Dollar Rally Yet to Impact Stocks

As we noted in a post last Friday (and in today’s Chart of the Day), the dollar has staged an impressive bounce off of its early September lows. You can see the rally and break of its downtrend line in the chart of UUP below.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

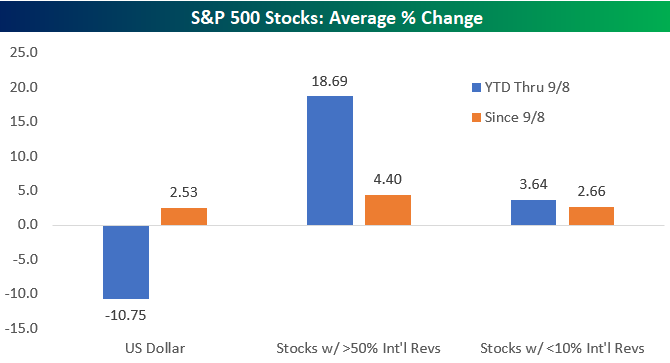

The dollar fell 10.75% from the start of the year through its closing low on September 8th. That’s a massive decline, and it impacted stocks significantly. S&P 500 companies that generate more than 50% of their revenues outside of the US averaged a gain of 18.69% YTD through September 8th. Companies that generate less than 10% of their revenues outside of the US only gained an average of 3.64% over the same time period.

Interestingly, though, the dollar’s 2.53% rally since 9/8 has yet to impact S&P 500 companies based on revenue exposure. “Domestic” companies that benefit from a strong dollar are actually underperforming companies with heavy international exposure since the dollar’s current rally began. Stocks with greater than 50% international revenues are up 4.4% since 9/8, while stocks with less than 10% international revenues are up just 2.66%. It looks like the “international” momentum that’s been in place all year is proving difficult to break. Or investors simply don’t think the dollar’s current rally will have much staying power. Regardless, positioning based on revenue exposure appears to be a bit out of whack over the last month. We’d bet that “domestics” start to gain steam soon if the dollar continues to move higher.

Bespoke’s International Revenues Database allows you to find the international revenue exposure for every stock in the S&P 500 and Russell 1,000. It’s available to Bespoke Premium and Bespoke Institutional members, which you can try out here.

ETF Trends: US Indices & Styles – 10/09/17

Bespoke Stock Seasonality Report: 10/9/17

Chart of the Day: Dollar Not Done

The Bespoke Report — As Good As It Gets?

Bespoke Brunch Reads: 10/8/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Economic Long Reads

Own-Account IT Equipment Investment by David M. Byrne, Carol A. Corrado, and Daniel E. Sichel (FEDS Notes)

An excellent analysis of the under-counting of firms’ investment in information technology infrastructure which often takes place off-market, which plausibly amounts to roughly $50bn per year. [Link]

Labour repression & the Indo-Japanese divergence (pseudoerasmus)

Economic historian Pseuderasmus is at it again, dissecting the two different paths travelled by the textile sectors in Japan and India and how labor relations may have played a role. Be warned: while there are lots of charts and graphs, this post comes in over 16,000 words, so make sure you’ve got a fresh coffee! [Link]

Bottlenecks

We’re Going to Need More Lithium by Jessica Shankleman, Tom Biesheuvel, Joe Ryan, and Dave Merrill (Bloomberg)

While the next dozen years of exploding demand will drain less than 1% of the world’s proven lithium supply, more mines built faster are needed to actually get the metal out of the ground and into batteries. [Link]

The FDA Is Approving Drugs at a Staggering Pace by Caroline Chen and James Paton (Bloomberg)

Twice as many drugs will be approved this year compared to last year as FDA Commissioner Scott Gottlieb (a Trump appointee) cranks out approvals. [Link; registration required]

Investing

22 timeless lessons for our 22nd month by Andrew Walker (Yet Another Value Blog)

This satire will bring smiles to the faces of many frustrated investors. [Link]

Politics

The Media Has A Probability Problem by Nate Silver (538)

Part of the much longer and broader “The Real Story of 2016” series (link), this particular piece focuses on the failings of the media in interpreting data and understanding statistics, an area where Silver has some expertise. [Link]

International Observers Worry Kenya May Be Spiraling Out of Control (Vice News)

Earlier this fall the Supreme Court in Kenya annulled an election filled with irregularities, a huge step forward in terms of institutions for the country. Since, street protests ahead of October 26th’s repeat vote have gotten out of hand. [Link]

Marketing

The Millennial Walt Disney by Anna Wiener (NYMag)

As perfect a distilling of the alleged zeitgeist – and we do mean that skeptically – as has ever been written, featuring the terms “elusive concept with a concrete aesthetic”, “considers herself an old soul”, and “disturbingly Millennial” in the first two paragraphs. [Link]

Brexit

How gold takes the shine off Britain’s trade balance by Ed Conway (Sky)

A side effect of having large gold storage facilities is that sometimes fleeing investors (moving gold elsewhere) look like trade exports. [Link]

Life

The New Midlife Crisis by Ada Calhoun (Oprah)

Middle aged women are feeling crushing lack of satisfaction, frustration, and anxiety in a way that breaks many stereotypes about the midlife crisis, who suffers it, and why. [Link]\

Insecure overachiever? You are perfect for the job by Andrew Hill (FT)

The constant desire for validation and winning makes the products of high pressure undergraduate programs and Type-A helicopter parents ideal grist for the mill of consulting or finance companies. [Link; paywall]

Bitcoin

Goldman Sachs Explores a New World: Trading Bitcoin by Paul Vigna, Telis Demos, and Liz Hoffman (WSJ)

The “vampire squid” is headed for the land of crypto currency, in a sign of both increasing legitimization of the space and increasing competition around its operations. [Link; paywall]

