Global Equity Markets: A Ten Year View

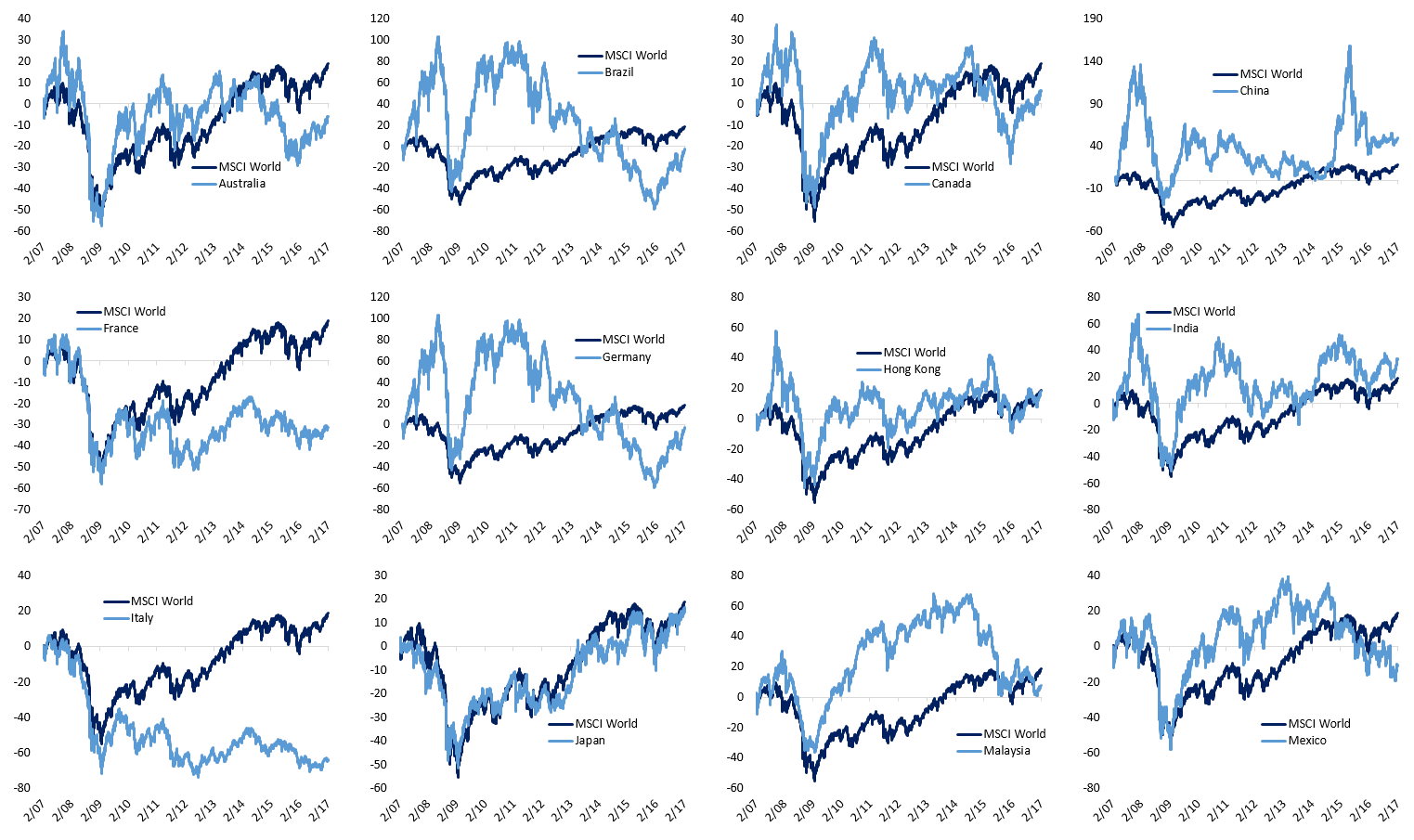

Over the last ten years, capital markets have seen a lot happen! The global financial crisis, a downgrade from AAA of the United States, Eurozone political risk emerging, a commodity boom and crash, EM outperformance and underperformance, Chinese stock bubbles and burstings…the list goes on. Below, we chart the percentage price change in 22 major global equity indices relative to the MSCI World index, starting from Valentine’s Day 2007. Each index is priced in USD, so currency effects can change outcomes significantly. For each country, we’ve chosen broad benchmark indices which for the most part are representative of large cap stocks in that country. The charts might seem pretty small, so if you need to zoom in you can just click the picture for a bigger view.

