Dynamic Upgrades/Downgrades: 12/19/16

Bespoke Brunch Reads: 12/18/16

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Investing

Superstar Investors (AQR Alternative Thinking)

Quantitative evidence from one of the world’s biggest quant investment firms that there are numerous sources of edge when investing. Notably, however, investors that do not commit to their source of outperformance will likely see performance slide in the longer-term. [Link; 13 page PDF]

Put Forecasting in Its Final Resting Place by Barry Ritholtz (Bloomberg)

An argument against forecasting, which is much easier to get wrong than right. [Link]

Anxious Mutual-Fund Industry Holds ‘Seismic Shift Senior Leadership Forum’ by Sarah Krouse (WSJ)

With assets under management cratering (thanks to the draw of lower-cost ETFs), the strategic challenge for the mostly-active management of mutual funds is: what next? [Link; paywall]

Trade, Jobs, and Profits

Why Doesn’t Apple Export More Services (Wonky) by Brad Setser (Council on Foreign Relations)

We regularly link to Setser’s “look things up and write them down” posts because they’re so informative on obscure topics. This week, he’s looking at how the accounting structure used by Apple and other companies impacts the US balance of payments. [Link]

IBM to hire 25,000 more workers in the US in the next four years and invest $1billion in employee development, tech boss vows ahead of Trump meeting by Hannah Al-Othman (Daily Mail)

Global headcount may have dropped by over 50,000 since the end of 2013 (along with declining revenues) but IBM is still promising big things for US jobs. [Link]

Who Should Be Paying Who

Who wins and loses from America’s transfer union? by Matthew C. Klein (FT Alphaville)

Some states pay higher taxes to the federal government than others; some states also receive more federal spending. The states paying the most relative to what they get back may surprise you. [Link; registration required]

The Case Against Globalisation Reparations by Tomas Hirst (Piera View)

An argument that the solution to political – and social – upheaval brought about by the decline in manufacturing is not some sort of reparation payment. [Link]

Trump Transition

‘Is a Tweet policy?’ State Department officials ponder by Arshad Mohammed (Reuters)

A detailed consideration of the confusion around Trump’s penchant for tweeting major departures from US policy tradition; are those tweets effectively instructions to be followed by diplomats on the ground? [Link]

Republicans face corporate tax rebellion by Barney Jopson (FT)

Massive changes to the US corporate tax code are being considered by Congress, including a so-called “border-adjusted tax” that could bankrupt major retailers by taxing them at greater levels than profit margins. [Link; paywall]

House GOP to Press Ahead With Business-Tax Plan Criticized by Importers by Richard Rubin (WSJ)

Another view on plans to introduce a border-adjusted tax program in the House. [Link; paywall]

McConnell, Warning of ‘Dangerous’ Debt, Wants Tax Cut Offsets by Steven T. Dennis and Sahil Kapur (Bloomberg)

While markets are intently focused on the benefits of fiscal stimulus and corporate tax cuts, the Senate seems unenthusiastic about increasing the deficit by spending more on infrastructure or reducing revenues with tax cuts. [Link]

The On-Demand Economy

Silicon Valley VCs are growing wary of on-demand delivery by Paul Lienert, Heather Somerville and Alexandria Sage (Reuters)

Investment flows into apps that deliver goods or services at the push of a button are flagging, if not outright collapsing. [Link]

Uber Defies California Regulators With Self-Driving Car Service by Mike Issaac (NYT)

Despite orders to either register with the state DMV or halt, Uber continues to operate unauthorized (and possibly illegal) autonomous cars on the streets of San Francisco. [Link; soft paywall]

Consumer Matters

Disgruntled Diesel VW Owners Are Stripping Their Cars Before Turning Them In by David Tracy (Jalopnik)

Thanks to the legalese on buyback terms, VW owners have been given a window to spite the supplier of vehicles that are being bought back under the terms of an EPA settlement. [Link]

How Antibiotic-Tainted Seafood From China Ends Up on Your Table by Jason Gale, Lydia Mulvany, and Monte Reed (Bloomberg)

A horror story about the possible providence of shrimp imported from Southeast Asia, with an overlay of concerning circumstances around antibiotics. [Link]

