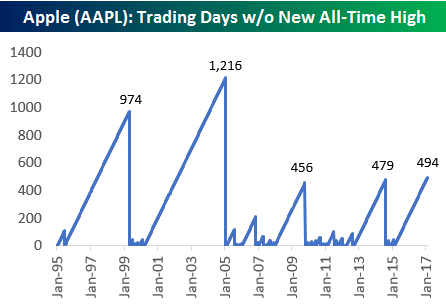

Chart of the Day: Apple (AAPL) Approaching New All-Time Highs

Apple (AAPL) is now less than $2 away from making a new all-time closing high. The stock last made a new all-time high on February 23rd, 2015 when it closed at $133/share. The chart below shows prior streaks of trading days without a new all-time high for the stock going back to 1995. As shown, the current streak of 494 trading days is the longest of the iPhone-era.

To read our thoughts and see more analysis of Apple’s (AAPL) historical trading pattern, start a 14-day free trial below and check out today’s Bespoke Chart of the Day.

Bespokecast — Episode 6 — Rob Bartenstein

In our newest conversation on Bespokecast, we speak with investment advisory industry veteran Rob Bartenstein. Rob is the CEO of Kestra Private Wealth, and he’s also a regular guest on financial networks like CNBC and Fox Business. Kestra is a platform for registered investment advisors. In our conversation, we discuss the current state of the investment advisory industry including the pending Department of Labor fiduciary rule. Rob also discusses his views on the market and the outlook for the economy. We learned a lot talking to Rob and think you will too!

In our newest conversation on Bespokecast, we speak with investment advisory industry veteran Rob Bartenstein. Rob is the CEO of Kestra Private Wealth, and he’s also a regular guest on financial networks like CNBC and Fox Business. Kestra is a platform for registered investment advisors. In our conversation, we discuss the current state of the investment advisory industry including the pending Department of Labor fiduciary rule. Rob also discusses his views on the market and the outlook for the economy. We learned a lot talking to Rob and think you will too!

To access episode 6 immediately, please start a 14-day free trial to Bespoke’s research product. If you’ve already signed up for a Bespoke free trial in the past, you can gain access by choosing a membership option at our products page. Here’s a look at past guests if you’re interested.

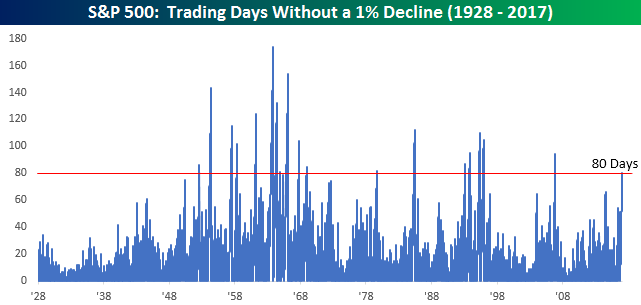

B.I.G. Tips – 80 Days and Counting

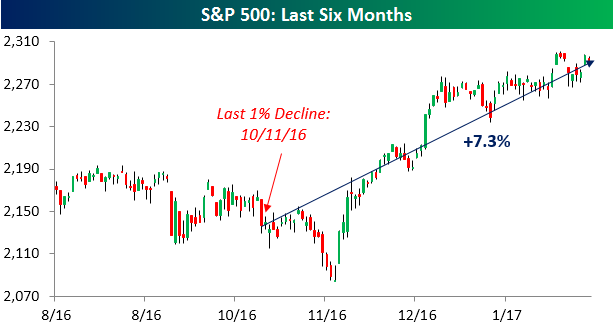

While equities finished the day down on Monday and have now traded down on a daily basis more in the last three weeks than they have traded up, amazingly, we have yet to see a day since the November election where the S&P 500 dropped 1% or more. In fact, you have to go back nearly a month before the election to find the last time the S&P 500 dropped 1% in a single day. The lack of a 1% decline through Monday is notable for the fact that it has now been 80 trading days since the S&P 500 last saw a one-day decline of 1%+. During that span, the index is up 7.3%.

