Bespoke Stock Seasonality: 9/25/17

Gas Prices Retreat From Hurricane Highs

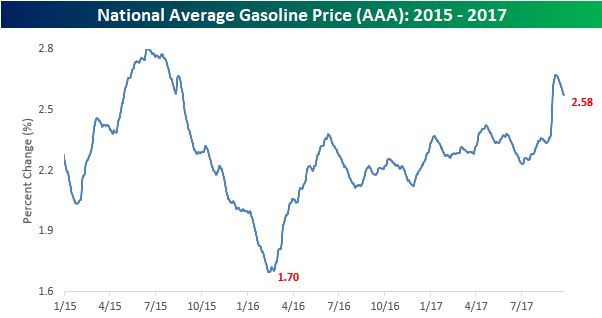

After a 15% spike from late August through early September, gas prices have started what has been a welcome retreat from their recent hurricane highs. According to AAA, the national average price of gasoline currently stands at $2.58 per gallon, which is down close to 4% from the recent high on 9/10 but still up 10% versus where it was before Hurrican Harvey started spinning in the Atlantic. Even after the recent spike, though, the national average price of a gallon of gas never quite made it to the highs we saw back in early 2015 before prices really began to crater and bottomed out at $1.70.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

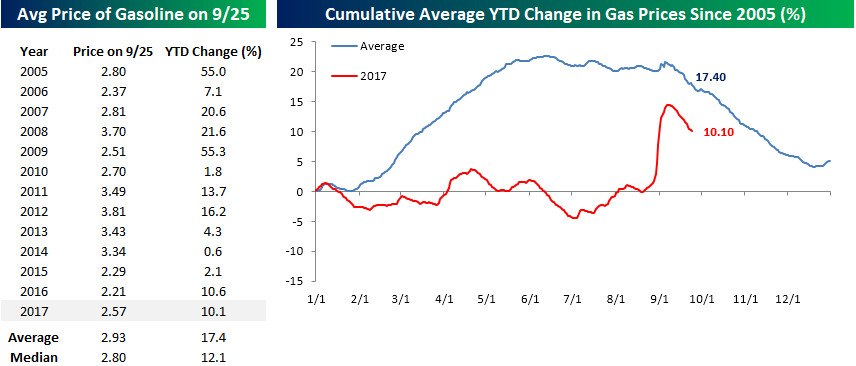

The table below compares the YTD change in gas prices this year to where prices were at the same point in prior years dating back to 2005. The recent surge in prices also wasn’t enough to push the YTD gain to an above average move. While prices so far in 2017 are up 10.1%, that is well below the average move of 17.4% for all years since 2005 and ranks as the sixth smallest YTD gain over the last thirteen years.

The chart to the lower right compares this year’s YTD change in gasoline prices and compares it to a composite of how average prices trend throughout the year going back to 2005. If the rest of this year follows the typical seasonal pattern, you can expect the recent pullback in gas prices to continue throughout the rest of the year.

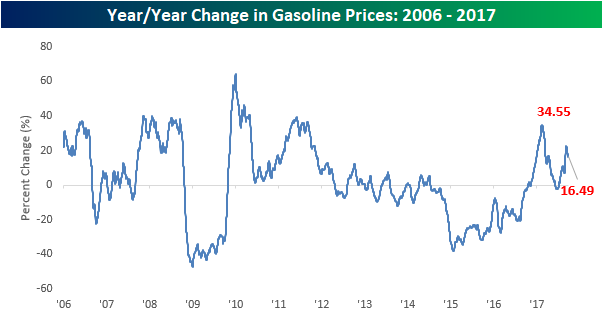

Finally, the chart below shows the y/y change in gas prices over time. Earlier this year, the y/y change in prices spike to 34.6% as the base effects from the 2016 lows reached their peak. In the most recent leg higher, the y/y change in prices peaked at just 16.5% highlighting how in the perspective of longer-term history, the most recent hurricane-induced surge in gas prices wasn’t that large.