Economic Research

Partisanship and Economic Behavior: Do Partisan Differences in Economic Forecasts Predict Real Economic Behavior? by Alan S. Gerber and Gregory A. Huber (American Political Science Review)

Not a new piece of research, but this paper from 2009 helps establish that there’s a concrete link between your “side” winning the White House and economic decisions like consumption. [Link; 20 page PDF]

The long-run poverty and gender impacts of mobile money by Tavneet Suri and William Jack (Science)

Provision of mobile banking services has a positive impact on income, wealth, and consumption. [Link]

Foreign Affairs

Canada’s natural resource wealth, 2015 (StatsCan)

Commodity prices are volatile, which makes the annual calculation of the value of Canada’s natural resources…quite amusing. In 2015, the net change was a decline of over 70%. [Link]

China: Renminbi stalls on road to being a global currency by Gabriel Wildau and Tom Mitchell (FT)

A summary of declining metrics of internationalization for the yuan, which had been trending towards a greater role in the global financial system. [Link; paywall]

Clean Energy

GM’s Ready to Lose $9,000 a Pop and Chase the Electric Car Boom by David Welch and John Lippert (Bloomberg)

The size of the Californian auto market means that in order to preserve access a number of firms are enthusiastically selling electric vehicles at a loss. [Link]

Lazard’s Levelized Cost of Energy Analysis Version 10.0 (Lazard)

On an unsubsidized basis, the range of cost per megawatt hour for wind ($32-$62) and solar photovoltaic ($46-$61) has fallen below that of natural gas ($68-$101) or coal ($60-$143). [Link; 22 page PDF]

Potpourri

Beer on tap? Robo barmaid slashes pub waiting time and pours pints with touch of a credit card by Ruki Sayid (Mirror)

A credit card company is the unlikely source of a new way to purchase sudsy goodness. [Link]

She staged a viral story. You fell for her hoax. She thinks that’s beautiful. by Abby Ohlheiser (WaPo)

Some of the most unique and hilarious memes in recent memory (pizza rat, raccoon riding alligator) are hoaxes. [Link; soft paywall]

When a Physicist Asked the FBI to Stop Calling Because He Helped Make the Atomic Bomb by JPat Brown (Atlas Obscura)

When a cold war scientist didn’t like the treatment he was receiving, a sternly worded letter was all that was needed. [Link]

Quick-View Chart Book — 12/17/16

The Bespoke Report – 12/16/16: Holiday Rest?

Before getting to our weekly Bespoke Report and our asset class performance matrix, we want to tell you about our upcoming 2017 Outlook Report. This is our most popular report each year, and it’s a must-read for any serious investor. We have already begun releasing sections of the report this week, and more will be forthcoming next week. If you’re not yet a Bespoke subscriber, you can get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

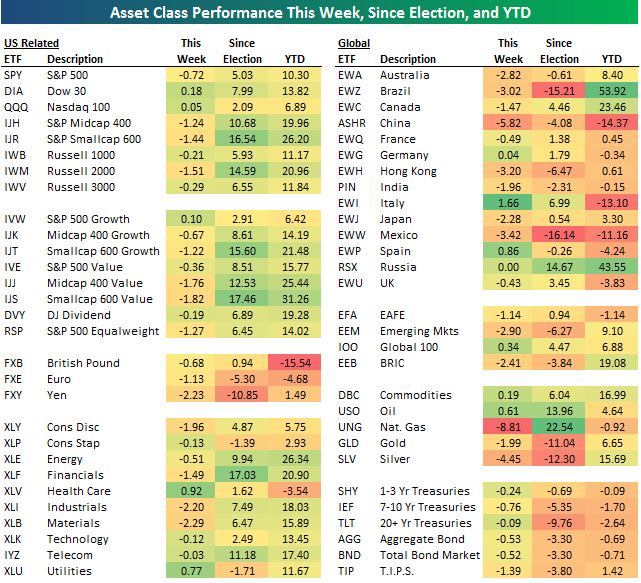

Below is a look at the recent performance of various asset classes using our key ETF matrix. This matrix is highlighted on page 2 of this week’s Bespoke Report newsletter, which was just sent to Bespoke Premium subscribers. As has been increasingly the case since the election, rather than just mostly winners or losers, this week winners and losers were mixed but this time with a downward bias.

