US Facebook (FB) Penetration Looks to Have Peaked

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

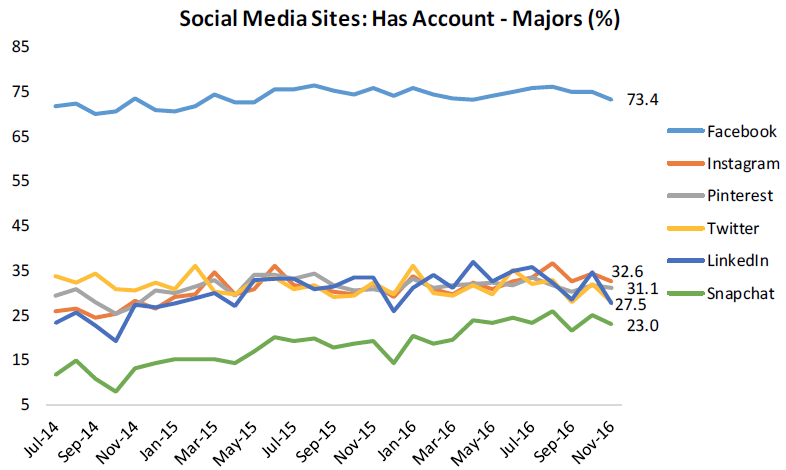

Each month in our survey, we ask participants if they have an account with any of the many social media platforms. Tracking this over time gives us an excellent look at how well they’re doing both collectively and individually. Below is a chart showing historical account data for sites like Facebook (FB), Instagram, Twitter (TWTR), and LinkedIn (LNKD). As shown, Facebook (FB) is very clearly the leader in the space with the remaining sites in a constant battle for second place. Since the beginning of our survey, Facebook (FB) has remained stable around 70%, but it looks like it could be trending lower based on data over the last year. On the other hand, Instagram and Snapchat have seen the biggest increases in users over the last 2+ years. Twitter (TWTR) and LinkedIn (LNKD) have both seen small declines.

In our full Pulse report released each month, we break down these numbers based on various demographics like age and income. If you’re not yet a Pulse member and you want to see the additional data, click here to start a 30-day free trial now!

B.I.G. Tips – Four Straight Years: Caterpillar Machinery Sales Down Again

Bespokecast — Episode 4 — Joe Weisenthal

In our newest conversation on Bespokecast, we speak with Bloomberg Markets Managing Editor Joe Weisenthal. Joe is a living clearinghouse for information and news on financial markets, with a huge presence on Twitter, the Odd Lots podcast co-hosted with Tracy Alloway, and a daily show on Bloomberg TV (What Did You Miss?). He’s been on the forefront of financial media since the mid-2000s, starting TheStalwart.com before joining Business Insider early in that company’s ascent in the digital media space. Joe has a fascinating perspective on markets and the media that cover them. In our hour-long conversation, we cover a range of topics, including his career path, how he thinks about the modern media landscape, the disconnect between accepted wisdom and actual events this year, and how becoming a father has impacted his career. We had a lot of fun recording this conversation and we hope you enjoy it!

In our newest conversation on Bespokecast, we speak with Bloomberg Markets Managing Editor Joe Weisenthal. Joe is a living clearinghouse for information and news on financial markets, with a huge presence on Twitter, the Odd Lots podcast co-hosted with Tracy Alloway, and a daily show on Bloomberg TV (What Did You Miss?). He’s been on the forefront of financial media since the mid-2000s, starting TheStalwart.com before joining Business Insider early in that company’s ascent in the digital media space. Joe has a fascinating perspective on markets and the media that cover them. In our hour-long conversation, we cover a range of topics, including his career path, how he thinks about the modern media landscape, the disconnect between accepted wisdom and actual events this year, and how becoming a father has impacted his career. We had a lot of fun recording this conversation and we hope you enjoy it!

To access this week’s podcast immediately, start a 14-day free trial to Bespoke’s research product. If you’ve already used your Bespoke free trial, you can gain access by choosing a membership option at our products page. Here’s a look at past guests as well if you’re interested.

