Bespoke Stock Seasonality Report – 2/13/17

ETF Trends: US Indices & Styles – 2/13/16

Steel, industrial metals, and Chinese equities have gained the most over the past week with Solar an unlikely but notable addition to the best-performers among ETFs we track over the past week. Decliners include gold miners (which had rallied quite significantly in recent weeks), natural gas, and a variety of foreign currencies.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Broken Record Breakouts

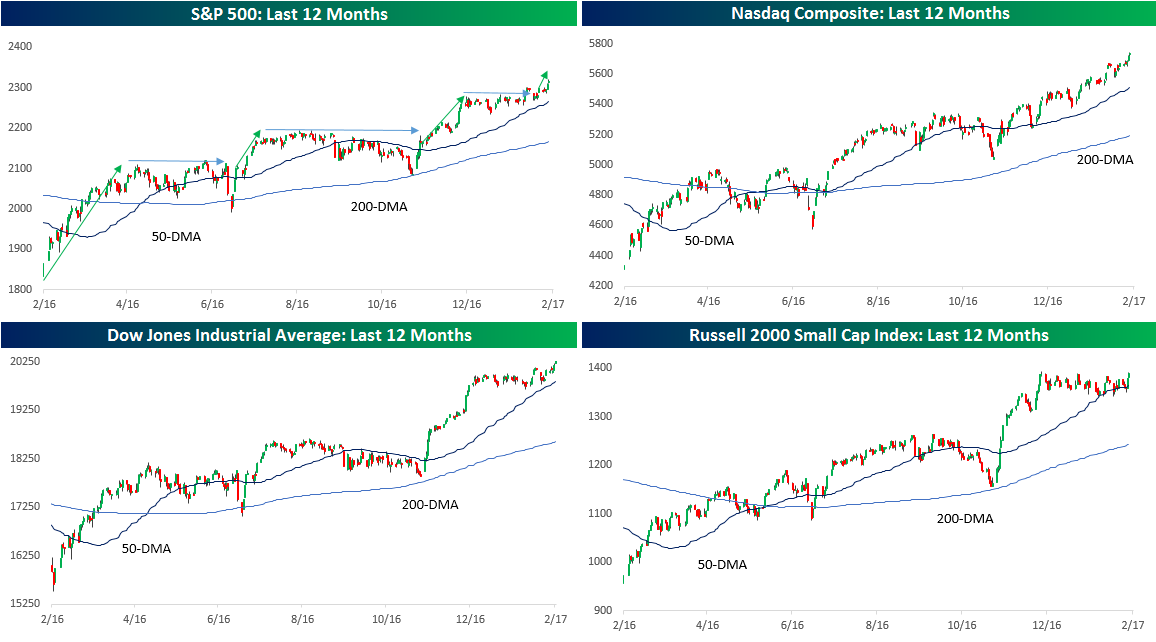

While not all of the indices got there on an intraday basis last week, the S&P 500, Nasdaq, Dow Jones Industrial Average, and Russell 2000 all closed at new all-time highs last Friday for the first time this year. These days, it’s getting to the point where everything is hitting new highs.

It’s not just the major US averages hitting new highs either. While still off its all-time highs, in dollar terms, the MSCI Emerging Market index also hit a new 52-week high in last Friday’s trading.

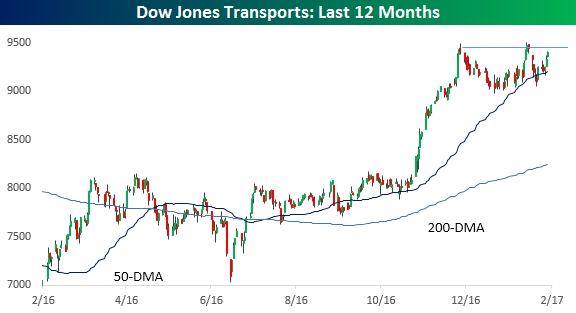

OK, not everything hit new highs last week. Digging down a little deeper, the Dow Jones Transports have been stymied at resistance at around the 9,500 level twice now in the last two months.

