Chart of the Day: Big Blue’s Big Move

Fixed Income Weekly – 10/18/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we demonstrate how significant the Fed’s tightening cycle is for the shape of the yield curve.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Global Macro Dashboard — 10/18/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The Closer — Breadth, Industry, Capital Flows — 10/17/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review breadth in below-the-headline US indices, update tracking of industrial production including the impact of Hurricane Harvey, and discuss August international capital flows data from the US Treasury.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

ETF Trends: US Indices & Styles – 10/17/17

Chart of the Day: Investors Becoming More Rational

You Gotta Be In It To Win It

Anyone who has ever attempted to make money trading has learned the lesson all too quickly that timing is everything. Some of the world’s greatest investors have lost nearly everything because their timing of the market was just slightly off. Without getting into individual names, we saw this among some of the greatest value investors in the late 1990s when they bet against internet stocks only to throw in the towel just before the peak, and then more recently in 2011 when some big-name investors went long European sovereign debt only to cover just before yields peaked leading to one of the biggest bond market rallies of our lifetimes. In both cases, the thesis was spot on, but because they were just a little too early, they ended up with nothing (literally in some cases) to show for it.

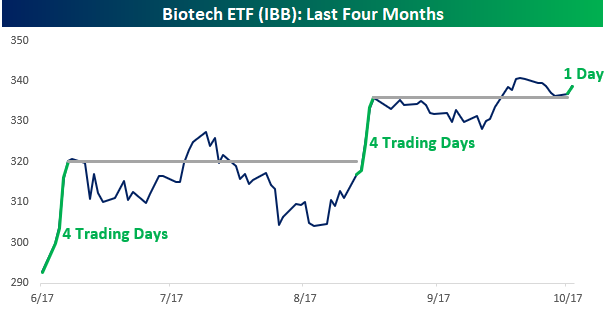

While the recent performance of biotech stocks hasn’t exactly been monumental, it does provide another example of the importance of timing and the market. With a gain of over 15% in the biotech ETF (IBB) since mid-June, just about any trader will tell you that it’s been a good few months for the group. However, looking at how that performance has been distributed over the last four months, all of the gains have come over the course of just nine trading days. The first leg of the rally came in mid-June when IBB surged 9% in four trading days. For the next two months, IBB did nothing until late August when another four-day rally pushed the ETF higher by 6%. Then from the start of September through yesterday, IBB did nothing until rallying modestly today. So yes, the last four months have been a very good time to be long the biotech group, but if you were late getting in, or tried to time the moves by getting in and out, there’s a good chance you’ve missed out on most of the move.

CLICK HERE to learn about Bespoke’s premium research options!

Shorts Piling Into Equifax (EFX)

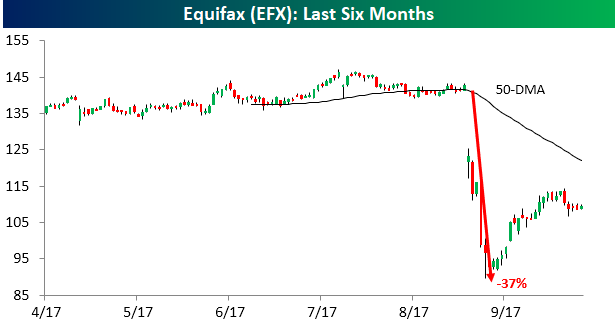

What happens when a company entrusted with the personal information of US consumers gets hacked and exposes the names, addresses, Social Security numbers, birth dates, and even drivers license numbers of just about every American who has a credit report? Well, for starters, your stock price goes down, and that’s exactly what happened to the price of Equifax after news of the massive security breach first broke in early September. From the close on 9/7 to its intraday low on 9/14, shares of EFX plunged more than 37%.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