While equities finished the day down on Monday and have now traded down on a daily basis more in the last three weeks than they have traded up, amazingly, we have yet to see a day since the November election where the S&P 500 dropped 1% or more. In fact, you have to go back nearly a month before the election to find the last time the S&P 500 dropped 1% in a single day. The lack of a 1% decline through Monday is notable for the fact that it has now been 80 trading days since the S&P 500 last saw a one-day decline of 1%+. During that span, the index is up 7.3%.

The chart below shows historical streaks of trading days since 1928 that the S&P 500 went without a decline of 1%+. Looking at the chart, these types of streaks were pretty common in the 1950s and 1960s, but from 1970 through the present, their frequency has become increasingly sporadic. While there were eleven streaks in the twenty-year stretch spanning the 1950s and 1960s, in the more than four decades since there have only been eight. In fact, the current streak represents the first 80+ trading day streak without a 1% decline since 2006, and before that, you have to go back to 1995 to find the next one.

Earlier today, we sent Bespoke Premium and Bespoke Institutional members a report highlighting the S&P 500’s performance during, and more importantly after, each of the prior 18 streaks. To see this report, sign up for a monthly Bespoke Premium membership.

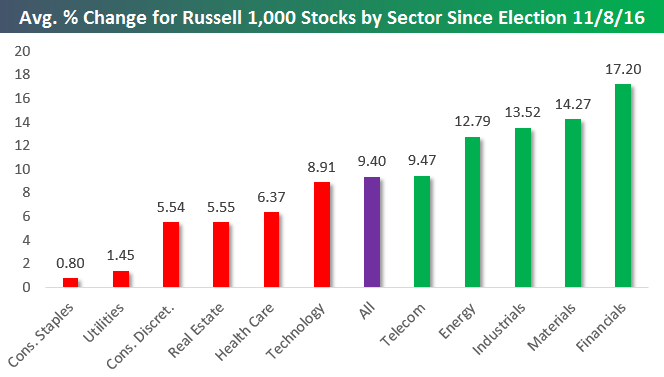

Post-Trump Performance Check-Up

Below is a look at the average performance of Russell 1,000 stocks by sector since the close on election day (11/8/16). As shown, the average stock in the entire index is now up 9.4% since election day. Five sectors have seen outperformance while six have seen underperformance.

The Financial sector is averaging the biggest gains at +17.20%, followed by Materials (+14.27%), Industrials (+13.52%), and Energy (+12.79%). While Technology has been outperforming recently since the election the average Tech stock is up 8.91%, which is actually less than the overall average. The real laggards have been Consumer Staples and Utilities. Both sectors have seen their stocks average very minute gains.

