Bespoke Brunch Reads: 1/8/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

CRISPR

A simple guide to CRISPR, one of the biggest science stories of 2016 by Brad Plumer and Javier Zarracina (Vox)

Some background on Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR), an unproven technology that has the potential to open incredible new doors for genetic engineering. [Link]

Rewriting The Code of Life by Michael Specter (New Yorker)

Hopeful potential for CRISPR, which has the potential to help species adapt and end diseases. [Link]

Food

There’s A Massive Restaurant Industry Bubble, And It’s About To Burst by Kevin Alexander (Thrillist)

More than half of American spending on food takes place at restaurants but the explosion in eating out has what can only be described as shaky underpinnings. [Link]

Americans Eat 554 Million Jack in the Box Tacos a Year, and No One Knows Why by Russell Adams (WSJ)

A fascinating dive into the world of America’s worst – and one of the most frequently consumed – tacos: the “gooey, deep-fried beef envelope” which sold over half a billion units in the US last year. [Link; paywall]

Investing

When do you average down? by John Hempton (Bronte Capital)

A thoughtful consideration of when and how to add to a loser from Australia’s most frequently blogging hedge fund manager. [Link]

How Merrill Tamed Its Herd, Pushing Brokers to Pitch Bank Products by Michael Wursthorn (WSJ)

The massive army of brokers who used to earn commissions relative to the number of stock sales they make has been reoriented to pitching accounts which come with an annual fee. [Link; paywall]

Byron Wien Announces Ten Surprises for 2017 (Blackstone)

While we wouldn’t classify all of these as surprises, they make interesting reading and are part of what’s frankly become a Wall Street tradition. Wien’s long experience and deep insight makes his opinions worthy of consideration, if not automatic acceptance. [Link]

Pitfalls

No One Questioned This Hedge Fund’s Madoff-Like Returns by Zeke Faux (Bloomberg)

A review of the fraud at Platinum Partners, which totaled more than $1 billion per the charges leveled by the government. [Link]

One Winner, One Loser in Brothers’ Lottery Worth Billions by Devon Pendleton and Yaacov Benmeleh (Bloomberg)

Despite every effort to make the distribution of their fathers’ assets equitable, the brothers Ofer have seen twists of fortune that deliver remarkably different fates. [Link]

Retail

How Credit-Card Data Might Be Distorting Retail Stocks by Miriam Gottfried (WSJ)

Investors place a lot of faith in the first looks on store revenues they get from research providers, and in many cases it’s too much, generating wild performance swings…and reversals. [Link; paywall]

The Brutal Truth Is That America Still Has Way Too Many Places to Shop by Brian Sozzi (The Street)

In purely quantitative terms, there are too many stores in the United States, with square footage running well above other countries with similar economies. [Link]

Millennial Myths

Millennials are entitled, narcissistic and lazy – but it’s not their fault: Expert claims ‘every child wins a prize’ and social media has left Gen Y unable to deal with the real world by Belinda Cleary (Daily Mail)

Is it really the fault of current twenty-somethings that their Baby Boomer parents demanded that their children get treated to trophies at every turn? [Link]

The Media’s Favorite ‘Millennial’ Is 55 Years Old by Ben Collins (The Daily Beast)

AP, Vocativ, Forbes, and Cosmopolitan are just a few of the outlets that have presented a man in his 50s as being a Millennial. [Link]

Driving

States Wire Up Roads as Cars Get Smarter by Paul Page (WSJ)

Speed limits that adjust for weather, driverless cars talking to asphalt, and the need to run wires under millions of miles of roadways. [Link; paywall]

Humanitarians

‘James Bond of Philanthropy’ Gives Away the Last of His Fortune by Jim Dwyer (NYT)

Giving away $8 billion isn’t as easy as it sounds, but Charles F. Feeney has managed to do it…becoming one of the greatest philanthropists in history in the process. [Link; soft paywall]

Farmer on Trial Defends Smuggling Migrants: ‘I Am a Frenchman.’ by Adam Nossiter (NYT)

“Liberté, égalité, fraternité” can be a bit difficult to square with national borders, as a unique case featuring an underground railroad for migrants shows. [Link; soft paywall]

Reviews

tom wolfe’s reflections on language by E.J. Spode (3am Magazine)

