The Bespoke Report – Even Twitter Is Up!

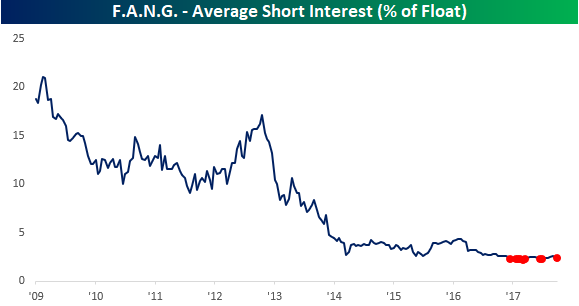

Here’s a cool chart from this week’s Bespoke Report. Short interest figures through the middle of October were released earlier this week and generally showed some modest increases following a major round of short covering in the second half of September. While there are any number of reasons why investors would be short a stock, it is usually a bet (or a hedge) that the price of the stock is going to go down. In looking at the short interest for individual stocks, we thought it was worth pointing out just how low short interest has become in the FANG stocks of Facebook, Amazon, Netflix and Alphabet.

Through the middle of October, the average short interest as a percentage of float (SIPF) in the four stocks was a minuscule 2.3%. While it is not uncommon to see some growth stocks have 10% or more of their float sold short, that isn’t the case with the FANG stocks. As recently as 2013, their average SIPF level was over 10%, and back in 2009 (before Facebook, when it was just “ANG”) the average SIPF level was above 20%! Click the button below to start a trial and read our popular Bespoke Report newsletter — released after the close every Friday.

The Closer: End of Week Charts — 10/27/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

ETF Trends: US Sectors & Groups – 10/27/17

S&P 500 Quick-View Chart Book — 10/27/17 — Lots of New Highs!

Each weekend as part of our Bespoke Premium and Institutional research service, clients receive our S&P 500 Quick-View Chart Book, which includes one-year price charts of every stock in the S&P 500. You can literally scan through this report in a matter of minutes or hours, but either way, you will come out ahead knowing which stocks, or groups of stocks, are leading and lagging the market. The report is a great resource for both traders and investors alike. Below we show the front page of this week’s report which contains price charts of the major averages and ten major sectors.

As seen in the charts below, the only major average that didn’t hit an all-time high this week was the Russell 2000, but it remains strong as well. In terms of individual sectors,we saw new highs from Financials, Health Care, Industrials, Materials, and Technology. The only cyclical sector that didn’t hit a new high was the brick-and-mortar-plagued Consumer Discretionary sector.

Make sure to check out our entire S&P 500 Chart Book by signing up for a 14-day free trial to our Bespoke Premium research service.

Technology Sector Weighting Explodes Higher

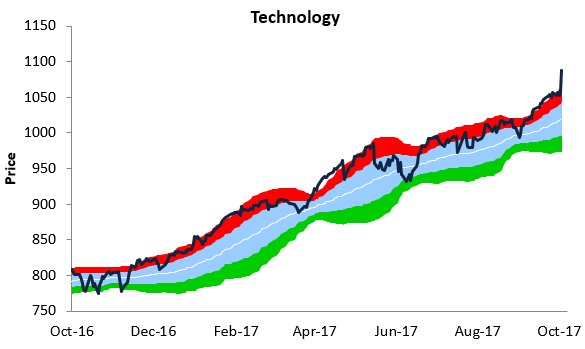

The S&P 500 Technology sector is up huge today, rallying 2.6% on a day when the S&P 500 as a whole is only marginally higher. As shown below, the sector has moved up into the stratosphere compared to its normal trading range. At this point in time, the sector is trading three standard deviations above its 50-day moving average. These kinds of overbought levels don’t last long, as either a pullback in price occurs or moving averages start to play catch up.

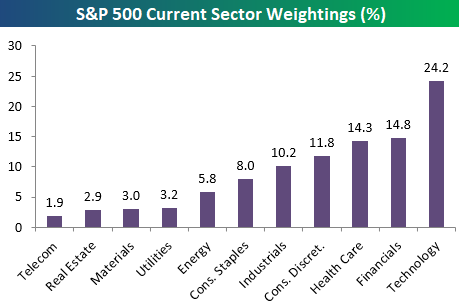

The move higher in the Tech sector has caused its weighting in the S&P 500 to balloon up to 24.2%. That’s almost ten percentage points larger than the 2nd largest sector in the S&P 500 — Financials. It’s also more than 12x as large as the smallest sector in the index — Telecom. Finally, Tech is now just as large as the smallest SIX sectors in the S&P.

