Bespoke Stock Scores: 1/10/17

Small Business Optimism Surges

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

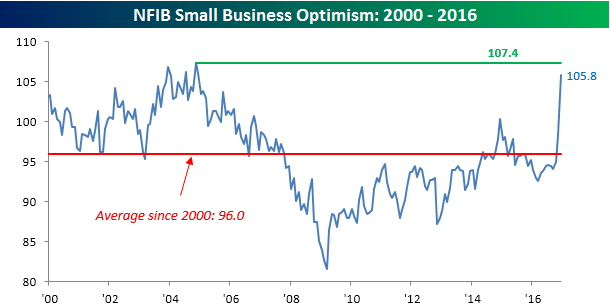

Add small business optimism to the list of sentiment surveys surging in the wake of November’s election as this month’s sentiment survey from the NFIB launched higher in December. According to the NFIB, its index of small business optimism surged to 105.8 from 98.4 in November and expectations of 99.1. As highlighted in today’s Morning Lineup, it was the 5th highest monthly reading in the history of the survey (going back to the 1970s) and the best reading since December 2004. Relative to expectations, it was also the best reading we have seen since at least 2009. With the caveat that the NFIB has a tendency to lean conservative, today’s report suggests that small business sentiment has kicked into a higher gear.

Almost all of the improvement in sentiment was driven by expectations rather than actual conditions in the field, though. As noted in the report, “Seventy-three percent of the gain in the Index was accounted for by more positive views about business conditions six months from December and improvements in real sales volumes. Improved views about the climate for expansion added another 15 percent, so more optimistic expectations account for 88 percent of the Index’s improvement, indicating little improvement in the other seven components and more importantly in the measures directly related to economic growth.”

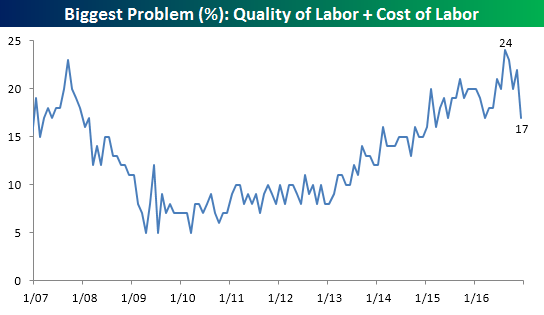

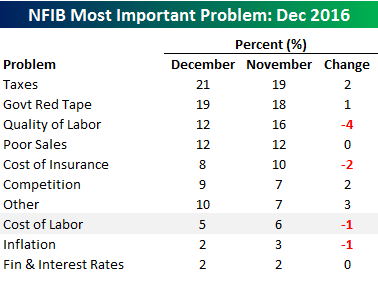

As we do each month, the table to the right lists which issues small business owners consider to be their biggest problems. In this month’s report, the ‘old-reliables’ of Taxes and Government Red Tape top the list at 21% and 19%, respectively, and both also saw an increase in December. On the downside, Quality of Labor (-4) showed the largest decline followed by Cost of Insurance (-2), Cost of Labor (-1), and Inflation (-1).

As we do each month, the table to the right lists which issues small business owners consider to be their biggest problems. In this month’s report, the ‘old-reliables’ of Taxes and Government Red Tape top the list at 21% and 19%, respectively, and both also saw an increase in December. On the downside, Quality of Labor (-4) showed the largest decline followed by Cost of Insurance (-2), Cost of Labor (-1), and Inflation (-1).

Along with the fact that business owners are getting more optimistic, labor issues have become an increasingly less pressing issue. The chart below shows the historical combined percentage of businesses citing cost and quality of labor as their number one problems. Back in August, this reading surged to an all-time high of 24%. In just the last four months. though, it has declined to 17%, which is tied for the lowest reading since March 2015. If in fact small business sentiment about the future is accurate, one would expect to see labor cost and quality issues start to become more problematic as hiring increases.

