B.I.G. Tips – 2017 Sector and Asset Class Correlations

Housing Starts and Home Builder Stocks Diverge

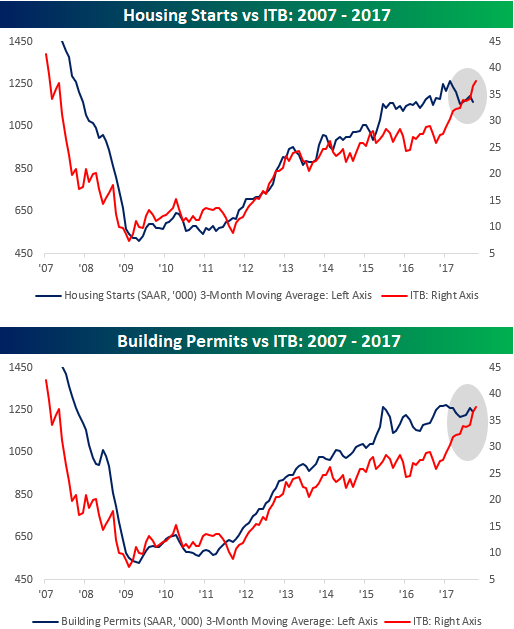

Throughout the bust and the ensuing recovery in residential housing, the performance of homebuilder stocks has closely tracked the trend in Housing Starts and Building Permits. Below, we highlight this relationship by comparing the iShares Home Construction ETF (ITB) to the three-month moving average of Housing Starts and Building Permits. The relationship between the two is so strong that the correlation coefficient between monthly Housing Starts and the closing prices of ITB is 0.89, while the correlation of ITB with Building Permits is even stronger at 0.91. For the sake of reference, a perfect correlation would be a reading of +1.

While the historical relationship between the two has been strong, we would note that in the last year both Starts and Permits have been drifting lower even as homebuilder stocks have surged. In 2015, we saw a divergence in the opposite direction where Starts and Permits outpaced the gains in homebuilder stocks. In that period, the homebuilder stocks eventually caught up, so perhaps we are just seeing the opposite pattern now. The two haven’t always tracked each other step for step, but the fact that the builders have rallied so much this year even as Starts and Permits have declined should be monitored for any signs of that weakness finding its way into the homebuilder stocks.

Chart of the Day: Capex Turning Up? Consider MYR Group (MYRG)

Philly Fed Positive For 15th Straight Month

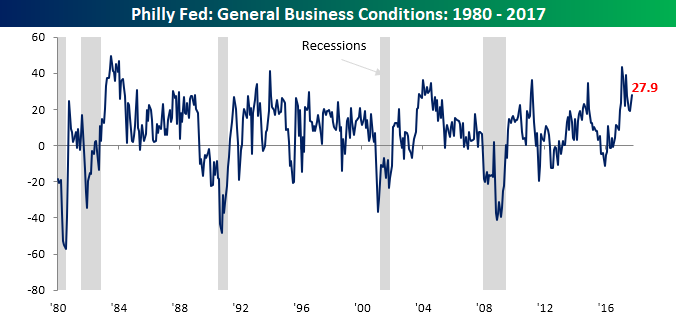

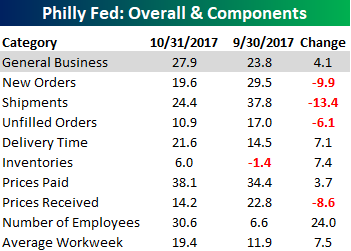

Manufacturing activity in the Philadelphia region continues to chug along as the Philadelphia Fed’s survey of manufacturing activity came in higher than expected for October rising to 27.9 compared to forecasts for a reading of 20. October’s reading represents the 15th straight month that manufacturing activity showed growth and is the strongest monthly reading since May. Looking at the chart below, the current period of consistent strength that we have seen has not been too common throughout the history’s survey.