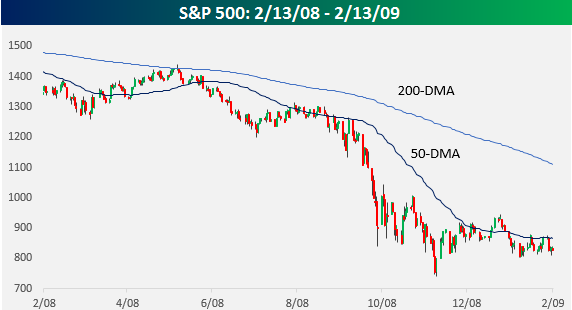

If you’re a bull, you have to love the way the market is trading, but enjoy it while it lasts. Nothing lasts forever. Just as the chart below from eight years ago eventually reversed itself, this too will eventually go the other way. Stay on your toes.

Bespoke Brunch Reads: 2/12/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Corporate News

Amazon.com Takes Aim at Victoria’s Secret With Its Own $10 Bras by Khadeeja Safdar and Laura Stevens (WSJ)

The latest market eyed by Amazon is one we wouldn’t have predicted: intimate apparel for women, a space that seems much less amenable to ruthless logistics than other areas the company has focused on. [Link; paywall]

Samsung battery factory bursts into flame in touching Note 7 tribute by Shaun Nichols (The Register)

Not content to be declared a civil aviation hazard, Samsung’s now setting fires at the recycling facility that is processing the batteries after they’ve been turned in. [Link]

Channeling Steve Jobs, Apple seeks design perfection at new ‘spaceship’ campus by Julia Love (Yahoo!/Reuters)

A look inside the giant corporate headquarters Apple has built itself in Silicon Valley, complete with seamless door frames and the feel of a landed alien spacecraft. [Link]

Economic Whimsy

Economics: An Illustrated Timeline by Heske van Doornen (The Minskys)

A one-stop shop for quick summaries of economic thinkers over time. [Link]

Karthik Sankaran’s guide to macroeconomics, in verse by Karthik Sankaran (FTAV)

Eurasia Group’s director of global strategy rolls out his hilarious version of economic thinking, properly metered. If you can’t get through this without at least one snort of amusement, you’re probably not an economics nerd! [Link; registration required]

Science

Here’s why golf balls have dimples by Mike Nudelman and Elena Holodny (Business Insider)

This may be common knowledge for those who avidly roam the links but we hadn’t heard it before: dimples are key to stabilizing the spinning white balls and reducing drag. [Link]

Injection could permanently lower cholesterol by changing DNA by Michael Le Page (New Scientist)

This therapy is probably years from widespread adoption but it’s a good example of the rapid progress being made in gene editing and just a hint of what may be to come in the space. [Link]

Economic Updates

Lawler on Household Projections by Tom Lawler (Calculated Risk)

Recent changes to estimates of net migration by the US Census which have nothing to do with recent political events (though could be exacerbated by them) suggest that current estimates for households occupied in the United States are much too high. [Link]

U.S. Firms Slash Interest Tab in $100 Billion Refinancing Blitz by Matt Wirz (WSJ)

In the month of January alone, firms refinanced an astound 12 figures worth of debt, reducing coupon payments in enormous chunks. [Link; paywall]

Here Comes the Economic Growth That Confidence Data’s Predicting by Luke Kawa (Bloomberg)

A round-up of “hard” economic data that’s starting to put some backbone in the “soft” survey improvements seen since the election. [Link]

Brexit

Local voting figures shed new light on EU referendum by Martin Rosenblaum (BBC)

A summary of new data which reveals key drivers of voting decisions to remain or leave in last summer’s referendum on the EU. [Link]

Money Managers

Hedge Fund Investor Letters Show Managers Are Stumped by Trump by Simone Foxman (Bloomberg)

A nice round up of the diverse perspectives held by hedge fund managers with respect to the new administration and what it means. [Link; auto-playing video]

A Quiet Giant of Investing Weighs In on Trump by Andrew Ross Sorkin (NYT)

This piece was probably the one we saw shared the most this week in our Twitter feeds; some perspective on what the new President means for his portfolio from Seth Klarman. [Link; soft paywall]

Tiger Hedge Funds Become Wall Street Prey by Juliet Chung (WSJ)

Stock pickers in general had a tough showing in 2016 but some of the hardest hit may have been the investors who trace their “family” tree back to the legendary Julian Robertson. [Link; paywall]

Pursuits

They Came to Ski Idaho Slopes. Now They’re Saving the Ski Resort. by Conor Dougherty (NYT)

An oral history of a community effort to make the first new US ski hill in a generation work. The best anecdote involves repo men in helicopters. [Link; soft paywall]