B.I.G. Tips – Death by Amazon – 9/25/17

Cryptocurrencies, Bitcoin, and the Blockchain — Bespoke’s Explainer

Bespoke recently brought on Dan Ciotoli to be our Chief Software Engineer. (Learn more about the Bespoke team at our About page.) Dan has a developer/coding background, and he also knows the ins and outs of the cryptocurrency phenomenon quite well. We asked Dan to essentially write up a “Bitcoin for Dummies” report so that we could get a better understanding of this growing area of the financial world. (We’re not afraid to admit we don’t know much about it yet!) With the help of Bespoke Macro Strategist George Pearkes, Dan did a great job — great enough for us to decide to publish the report for Bespoke readers as well.

Please click the thumbnail below to read our Bespoke Briefs report on Cryptocurrencies, Bitcoin, and the Blockchain.

Gain access to all of Bespoke’s financial markets research with a 1-month trial for just $1.

Most Overbought and Oversold S&P Stocks

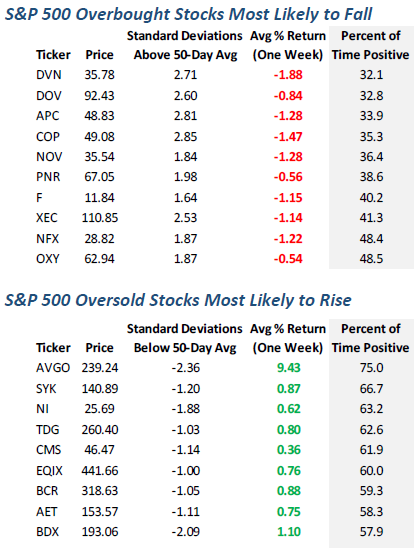

Every day in our Bespoke Morning Lineup, we publish a list of overbought and oversold S&P 500 stocks that are likely due to experience mean reversion based on historical trading patterns. In the table below, we show “S&P 500 overbought stocks most likely to fall” and “S&P 500 oversold stocks most likely to rise.”

After the close each day, we gather a list of the most overbought stocks in the S&P 500. We then look at each stock that is overbought and see how it has performed over the next week when it has been at similarly overbought levels. The names that make our daily table in the Morning Lineup (shown below) are the ones that typically trade the weakest when they get this overbought. For example, Devon Energy (DVN) is currently trading overbought by 2.71 standard deviations above its 50-day moving average. When it has been this overbought in the past, it has averaged a decline of 1.88% over the next week with positive returns 32.1% of the time.

The second table below shows the stocks that have historically traded the best over the next week when they have been at similarly oversold levels. AVGO is currently trading 2.36 standard deviations below its 50-day moving average. When it has been this oversold in the past, it has averaged a one-week gain of 9.43% with positive returns 75% of the time.

Gain access to the most overbought and oversold stocks in Bespoke’s Morning Lineup for just $1!

September Rotation Out of Winners Into Losers

The S&P 500 is currently up more than 1% during the month of September, and if it can simply finish the month in the green, it will be considered a big win given that September has historically been the worst month of the year for stocks.

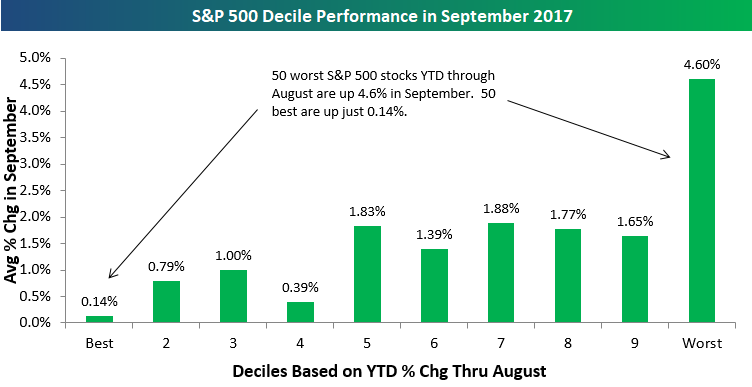

What’s interesting about the market’s performance this month is the underlying stocks that are driving major indices higher. We broke the S&P 500 into deciles (10 groups of 50 stocks each) based on year-to-date performance through August to see how the year’s biggest winners and losers heading into September are doing this month.

As shown below, it’s 2017’s biggest losers that have posted the biggest gains in September, while the year’s biggest winners have taken a breather. The 50 S&P 500 stocks that were performing the worst on a YTD basis through August are up 4.6% in September, while the 50 best-performing stocks YTD through August are up just 0.14%.

