Bespokecast Episode 4 — Joe Weisenthal — Now Available on iTunes, GooglePlay, Stitcher and More

We’re happy to announce that the newest episode of Bespokecast is now available to the general public both here and via the various podcast platforms. Be sure to subscribe to Bespokecast on your preferred podcast app of choice to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

We’re happy to announce that the newest episode of Bespokecast is now available to the general public both here and via the various podcast platforms. Be sure to subscribe to Bespokecast on your preferred podcast app of choice to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

In our newest conversation on Bespokecast, we speak with Bloomberg Markets Managing Editor Joe Weisenthal. Joe is a living clearinghouse for information and news on financial markets, with a huge presence on Twitter, the Odd Lots podcast co-hosted with Tracy Alloway, and a daily show on Bloomberg TV (What Did You Miss?). He’s been on the forefront of financial media since the mid-2000s, starting TheStalwart.com before joining Business Insider early in that company’s ascent in the digital media space. Joe has a fascinating perspective on markets and the media that cover them. In our hour-long conversation, we cover a range of topics, including his career path, how he thinks about the modern media landscape, the disconnect between accepted wisdom and actual events this year, and how becoming a father has impacted his career. We had a lot of fun recording this conversation and we hope you enjoy it!

Each new episode of our podcast will feature a special guest to talk markets with, and Bespoke subscribers receive special access before it’s made available to the general public. If you’d like to try out a Bespoke subscription in order to gain access to these podcasts in advance, you can start a two-week free trial to check out our product. To listen to episode 4 or subscribe to the podcast via iTunes, GooglePlay, OvercastFM, or Stitcher, please click below.

The Closer 12/21/16 – Snoozing Ahead Of Saint Nick

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the extremely tight range on the S&P 500 today, the impact of higher rates on home prices, and today’s existing home sales report.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Holiday Snooze-Fest for Markets

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

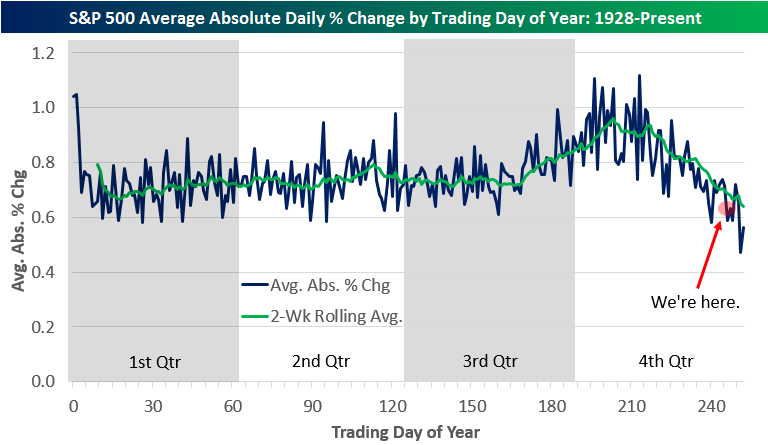

The spread between the S&P 500’s intraday high and its intraday low today was just 0.26%. That ranks in the top 25 for most boring days over the last 30+ years (our intraday data goes back to 1984). It’s not surprising given the holidays. Markets nearly always die down at this time of year. You may remember the chart below if you’ve been reading Bespoke throughout the year — we’ve posted it a few times already. It shows the S&P 500’s average absolute percentage change for each trading day of the year going back to 1928. As you can see, daily volatility runs between +/-0.60% and +0.80% over the first two and a half quarters of the year before picking up significantly from late September through early November. Then we see the daily action fall off a cliff from mid-November through the end of the year, which is where we currently sit.

Chart of the Day: Sector Performance in Year One of Election Cycle

The Bespoke Report — 2017 — “Valuation”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, Washington, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Over the next few weeks until the full publication is sent to paid members on December 29th, we’ll be releasing individual sections as we complete them. Today we have published the “Valuation” section of the 2017 Bespoke Report, which looks at a variety of different valuation metrics for the broader market as well as individual sectors. We answer just how overvalued (or undervalued?) this market really is.

To view this section immediately and also receive the full 2017 Bespoke Report when it’s published on December 29th, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

The Bespoke Report — 2017 — “The Year in Headlines”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Over the next week until the full publication is sent to paid members on December 29th, we’ll be releasing individual sections as we complete them. Today we have published the “Year in Headlines” section of the 2017 Bespoke Report, which provides a month-by-month and day-by-day look at the major financial news headlines that impacted markets throughout 2016.

To view this section immediately and also receive the full 2017 Bespoke Report when it’s published on December 29th, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

ETF Trends: Fixed Income, Currencies, and Commodities – 12/21/16

Yield plays and riskier micro cap stocks have performed well over the past week with MLPs, Telecoms, REITs, and Micro Caps leading the charge. A variety of other small cap funds have also done well. Among the worst performers are gold miners, silver, and Asian country ETFs (Singapore, Malaysia, China).