You’ll notice when looking through the charts that the MSCI World index has outperformed most countries over the last ten years. The US has clearly been the main driver of performance since it makes up roughly 35% of world market cap and has tripled the performance of the MSCI World. China, Taiwan, and India are the only other countries that have outperformed the MSCI World by a meaningful amount.

ETF Trends: Hedge – 2/14/17

Steel producers, solar stocks, retail, and a number of EM countries lead the pack in terms of recent ETF performance over the last 5 days. China, banks, and biotechs have also performed well. Laggards include gold miners, natural gas, long-term Treasuries, and FX ETFs owning currencies like euros, Swiss francs, and the Swedish krona.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Bespoke Stock Scores: 2/14/17

A Look At Bank and Broker Credit Default Swap (CDS) Prices

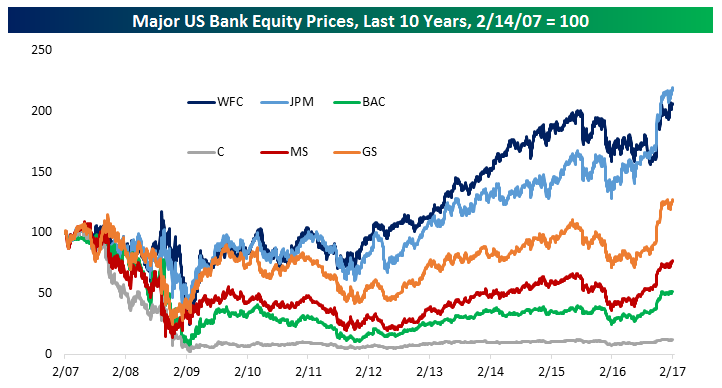

With new all-time highs for some of the largest US banks (JPM, WFC) and some investment banks (GS), we wanted to see if credit markets are saying the same thing as equity markets.

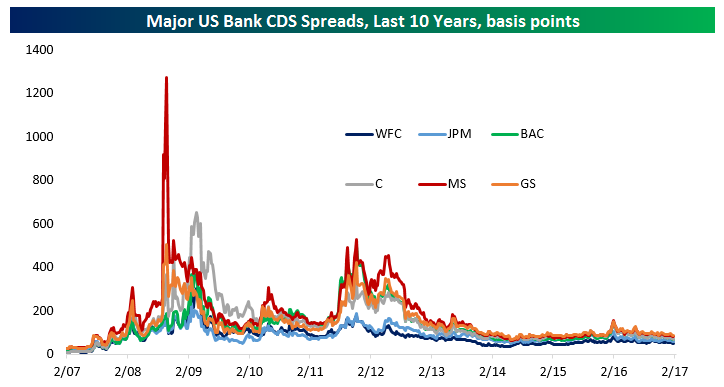

First, in the chart below, we compare the spread on US bank CDS (5-Year CDS) for some of the largest US banks by market cap: Wells Fargo, JP Morgan, Bank of America, Citi, Morgan Stanley, and Goldman Sachs. The higher the CDS spread, the more expensive it becomes to insure bank debt against a default. While it can be challenging to directly imply a probability of default from CDS prices (because they’re also sensitive to recovery value), higher CDS spreads are indicative of the market pricing in stress for a given credit issuer.

Want to see more of our market research? Start a 14-day free trial today.

As shown in the chart above, the highest spreads in recent history came in two waves: during the global financial crisis (2008-2009) and the Eurozone/US debt ceiling stress of 2011-2012. Since then, while CDS spreads have moved somewhat, there’s been very little change in credit spreads. The same can’t be true for equity prices, as we show in the chart below.

Wells Fargo, JPM, and Goldman are all at all-time highs. Others like MS, BAC, and Citi have rallied significantly off recent lows but are still well below the prices seen in 2007. In aggregate, the six stocks above have a combined market cap of $1,197 billion, versus a pre-crisis high water mark of $995 billion and a post-crisis low of $179 billion.