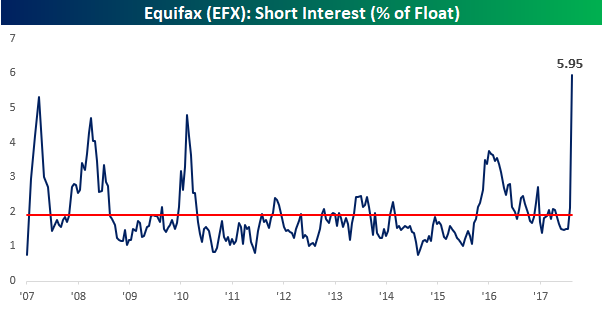

While they have recovered a bit of that decline in the last month, short-sellers have been piling into the stock, sending its short interest as a percentage of float up to just under 6%. While 6% may not sound like a lot when there are other stocks that have more than half of their float sold short, with its historically stable business, EFX is not the type of stock that typically attracts short-sellers. For EFX, 6% short interest is a extremely high. Looking back over the last decade, short interest levels for EFX have never been as high as they are now after the security breach. Not even during the financial crisis. One could easily argue that for Equifax at least, the latest security breach is a much more negative event than the financial crisis, so the high level of short interest may very well be warranted. The company is far from out of the woods. What the high short interest level does provide, though, is some degree of cushion against further weakness. With the stock already down over 25% and 6% of its outstanding shares sold short, eventually, those shares will have to be covered.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

Bespoke Stock Scores: 10/17/17

19K, 20K, 21K, 22K, 23K…

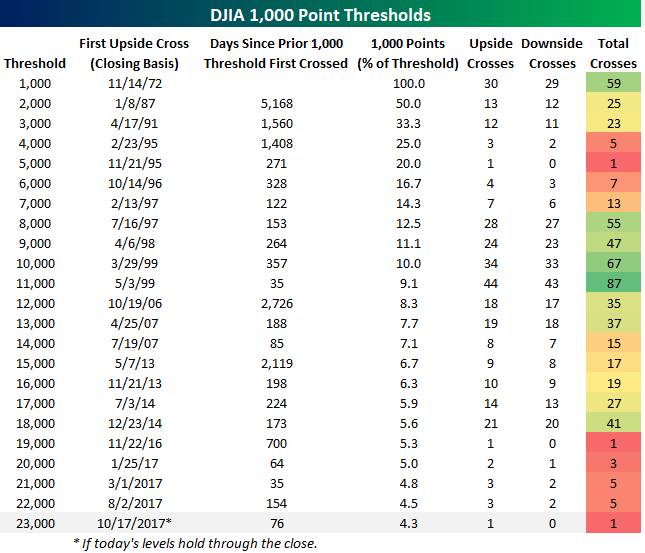

The thousand point thresholds continue to drop like flies these days. With the caveat that a thousand points becomes an increasingly small percentage of the overall index as prices rise, the DJIA just crossed its fifth 1,000 point threshold since Trump’s election last November. The table below shows the date that the DJIA has first crossed each 1,000 point threshold on a closing basis since it first closed above 1,000 back on 11/14/72. For each 1,000-point threshold, we also show how many days transpired between that cross and the prior 1,000 point threshold, the percentage that each 1,000-point threshold represents of the index’s price, and then how many upside and downside crosses the DJIA has had with each level.

Since the election, the DJIA has crossed five 1,000-point thresholds, and with each one, there has been very little in the way of looking back. For instance, once the DJIA crossed 19,000, it never closed back below that level. Once 20,000 was crossed, it only closed below it again once, while 21,000 only saw two subsequent closes below. In looking for comparable periods, the current period is somewhat similar to the late 1990s, when the DJIA crossed several 1,000-point thresholds in very short order. In the current period, these levels have been coming and going a lot faster, but again, it’s important to remember that they represent a much smaller percentage of the overall index’s value than the levels that were crossed in the 1990s. Finally, while it may seem as though the move from 22K to 23K was quick, at 76 calendar days (if that level holds between now and the closing bell), it was longer than the time that elapsed between 20K and 21K (35 days) as well as the time it took to get from 19K to 20K (64 days).

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!