The Closer 12/16/16 – End of Week Charts

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

ETF Trends: Hedge – 12/16/16

No ETF we track has gained more than 2% in the past five days. The best performer, Coffee, is bouncing after a long decline off recent highs. Turkey, Italy, and Spain have performed reasonably well, while the USD has outperformed most equities. Energy, European equities hedged against FX moves, and oil have also performed well.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

The Bespoke Report — 2017 — “Credit Markets”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Over the next two weeks until the full publication is sent to paid members on December 29th, we’ll be releasing individual sections as we complete them. Today we have published the “Credit Markets” section of the 2017 Bespoke Report, which looks at both high yield and investment grade bonds and credit spreads. Movements in the credit markets are often viewed as leading indicators for the stock market, so knowing how they’re trending and why is important for any equity investor.

To view this section immediately and also receive the full 2017 Bespoke Report when it’s published on December 29th, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

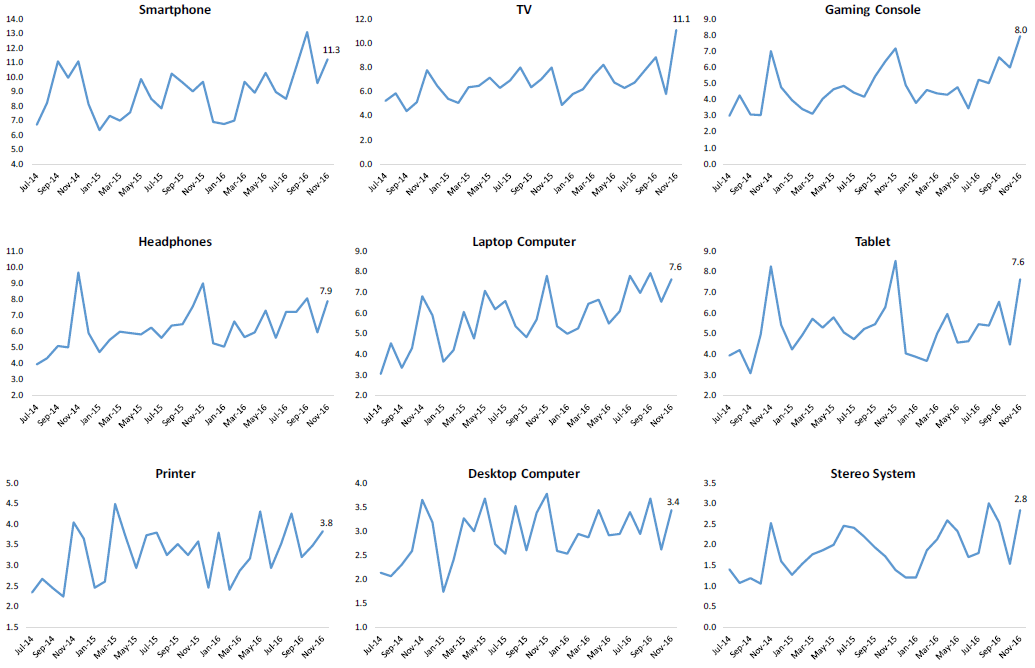

Consumer Pulse – New Highs for TV and Gaming Console Purchases

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

Below are a few charts tracking consumer purchases for various electronics from July 2014 through this November. Each month in our Pulse survey, we ask survey takers whether they’ve purchased any of the following items in the past month. The glaring similarity between each one of these charts is that there have recently been meaningful ticks up in purchase intentions for all items surveyed. That’s expected each holiday season, but most electronics have been in nice uptrends for the last couple of years. In our November survey, we saw new highs in purchases for TVs and gaming consoles, which bodes well for the companies that sell these two products.

Dynamic Upgrades/Downgrades: 12/16/16

The Closer 12/15/16 – Flash PMIs Impress, Current Account Improves, Central Bank Recap

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at a series of central bank decisions around the world in the past 24 hours, analyze US current account balance data, and update charts on global PMIs.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Bespoke’s Sector Snapshot — 12/15/16

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a 14-day trial to Bespoke Premium now.