The Closer 1/9/17 – Credit Cards Back In Vogue

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at today’s consumer credit release from the Federal Reserve.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Chart of the Day – Consumer Pulse Sentiment Check

Bespoke’s Commodity Trading Range Screen

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

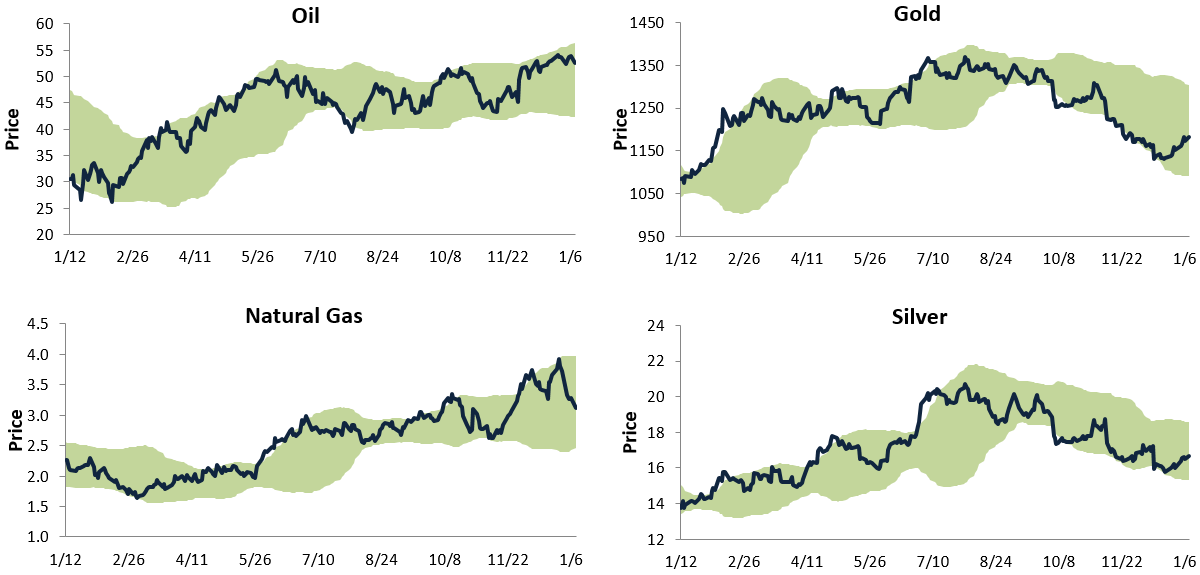

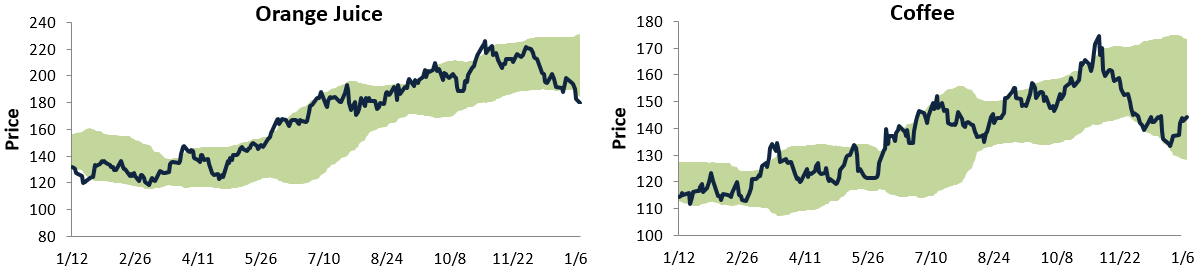

Below is a look at our trading range charts for ten major commodities. Each chart goes back one year, and the light green shading represents between two standard deviations above and below each commodity’s 50-day moving average. You’ll notice that rarely do prices move above or below this range, and pullbacks or bounces typically occur when prices reach the top or bottom of the range.

Oil remains in a nice long-term uptrend, but it appears to be dipping back towards the middle of its range after reaching the top of its range at the start of 2017. Natural gas also remains in a long-term uptrend, and it recently experienced a significant pullback after hitting the top of its range. While energy commodities are in uptrends, the two major precious metals — silver and gold — are in downtrends. Both recently experienced bounces off the bottom of their ranges, but they are still a long way away from overbought territory.