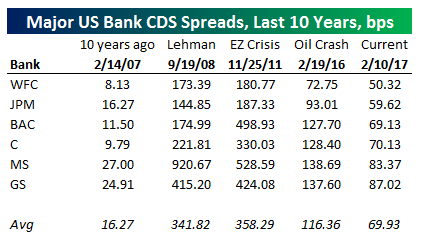

The last thing we wanted to show is the CDS spread of these major banks at various points in time. While the current CDS spread levels are dramatically lower than late 2008 (in the week Lehman went bankrupt) or the peak of the Eurozone crisis and US ratings downgrade, they’re higher than they were during the broad credit market excesses of the pre-crisis period. Even during the peak of oil market concerns and the broad financial market selloff in Q1 of last year, CDS spreads didn’t widen by very much.

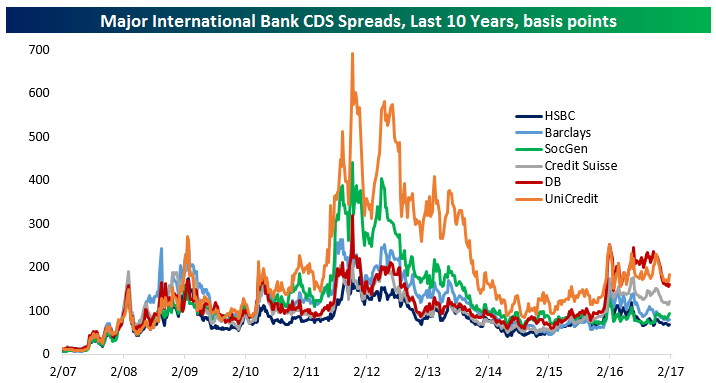

International banks aren’t necessarily in the same position. Below, we recreate the same CDS chart as above, but for six major international banks. Similar to US banks, spreads were extremely low in the pre-crisis period, and climbed steadily into the 2008-2009 period. We should note, however, that unlike the US, most of these banks saw spreads peak well after the crisis. Because five of the six we chose are primarily European (HSBC being the exception; headquartered in London its focus is more global), they were much more adversely impacted by the Eurozone crisis relative to the global financial crisis. Also, unlike US bank CDS, these credit indicators are still showing some stress after widening last spring. Lower profitability, lower capital levels, lower asset quality, and exposure to political shocks are all factors keeping these banks’ CDS spreads wider than their American peers.

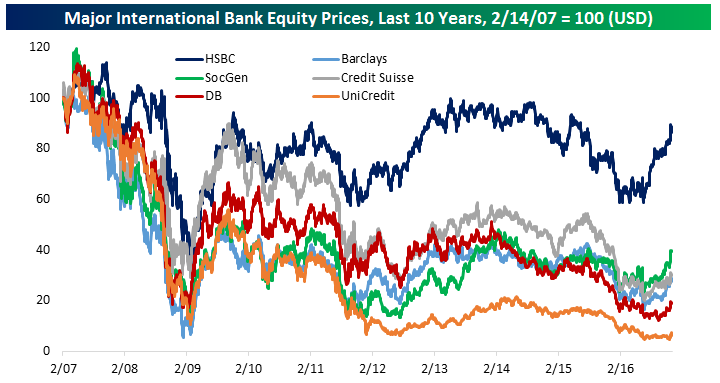

We should also point out that none of the six banks we’ve picked have seen their share prices make new all-time highs when priced in USD. Indeed, UniCredit (the largest Italian bank by assets) still has an equity price over 90% lower than it did pre-crisis. While HSBC has held up okay (from the perspective of a US investor), it’s well off post-crisis highs and remains dramatically lower than it traded in 2007. Again, concerns over profitability, capital, asset quality, and European politics are all risk factors that the European banks have to contend with which don’t have as large of an impact on US banks.

Want to see more of our market research? Start a 14-day free trial today.

Remarkably the average CDS spread for European banks we’ve highlighted is almost as high as it was the week Lehman Brothers failed! It was higher during the peak of global market concerns in Q1 of 2016, though bank CDS remain well below the spreads seen during the peak of the EZ crisis.

