The Closer — Equity Strength Readings, Savings Rate Bombs, China Assets — 10/30/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss the goings on today in Catalonia, the ECB’s decision to trim stimulus, and the strong footing for the dollar.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Politics and Investing: Keep Them Separate

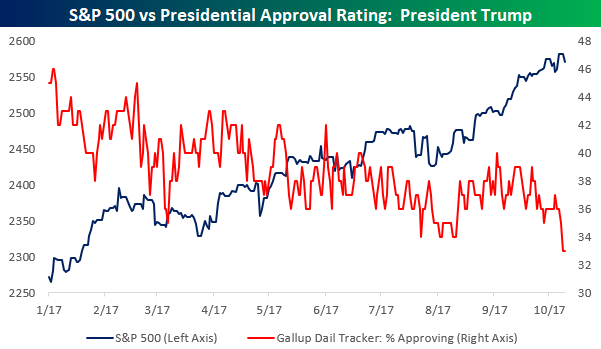

A popular chart making the rounds today is the one below from Gallup, which shows the daily tracking of President Trump’s approval and disapproval ratings. As shown, just ahead of grand jury indictments concerning former members of his campaign staff, the President’s approval rating is sinking like JC Penney, while his disapproval rating looks closer to Apple as it just broke out to new highs.

While these charts always make for some good conversation, their utility stops right about there, especially when it comes to the market. The chart below compares the performance of the S&P 500 to Trump’s approval rating throughout his Presidency. Even as Trump’s popularity plumbs new lows, the S&P 500 has been going in the exact opposite direction. Sure, the President may be unpopular, and based on his approval ratings there’s only a one in three chance that anyone reading this approves of the job he is doing. Like him or not, though, never let politics impact your investment decisions. Just as a lot of investors missed out on the bulk of this bull market because they didn’t care for President Obama and his policies, another group of different investors has now likely missed out on another good year for the equity market just because they don’t care for President Trump.

