across the screen in December with every metric increasing on a month/month basis. Not only did every category increase, but they also all hit highs for the current cycle. Homebuilders are now extremely optimistic about future sales.

The table to the right breaks down this month’s report by present and future sales, traffic, and regional sentiment. As shown, it was green across the screen in December with every metric increasing on a month/month basis. Not only did every category increase, but they also all hit highs for the current cycle. Homebuilders are now extremely optimistic about future sales.

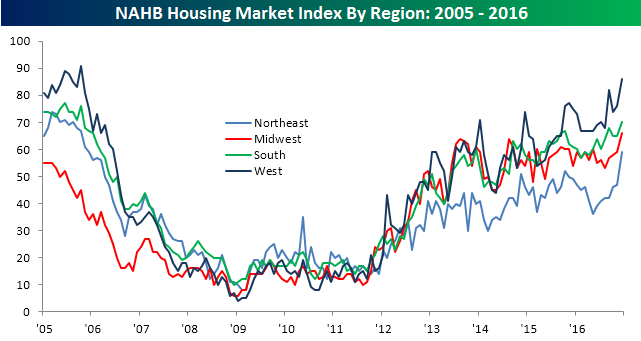

The chart below shows changes in homebuilder sentiment by region going back to 2005. Here again, sentiment in every region is now at cycle highs. Even in the Northeast and South regions where sentiment was showing signs of faltering, those indices are now at new cycle highs.

Dynamic Upgrades/Downgrades: 12/15/16

the Bespoke 50 — 12/15/16

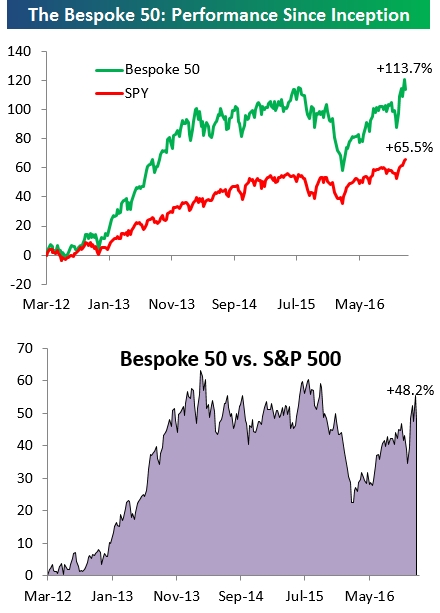

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has nearly doubled the performance of the S&P 500. Through today, the “Bespoke 50” is up 113.7% since inception versus the S&P 500’s gain of 65.5%.

To view our “Bespoke 50” list of top growth stocks, sign up for Bespoke Premium ($99/month) at this checkout page and get your first month free. This is a great deal!

Still No Joy in Investor-Ville

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

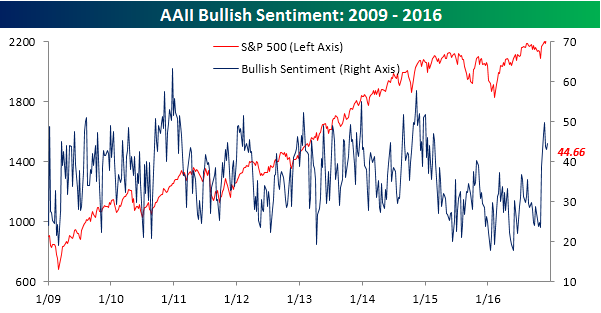

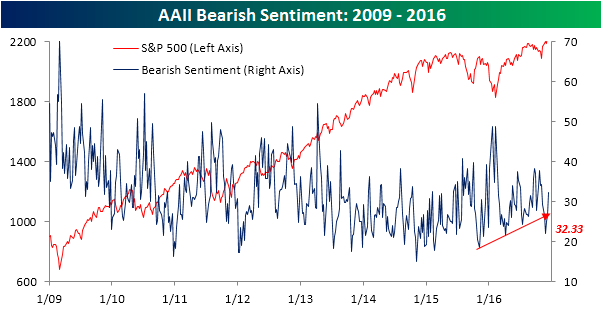

US equities saw more all-time highs this week, but individual investors are digging in their heels and actually turning more bearish. According to this week’s survey of stock market sentiment from AAII, bullish sentiment saw a slight increase of 1.6 percentage points, rising from 43.1% up to 44.7%. That now puts the current streak of sub-50% readings at 102 weeks! Over the last several months we have heard that the country has never been as divided as it is now politically, and in terms of sentiment, we are seeing a similar picture as it has become seemingly impossible for the bullish camp to get a majority.

While the move in bullish sentiment was slight this week, bearish sentiment saw its largest one-week increase in 13 weeks, rising from 26.5% up to 32.3%. That’s the highest reading since the election, and takes bearish sentiment back above the downtrend that it had broken below a few weeks back.