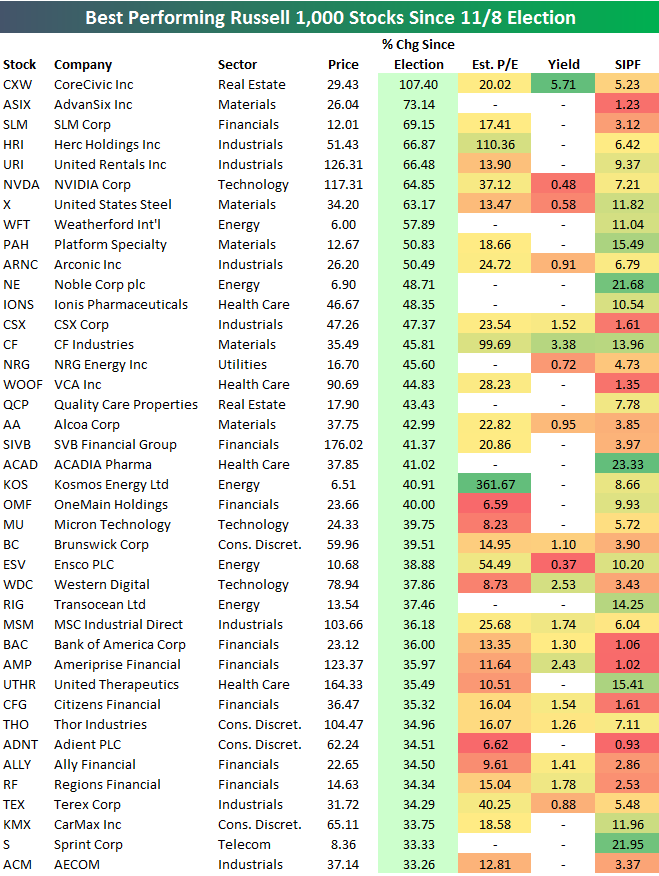

Below is a list of the 40 Russell 1,000 stocks that are up the most since election day (through the close on 2/6). As shown, CoreCivic (CXW) — a REIT — is up the most with a gain of 107.4%, followed by AdvanSix (ASIX), SLM, and Herc Holdings (HRI). United Rentals (URI), NVIDIA (NVDA), and US Steel (X) rank 5th through 7th. Other notables on the list of big winners include Alcoa (AA), Micron (MU), Western Digital (WDC), Bank of America (BAC), and Sprint (S). For each name, we also include its estimate P/E ratio, its dividend yield, and its short interest as a percentage of float (SIPF).

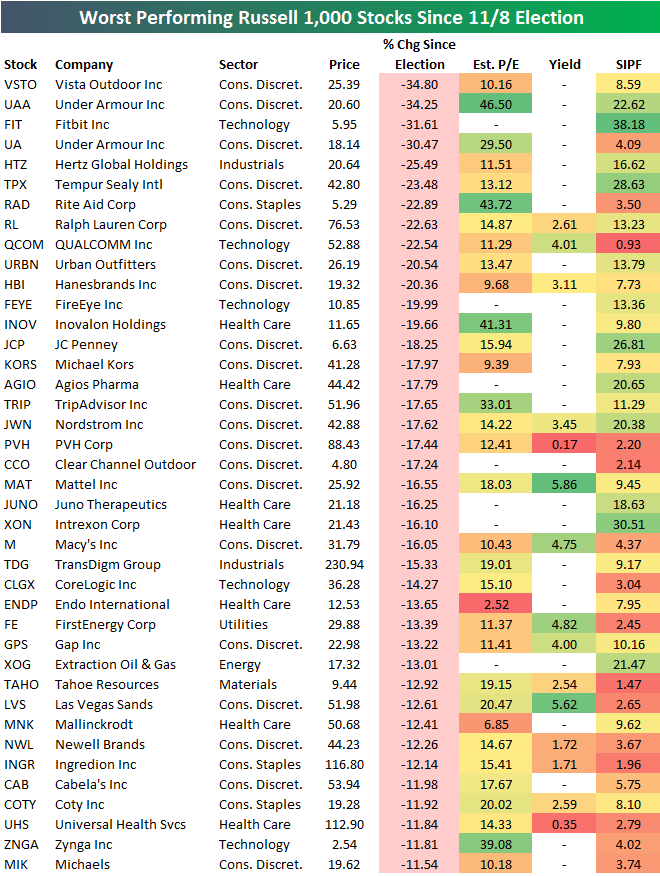

The list of biggest losers since election day is led by Vista Outdoor (VSTO) and Under Armour (UAA), which have both declined more than 34%. Fitbit (FIT) ranks third worst with a decline of 31.61%. Other notables on the list of losers include Ralph Lauren (RL), QUALCOMM (QCOM), FireEye (FEYE), JC Penney (JCP), Nordstrom (JWN), Macy’s (M), and Las Vegas Sands (LVS). The list is riddled with retailers and other consumer stocks that are suffering “Death by Amazon.”

ETF Trends: Hedge – 2/7/17

Gold and gold miners continue to rally with the best performance over the last five trading days. A number of US equity industries have performed well over the last couple of weeks, with mortgage real estate, MLPs, financial services, and semiconductors all performing well. On the losing side of the slate, a number of currencies are major underperformers over the last week: pound sterling, Swedish krona, and the Canadian dollar are all down sharply while French and Spanish equities have been the biggest country ETF decliners.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Bespoke Stock Scores: 2/7/17

The Closer 2/6/17 – Less Lending Looms

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a comprehensive look at US bank lending.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!