ETF Trends: International – 10/30/17

Chart of the Day: Earnings Winners Reporting This Week

Bespoke Summary of Economic Indicators: 10/30/17

Biggest Winners and Losers this Earnings Season

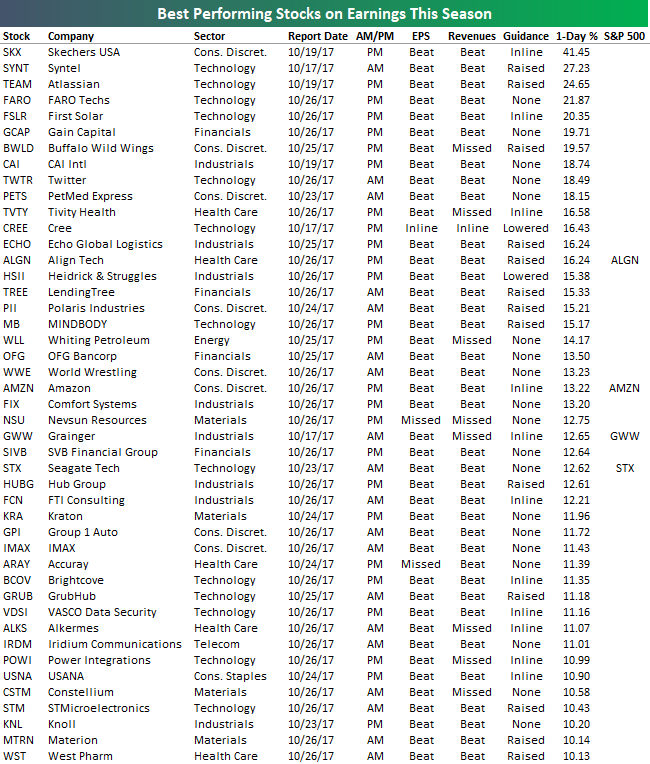

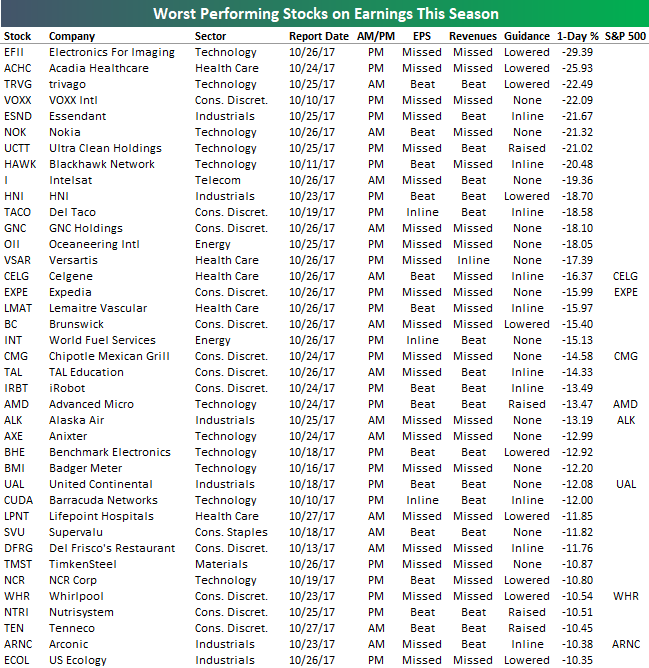

Roughly 1,000 companies have reported Q3 2017 earnings numbers over the last three weeks. Below is a list of the stocks that have posted the biggest one-day gains on their earnings reaction days so far this season.

As shown, Skechers (SKX) ranks first with a huge gain of 41.45% that it saw on 10/20. Syntel (SYNT) ranks 2nd with a gain of 27.23%, followed by Atlassian (TEAM), FARO Techs (FARO), and First Solar (FSLR). No other companies besides these have see one-day gains of more than 20%.

There are quite a few well-known names on the list of earnings season winners. These include Buffalo Wild Wings (BWLD), Twitter (TWTR), Amazon (AMZN), Seagate Tech (STX), and IMAX,

While there have been 45 stocks that have gained more than 10% on their earnings reaction days this season, there have been nearly as many (39) that have fallen 10% or more. Electronics for Imaging (EFII) has been the biggest loser with a one-day drop of 29.39% last Friday. EFII posted what we call a reverse triple play — it missed EPS estimates, missed revenue estimates, and lowered guidance. Acadia Healthcare (ACHC) also reported a reverse triple play, and it fell 25.93% on its earnings reaction day, ranking it second worst this season behind EFII. Six other stocks have experienced one-day drops of 20%+ on earnings this season — TRVG, VOXX, ESND, NOK, UCTT, and HAWK. Other notables on the list of biggest earnings season losers include GNC Holdings (GNC), Celgene (CELG), Expedia (EXPE), Advanced Micro (AMD), United (UAL), Whirlpool (WHR), Nutrisystem (NTRI), and Chipotle (CMG).

See our most in-depth earnings analysis with a two-week free trial to one of Bespoke’s membership levels.

B.I.G. Tips – November 2017 Seasonality

Bespoke Stock Seasonality: 10/30/17

Bespoke Brunch Reads: 10/29/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Rethinkings

Public Policy After Utopia by Will Wilkinson (Niskanen Center)

A case for evidenced-based policy making and an eschewing of “the perfect world” that radicals of all kinds think they can achieve, but are often unable to show would actually move forward their goals. [Link]

A Peek at Future Jobs Shows Growing Economic Divides by Ben Casselman (NYT)

Huge swathes of the country have employment landscapes dominated by jobs that are estimated to shrink by 2026 per new BLS data. [Link; soft paywall]

Investing

The Morningstar Mirage by Kirsten Grind, Tom McGinty and Sarah Krouse (WSJ)

Investors flock to funds that receive a coveted five star rating from Morningstar, but returns don’t tend to be much higher for funds with more stars. [Link; paywall]

Inflation

How I Accidentally Stiffed My Poor Venezuelan Waiter by Stephen Merelman (Bloomberg)

When the amount of cash you need to accomplish daily tasks rises into the “grocery bags” denomination, even tipping becomes a major challenge. [Link]

The Lighter Side

So This Happened in Our Comments Section Today by Nancy Wartik (NYT)

Never read the comments, except for this one. [Link; soft paywall]