If you’d like to see the rest of this week’s Bespoke Report newsletter, take advantage of our one-month Bespoke Premium free trial offer that includes our 2017 Outlook Report. Sign up now at this page.

Have a great weekend!

The Closer 12/16/16 – End of Week Charts

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

ETF Trends: Hedge – 12/16/16

No ETF we track has gained more than 2% in the past five days. The best performer, Coffee, is bouncing after a long decline off recent highs. Turkey, Italy, and Spain have performed reasonably well, while the USD has outperformed most equities. Energy, European equities hedged against FX moves, and oil have also performed well.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

The Bespoke Report — 2017 — “Credit Markets”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Over the next two weeks until the full publication is sent to paid members on December 29th, we’ll be releasing individual sections as we complete them. Today we have published the “Credit Markets” section of the 2017 Bespoke Report, which looks at both high yield and investment grade bonds and credit spreads. Movements in the credit markets are often viewed as leading indicators for the stock market, so knowing how they’re trending and why is important for any equity investor.

To view this section immediately and also receive the full 2017 Bespoke Report when it’s published on December 29th, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

Consumer Pulse – New Highs for TV and Gaming Console Purchases

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

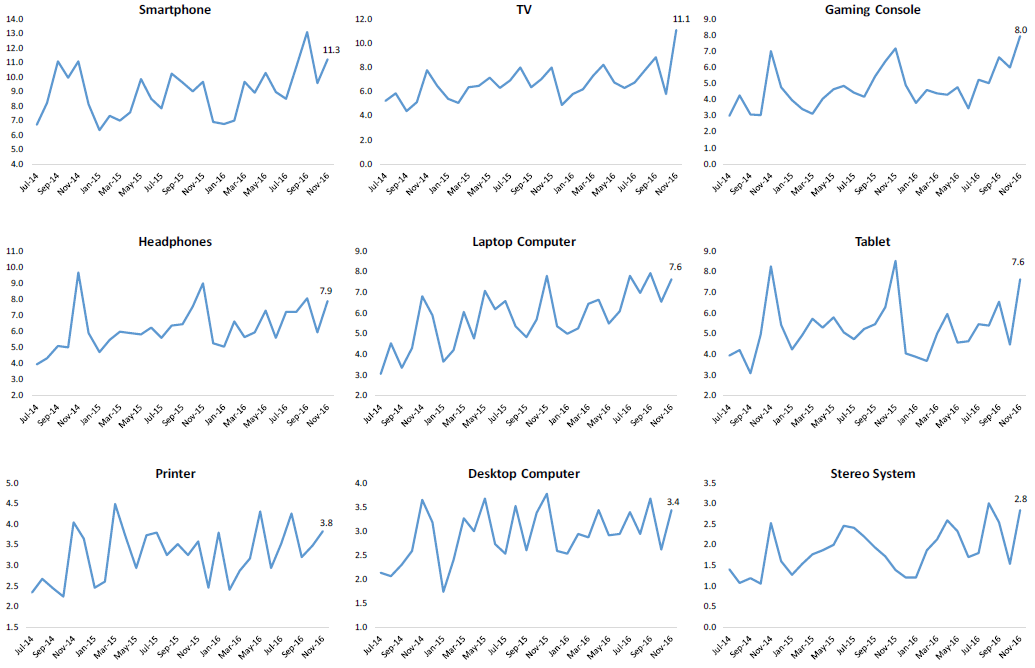

Below are a few charts tracking consumer purchases for various electronics from July 2014 through this November. Each month in our Pulse survey, we ask survey takers whether they’ve purchased any of the following items in the past month. The glaring similarity between each one of these charts is that there have recently been meaningful ticks up in purchase intentions for all items surveyed. That’s expected each holiday season, but most electronics have been in nice uptrends for the last couple of years. In our November survey, we saw new highs in purchases for TVs and gaming consoles, which bodes well for the companies that sell these two products.

Dynamic Upgrades/Downgrades: 12/16/16

The Closer 12/15/16 – Flash PMIs Impress, Current Account Improves, Central Bank Recap

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at a series of central bank decisions around the world in the past 24 hours, analyze US current account balance data, and update charts on global PMIs.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!