NLRB rules football players at private FBS schools are employees by Lester Munson (ESPN)

Big-time college football may be poised to change significantly as the National Labor Relations Board has ruled that private schools must treat their football players as employees. [Link]

Patriots Love ‘Heads’ in Coin Toss; Super Bowl Bettors Bank On It by Victor Mather (WSJ)

A European bookmaker is a taking a bath after taking prop bets without doing its due diligence. [Link; paywall]

Long Reads

Serial Killers Should Fear This Algorithm by Robert Kolker (Bloomberg)

A deep dive on murder data, clearance rates, and the uses of big data sets in helping police identify serial killers (as well as other murderers). [Link]

The New Face of American Unemployment by Jeanna Smialek and Patricia Laya (Bloomberg)

A portrait of Americans who are not employed and can’t find work, despite tighter labor markets and an expanded economy. [Link]

Youths

China’s Middle Class Anger at its Education System Is Growing by Lauren Teixeira (Foreign Policy)

Admissions quotas, regional rivalries, and parents desperate to make sure their children are given the opportunity to succeed. Welcome to China’s educational system. [Link]

Millennials across the rich world are failing to vote (The Economist)

A summary of voter turnout trends and their implications as the old start to outnumber the young significantly for the first time ever. [Link]

Trade

One Tiny Widget’s Dizzying Journey Shows Just How Critical Nafta Has Become by Thomas Black, Jeremy Scott Diamond and Dave Merrill (Bloomberg)

An illustrated example of how complex modern supply chains are; efforts to erect protectionist schemes around the world are playing with a very delicate system. [Link]

Infrastructure

As Trump Vows Building Splurge, Famed Traffic Choke Point Offers Warning by Charlie Savage (NYT)

An admittedly extreme but nonetheless informative study of behavior organizing itself around fixed assets, and the resulting creation of interest groups that can get in the way of broader efficiency. [Link; soft paywall]

Have a great Sunday!

Bespoke’s Quick-View S&P 500 Chart Book

The Bespoke Report – On The Riser – 2/10/17

And you thought politics was crazy! After record high temperatures in the Northeast on Wednesday, Thursday brought a freak snowstorm that dumped more than a foot of snow in the tri-state area, grounding pretty much everything to a halt. After digging out the summer clothes Wednesday, shovels were the order of the day on Thursday. Through the weather and everything else, though, the stock market continued to serve as a rock of stability, steadily rising in what was a relatively uneventful week in terms of the market. After a small decline to start the week, the S&P 500 saw four straight days of gains for its longest winning streak of the year.

In our Bespoke Report a few weeks back, we highlighted the S&P 500’s stair-step pattern of the last year and how the recent pattern looked to be in the middle stages of completing the tread of a stair. With each day that the sideways pattern went on, an increasing number of pundits were busy writing off the so-called Trump rally. It only seems fitting that just when doubts over the sustainability of the rally reached their highest levels since the election, the S&P 500 broke out of its recent range to new all-time highs and forming a new riser in the stair step pattern. Wherever the rally stops, nobody knows, but when it ends it will be at precisely the point when everyone who called an end to the rally decides that the rally “now has legs.”

If you’d like to read our thoughts on recent performance plus the rest of this week’s Bespoke Report newsletter, take advantage of our one-month Bespoke Premium free trial offer. Sign up now at this page.

Have a great weekend!

The Closer 2/10/17 – End of Week Charts

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model.

The Closer is one of our most popular reports, and you can sign up for a trial below to see it and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

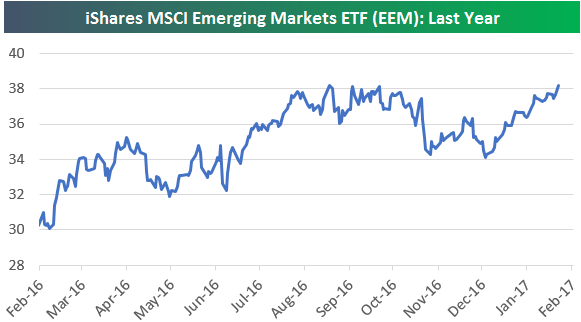

Emerging Markets Breakout?

After experiencing a big drop in the immediate aftermath of Trump’s victory last November, the iShares MSCI Emerging Markets ETF (EEM) has rallied from $34 up to $38+ over the last couple of months. Today the ETF is trading just 10 cents away from a new 52-week high, which is at $38.32. As shown in the chart below, from a one-year perspective, EEM looks like it has nice breakout potential.

