Bespoke CNBC Appearance (12/30/16)

Bespoke co-founder Paul Hickey appeared on CNBC’s Fast Money Halftime to discuss markets and our outlook for 2017. To view the segment, please click on the image below.

Like what you see? Click here to gain full access to Bespoke and our 2017 outlook report.

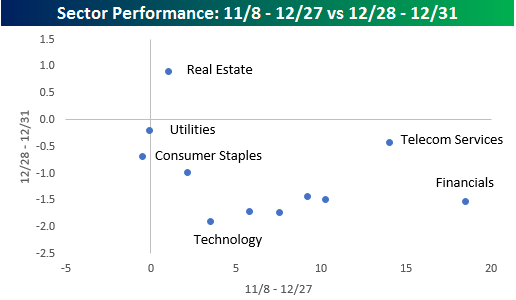

Sector Performance During Three Day Sell-Off

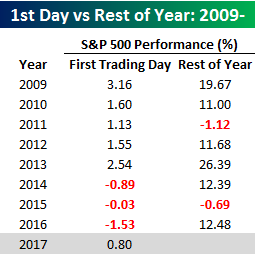

2016 may have gone out like a bear, but 2017 is kicking off bullish. US equities are beginning the year in the green, looking to end what was a three-day losing streak for the S&P 500, DJIA, and Nasdaq to close out 2016; the first such streak since the start of November. So just when you thought they couldn’t go down anymore, the last three days of 2016 served as a reminder that equity performance is in fact a two-way street. But today, the direction is back up as the S&P 500 is set for its first positive day to start a year since 2013.

2016 may have gone out like a bear, but 2017 is kicking off bullish. US equities are beginning the year in the green, looking to end what was a three-day losing streak for the S&P 500, DJIA, and Nasdaq to close out 2016; the first such streak since the start of November. So just when you thought they couldn’t go down anymore, the last three days of 2016 served as a reminder that equity performance is in fact a two-way street. But today, the direction is back up as the S&P 500 is set for its first positive day to start a year since 2013.

Looking at sector returns during the last three days of the year, it looked like nothing more than profit-taking as the market’s leading sector (Financials) during the rally was among the laggards, while the three sectors that held up the best were among the biggest laggards during the rally. One sector that stands out is Telecom Services; while it was the second best performing sector during the rally, it was the third best performing sector in the last three trading days of 2016. With just five stocks in the sector, though, we have probably already wasted more than enough ink talking about it.

One significant sector worth talking about, though, is Technology. With a gain of 3.5% post-election, through 12/27, the sector fell close to 2% in the last three days of the year, erasing more than half of its post-election gains. Since the close on 11/8, the only three sectors that have done worse are Consumer Staples (-1.2%), Utilities (-0.27%), and Health Care (1.2%).

Like what you see? Click here to gain full access to Bespoke and our 2017 outlook report.

The Bespoke Report — 2017 Annual Outlook

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we cover every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we cover every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more.

To view our 2017 Bespoke Report annual outlook, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

Bespoke’s Trump Stock Portfolio for 2017

With the new Trump administration set to take control of the Executive Branch on January 20th, 2017, we thought we’d publish a list of stocks that we think have a chance to benefit the most from the “Trump trade” in 2017. While we have a relatively neutral view on the market (and the Trump trade) entering the new year, if you’re fully on board, these are the names that we’d expect to do best. There are 43 names on the list, so it’s tough to just do a sweep buy of each individual name since each one has an equal weighting of just 2.3%. (Anyone want to make an ETF with us?) Instead, we recommend looking through each of the names and seeing if any pique your interest. Each name fits within broad boundaries of what we think will benefit from Trump’s stated policy goals, though try as we did, we couldn’t think of any public companies that actually drain swamps!

To view the Trump portfolio and our 2017 Outlook report, please start a 30 day trial to Bespoke Premium.

