ETF Trends: Fixed Income, Currencies, and Commodities – 2/10/17

Peripheral European equities have seen the worst returns over the last week or so with concerns about Greece and French elections serving to punish Spain and Italy. Energy-related assets, EM, and other foreign equities have been broadly weak. Looking to the positive, gold miners and other metals names continue to rally while China has jumped up over the last five sessions. Retail has also performed quite well overall.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

The Closer 2/10/17 – Election Versus Inauguration

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In today’s Closer sent to Bespoke Institutional clients, we take a look at returns between the election and the inauguration versus returns since the inauguration.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

Short Interest Report: 2/10/17

Bespoke Bloomberg TV Appearance (2/8/17)

Bespoke’s Sector Snapshot — 2/9/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a 14-day trial to Bespoke Premium now.

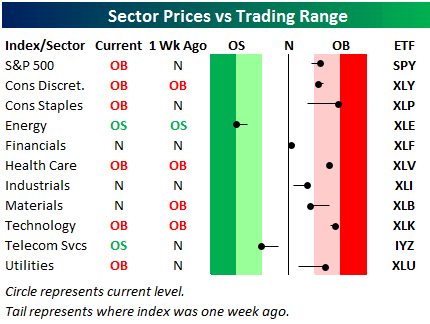

Below is one of the many charts included in this week’s Sector Snapshot, which highlights our trading range screen for the S&P 500 and ten sectors. The black vertical “N” line represents each sector’s 50-day moving average, and as shown, all but two sectors are currently above their 50-days. Consumer Staples is currently the most extended above its 50-day, while Energy is currently the most oversold.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a 14-day free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Earnings Estimate Revisions Report: 2/9/17

Twitter (TWTR) Down on Earnings…Again

As shown below in the intraday chart of Twitter (TWTR) over the last 15 days, the stock took the stairs up and is now taking the elevator down. After basically rallying from $17 up to $19 from the end of January through yesterday, today it has given it all back on earnings.

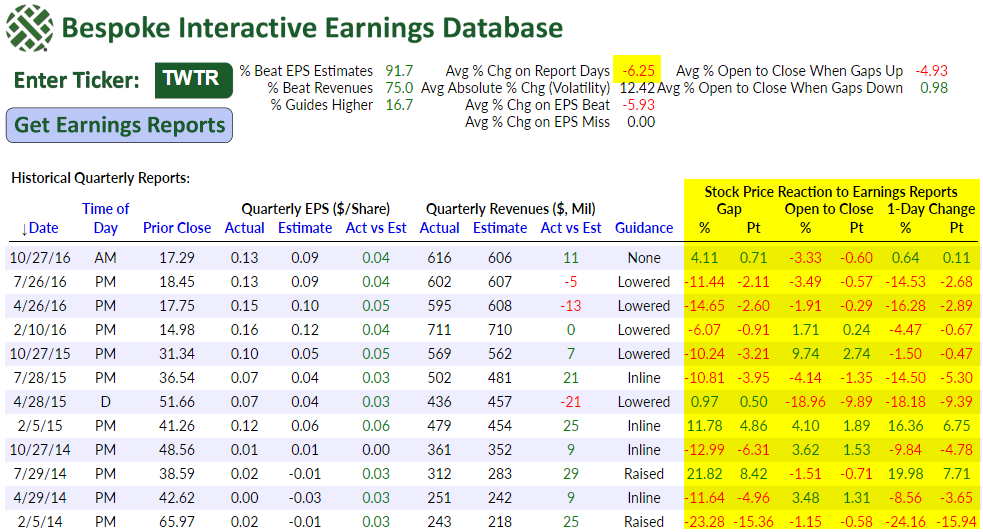

Big drops on earnings are nothing new for Twitter (TWTR). Below is a snapshot from our Interactive Earnings Report Database (start a 14-day free trial to sample) showing Twitter’s historical earnings reports since it went public back in late 2013. The stock has now had 13 earnings reports, and its share price has fallen on its report day 10 times. Shares have only traded up on earnings 3 out of 13 times. The stock’s average price move on its historical earnings reaction days has been absolutely horrid at -6.25%.