Bitfinex Tokens Let Users Hedge Bets On Bitcoin SegWit2x Hard Fork by William Suberg (The Cointelegraph)

Bitcoin’s code is forking (that is, there will be two forms of bitcoin going forward), and a cryptocoin exchange has created a way to speculate on how that fork goes. [Link]

Sports

Football’s decline has some high schools disbanding teams by Ben Nuckols (AP)

With high school football participation dropping 3.5% nationally over the last 5 years, some schools are finding it challenging to get enough bodies in pads to keep teams operating. [Link]

ESPN Enters Incomprehensible Partnership With Incomprehensible Media Company by Tom Ley (Deadspin)

We have nothing for you other than the headline here, we genuinely don’t understand what ESPN is doing here. [Link]

No Excuses: Jerry Rice Is Playing Like a Champion by Kevin Clark

“Uh, Jerry Rice crashed our wedding”. [Link]

The Astros: Baseball’s Great Experiment Is Set to Pay Off by Jared Diamond (WSJ)

Sometimes you need to tear everything down to prove a wacky Sports Illustrated cover correct. [Link; paywall]

Have a great Sunday!

The Closer: End of Week Charts — 10/6/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by joining Bespoke Institutional at our special $1 introductory rate!

S&P 500 Quick-View Chartbook – 10/6/17

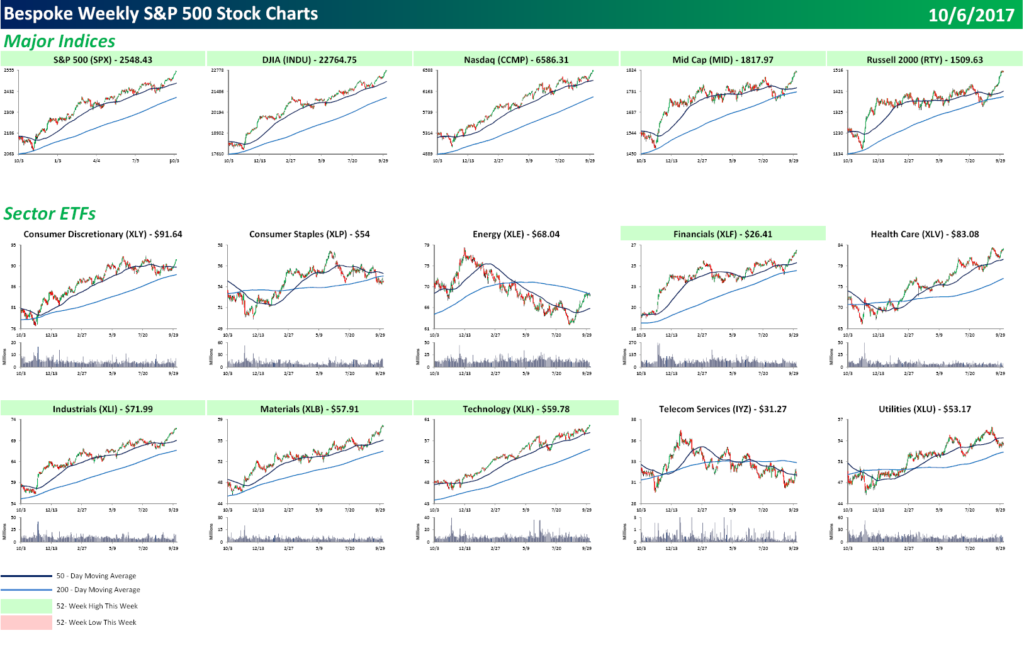

Each weekend as part of our Bespoke Premium and Institutional research service, clients receive our S&P 500 Quick-View Chart Book, which includes one-year price charts of every stock in the S&P 500. You can literally scan through this report in a matter of minutes or hours, but either way, you will come out ahead knowing which stocks, or groups of stocks, are leading and lagging the market. The report is a great resource for both traders and investors alike. Below, we show the front page of this week’s report which contains price charts of the major averages and ten major sectors.

To see this week’s entire S&P 500 Chart Book, sign up for a 14-day free trial to our Bespoke Premium research service.

Dollar Staging a Coup

After a performance that was putting it on pace for its worst year in a long time, the dollar has seen quite a bounce recently as prospects for a December rate hike increase and the US economy picks up steam. After a YTD decline of over 10% through early September, the Bloomberg US Dollar Index has rallied nearly 4% in less than a month! What’s really notable about the bounce is that the Dollar Index has not only broken back above its 50-DMA (a level it didn’t trade above all summer), but it has also broken the downtrend range that it had been stuck in all year long. That’s an encouraging sign, even if the Dollar Index is still down over 7% on the year.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

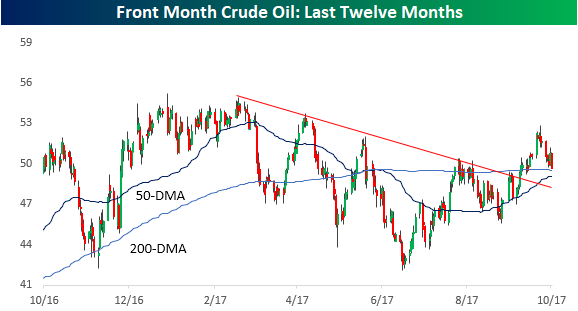

The recent rally in the dollar has also helped to put the breaks on the recent rally in crude oil, which is good for the consumer. After nearly kissing $53 in late September, crude has been under a bit of pressure in the last two weeks and dropped back below $50 earlier today. Anything that keeps some pressure on oil prices, we’ll take.

The Closer — Transportation, Factories, & Trade — 10/5/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review two data releases today from the US Census, along with national transportation activity statistics and the relative performance of the US and Canadian equity markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!