These stats show that momentum traders are likely underperforming in September. If you stuck your neck out and bought the most beaten down names, you’re likely having a banner month.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Bespoke Brunch Reads: 9/24/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Politics

The insane news cycle of Trump’s presidency in 1 chart by Stef W. Kight (Axios)

Regardless of your feelings about the President, you’re going to find the chart featured in this article remarkable, detailing the swings in attention that whip through the public discourse on a daily basis. [Link]

Tensions Rise in Spain as Catalonia Referendum Nears by Raphael Minder (NYT)

A referendum on independence has been scheduled in Catalonia by a narrow majority of independence-focused local representatives over the objections of the central government and the country’s constitutional court, leading to police action. [Link; soft paywall]

Labor Markets

For Holiday Hires, It’s Already Beginning to Look a Lot Like Christmas by Jennifer Smith (WSJ)

Retailers hoping to staff up ahead of the all-important holiday season are having a hard time finding willing workers: “it’s the tightest labor market we’ve ever seen”. [Link; paywall]

Not Driving to Work Is the Hot New High-End Job Perk by Justin Fox (Bloomberg)

White collar workers are increasingly avoiding commutes by working from home. [Link]

Credit Markets

Juiciest Junk Bonds Going Extinct as Autumn Calls Approach by Cecile Gutscher (Bloomberg)

Declining spreads on high yield credit mean that many bonds that give borrowers the option to call debt in have coupons well above what the market would offer if the bonds were re-issued, leading to a wave of calls. [Link]

U.S. Leveraged Loan Repricings Get Boost from Issuers Returning for Round Two (Leveraged Loan)

A nice round up of the strength in the very strong leveraged loan market, with numerous issuers re-borrowing at lower rates or more favorable terms. [Link]

Big Reads

Demographics will reverse three multi-decade global trends by by Charles Goodhart and Manoj Pradhan (BIS Working Papers)

A huge read on the implications of a reversing global labor supply shock that has pushed inflation lower and inequality higher over the past several decades. [Link; 47 page PDF]

Time to Change Your Investment Model by Feng Gu and Baruch Lev (CFA Institutes Perspectives)

It’s less helpful to figure out what corporations will earn, with the value of “strategic assets” (the facets of the business that create a durable competitive advantage). [Link; 11 page PDF]

Surprise Pregnancy

Amazon sends accidental gift email to shoppers due to glitch by Jeffrey Dastin (Reuters)

A technical glitch sent emails to customers telling them they’d gotten a baby registry gift; this came as a big surprise to many who had no new kids on the way! [Link]

Potpourri

How this entrepreneur went from a crack addict to a self-made multimillionaire (CNBC)

The story of the MyPillow. Note: not a “read”, but definitely an amazing story worth watching. [Link; auto-playing video]

What Hurricanes Can Dredge Up: Coffins, Canoes and Creatures by Jacey Fortin (NYT)

A catalogue of the strange, horrifying, and remarkable objects and animals that wash up following huge storms. [Link; soft paywall]

Sports

Sliding NFL ratings could throw networks for a loss by Jonathan Berr (CBS)

With NFL viewership down 14% YoY to the lowest level since 2009, major cable properties are in a tough spot having paid up huge for broadcast rights. [Link]

How Gennady Golovkin managed to eat this shot continues to astound us by Darragh Murphy (Joe)

There are very, very few people on the planet that can take a Canelo overhand right on the chin and keep at it, but that’s just one example of Golovkin’s ability to take a pounding and keep coming. [Link]

Have a great Sunday!

The Closer: End of Week Charts — 9/22/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by joining Bespoke Institutional at our special $1 introductory rate!

The Bespoke Report — 9/22/17

S&P 500 Quickview Chartbook: 9/22/17

Each weekend as part of our Bespoke Premium and Institutional research service, clients receive our S&P 500 Quick-View Chart Book, which includes one-year price charts of every stock in the S&P 500. You can literally scan through this report in a matter of minutes or hours, but either way, you will come out ahead knowing which stocks, or groups of stocks, are leading and lagging the market. The report is a great resource for both traders and investors alike. Below, we show the front page of this week’s report which contains price charts of the major averages and ten major sectors.

To see this week’s entire S&P 500 Chart Book, sign up for a 14-day free trial to our Bespoke Premium research service.