Bespoke Brunch Reads: 1/1/17

Happy New Years and welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Hedge Funds

Hedge Fund Math: Heads We Win, Tails You Lose by James B. Stewart (NYT)

A look inside the math of big revenues despite underperformance for hedge funds. [Link; soft paywall]

Trump’s Treasury Pick Moves in Secretive Hedge Fund Circles by Matthew Goldstein and Alexandra Steveson (NYT)

We’re confused: is being a Goldman Sachs alum a plutocratic non-starter for a cabinet position, or is the right angle “Mnuchin wasn’t that famous as a Goldman Sachs guy, and probably not even as a hedge fund guy, so why is he there?” We’ll let you make the call. [Link; soft paywall]

Amazon

Amazon wins patent for a flying warehouse that will deploy drones to deliver parcels in minutes by Arjun Kharpal (CNBC)

Who knows whether this new patent will come to anything – the US Patent Office literally floats on a sea of ideas that never came to fruition – but the idea of flying warehouses is certainly attention-grabbing! [Link; auto-playing video]

Want an Amazon Echo for Christmas? Sorry, it’s sold out by Stan Schroeder (Mashable)

Both the Echo and its smaller Echo Dot sister device were in high demand this holiday season, as the speakers become one of the more successful hardware efforts the company has come up with. [Link]

Fun With Hardware

From Tape Drives to Memory Orbs, the Data Formats of Star Wars Suck (Spoilers) by Sarah Jeong (Motherboard)

A hilarious look at the plethora of storage devices used to move around plans for the Death Star. [Link]

Real Estate

House Flipping Makes a Comeback as Home Prices Rise by Kirsten Grind and Peter Rudegeair (WSJ)

While it hasn’t come close to the heights reached in the mid-2000s, rising home prices and demand for housing stock has made the buy, renovate, and move on popular – and profitable – again. [Link; paywall]

A Storm Brewing on the Apartment Horizon by Mark Hickey (CoStar Group)

While single family home demand is doing great things (see the story above!), apartments are starting to enter a period of structural low demand driven by demographics. [Link]

Economic Musings

Why historians would make bad policy advisers by Neville Morley (Aeon)

While history can often be a guide to current events – and has a funny habit of repeating – Dresser argues that the human element is far more important than the abstract “laws” of history. [Link]

The emptiness of life will save us from mass unemployment (Pseudoerasmus)

A succinct and digestible argument that despite fears of machine-driven mass unemployment, there will always be demand for human labor. [Link]

The “Lucky 13” States and the Challenges of Geographically Concentrated Growth by Adam Carstens (Medium)

Summarizing the combination of geography and demographics that are currently bestowing growth on a relatively small portion of US with major tailwinds, Carstens also offers some possible solutions for the headwinds facing the rest of the country. [Link]

Long Reads

Our Favorite Wired Longreads of the Year by Charley Locke (Wired)

VR, AI, streaming, memory, robot velociraptors, ISIS social media strategy, old observatories, lead water, teens on the internet, the end of movies, terrible first seasons, pun competitions, the President on tech, graphic design, and the Dallas Police Department: 15 long reads for the year that was. [Link]

The Manhattan Cocktail: A Complete Guide to Its Myths and Mixology by Troy Patterson (Bloomberg)

A long meandering stroll down the road of whiskey, vermouth, and bitters that combine into what is still, in our opinion, a very underrated cocktail. [Link]

A Bigger Problem Than ISIS? by Dexter Filkins (The New Yorker)

When you start using billions of cubic meters and millions of acre-feet to describe volumes of water, you know you’re operating on a pretty ridiculous scale. That’s the sort of threat that’s sitting behind an aging bank of concrete in northern Iraq. [Link]

Business In America

Big Growth in Tiny Businesses by Jeffrey Sparshott (WSJ)

The ranks of manufacturers with no employees have swollen by 17% over the last decade, driven by surging demand for “craft” and “quaint” products that command a premium. [Link; paywall]

Democracy

The Toughest Death of 2016: the Democratic Norms That (Used to) Guide Our Political System by Seth Masket (Pacific Standard)

In the long run, the only real problem with 2016 might have been the damage done to norms that have served our republic well for the past two centuries. [Link]

A Bullish Signal From The 2017 Bespoke Report

Yesterday we posted a bearish chart from our 2017 Bespoke Report market outlook. Lest we end the year on an overly negative note, we thought we’d also post a more positive spin on things. We like to think our outlook paints a full picture, taking into account both the positives and negatives facing investors. In 178 pages of charts, analysis and commentary there is obviously no shortage of important data points, some of which paint a positive, while others a negative picture. Below we’re including one of the more bullish tables from the outlook report. In the table below we show market returns following long periods in a bull market where the S&P fails to make a new bull market high. As can be seen, long consolidation phases without a new high, tend to be followed by positive returns over the following 3, 6 and 12 months. Since we exited a 416 day consolidation phase in July 2016, this certainly qualifies as a positive indicator heading into 2017.