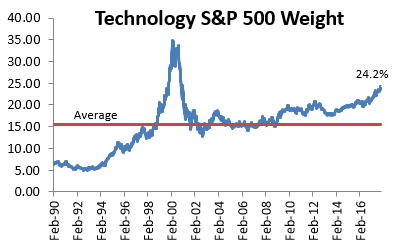

Below is a chart showing Tech’s weighting in the S&P 500 going back to 1990. You may not know it, but Tech was actually the SMALLEST sector in the S&P back in 1991. My how times have changed!

If it provides any comfort, while 24.2% is a huge weighting, keep in mind that it’s still 10 percentage points lower than the weighting Tech saw at the end of the Dot Com boom back in the late 1990s. At Tech’s peak back in March 2000, it had a record 34.81% weighting in the S&P. Even still, Tech’s weighting of 24.2% now was only seen for a few months at the very tail end of the Dot Com boom. It didn’t reach 24.2% until November 1999. At that point, the Tech Bubble only had four months to go before the epic crash occurred.

We know times are different now, but we definitely get a little uneasy when we see one sector taking up basically a quarter of the entire market. It’s not healthy in our view.

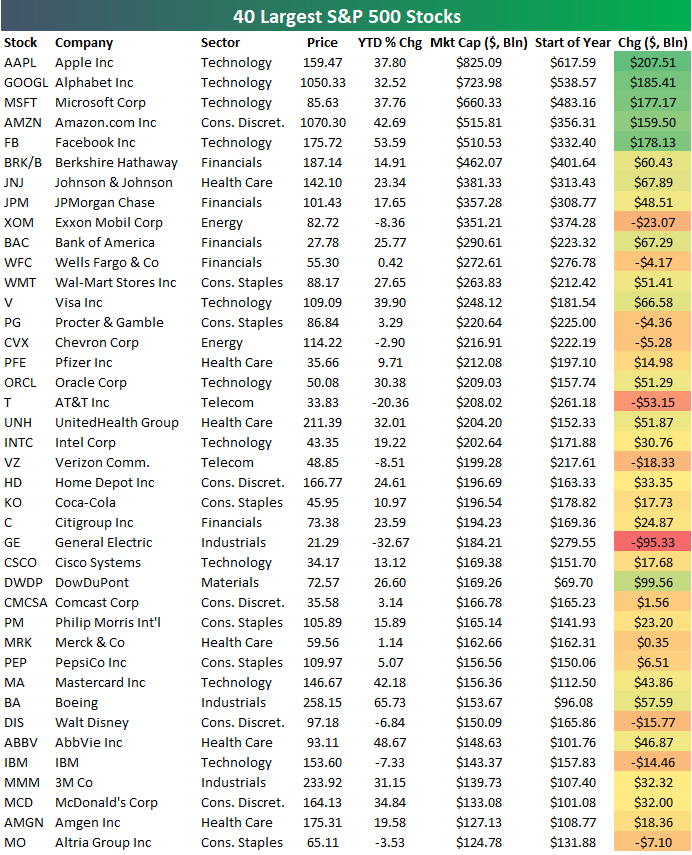

The Biggest Get Even Bigger

Below is a look at the 40 largest companies in the S&P 500. Today has been a big day for the largest companies in the world. They’re all trading higher on the back of strong earnings reports from Alphabet (GOOGL), Microsoft (MSFT), and Amazon (AMZN).

Apple (AAPL) remains in the lead as the largest public company in the world by more than $100 billion in market cap, but GOOGL is now worth $724 billion — larger than any company not named Apple has ever been.

The 3rd, 4th, and 5th largest companies in the S&P are now all worth more than $500 billion as well.

So far in 2017, the five largest companies — all Tech related names — have added close to a trillion in market cap. The remaining 495 stocks in the S&P 500 have added roughly 2 trillion. This means the five largest stocks have accounted for a third of the 2017 gains in market cap for the entire S&P 500.

The Closer — Capex Comeback, No Fiscal Fecundity — 10/26/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss the goings on today in Catalonia, the ECB’s decision to trim stimulus, and the strong footing for the dollar.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 10/26/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

Below is one of the many charts included in this week’s Sector Snapshot, which is our trading range chart for S&P 500 sectors. The black vertical “N” line represents each sector’s 50-day moving average, and as shown, 8 of 10 sectors are currently above their 50-days. We have seen a slight pullback over the past week for most sectors, though, with the biggest pullback coming from Health Care (XLV).

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.