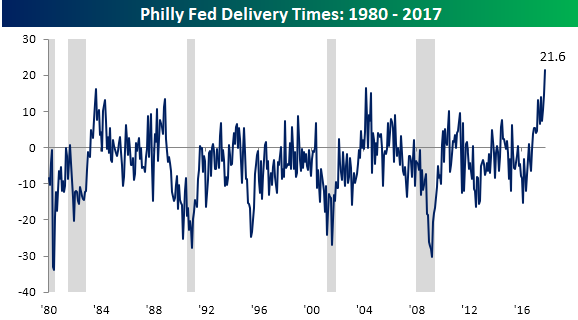

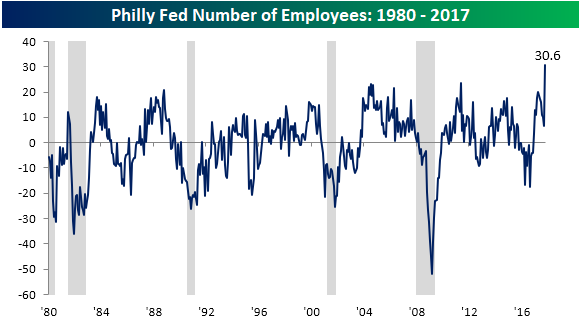

The table below breaks down this month’s report by each of its subcomponents and the results were mixed. While New Orders, Shipments, Unfilled Orders, and Prices Received all declined, we saw monumental increases in Delivery Time and Number of Employees. Both of these components are currently at record high levels in the history of the survey dating back to 1980 (see charts below).

the Bespoke 50 — 10/19/17

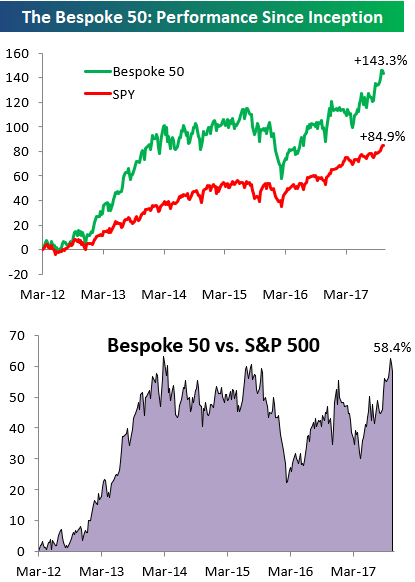

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 58.4 percentage points. Through today, the “Bespoke 50” is up 143.3% since inception versus the S&P 500’s gain of 84.9%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

New Lows For Jobless Claims

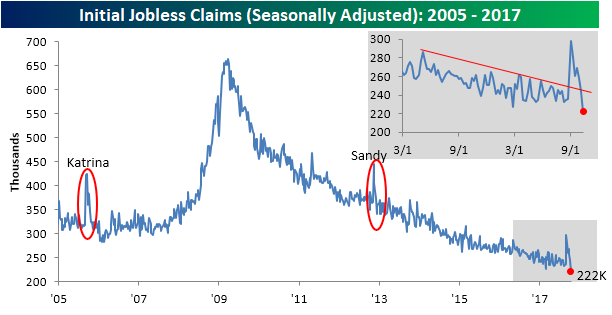

While there is still a ton of rebuilding and cleanup left in the aftermath of this Summer’s hurricanes, jobless claims have already put the impact of those storms in the rearview mirror. In this week’s report, first-time claims fell to an incredibly low level of 222K compared to expectations for a level of 240K. The last time claims were this low was all the way back in 1973! While the speed with which claims have already reverted back to their pre-hurricane trend seems quick, we would note that following hurricanes Katrina in 2005 and Sandy in 2012, claims saw similar (although larger) spikes, but quickly reverted back to their pre-storm levels as well.

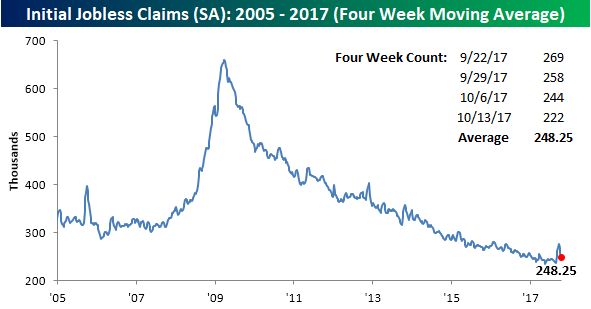

While weekly claims are at new multi-decade lows, the four-week moving average has naturally been slower to respond. In this week’s report, the four-week moving average dropped from 257.75K down to 248.25K. That’s still more than 10K above the cycle low back in May, but with a reading of 269K dropping off next week and then 258K falling off after that, the four-week moving average is set to sink like a stone.