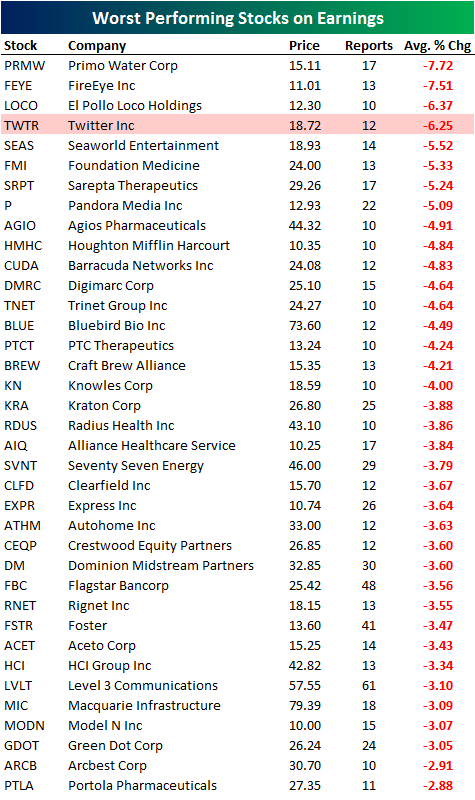

As mentioned above, TWTR has historically averaged a one-day drop of 6.25% on days it reports earnings. Using our Interactive Earnings Report Database, we checked to see how that compared to the entire universe of US stocks. As shown below, we found that TWTR is the fourth worst stock in the US when it comes to reacting to earnings reports. There are only three stocks that have historically averaged bigger one-day drops on their earnings reaction days — PRMW, FEYE, and LOCO. That’s a pretty brutal ranking to hold.

Start a 14-day free trial to sample our Interactive Earnings Report Database now.

(The table below lists the stocks that have historically averaged the biggest one-day declines on their earnings reaction days. For stocks that report before the open, we use that day’s trading. For stocks that report after the close, we use the next day’s trading. Only stocks with at least 10 quarterly earnings reports on record are included, and to make the list, the stock had to be trading above $10/share as of yesterday’s close.)

Chart of the Day: Marine Misery?

ETF Trends: International – 2/9/17

Gold and precious metals continue to surge relative to other areas of the financial markets. Long-term Treasury bonds have also performed very well over the last week or so as rates have backed up notably. With that duration outperformance, equity sectors like Consumer Staples, REITs, and Utilities have also outperformed. Energy equities continue to underperform while European country ETFs are have moved notably lower over the last five days.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Individual Investors Slightly Less Depressed

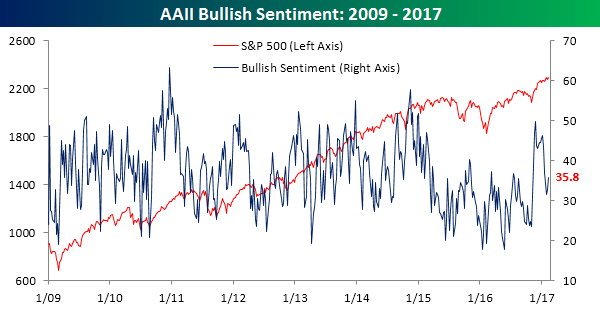

After dropping below a third in the last two weeks, bullish sentiment on the part of individual investors saw a modest rebound this week, rising from 32.8% up to 35.8%, which is still an extraordinarily low level given where the market is. This week’s level also marks the 110th straight week where bulls have not been in the majority.

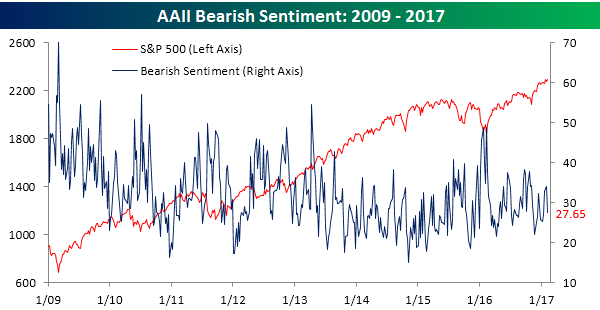

While bullish sentiment saw just a modest rebound, bearish sentiment saw a pretty sizable drop, falling from 34.17% down to 27.65%. That’s the largest one-week decline in bearish sentiment since early October.

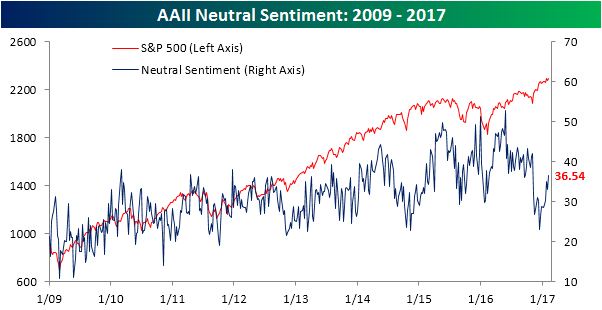

With Trump’s agenda seemingly hitting a speed bump in recent days as tax reform appears to be getting pushed further and further back, a plurality of investors couldn’t make up their minds. Neutral sentiment jumped to 36.54% this week, which is the highest level since the election.