Start a 14-day free trial to see more of our earnings season research.

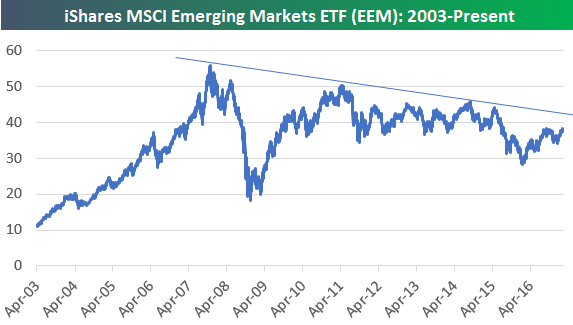

While the one-year chart looks bullish, the long-term chart for EEM going back to 2003 looks much less enticing. As shown below, the ETF — which is a way for US investors to gain exposure to the emerging markets asset class — has been making a series of lower highs for the last ten years now. To get above the top of the downtrend line that has formed, EEM needs to move into the mid-$40s, which is 20% higher from current levels.

Earnings Beat Rate Finishing Strong

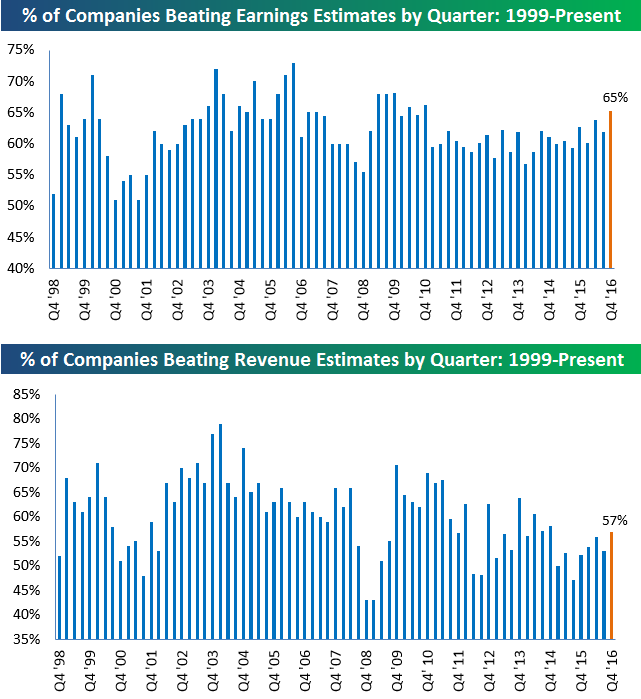

While guidance keeps getting worse and worse as earnings season progresses, the backward-looking earnings and revenue beat rates continue to come in strong. So far this earnings season, 65% of companies that have reported have beaten consensus analyst earnings per share estimates. As shown in the first chart below, 65% would be the strongest reading seen since Q3 2010 if it holds through the end of earnings season on February 21st (2/21 is when Wal-Mart reports — WMT marks the unofficial end to earnings season).

For top-line revenues, 57% of companies have beaten estimates this season. While not as strong as the bottom-line EPS beat rate, a revenue beat rate of 57% would be good enough for the strongest reading since Q4 2014.

Start a 14-day free trial to see more of our earnings season research.

Guidance Gets Worse and Worse

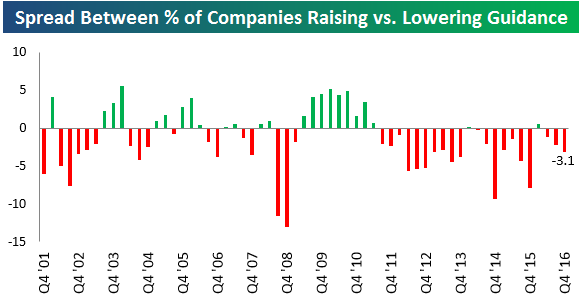

Early on this earnings season, companies were raising guidance at a higher rate than they were lowering guidance. But over the last two weeks, guidance has gotten worse and worse, and at this point the number of companies that have lowered guidance far exceeds the number of companies that have raised guidance. Below is a look at the quarterly spread between the percentage of companies raising guidance minus lowering guidance going back to 2001. As shown, the current reading of -3.1 percentage points would be the weakest seen in a year.

Start a 14-day free trial to see more of our earnings season research.