While we enjoyed The Electric Kool-Aid Acid Test, The Right Stuff, Bonfire of the Vanities, and I Am Charlotte Simmons as much as the next person, this frankly gutting review of Wolfe’s most recent effort at non-fiction gives us serious pause. [Link]

Media Matters

Megyn Kelly’s Jump to NBC From Fox News Will Test Her, and the Networks by Jim Rutenberg (NYT)

The cable TV star is hoping her sharp, plain-spoken brand of questioning and presentation will work on a larger scale. [Link; soft paywall]

Miscellaneous

Good Luck, Morons by Sara Estes (Bitter Southerner)

The hardest ultramarathon in the world is found in Eastern Tennessee, but the story of the man that dreamed it up is one that’s harder to believe than the fact that human beings run scores of miles for fun! [Link]

Carrie Fisher, Script Doctor: Her Unknown Legacy Examined by Peter Sciretta (Slashfilm)

The story behind Carrie Fischer’s under-appreciated work on major scripts that salvaged dialogue, plots, and the films themselves. [Link]

The Bespoke Report — Dow 19,999.63

If you’re not yet a Bespoke subscriber, you can still get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

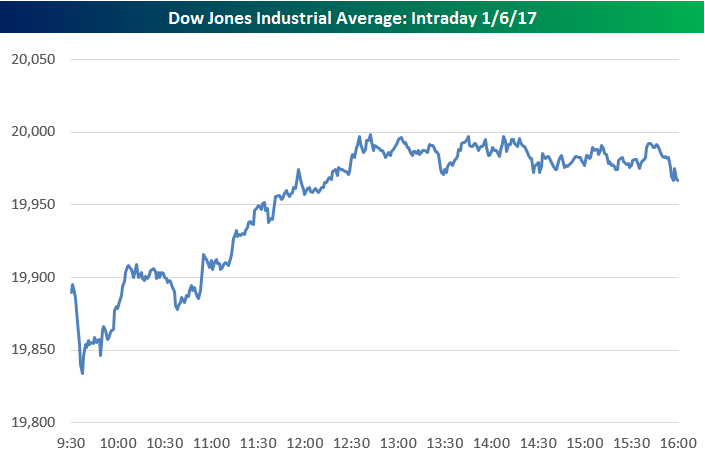

The chart below is included on page one of this week’s Bespoke Report newsletter, which was just sent to Bespoke Premium subscribers. Don’t tell traders that Dow 20,000 is just a meaningless number. While many like to mock the focus on big round numbers in the financial media, Friday’s action for the index shows that someone out there is using 20,000 as something more than just an arbitrary level. The chart highlights the intraday minute-by-minute action of the Dow Jones Industrial Average today. The closest the index had gotten to 20,000 prior to today was 19,987, but by mid-day Friday, it looked as if a cross of the 20,000 level was a shoe-in. It never happened, though.

All afternoon, the index got close to 20,000 — as close as 19,999.63 in fact — but every time it got near 20,000, sellers stepped in with force to not let it happen. It appears as if there are a large number of sell orders right at Dow 20,000. We’ll have to wait until Monday now to see if all of those sells are still in place.

Even though NYSE floor traders couldn’t wear their Dow 20,000 hats home for the weekend, it is important to note that all three major indices (Dow, S&P 500, Nasdaq) still hit new intraday highs today, which is quite a healthy sign for the market.

If you’d like to see the rest of this week’s Bespoke Report newsletter, take advantage of our one-month Bespoke Premium free trial offer that includes our 2017 Outlook Report. Sign up now at this page.

Have a great weekend!

The Closer 1/6/17 – End of Week Charts

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

Quick View Chart Book – 1/6/17

Consumer Pulse – Personal Finances

Each month, Bespoke runs a survey of 1,500 US consumers balanced to the demographic weights tracked by the US Census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

Below are charts from our most recent survey (covering the month of December) regarding personal finances. We asked consumers to tell us how they feel about their personal financial situation today, versus last year and also versus the average person. As you can see, since the election, the US consumer is significantly more comfortable with their personal financial position now as well as compared to how they felt last year. You should keep this information handy for next time you hear a CEO or CFO of a struggling retailer tell how “challenging the retail environment” is. It may be challenging, but it’s definitely not because of the consumer!