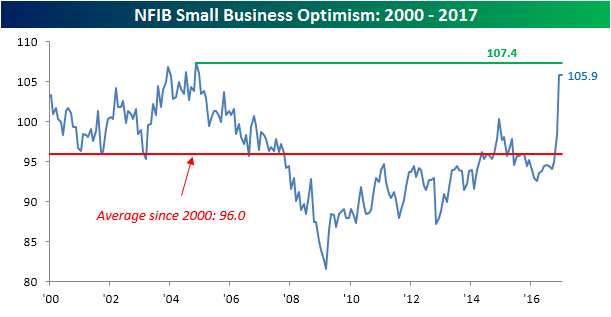

Small Business Optimism Maintains Post-Election Spike

This morning’s release of the NFIB’s monthly report on small business optimism came in higher than expected, rising to 105.9 from last month’s reading of 105.8 and above the consensus expectation of 105. While the index didn’t rise, it did hold on to the post-election surge, which is impressive on its own. At current levels, small business optimism is at the highest level since December 2004 and not far below the post-2000 high of 107.4. Going forward, the improved sentiment on the part of businesses should translate into better economic data. The key word here is should. Any signs that this improved sentiment is not translating into better data will be greeted harshly.

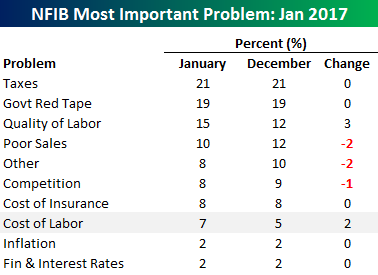

As we do each month, the table to the right summarizes the issues that small businesses consider to be the biggest problems they face in operating their businesses. As is always the case, the two issues topping the list this month are Taxes (21%) and Government Red Tape (19%), which account for a combined 40% of all responses. Next on the list is Quality of Labor, which was cited by 15% of respondents, up from 12% last month. Along with lower labor quality, business owners are also increasingly having problems with labor costs, as that was the only other problem to register a m/m increase. It’s just one month, but that is something to watch going forward. A continued increase could lead to upward pressure on wages.

As we do each month, the table to the right summarizes the issues that small businesses consider to be the biggest problems they face in operating their businesses. As is always the case, the two issues topping the list this month are Taxes (21%) and Government Red Tape (19%), which account for a combined 40% of all responses. Next on the list is Quality of Labor, which was cited by 15% of respondents, up from 12% last month. Along with lower labor quality, business owners are also increasingly having problems with labor costs, as that was the only other problem to register a m/m increase. It’s just one month, but that is something to watch going forward. A continued increase could lead to upward pressure on wages.

Bespoke CNBC Appearance (2/14/17)

Bespoke Co-Founder Paul Hickey appeared on CNBC’s Squawk Box this morning to discuss the market set up with the major averages trading at or right near all-time highs. To view today’s segment, please click on the image below. Want to see more of our market research? Start a 14-day free trial today.

The Closer — The Buck Versus Prices — 2/13/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss the valuation of the USD relative to the terms of trade index for the United States.