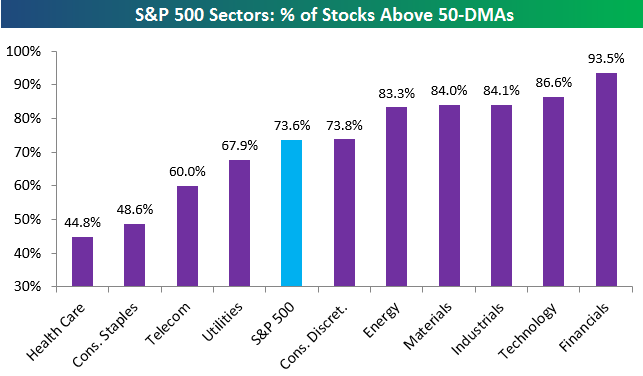

Below is one of the many charts included in this week’s Sector Snapshot, which highlights the percentage of stocks in each sector trading above their 50-day moving averages. This is a sector breadth measure we like to use to check up on the underlying health of the market. While the Financial sector currently has the strongest breadth with 93.5% of its stocks trading above their 50-days, the Technology sector now ranks second at 86.6%. Prior to this week, the Tech sector had been lagging since the election, but it has made a nice comeback recently.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a 14-day free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Strength in Regional Manufacturing

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

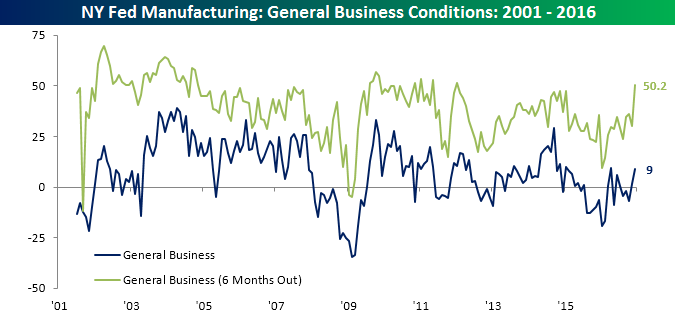

Among a deluge of economic data, we saw two strong regional Fed surveys out of the New York and Philadelphia regions. First, in the New York region, the General Business Conditions of the Empire Manufacturing report came in at a level of 9.0 versus expectations for a level of 4.0. This month’s reading was the highest level since April (9.6) and the second highest reading since January 2015. Even more impressive than the current conditions index was expectations for six months from now. That index rose from 29.9 up to 50.2, which is the highest reading since January 2012 and the largest one-month increase since November 2011.

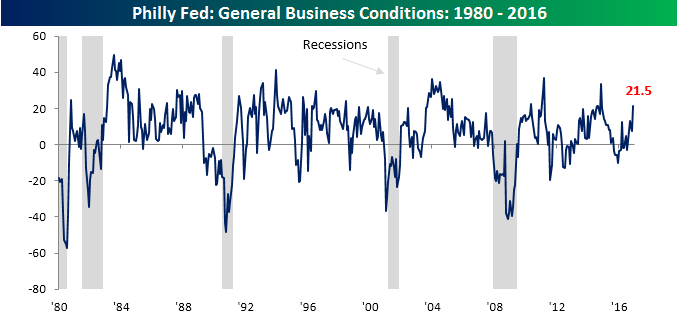

In the Philadelphia region, we saw similar strength as the headline index for business conditions exceeded consensus expectations of 9.1, rising from 7.6 up to 21.5. That’s both the highest monthly reading and the largest one-month increase since November 2014. Skeptics may argue that all of the recent improvement in data is based on surveys and expectations rather than hard data, but clearly, sentiment about the future has changed, and if this sentiment doesn’t materialize it would go down as one of the biggest fake-outs ever seen.

ETF Trends: US Indices & Styles – 12/15/16

The USD has soared over the last five sessions, one of the best performing ETFs we track. Health Care and Pharma stocks have also performed well. Being long Japanese or European equities with an FX hedge has also performed well while Consumer Staples, Utilities, and Growth stocks have also turned around relative to all ETFs. On the losing side of the equation, metals prices have plunged while a number of EM ETFs have also moved lower as yield jumps have pushed down bond prices and the mortgage market.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

The Bespoke Report — 2017 — “Market Cycles”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Over the next few weeks until the full publication is sent to paid members on December 29th, we’ll be releasing individual sections as we complete them. Today we have published the “Market Cycles” section of the 2017 Bespoke Report, which looks at the current bull market that is now entering its 9th year. In this section we look at historical bull markets and how they typically look when they’re close to reaching a top. Is the current bull also looking toppy or does it still have legs?

To view this section immediately and also receive the full 2017 Bespoke Report when it’s published on December 29th, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!