Bespoke Earnings Estimate Revisions: 1/6/16

Death By Amazon – January 2017

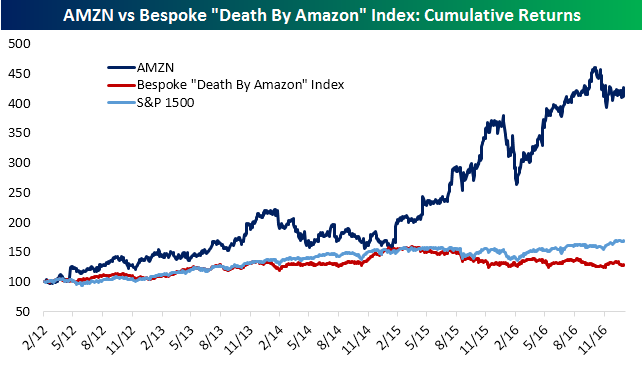

Following brutal reports from a few different department stores this week, we mentioned our Death By Amazon Index in a blog post yesterday. Today, we updated that index in one of our B.I.G. Tips reports. Below we chart the performance of the index versus Amazon (AMZN) and the S&P 1500.

To see the report, which includes more information about the construction of the Death By Amazon Index, its performance, and the stocks that make up the index sign up for a monthly Bespoke Premium membership.

ETF Trends: US Indices & Styles – 1/6/17

Gold miners have outperformed over the past week, with Biotech, oil services, and a few EM names also doing quite well. Not all of EM has rallied over the past week, however. Turkey and Mexico are two of the weakest performers over the past five sessions, with Turkey drastically underperforming thanks in large part to chaos in USDTRY. Natural gas has also gotten pounded by weather shifts, while the USD has delivered a pretty weak showing, especially in the last two days.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

The Closer 1/5/17 – Are Trump Trades Still Intact?

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we update our tracking of US crude oil inventories and production as well as checking in on the performance of post-election Trump trades.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Death By Amazon Lives Up to its Name

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

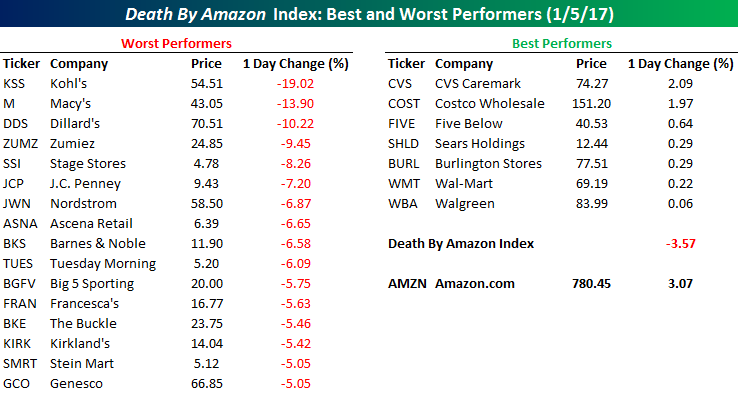

With big blowups from Kohl’s (KSS) and Macy’s (M), it was a bloodbath for retail related stocks today. A perfect illustration of this weakness was the performance of our Death By Amazon Index. Bespoke’s “Death By Amazon” index was created in 2014 as a way to track the performance of the companies most affected by the rise of Amazon.com (AMZN). Companies included must be direct retailers with a limited online presence (or core business based on physical retailing locations), a member of either the Retail industry of the S&P 1500 Index or a member of the S&P Retail Select Index, and rely on third party brands. We view these attributes as the best expression of Amazon’s threat to traditional retail.

Of the 54 stocks that currently make up the index, all but seven were down today, and the average return of the 54 stocks was a decline of 3.57%. The table below lists the best (stocks that were up) and worst (stocks down 5%+) performing components of the index in Thursday’s trading. Leading the way to the downside were KSS and M, which proved today why they were included in the index in the first place! Other big losers included Dillard’s (DDS), J.C. Penney (JCP), and Nordstrom (JWN). On the upside, the only two stocks that were up more than 1% on the day were CVS Caremark (CVS) and Costco (COST). Meanwhile, while the Death By Amazon Index sank today, Amazon’s stock feasted on the weakness, rising 3.07%.

To gain access to our “Death by Amazon” index with monthly updates, sign up for a Premium or Institutional membership at our Products page now.