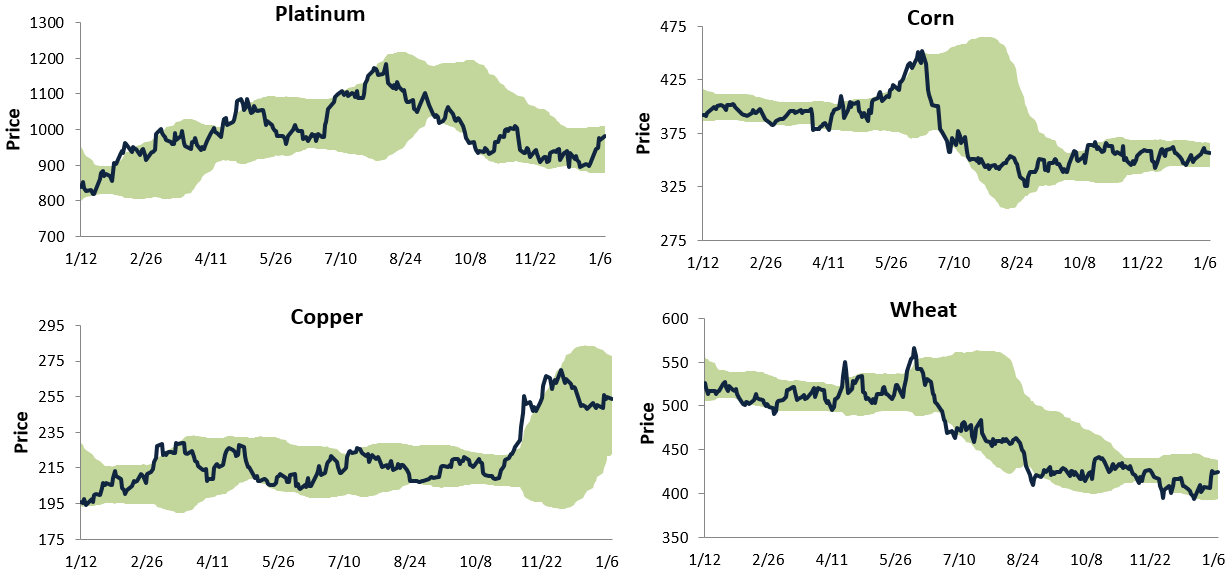

While gold and silver remain in downtrends, platinum is looking better recently. Copper is in a consolidation phase after a big spike after the November election, while corn and wheat have been in tight, sideways ranges for the last five months. Interestingly, both orange juice and coffee broke their long-term uptrends back in November, and while coffee recently ticked up off the bottom of its range, orange juice has yet to find a bottom.

