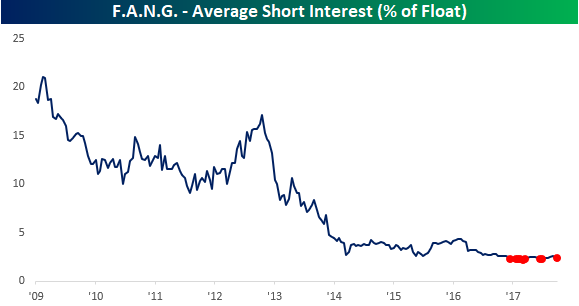

Here’s a cool chart from this week’s Bespoke Report. Short interest figures through the middle of October were released earlier this week and generally showed some modest increases following a major round of short covering in the second half of September. While there are any number of reasons why investors would be short a stock, it is usually a bet (or a hedge) that the price of the stock is going to go down. In looking at the short interest for individual stocks, we thought it was worth pointing out just how low short interest has become in the FANG stocks of Facebook, Amazon, Netflix and Alphabet.

Through the middle of October, the average short interest as a percentage of float (SIPF) in the four stocks was a minuscule 2.3%. While it is not uncommon to see some growth stocks have 10% or more of their float sold short, that isn’t the case with the FANG stocks. As recently as 2013, their average SIPF level was over 10%, and back in 2009 (before Facebook, when it was just “ANG”) the average SIPF level was above 20%! Click the button below to start a trial and read our popular Bespoke Report newsletter — released after the close every Friday.