On a non-seasonally adjusted (NSA) basis, claims fell this week down to 204.8K from 229.3K. That’s more than 120K below the average for the current week of the year dating back to 2000, and you have to go back to 1973 to find a week where NSA claims were lower at this time of year.

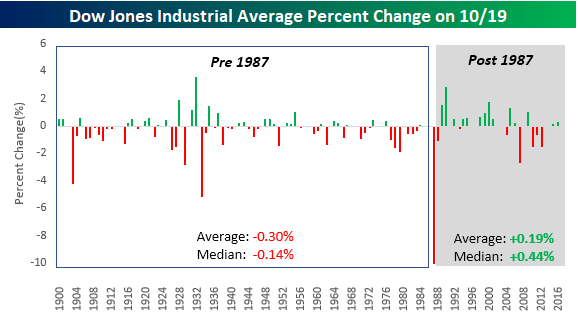

So Much For the Scars of 1987

Today marks the 30th anniversary of the 1987 Black Monday Crash, an event that had a major impact on investor psychology for a generation and beyond. While it would be completely irrational, given human nature, one would think that the 22% decline in the DJIA on 10/19/87 would cause investors to become a little more risk averse at this time of year. The increase in articles about the “Crash of ’87” every October has to make some investors uneasy.

Interestingly enough, looking at the historical performance of the DJIA on October 19th shows an interesting trend. In the years from 1900 through 1986, the DJIA averaged a one-day decline of 0.30% (median: -0.14%) on 10/19 with positive returns just 43% of the time. In the 30 years since the crash, however, the DJIA has averaged a gain of 0.19% (median: 0.44%) with positive returns two-thirds of the time. So much for the scars of 1987.

The Closer — Housing And Energy — 10/18/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we recap monthly housing starts numbers and this week’s petroleum market report from the EIA.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

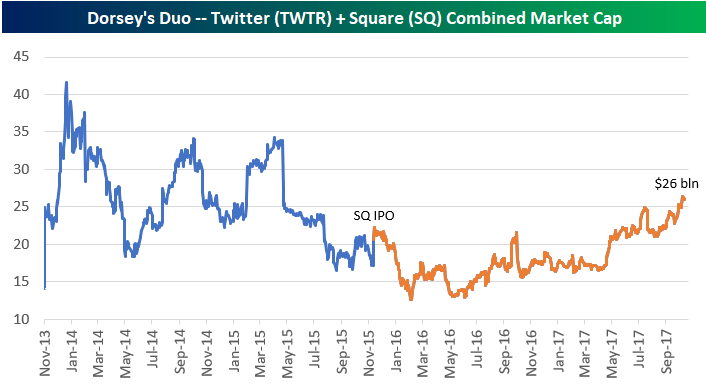

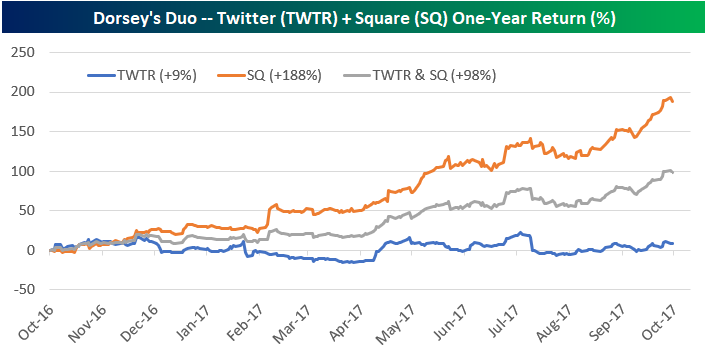

Dorsey’s Duo Not So Bad

Twitter (TWTR) CEO Jack Dorsey takes a lot of heat for the company’s weak performance, especially since he’s juggling the running of two multi-billion dollar companies at the same time. Along with running Twitter, Dorsey is the CEO of Square (SQ) as well. But you don’t hear people talk about how well Square (SQ) is doing nearly as much as you hear people talk about how poorly Twitter is doing. If you combine the performance of both companies, Dorsey is doing just fine. (Don’t tell that to Twitter shareholders!)