Global 10-Year Trading Range Charts

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

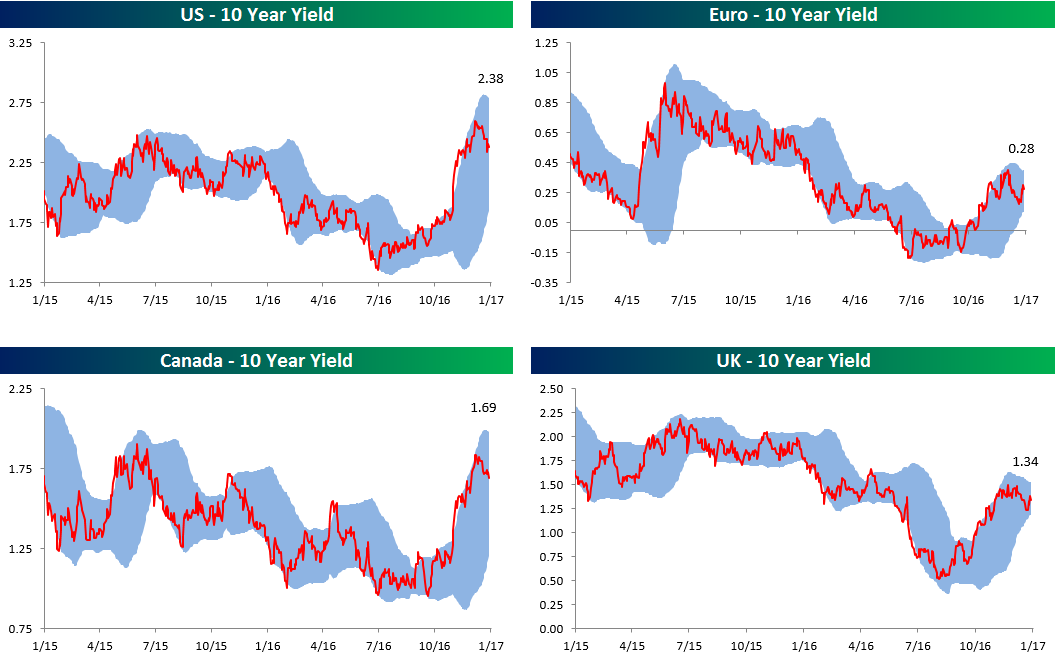

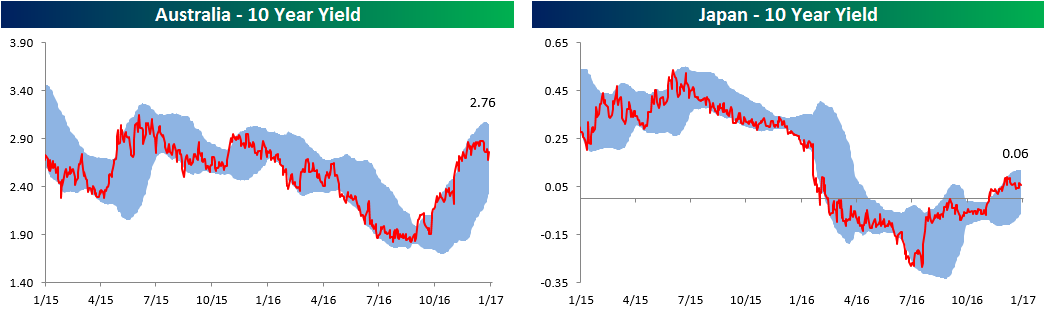

Below is an updated look at our trading range charts for various 10-year sovereign debt yields around the world. When we last posted these charts in mid-2016, the yield on the 10-Year US Treasury Note was under 1.5%. As shown in the top left chart below, the yield currently sits at 2.38% after getting as high as 2.5% a few weeks ago. After trading at the top of or above its normal range (blue shading) for pretty much all of November and December, the US 10-year yield currently sits in the middle of its range.

While the US saw its 10-year yield dip down to 1.5% at its lows, and Canada and the UK both dipped below 1%, the major news of 2016 was negative 10-year yields for the Euro area and Japan. Both areas saw their 10-years dip below -0.10% at last year’s lows. But all is well in the world now as yields have moved back into positive territory. The Euro area 10-year is back to yielding 0.28%, while Japan’s 10-year now pays a hefty interest rate of 0.06%.

Stock Seasonality Report: 1/9/17

ETF Trends: Hedge – 1/9/17

Gold miners have surged over the last few days with the shiny metal’s recovery in recent sessions. Biotechs have also made a bit of a comeback while metals and mining, east Asian equity indices, and oil services have also done well. Over the past week natural gas has gotten positively demolished, down over 16%. Turkey is down almost 6% as USDTRY continues to skyrocket higher amidst further purges of academics and the media by Erdogan. Oil has also undperformed, dropping on the order of 2%. Most equity indices haven’t dropped that much with the worst US-focused equity ETF we track (DES) dropping only 1.1%.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Bulls Sinking Their Teeth Back into FANG

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

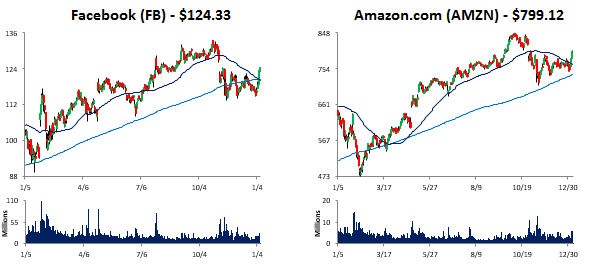

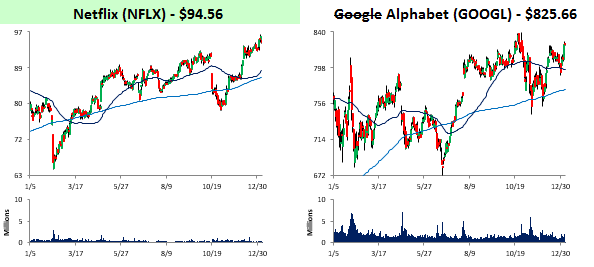

Largely written off after the election when shares underperformed, the FANG trade of Facebook (FB), Amazon.com (AMZN), Netflix (NFLX), and Google Alphabet (GOOGL) has kicked off 2017 with a bang. Through early Monday morning, GOOGL is the worst performing of the four but is still up over 4%. Overall, the average return of the four stocks that make up FANG is a gain of 6.04%, and Netflix is trading right near all-time highs. That’s already two full percentage points more than the average strategist S&P 500 forecast for the entire year!