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Not So Lucky Sevens

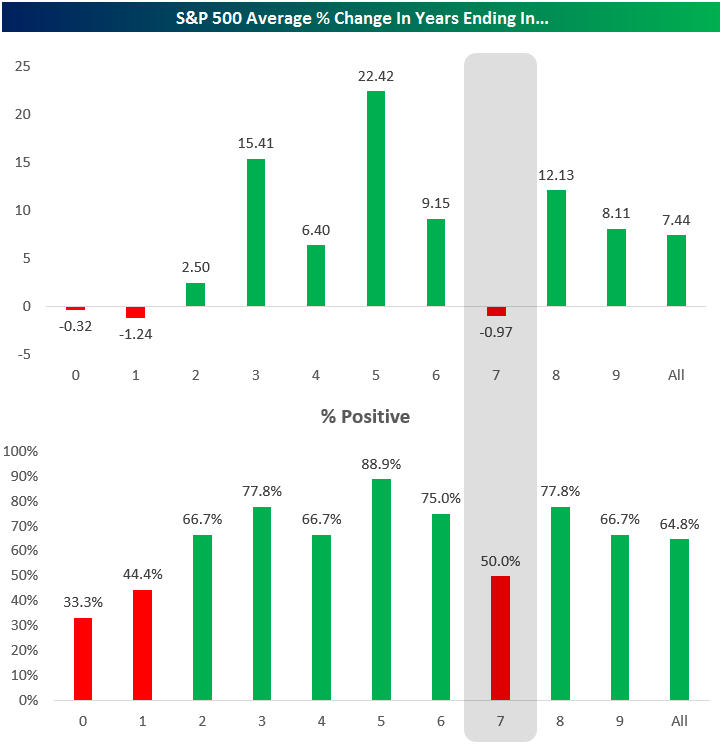

In working on our 2017 annual outlook report, we decided to take a quick look at how the S&P 500 has historically performed in years ending in “7” going back to 1928 when the index was formed. Unfortunately for market bulls, this is an instance where 7 is not a very lucky number. As shown below, the S&P has historically averaged a slight decline of 0.97% in years ending in 7, with gains occurring only half of the time. Years ending in “0” and “1” have also seen the S&P average a decline, and in these years the index has posted gains less than half the time.

So what has been the best year to be invested? Years ending in a “5” have averaged a mammoth gain of 22.42%, and the index has been up 88.9% of the time in these years (8 out of 9). Unfortunately we have to wait until 2025 to get the next one!

Want to see Bespoke’s 2017 annual outlook report? Click here to gain access with a 30-day free Bespoke research trial.

Dynamic Upgrades/Downgrades: 12/21/16

End of Year Winners and Losers

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

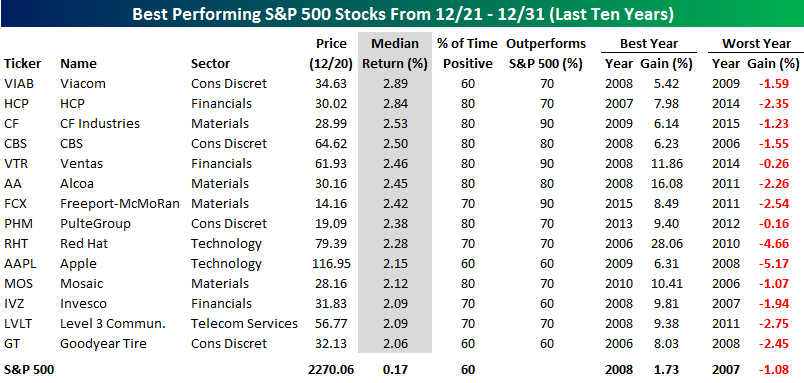

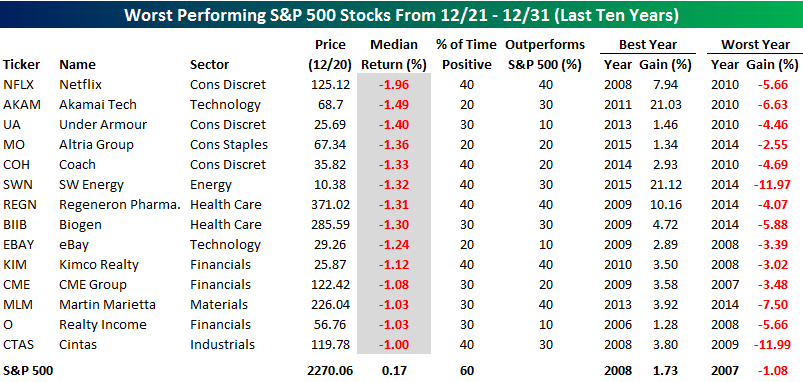

While December is typically a strong month for equities, most of the month’s gains have historically come prior to Christmas, while the last week of the year tends to be trendless with a slight positive bias. With just seven trading days left in the year, we wanted to highlight which stocks in the S&P 500 have historically seen the best and worst returns from the close on 12/21 through the end of December over the last ten years. The first table below lists the 14 stocks in the index that have seen a median gain of 2% or more during this period, and for each stock, we include the year where it saw its best and worst gains.

Topping the list of winning stocks to close out the year, shares of Viacom (VIAB) have seen a median gain of 2.89% with positive returns 60% of the time. The stock had its best end-of-year gain in 2008 when it rallied 5.4% and its worst in 2009 when it fell 1.59%. The most notable name on the list of winners, however, is Apple (AAPL). Over the last ten years, the stock has seen a median gain of 2.15% with positive returns 60% of the time. AAPL’s best end to a year was in 2009 (6.31%) while its worst was 2008 (-5.17%). In terms of sector representation, both the Consumer Discretionary and Materials sectors account for four of the fourteen stocks listed.

On the downside, fourteen stocks in the S&P 500 have seen a median decline of 1% or more to end the year. Surprisingly, Netflix (NFLX) tops the list of losers with a median decline of 1.96% and positive returns just 40% of the time. The next worst performer has been Akamai (AKAM), which has seen a median decline of 1.49% with positive returns just twice. Along with Altria (MO) and eBay (EBAY), AKAM is the least consistent to the upside of the stocks listed.