As shown below, while Twitter (TWTR) is down 30% from its IPO back in late 2013, Square (SQ) is now up 263% since its IPO in late 2015.

CLICK HERE to learn about Bespoke’s premium research options!

Below is a chart showing the combined market caps of both Twitter and Square. Note that both companies have market caps that are very similar at the moment, but Twitter still has a slight edge. Twitter is currently worth about $13.5 billion while Square is at $12.5 billion. But only Square has been adding value over the past couple of years.

As shown below, over the last year, if you “invested in Dorsey” and owned an equal amount of Twitter and Square, you’d be up nearly 100%. There’s not much wrong with that kind of return!

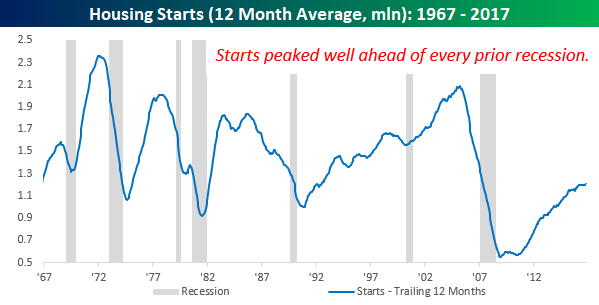

Housing Starts and the Economic Cycle

Wednesday’s data on Housing Starts and Building Permits disappointed consensus expectations, and while some of the declines can be chalked up to the hurricanes in the South, we would note that Starts in both the Northeast and Midwest regions also showed declines. One silver lining to this month’s data was that in both the cases of Housing Starts and Building Permits, the majority of the weakness was in multi-family units, which tend to be more volatile.

Residential construction is a big part of the US economy, so naturally, an uptick or slowdown in activity is going to have an impact on the business cycle. The chart below compares historical levels of Housing Starts on a 12-month average basis to expansions and recessions since 1967. It’s pretty easy to see in the chart that peaks in Housing Starts tend to occur late in the cycle, while troughs are formed right after the recession ends. What’s important to note, however, is that even after the peak level of Housing Starts for a given cycle, a recession doesn’t usually begin for at least another year.

So where do things stand right now with Housing Starts? Even after this month’s data, the 12-month moving average of Housing starts actually ticked higher in September, rising from 1.199 mln up to 1.204 mln. That’s the highest level since March 2008. While that’s definitely a positive data point, we would also note that barring a major improvement in the data over the coming months, we have likely seen a short-term peak in this reading as the 12-month average will be dropping average monthly readings of 1.243 mln for the next six months.

CLICK HERE to learn about Bespoke’s premium research options!

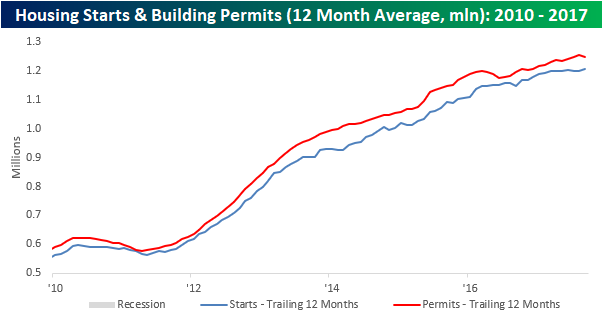

Taking a look at a shorter term window, the chart below shows the 12-month moving average of Housing Starts and Building Permits going back to 2010. Here it’s a little bit easier to see the most recent uptick in Housing Starts, but at the same time, the 12-month moving average of Building Permits has already started to tick lower. As is the case with Housing Starts, barring an imminent uptick in activity, this 12-month moving average will continue to decline in the months ahead.

CLICK HERE to learn about Bespoke’s premium research options!