Dynamic Upgrades/Downgrades: 12/20/16

Bespoke CNBC Appearance (12/20)

The Closer 12/19/16 – Yellen Speaks

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review Fed Chair Yellen’s speech from this afternoon.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Chart of the Day: Sector Correlations

Bespoke Stock Seasonality Report: 12/19/16

ETF Trends: US Sectors & Groups – 12/19/16

Gold miners continue to get absolutely smashed as real rates punish the yellow metal. Steel, metals and mining, China, and Lat Am are also prominent on our list of largest declines among ETFs over the last week. On the bull side of the equation, a strong USD is supporting DXJ and HEDJ while biotech has bounced back a bit. The Nasdaq is the best performer among major US indices in part because of biotech, while Momentum stocks, growth, and micro caps have also done well.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Crude Oil’s Wild Ride

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

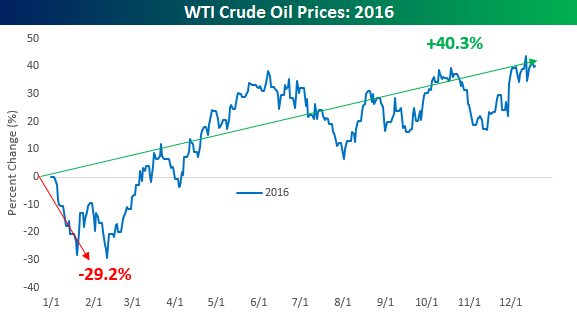

As 2016 winds down and we look back at what transpired over the course of the year, one of the biggest standouts has to be the turnaround in crude oil prices. After starting 2016 just like it finished 2015, crude oil prices were down close to 30% on the year as of early February. However, like the equity market in 2016, crude oil prices staged a major rally and turned big YTD losses into big YTD gains. At current levels, crude is on pace for an annual gain of over 40% and nearly a double from its intra-year low.

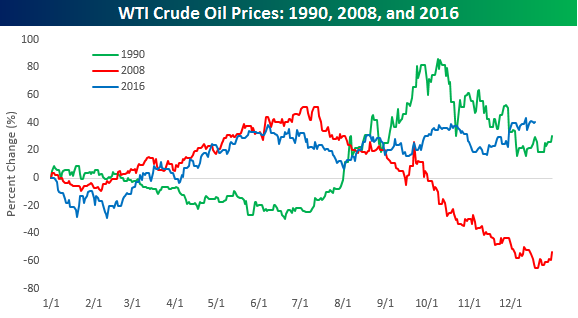

Looking back over the last 30+ years of annual returns for crude oil, there have only been two other years where the commodity has been both up 25%+ YTD and down 25%+ YTD in the same year. Those two years were 1990 and 2008. As shown in the chart below, however, both years saw entirely different paths. Like 2016, in 1990 crude oil prices were weak to start the year and then rallied strongly. Obviously, the circumstances were a lot different between now and then as the late year spike in 1990 was driven by Iraq’s invasion of Kuwait. In 2008, the swings occurred in the opposite order where the 25%+ YTD gain occurred ahead of the 25%+ YTD decline.

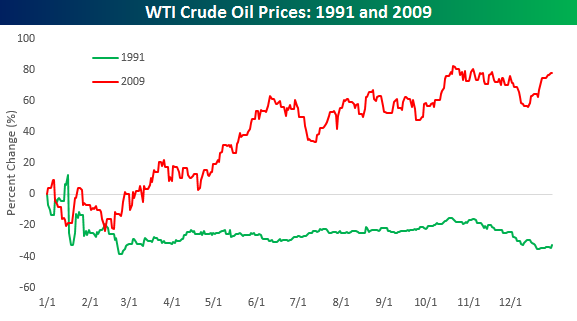

So what happened after these wildly volatile years for crude oil in the past? Did the commodity start to settle down, or did the volatility continue? The chart below shows the performance of crude oil prices in the year after both of the prior years cited below (1991 and 2009). As shown, the year that followed these two prior years was almost as volatile but in two completely directions. In 1991, oil prices continued the declines they saw in the fourth quarter of 1990 and traded sharply lower in the first quarter of 1991 before settling down for the remainder of the year but still finishing down over 30%. More recently, in 2009 crude oil also started off the year relatively weak before turning around and finishing the year sharply higher with a gain of over 75%. Whichever way it goes next year, one thing you can probably count on with crude oil is that like 2016, the magnitude of the move is likely to be large.