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

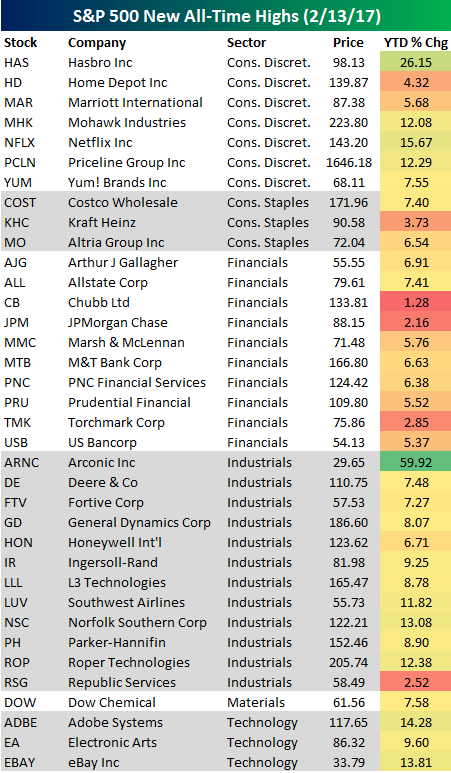

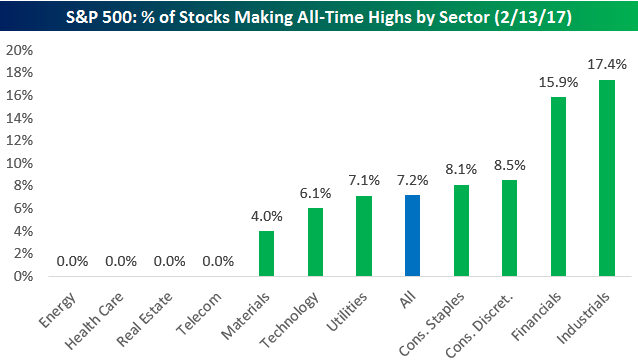

36 New S&P 500 All-Time Highs

Investors like to track the number of new 52-week highs in the S&P 500 (or any index for that matter) to measure underlying breadth of the index. With the S&P making another new all-time high today, we looked to see how many individual stocks in the index also made new all-time highs today. In total there were 36, or 7.2% of the index.

Below is a list of the 36 stocks that made new all-time highs today sorted by sector. Some of the key names on the list include Home Depot (HD), Netflix (NFLX), Costco (COST), Altria (MO), JP Morgan (JPM), Deere (DE), Dow Chemical (DOW), Adobe (ADBE), and even eBay (EBAY). Talk about a diversified basket of names.

Start a 14-day free trial to see more of our earnings season research.

The Industrials sector saw the highest percentage of new all-time highs today at 17.4%, followed by Financials at 15.9%. No stocks in the Energy, Health Care, Real Estate, or Telecom sectors made new all-time highs today.

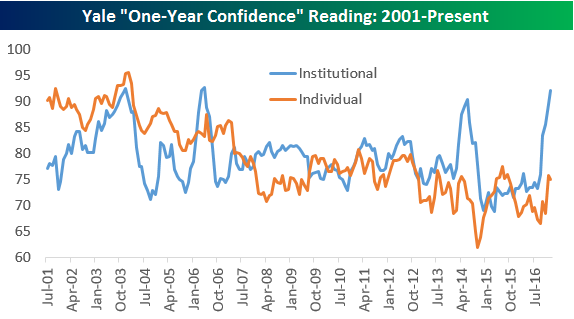

Interesting Trends in Yale Investor Confidence Surveys

Two of the most widely followed stock market sentiment indicators come from Investors Intelligence and the American Association of Individual Investors. The Yale “Stock Market Confidence” indices are much lesser known, but they provide key insights into investor sentiment trends nonetheless.

The Yale School of Management has been surveying both individual and institutional investors for nearly two decades now, and below we provide historical charts that track the four survey questions they ask investors each month.

The first survey highlighted below is Yale’s “one-year confidence” reading which asks investors if they think the stock market will be up one year from now. As shown, for institutional investors this reading had been trending lower for years now, but we’ve recently seen a massive spike in expectations. At the same time, sentiment on the part of individuals has only seen a minor pickup. In this regards, it appears that institutional investors have turned significantly more bullish since the election, while individual investors simply aren’t sold.

Start a 14-day free trial to see more of our investor sentiment research.

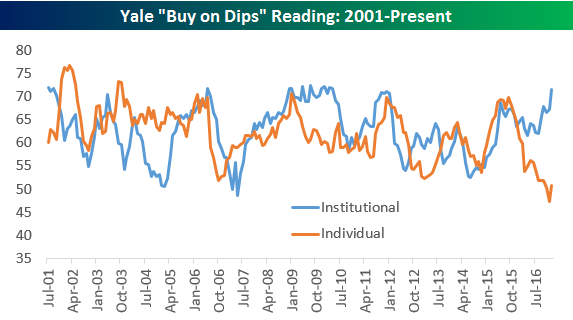

The second survey question asks investors how confident they are that the market will rise the day after a sharp fall. Yale calls it the “Buy on Dips” measure. Similar to the “One-Year Confidence” reading, we’ve seen a big divergence between institutional and individual investors for the “Buy on Dips” measure. Institutional investors have gotten very confident to buy on dips, while the reading for individual investors just recently hit new lows.