To view the full 2017 Bespoke Report, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

The Closer 12/30/16 – End of Week Charts

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

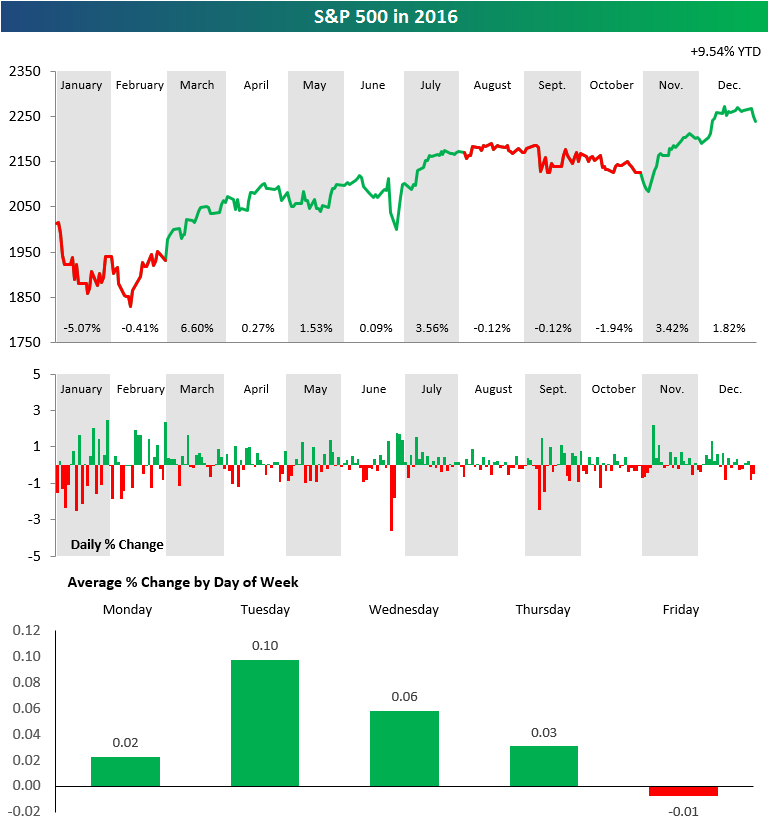

2016 S&P 500 Price Chart

The S&P 500 couldn’t quite break the double-digit percentage mark for the full year, finishing up 9.54%. Below is one of the many graphics included in our 2017 annual outlook report. The top chart shows the S&P 500’s daily price movement throughout the year. Months that finished positive have green highlighting, while down months have red highlighting. After a brutal January, the S&P gained nicely from March through July before trending slightly lower from August through October. The post-Trump rally then took hold in November and December.

In the second chart, we highlight the daily change of the index for the entire year, with up days highlighted in green and down days highlighted in red. January was definitely the most volatile month of the year. The big dips in late June were due to the UK’s Brexit vote. The final chart shows the average change of the S&P by weekday for the year. Monday through Thursday all ended up averaging gains in 2016, while Fridays averaged a very slight decline.

Click here if you’d like to read our full 2017 outlook report and do not currently have access.

Quick View Chart Book – 12/31/16

ETF Trends: International – 12/30/16

Over the past week the only two ETFs we track up double-digits have been gold miners, finally recovering a bit after a brutal run since the election. Commodity markets in EM all performed well, along with Russia, Energy, and REITs. With the yen rally over the week or so, Japanese equities have sold off along with FX-hedged Japanese equities. While Energy commodities are up, E&Ps are down, along with Consumer Discretionary, Semis, and Retail.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.