Blockchain

This Company Added the Word ‘Blockchain’ to Its Name and Saw Its Shares Surge 394% by Lisa Pham (Bloomberg)

A company with little to offer got investors to bid up its shares by almost 4x on a simply name change, in case you’re wondering what sentiment around cryptocurrencies looks like. [Link]

Backed by Dollar Scarcity, Price of Bitcoin Caps $10,000 in Zimbabwe by William P (Crypto Analyst)

The exchange which services Zimbabwe has seen an explosion in local prices for bitcoin, driven by huge domestic demand and a lack of arbitrage. [Link]

Tech Dystopia

The 12 Most Desperate Stunts Cities Have Pulled To Woo Amazon’s New H.Q. by Maya Kosoff (Vanity Fair)

Buying (and reviewing!) 1000 separate items, Spotify playlists, noisemeters at hockey games, a 21 foot cactus, free sandwiches, and more. [Link]

Elon Musk Was Wrong About Self-Driving Teslas by Tom Randall (Bloomberg)

Tesla owners are suing over a feature that hasn’t lived up to its much-hyped debut buzz last year, and doesn’t show any sign of being ready soon. [Link]

New Chatbots Will Help People Accept Death by Jordan Pearson (Vice)

While chatbots are proving helpful for people unaware of basic legal and medical planning for the end of their lives, they’re not going to be providing much in terms of spiritual guidance any time soon. [Link]

Food & Drink

‘Fish Fraud’ Is Rampant. Here’s How to Fix It by Elizabeth Dunn (WSJ)

As much as one third of US seafood is mislabeled, and with 90% it imported there’s lots of room for standards in the market to propagate better practices elsewhere around the world. [Link; paywall]

World wine production ‘to hit 50-year low’ (BBC)

+15% declines in Italy, Spain, and France brought about by weather mean global grape growth has slowed dramatically. Australia and Argentina will be up while the US crop should be little changed (forest fires in California came after most of the harvest). [Link]

The Thing About Bisquick by Alia Akkam (Taste Cooking)

For our two cents, biscuits don’t need anything more than flour, milk, butter, baking powder, and a bit of honey. But Bisquick is defensible if only for its time saving properties. [Link]

Long Reads

Under The Darkest Sky by Jasmina Keleman (Roads And Kingdoms)

In wide open Texas, the limitless night skies are in need of conservation; not against traditional threats to visibility, but from the even more pernicious footprint of human civilization, light. [Link]

How Martin Luther Changed The World by Joan Acocella (The New Yorker)

While the man who launched the Reformation probably never nailed his 95 Theses to a church door, he was still a fascinating and truly revolutionary character who has deeply shaped our modern world. [Link]

Have a great Sunday!

The Bespoke Report – Even Twitter Is Up!

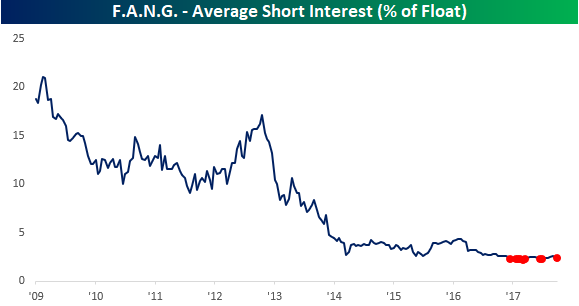

Here’s a cool chart from this week’s Bespoke Report. Short interest figures through the middle of October were released earlier this week and generally showed some modest increases following a major round of short covering in the second half of September. While there are any number of reasons why investors would be short a stock, it is usually a bet (or a hedge) that the price of the stock is going to go down. In looking at the short interest for individual stocks, we thought it was worth pointing out just how low short interest has become in the FANG stocks of Facebook, Amazon, Netflix and Alphabet.

Through the middle of October, the average short interest as a percentage of float (SIPF) in the four stocks was a minuscule 2.3%. While it is not uncommon to see some growth stocks have 10% or more of their float sold short, that isn’t the case with the FANG stocks. As recently as 2013, their average SIPF level was over 10%, and back in 2009 (before Facebook, when it was just “ANG”) the average SIPF level was above 20%! Click the button below to start a trial and read our popular Bespoke Report newsletter — released after the close every Friday.