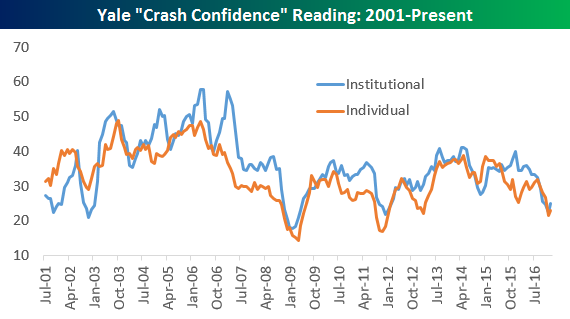

The third survey question asks investors how confident investors are that there will not be a stock market crash in the next six months. For this reading, the lower the number, the more concerned investors are about a crash, and vice versa. Interestingly, both individual and institutional investors have become less confident that there won’t be a stock market crash in the coming months. It’s not surprising to see the reading where it is for individual investors, but it is surprising to see that institutional investors are just as concerned about a stock market crash even though they’re much more bullish on the stock market based on the readings above.

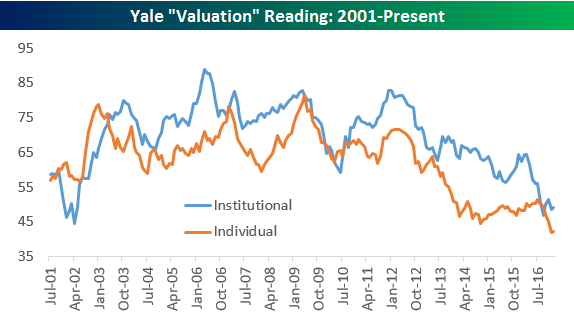

The final question asks investors how confident they are in the valuation of the market. Here, low readings mean investors don’t think the market is attractively valued, and vice versa for high readings.

As shown below, both individual and institutional investors have become less and less confident in the valuation of the market over the years, and the reading keeps hitting new lows for individual investors. The reading for institutional investors is extremely low as well.

Based on all four readings, individual investors seem less than enthusiastic about stocks, even after the election. For institutional investors, they’re bullish on the market, but at the same time, they don’t think it’s attractively valued and they’re relatively concerned about a crash. To us, it seems like institutional investors are basing their bullishness on hope.

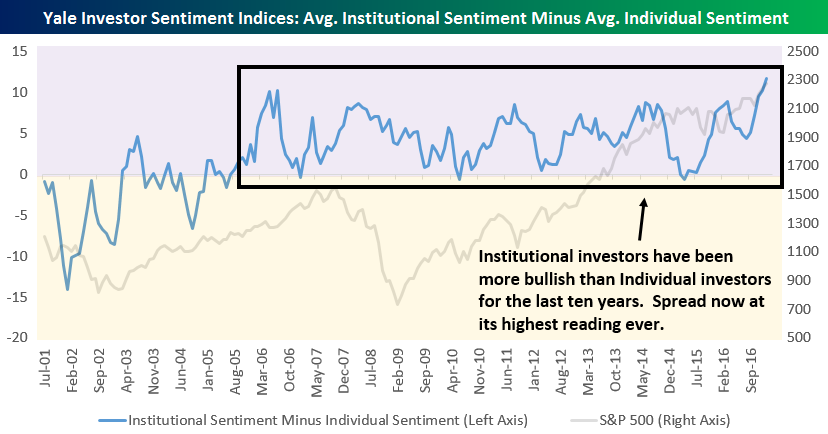

As highlighted above, institutional investors are much more optimistic about the stock market than individual investors. Remarkably, this is a trend that has been in place for more than ten years now!

In the chart below, we show the spread between the average institutional investor reading (based on all four of Yale’s survey questions) and the average individual investor reading. When the spread (blue line) is in positive territory, it means institutional investors are more bullish than individual investors. As you can see, the spread has essentially been in positive territory since 2005, and it just recently hit an all-time high. Over the years we’ve written a lot about the plight of the individual investor and the impact that two 50%+ drawdowns for the S&P 500 over the last 20 years have had on individual investor sentiment. It’s the old “fool me once, shame on you…fool me twice, shame on me” saying, and they don’t want to be burned again.

The current bull market is about to enter its 8th year, and we still haven’t seen individuals turn bullish on stocks. If a 200% rally over 8 years isn’t enough to draw them back in, we don’t know what will. At this point it looks as if the only remedy is going to be time — and it’s not going to be months or years, but maybe decades.