Average Country ETF Down 2%+ Since Election

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

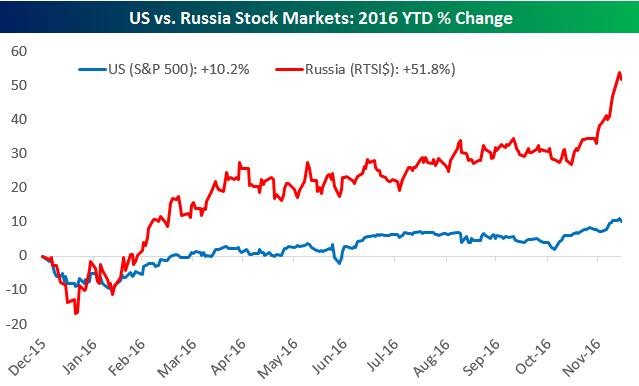

While the US stock market (S&P 500) is up 10% year-to-date heading into today’s trading, the Russian stock market is now up 5x more on the year at +51.8%. Check out the year-to-date performance chart of the two countries below. As shown, Russia has exploded higher since Trump was elected, but even heading into the election, the country was significantly outperforming the US.

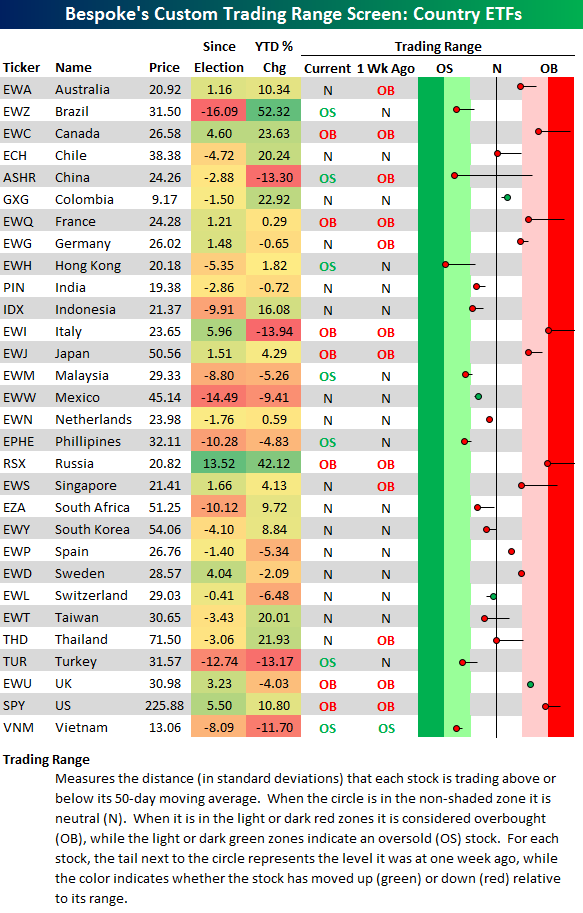

Below is a look at our trading range screen for the 30 largest country ETFs traded on US exchanges. For each ETF, the dot represents where it’s currently trading within its normal range, while the tail end represents where it was trading one week ago. The black vertical “N” line represents each ETF’s 50-day moving average, and moves into the red or green zones are considered overbought or oversold.

If you’re a US investor buying these country ETFs looking to gain international exposure, you’ve got to be aware that movements in the US dollar will make it so that you’re not getting the same performance as you’d get if you were say a domestic German investor buying the German stock index. If the US dollar gains against the euro while you own the Germany ETF (EWG), it’s going to hurt your EWG performance.

The reason we’re bringing up the dollar’s impact on these ETFs is because the dollar has surged since Trump was elected, and as a result, the average performance of these 30 country ETFs since the close on Election Day is actually a decline of 2.6%. As shown, while Russia (RSX) is up 13.5%, the next best performing country ETFs since Election Day are Canada (EWC) at +4.6%, Italy (EWI) at +5.96%, and the US (SPY) at +5.5%. Most country ETFs are either flat or down, however, and at this point, only a handful remain in “overbought” territory. Countries like Brazil (EWZ), China (ASHR), and Hong Kong (EWH) are now oversold.

The Closer 12/14/16 – And On The Eighth Meeting, A Hawkish Hike

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we recap the Fed decision today including analysis of the statement, economic projections, and Chair Yellen’s press conference. We also recap asset price reaction with six pages of charts as well as analyzing PPI and industrial production releases from this morning.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Chart of the Day: Rising From the Ashes – Technology vs. Financials

Fixed Income Weekly – 12/14/16

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we review 2016 returns in high yield and Treasuries relative to past years.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!